Tracxn, a leading global SaaS-based market intelligence platform, has released its Annual Report: Karnataka Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Karnataka Tech space.

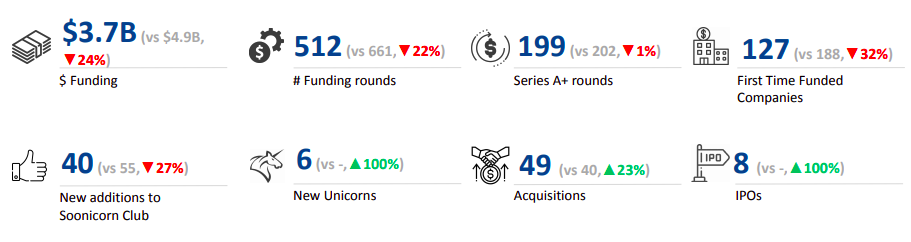

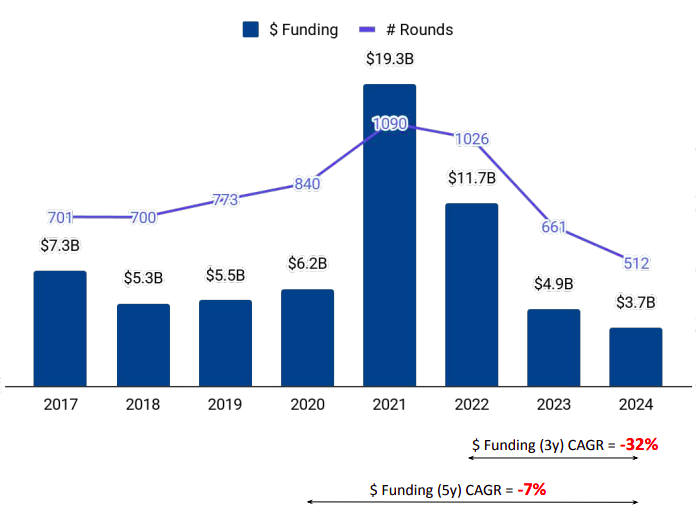

In 2024, Karnataka tech startups raised $3.7 billion in funding, representing a 24% decline from the $4.9 billion secured in 2023 and a 68% drop compared to the $11.7 billion raised in 2022.

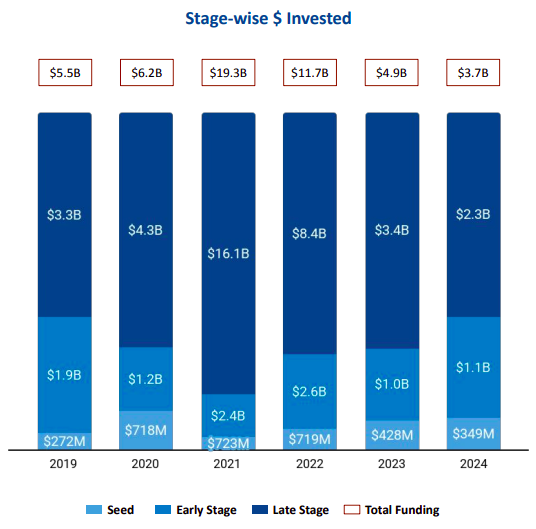

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage funding experienced a 32% decline, totaling $2.3 billion in 2024, down from $3.4 billion in 2023.

● Seed-Stage Funding: Seed-stage investments dropped by 18%, falling to $349 million in 2024 from $428 million in 2023.

● Early-Stage Funding: Early-stage investments surged to $1.1 billion in 2024, marking an 10% increase from $1 billion in 2023.

Sectoral Performance

Top-performing sectors in 2024 included Retail, Enterprise Applications, and Transport & Logistics Tech:

● Retail: Funding decreased by 25% in 2024 compared to 2023 and 43% drop compared to 2022.

Sports● Enterprise Applications: Funding decreased by 15% in 2024 compared to 2023 and 61% drop compared to 2022.

● Transport & Logistics Tech: Funding decreased by 7% in 2024 compared to 2023 and 74% drop compared to 2022.

Top cities leading the landscape

● Bengaluru-based tech firms accounted for 98.44% of all funding raised by Karnataka tech companies.

● Mysuru followed at a distant second, contributing 1.01% of the total funding.

Leading Investors

Accel, Peak XV Partners and LetsVenture emerged as the top investors in the Karnataka tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions

The Karnataka tech ecosystem recorded 49 acquisitions in 2024, up from 40 in 2023. Notable deals include:

● iBUS acquisition by NIIF for $200M, the highest-valued deal of the year. Uwin

● Loyal Hospitality’s acquisition by Finnest for $160M.

This data underscores the evolving dynamics of the Karnataka tech ecosystem, reflecting both growth opportunities and challenges across different funding stages, sectors, and regions.