Tracxn has released its Karnataka Tech Ecosystem Report for 9M 2025, outlining funding activity, sector performance, IPOs, acquisitions, and investor participation across the state. Karnataka’s tech landscape saw shifts in investment sentiment during the period, reflecting fluctuations across deal sizes, stages, and sector-wise participation. Bengaluru-based tech firms contributed nearly all of the funding raised by tech companies across Karnataka.

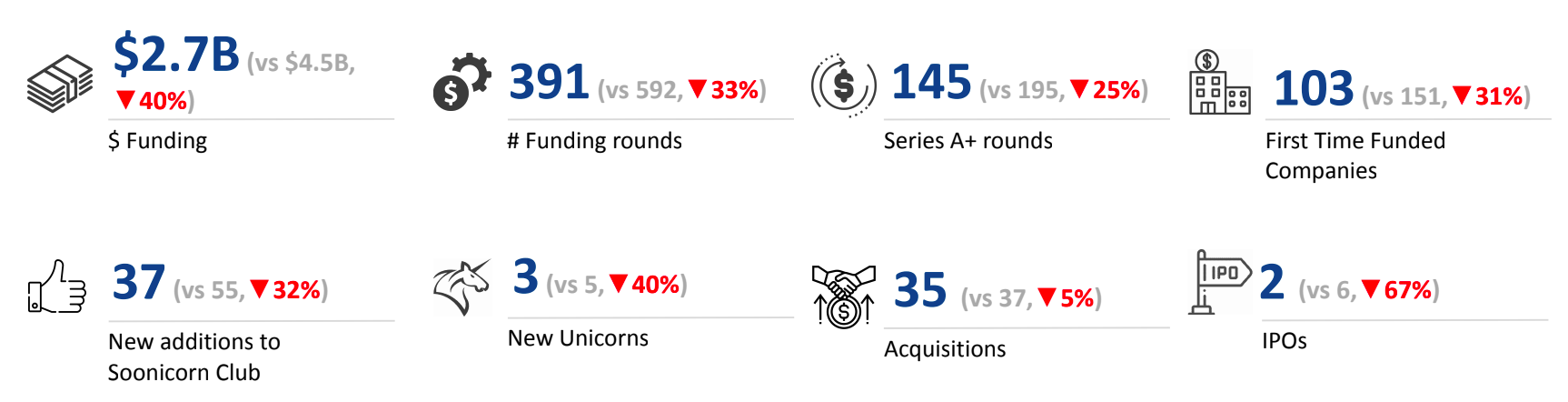

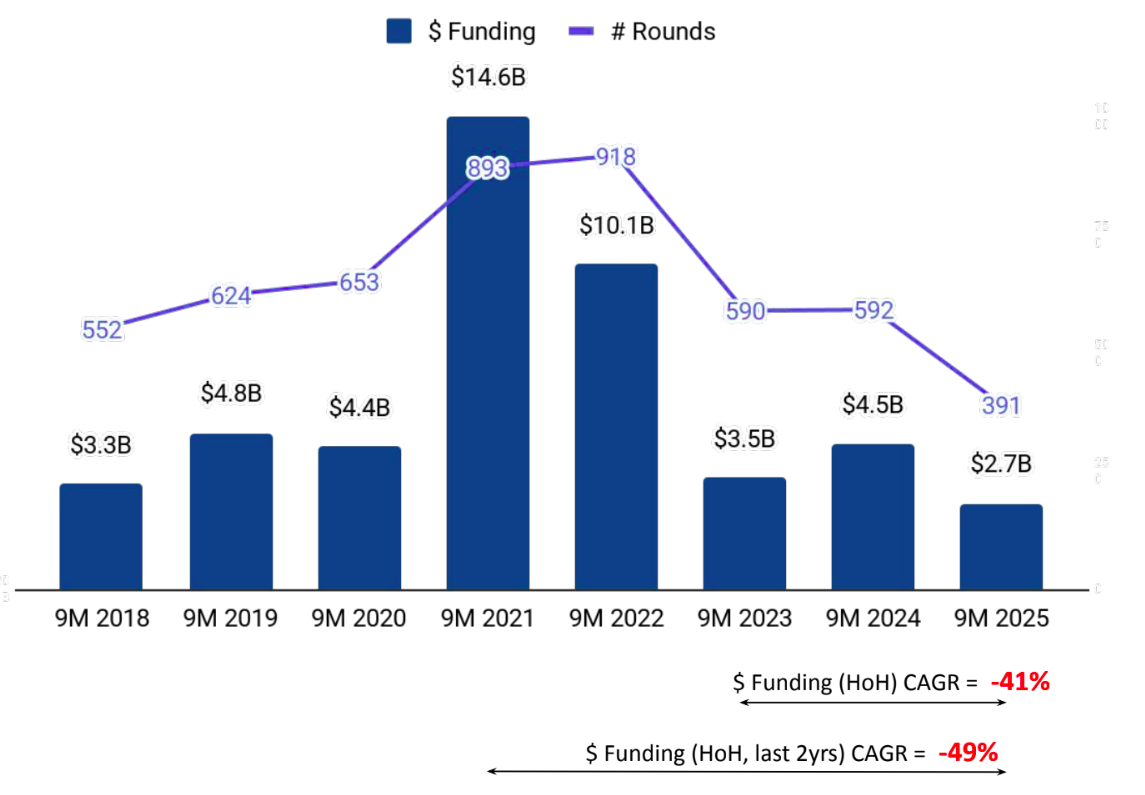

A total of $2.7B was raised in 9M 2025, representing a 40% drop compared to $4.5B in 9M 2024, and a 23% decline compared to $3.5B raised in 9M 2023. The period witnessed a noticeable slowdown in large-ticket rounds, impacting overall capital flow into the ecosystem.

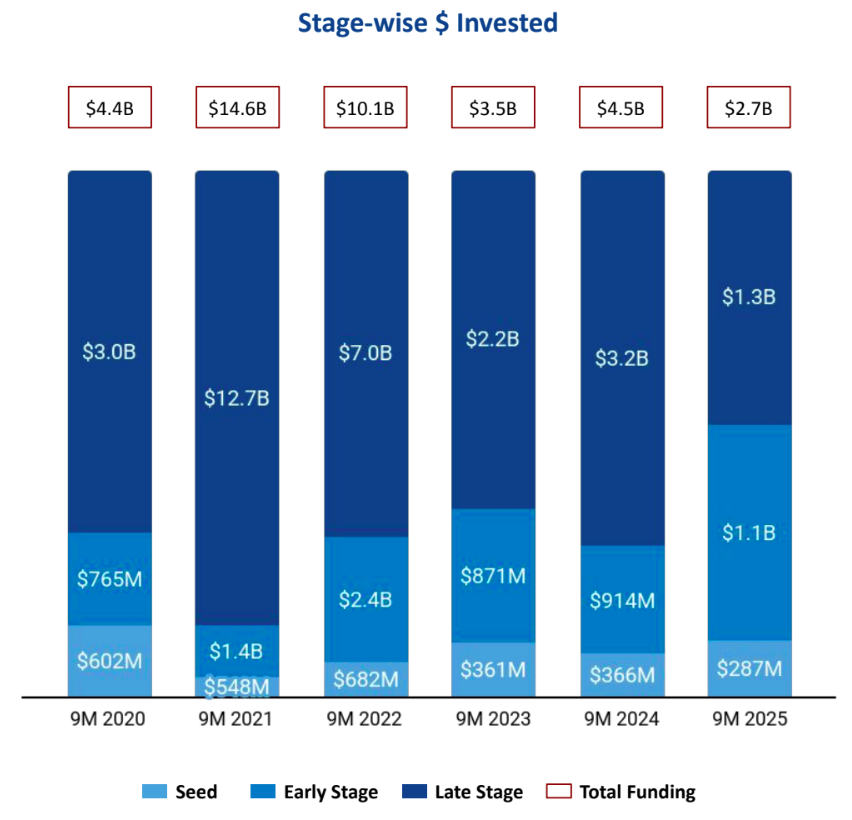

Funding activity across stages in Karnataka reflected mixed but steady movement in 9M 2025. Seed-stage funding stood at $287M, representing a 22% decline from $366M in 9M 2024 and a 21% decrease from $361M in 9M 2023, while maintaining consistent early-stage momentum in the ecosystem. Early-stage investment showed strong progress, reaching $1.1B, a 20% increase compared to $914M in 9M 2024 and a 26% rise from $871M in 9M 2023, highlighting growing investor confidence in emerging companies. Late-stage funding totaled $1.3B, reflecting a 59% decrease from $3.2B in 9M 2024 and a 41% decline compared to $2.2B in 9M 2023, pointing to more selective participation at the mature end of the market.

FinTech, Enterprise Applications, and Retail were the top-performing sectors in Karnataka during 9M 2025. The FinTech sector recorded $841M in funding, an increase of 38% compared to $608M in 9M 2024, but a decrease of 21% compared to $1.1B in 9M 2023. The Enterprise Applications sector saw $830M in 9M 2025, representing a 19% decrease from $1.0B in 9M 2024, and a 26% decline compared to $1.1B in 9M 2023.The Retail sector recorded $730M in 9M 2025, a 43% drop from $1.3B in 9M 2024, but a 10% increase compared to $663M raised in 9M 2023.

9M 2025 registered two funding rounds above $100M, compared to eight such rounds in 9M 2024 and seven in 9M 2023. Companies like Groww and Jumbotail raised more than $100M during this period. Groww secured $202M in a Series F round, while Jumbotail raised $120M in a Series D round. A major part of these $100M+ funding rounds came from FinTech and Retail sectors.

Karnataka’s tech ecosystem saw 2 IPOs in 9M 2025, a 67% drop from 6 in 9M 2024, compared to none in 9M 2023. Ather Energy and BlueStone were the companies that went public during this period. In 9M 2025, 3 new unicorns emerged, representing a 40% drop from 5 in 9M 2024, and a 200% rise compared to 1 in 9M 2023.

Tech companies in Karnataka saw 35 acquisitions in 9M 2025, a 5% drop compared to 37 in 9M 2024, but a 13% increase compared to 31 in 9M 2023. The highest-valued acquisition was Groww acquiring Fisdom for $150M, followed by ICRA acquiring Fintellix for $26M.

Bengaluru-based tech firms accounted for nearly all of the funding raised by tech companies across Karnataka in 9M 2025, positioning the city as the state’s dominant hub for startup investments.

N8Investor participation in Karnataka’s tech ecosystem remained active across stages in 9M 2025. Venture Catalysts, Antler, and Rainmatter emerged as the most active investors at the seed stage, supporting early-stage companies across the state. At the early stage, Accel, Peak XV Partners, and Elevation Capital played key roles in driving scale-up investments. At the mature end of the market, Sofina, Softbank Vision Fund, and Mars Growth Capital led late-stage investment activity in the Karnataka tech ecosystem during the period.

Karnataka’s tech ecosystem continued to demonstrate strong activity in 9M 2025, with healthy participation from investors across stages. Early-stage funding remained active, reflecting sustained confidence in the region’s growing startup base. Mid-stage and late-stage investments also continued, indicating steady scale-up momentum among established companies. Acquisition activity remained robust, contributing to the overall strength of the market. The period additionally saw the emergence of new unicorns and two companies going public. Overall, the ecosystem continued to evolve with greater maturity and sustained dynamism throughout 9M 2025.