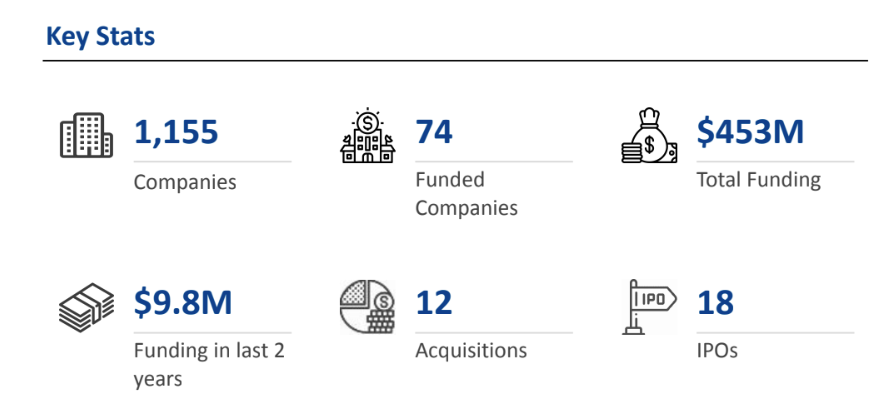

The K-Beauty sector, long celebrated for its innovation and global cultural influence, continues to carve a prominent space in the beauty industry, supported by a vibrant ecosystem of over 1,100 companies worldwide. According to internal research, 74 startups in this space have secured funding, with South Korea firmly leading both in terms of the number of companies and total funding raised. South Korean startups account for over 55% of the total funding in the sector. The global appeal of K-Beauty has been driven by its high-quality products, natural and innovative ingredients, unique formulations, and the sweeping influence of Korean pop culture through K-pop, K-dramas, and social media platforms.

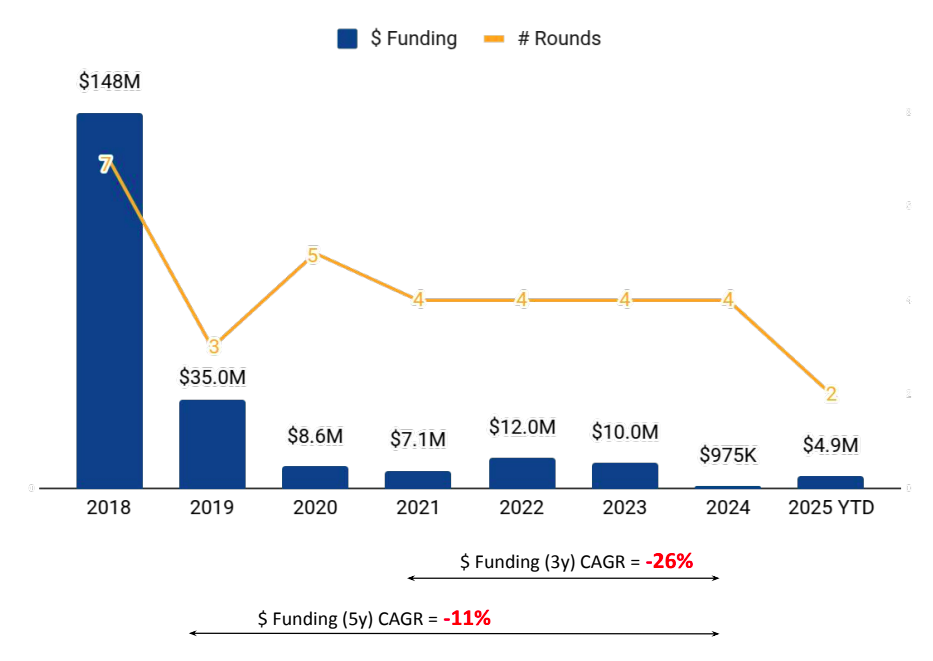

To date, the K-Beauty sector has garnered a total of $453 million in funding. The sector experienced its highest funding peaks in 2016 and 2018, raising $186 million and $148 million, respectively. However, recent years have been more challenging, with 2024 recording the lowest funding in the past decade at $975K, marking a steep 90% decline compared to $10 million in 2023. Promisingly, 2025 has already witnessed a strong start, with $4.9 million raised in just the first four months of the year.

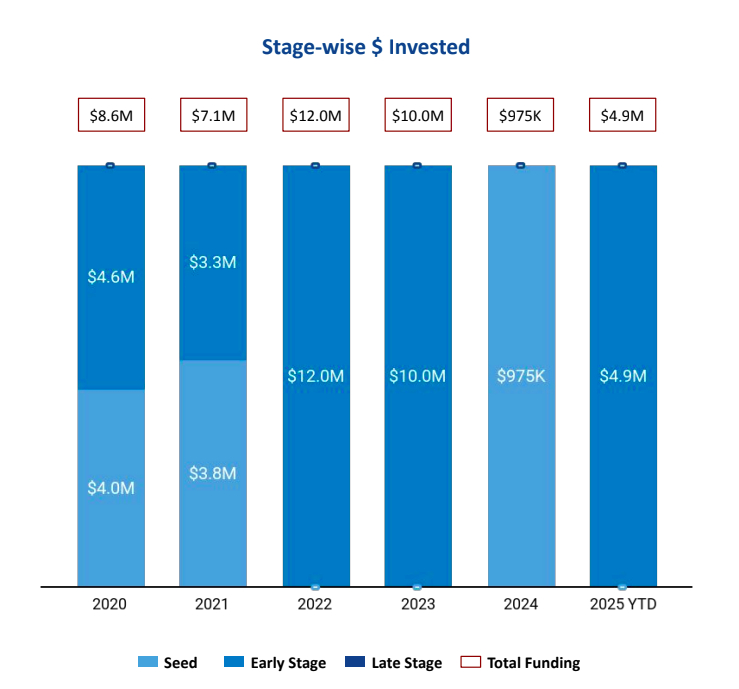

Early-stage funding has been the backbone of the sector’s financial activity in recent years. Over the last five years, early-stage rounds have consistently driven investment, accounting for 27.8% of the total funding to date. Notably, the entire funding secured in 2022 ($12 million), 2023 ($10 million), and $4.9 million in 2025 YTD had been contributed by early-stage investments. In contrast, late-stage funding raised a total of $311M to date, which historically accounts for 69% of the sector’s total funding, has seen no new activity in the past five years.

Seed-stage funding has witnessed $15.3 million till date, with 2024 recording $957K at this stage, although no seed deals have been closed so far in 2025.

South Korea leads the K-Beauty landscape with $250 million in funding, followed by the United States at $199 million and India at $4 million.

Among the top companies in the K-Beauty ecosystem, Memebox emerges as the highest-funded startup with $193 million raised, followed by GP Club with $67.5 million, and Clio Professional with $50.1 million.

In terms of segments, Color Cosmetics, Multi-Category K-Beauty, and Skincare K-Beauty have seen the most funding. Color Cosmetics brands have raised a total of $245 million, with funding peaking in 2016 at $177 million. Multi-Category K-Beauty companies have secured $77 million in total, with all the funding recorded in 2025 YTD ($4.9 million) going to this segment. Skincare K-Beauty companies have attracted $46.5 million to date, with a major funding high observed in 2018 of $33 million.

"K-Beauty's global footprint is expanding as consumers seek ethical, high-performing products rooted in innovation. With early-stage investments driving the sector's revival, we expect K-Beauty brands to play a pivotal role in shaping the future of the global beauty industry," said Neha Singh, Co-founder & CEO, Tracxn.

The K-Beauty startup ecosystem has also witnessed notable M&A activity, with 12 acquisitions recorded so far. In 2025, Manyo, a natural skincare brand, was acquired by Klpartners for $129 million. Another major acquisition includes The Crème Shop, which was acquired by LG Household & Healthcare for $120 million in 2022.

The ecosystem has produced two unicorns to date, with GP Club achieving a valuation of $1.3 billion in 2019, and Mediheal, a facial care products provider that reached unicorn status in 2017. Furthermore, 18 K-Beauty startups have gone public so far, with APR being the only IPO recorded in 2024.

Investor activity has remained robust, with Goodwater Capital, Pear VC, and Altos Ventures Management emerging as the top investors overall in the K-Beauty space. In the seed-stage landscape over the past two years, 500 Global, Barlon Capital, and Blueprint have led the way, while khfamily.kr, Company K Partners, and Smile Gate Investment have been active investors in early-stage rounds in the last two years..

UwinAs global consumer fascination with Korean beauty innovations remains strong, the K-Beauty sector is well-positioned for a new phase of growth, driven by a resilient ecosystem and increasing international appeal. As the K-Beauty movement continues to innovate and inspire, it remains one of the most exciting segments in the global beauty landscape. VCs globally have turned risk-averse due to macroeconomic factors like inflation, geopolitical conflicts, supply chain disruptions, among others, leading to lower funding inflows across sectors. Despite this, K-Beauty brands show strong potential with their focus on innovation, scientific research, and sustainability. As consumer demand for ethical and high-quality products rises and K-Beauty scales globally, VC interest in the sector is expected to grow.