Tracxn has released its Japan Tech H1 2025 Funding Report, covering the period from January to June 2025. The report highlights a continued decline in venture funding across the Japanese tech ecosystem. Total funding dropped notably compared to both the previous half and the same period last year, with subdued activity across most stages. While sectors like HealthTech and FinTech saw notable growth, Japan recorded no mega-deals or unicorns during this period.

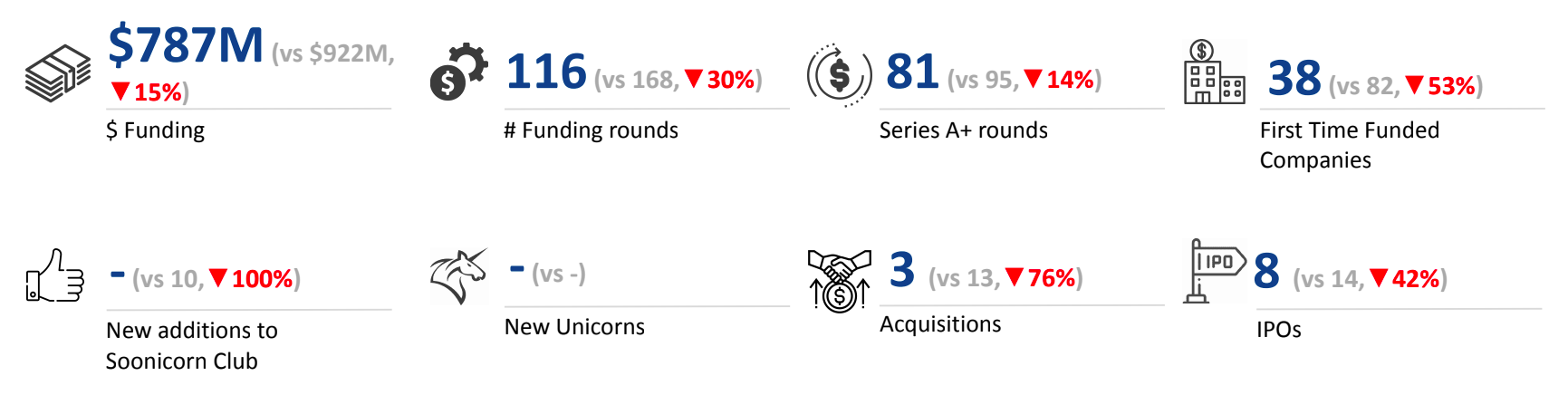

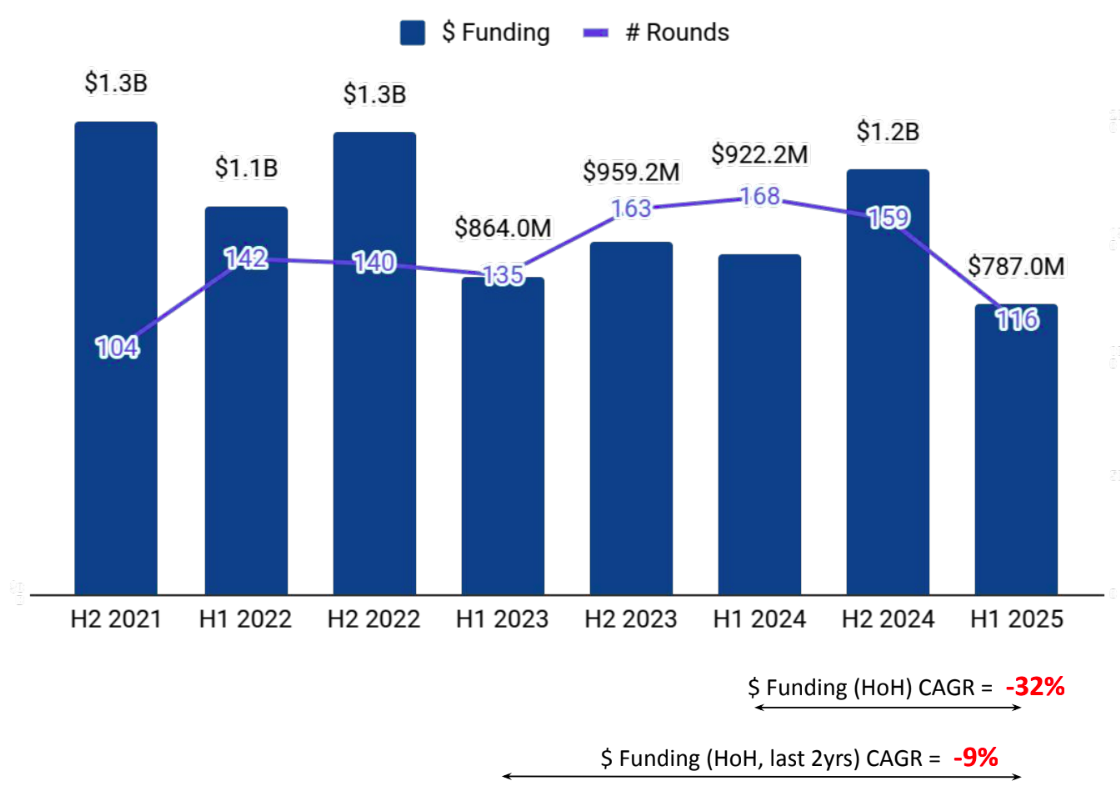

A total of $787M was raised by tech companies in Japan in H1 2025, reflecting a decline of 32% compared to $1.2B raised in H2 2024 and a 15% drop from $922M raised in H1 2024. The sharp downturn across two consecutive halves points to a significant contraction in capital inflows into the region's tech sector.

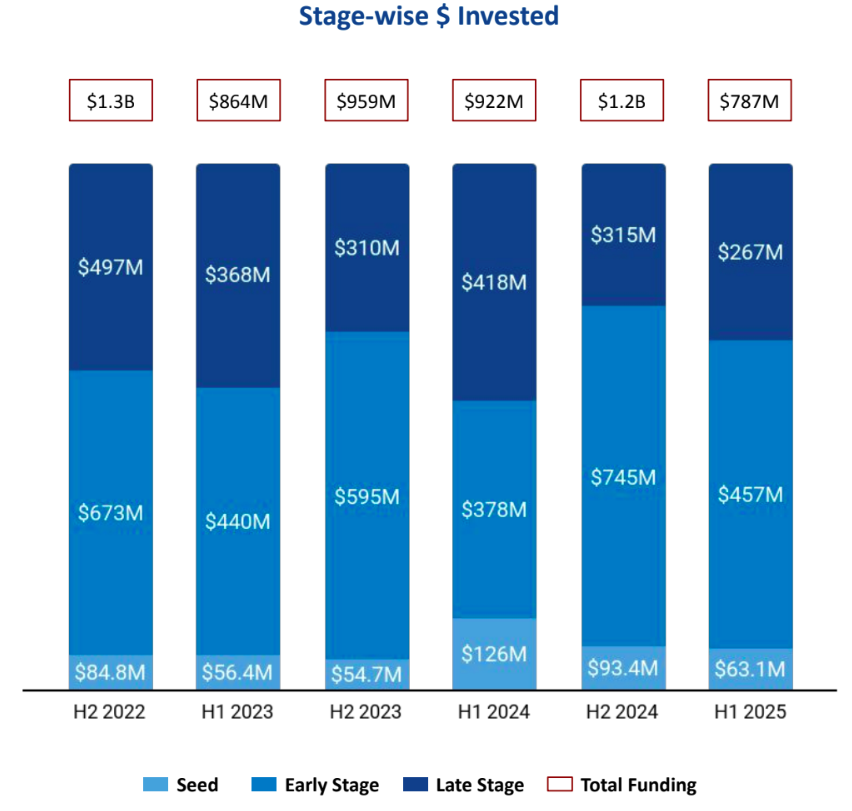

Seed Stage saw a total funding of $63.1M in H1 2025, a drop of 32% compared to $93.4M raised in H2 2024, and a drop of 50% compared to $126M raised in H1 2024. Early Stage saw a total funding of $457M in H1 2025, a drop of 39% compared to $745M raised in H2 2024, and an increase of 21% compared to $378M raised in H1 2024. Late Stage witnessed a total funding of $267M in H1 2025, a drop of 15% compared to $315M raised in H2 2024, and a drop of 36% compared to $418M raised in H1 2024.

Enterprise Applications, HealthTech, and FinTech were the top-performing sectors in H1 2025 in this space. The Enterprise Applications sector saw a total funding of $301.2M in H1 2025, a drop of 45% and 43% compared to $552.2M in H2 2024 and $528.3M in H1 2024. The HealthTech sector saw a total funding of $117.6M in H1 2025, an increase of 86% from $63.1M in H2 2024 and 181% from $41.9M in H1 2024. The FinTech sector saw a total funding of $97.2M in H1 2025, an increase of 23% and 68% compared to $79.2M in H2 2024 and $57.9M in H1 2024.

No unicorns were created in H1 2025, H2 2024 and H1 2024. Digital Grid, Dynamic Map Platform, ZenmuTech, and Visual Processing Japan were some of the companies that went public in H1 2025.

Tech companies in Japan saw 3 acquisitions in H1 2025, which is a 79% decrease as compared to 14 acquisitions in H2 2024 and a drop of 76% compared to 13 acquisitions in H1 2024. Strainer was acquired by ateam-entertainment.com at a price of $1.71M. This became the highest valued acquisition in H1 2025 followed by the acquisition of Coinbook by Backseat.

Tokyo based tech firms accounted for 28% of all funding seen by tech companies across Japan. This was followed by Setagaya at a close second at 9%.

Mitsubishi UFJ Capital, SMBC Venture Capital and Global Brain were the overall top investors in the Japan Tech ecosystem. Global Brain, ANRI and Incubate Fund were the top seed stage investors in the Japan Tech ecosystem for H1 2025 . Mitsubishi UFJ Capital, SMBC Venture Capital and Keio Innovation Initiative were the top early stage investors in Japan Tech ecosystem for H1 2025.SBI Investment, NOBUNAGA Capital Village and JP LIFE NEXT FUND were the top late stage investor in the Japan tech ecosystem for H1 2025.

The Japan tech ecosystem faced a notable decline in funding in H1 2025, with reductions across all funding stages and a steep drop in acquisitions. Despite the broader downturn, sectors such as HealthTech and FinTech posted impressive growth. Tokyo maintained its lead as the top-funded city, while investor activity remained diverse across stages, led by Mitsubishi UFJ Capital, Global Brain, and SMBC Venture Capital.