Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Japan Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the Japanese Tech space.

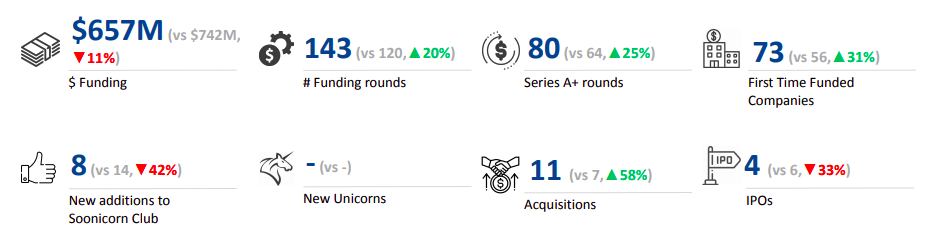

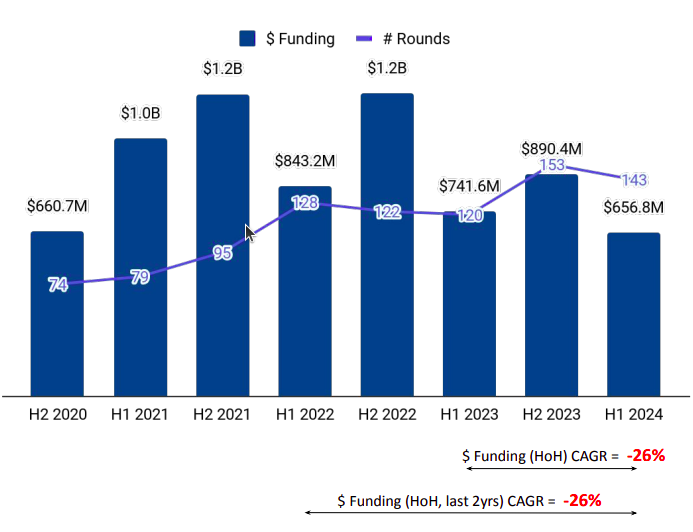

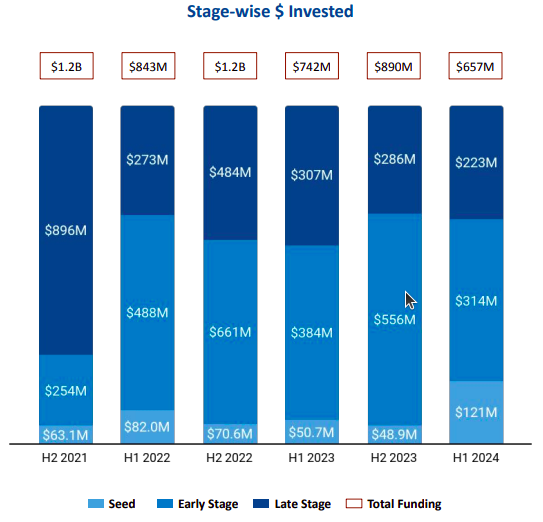

The Japanese tech startup ecosystem ranked 15th globally in terms of funding, raising $657 million in the first half of 2024, an 11.4% drop from the $742 million raised in H1 2023. Seed-stage investments stood at $121 million in H1 2024, a surge of 138.7% from the $50.7 million raised in H1 2023. This space witnessed early-stage funding of $314 million in H1 2024, a drop of 18.2% from the $384 million raised in H1 2023. Late-stage funding fell 27.4% to $223 million in H1 2024 from the $307 million raised in the first half of 2023.

Only one 100M+ funding round was observed in the first six months of 2024. Sakana raised a total of $100 million in a Series A round led by New Enterprise Associates, Lux Capital and Khosla Ventures.

The number of acquisitions rose to 11 in H1 2024 from seven in H1 2023. ToposWare, COSMEbi and LivePocket are some of the companies that were acquired in H1 2024. Further, four companies went public, slightly lower than six each in H2 2023 and H1 2023. Astroscale, Soracom, Cocolive and Veritas In Silico are the companies that went public in H1 2024.

High Tech, Enterprise Applications and Retail were the top-performing sectors in H1 2024. The High Tech space witnessed a 7% drop in funding, from $319 million in H1 2023 to $374 million in H1 2024. Funding in the Enterprise Applications segment stood at $236 million in H1 2024, 26% lower than the $322 million raised in H1 2024. The Retail segment attracted investments worth $126 million in H1 2024, a 101% spike from $62.5 million raised in H1 2023.

Tokyo took the lead in terms of city-wise funding, followed by Hitachiomiya and Minato City. Tech startups based in Tokyo raised $177 million in the first half of 2024, while those based in Hitachiomiya and Minato City raised $65.3 million and $64.4 million respectively.

Mitsubishi UFJ Capital, SMBC Venture Capital and JAFCO Group are the all-time overall top investors in the Japan Tech ecosystem. Mitsubishi UFJ Capital, SMBC Venture Capital and Nissay Capital were the overall top investors in the Japan Tech ecosystem for H1 2024. SMBC Venture Capital, JAFCO Group and Nissay Capital are the top early-stage investors in the Japan Tech ecosystem in H1 2024, Cygames Capital, Niigata Venture Capital and JBC were the top investors in late-stage rounds.

The tech startup ecosystem in Japan is evolving rapidly, driven by increased government support, corporate involvement, and a shift towards a more entrepreneurial culture. With continued support and investments, significant advancements are likely in the coming years.