Tracxn has released its Q1 2025 Karnataka Tech Funding Report, offering a comprehensive view of the region’s startup ecosystem performance over the first quarter of the year. The report reveals a substantial contraction in funding activity, both quarter-over-quarter and year-over-year, alongside a complete absence of unicorns or $100M+ funding rounds. Despite the downturn, specific sectors like Enterprise Applications, FinTech, and Retail emerged as strong contributors to the overall capital raised.

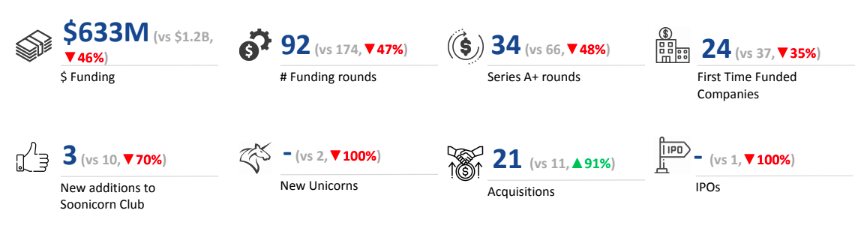

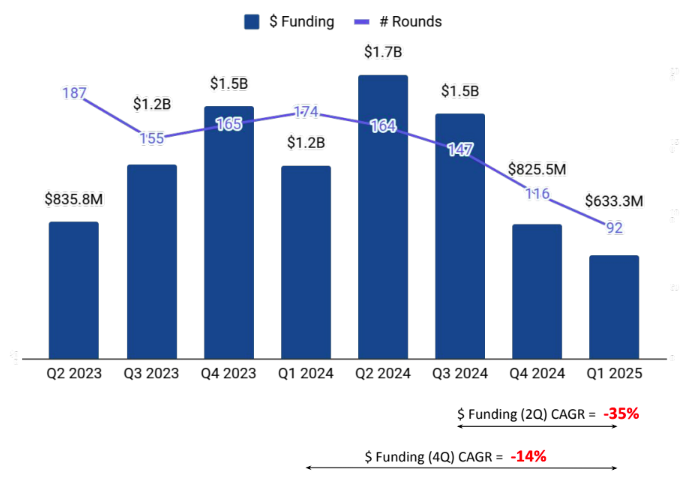

A total of $633M was raised in Q1 2025, marking a 23% decline compared to the $825.5M raised in Q4 2024 and a 46% drop from the $1.20B raised in Q1 2024. This significant downturn highlights a widespread pullback in venture activity across the Karnataka tech ecosystem.

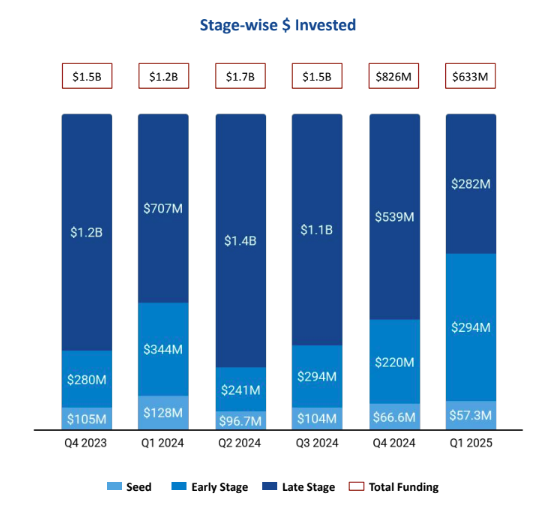

Seed Stage saw a total funding of $57.3M in Q1 2025, a drop of 14% compared to $66.6M raised in Q4 2024, and a drop of 55% compared to $128M raised in Q1 2024. Early Stage saw a total funding of $294M in Q1 2025, an increase of 34% compared to $220M raised in Q4 2024, and a drop of 14% compared to $344M raised in Q1 2024. Late Stage witnessed a total funding of $282M in Q1 2025, a drop of 48% compared to $539M raised in Q4 2024, and a drop of 60% compared to $707M raised in Q1 2024.

Enterprise Applications, FinTech, and Retail were the top-performing sectors in Q1 2025 in this space. Enterprise Applications sector saw a total funding of $298.6M in Q1 2025, which is an increase of 80% when compared to $166M raised in Q4 2024 and a drop of 18% when compared to $362.3M raised in Q1 2024. FinTech sector saw a total funding of $221.1M in Q1 2025, which is an increase of 271% when compared to $59.7M raised in Q4 2024 and a drop of 28% when compared to $309.2M raised in Q1 2024.

Retail sector saw a total funding of $219.8M in Q1 2025, which is an increase of 80% when compared to $122M in Q4 2024 and a drop of 12% when compared to $249.4M raised in Q1 2024.

N8

Tech companies in Karnataka saw 21 acquisitions in Q1 2025, which is a 91% increase as compared to 11 acquisitions in Q1 and Q4 2024. Axio was acquired by Amazon at a price of $150M. This became the highest valued acquisition in Q1 2025 followed by the acquisition of Digiledge by Mintoak at a price of $3.50M.

Bengaluru-based tech firms accounted for more than 99% of all funding seen by tech companies across Karnataka. This was followed by Hubli at a distant second.

Accel, Blume Ventures, and Sequoia Capital were the overall top investors in the Karnataka tech ecosystem. 100X.VC, Venture Catalysts, and Antler led seed-stage investments during Q1 2025, while Accel, Alteria Capital, and Peak XV Partners were the most active in early-stage deals. At the late stage, Think Investments, M&G, and Mars Growth Capital emerged as the top investors. Among VCs, United States-based Accel led the most number of investments in Q1 2025 with 16 rounds. Late-stage VC investments saw United States-based Think Investments and United Kingdom-based M&G add 1 company each to their portfolios.

The Karnataka tech ecosystem saw a notable downturn in Q1 2025, with total funding declining sharply and no unicorns or $100M+ rounds recorded. Despite the drop, sectors like Enterprise Applications, FinTech, and Retail attracted strong investor interest. Acquisition activity surged during the quarter, led by Amazon’s $150M acquisition of Axio. Bengaluru remained the dominant tech hub, drawing nearly all of the funding in the state. While seed and late-stage funding declined, early-stage investments showed resilience, supported by strong participation from both domestic and international investors.