Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Latam Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the Latin American Tech space.

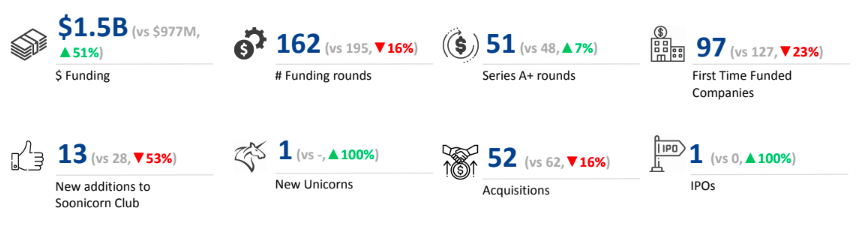

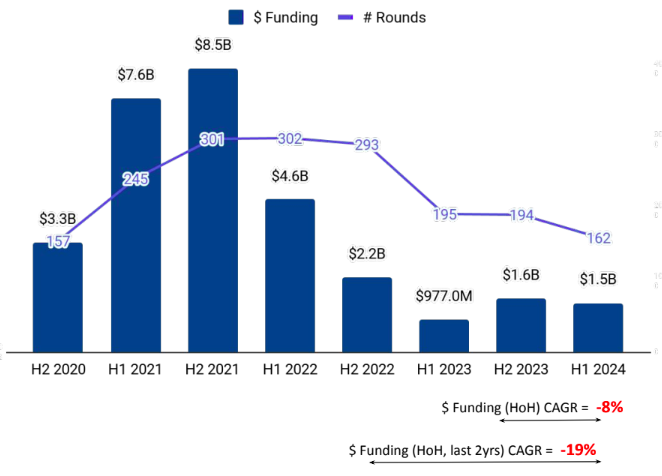

Latin American tech startups have seen a downward trend in funding, after a peak in 2021. However, the region has established itself as an emerging market with an evolving startup landscape. The Latam Tech startup ecosystem secured total funding of $1.5 billion in H1 2024, a jump from the $977 million raised in H1 2023. This is also a funding drop of only 8.4% from $1.6 billion in H2 2023.

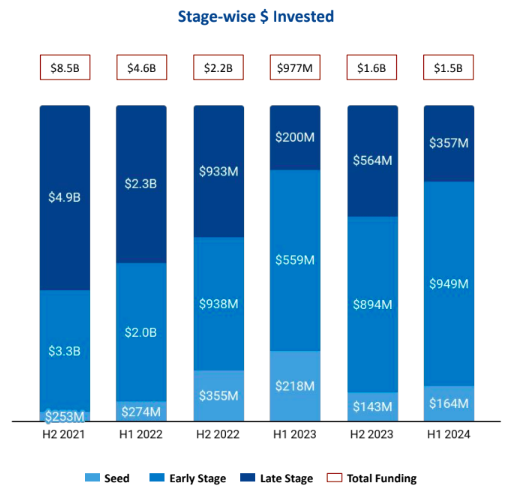

Seed-stage funding stood at $164 million in H1 2024, a decline of 24.8% from the $218 million raised in H1 2023. Early-stage investments rose nearly 70% to $949 million in H1 2024 from $559 million in H1 2023. Late-stage investments, too, rose 78.5% to $357 million in H1 2024 from the $200 million raised in H1 2023.

Only two 100M+ funding rounds took place in the first half of 2024. Companies like Origo Energia, HIF Global have managed to raise funds above $100 million in this period. Origo Energia raised $400 million in a Series B round led by I Squared Capital, while HIF Global raised a total of $164 million in a Series D round.

FinTech, Enterprise Applications and High Tech were the top-performing sectors in H1 2024. FinTech companies raised $484 million in the first half of 2024, a rise of 22% from the $396 million raised in H1 2023. Funding in the Enterprise Applications space fell 30% to $391 million in H1 2024 from $556 million in H1 2023.

There was hardly any activity on the IPO front, with Unusual Machines being the only company to go public in H1 2024. A total of 52 companies were acquired in H1 2024, significantly lower than the 62 acquisitions observed in the first six months of 2023. Exito was acquired by Calleja Group and Groupe Casino for $156 million, becoming the highest-valued acquisition in H1 2024, followed by the purchase of Quiver by Dimensa for a price of $23 million.

Further, Q1 Tech was the only new unicorn that emerged in H1 2024, a minor improvement from H1 2023, which did not witness any new unicorns.

Campinas took the lead in terms of city-wise funding, accounting for 27% of the total investments secured by tech startups in the region. Companies based in Campinas raised $402 million in H1 2023, followed by those based in Sao Paulo ($301 million) and Bogota ($165 million).

Y Combinator, Kaszek and 500 Global are the all-time top investors in the Latam Tech ecosystem. Bossa Nova, DOMO, 500 Global were the overall top investors in the Latam Tech ecosystem in H1 2024.

The Latin American startup ecosystem has recently shown some stability in terms of investments. Factors such as increasing internet penetration, a young and tech-savvy population, and evolving digital infrastructure are likely to sustain this momentum.