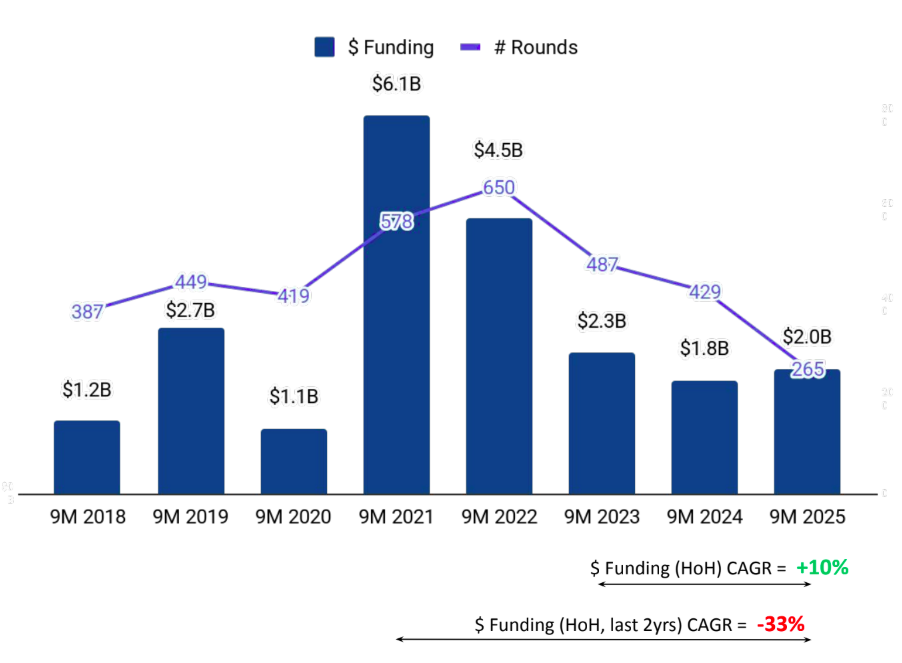

Tracxn has released its Maharashtra Tech 9M 2025 funding report, presenting an overview of investment activity across the state’s startup and technology ecosystem. In 9M 2025, Maharashtra continued to demonstrate stable investment performance with consistent deal flow across stages, multiple large-ticket rounds, strong sectoral activity, and robust participation from early, mid, and late-stage investors. The period also saw new public listings, sustained M&A momentum, and continued dominance of Mumbai as the state’s leading innovation and funding hub.

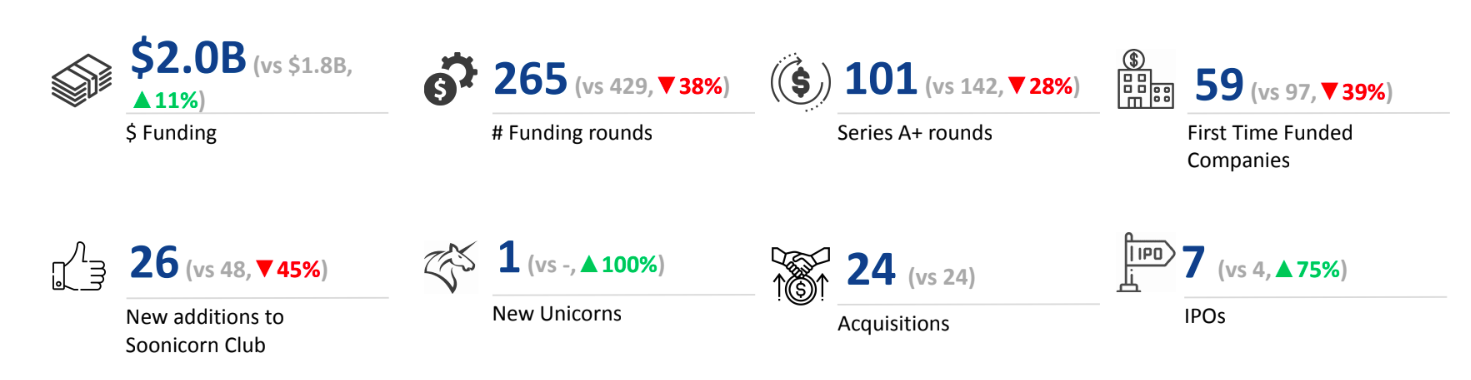

Maharashtra tech companies raised a total of $2.0B in 9M 2025, an 11% rise compared to $1.8B in 9M 2024. However, this represents an 11% decline from $2.3B recorded in 9M 2023. While overall activity remained strong, investment inflows showed changes across stages and sectors, shaping the growth trajectory of the ecosystem during the period.

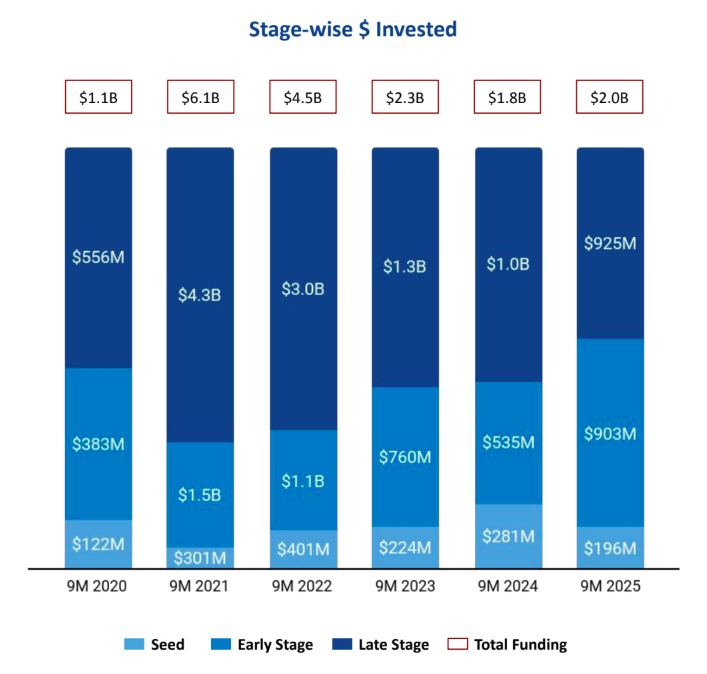

Funding activity across stages in Maharashtra displayed varied momentum in 9M 2025. Seed-stage funding stood at $196M, reflecting a 30% decline from $281M in 9M 2024 and a 12% drop from $224M in 9M 2023. Early-stage investment registered strong growth, reaching $903M, a 69% jump compared to $535M in 9M 2024 and a 19% rise from $760M in 9M 2023. In contrast, late-stage funding totaled $925M, marking a 10% decline from $1.0B in 9M 2024 and a 29% decrease compared to $1.3B raised in 9M 2023, indicating softer activity at the mature end of the market.

Retail, Real Estate and Construction Tech, and FinTech emerged as the top-performing sectors in 9M 2025. The Retail sector recorded $633M in total funding, reflecting a 50% increase compared to $421M in 9M 2024, and 55% growth over $408M in 9M 2023. The Real Estate and Construction Tech sector saw funding of $555M, representing a 444% surge compared to $102M in 9M 2024, and an increase of 1414% over $37M in 9M 2023. The FinTech sector recorded $477M, which is an 11% decrease compared to $533M in 9M 2024, but an increase of over 10% compared to $433M in 9M 2023.

Three $100M+ funding rounds were recorded in Maharashtra in 9M 2025, in line with the three seen in 9M 2024 but slightly lower than the four recorded in 9M 2023. GreenLine raised $275M in a Series A round, Infra.Market secured $222M in a Series F round, and Weaver Services raised $170M in an Unattributed round, all crossing the $100M mark. These large-ticket deals were primarily driven by the Real Estate and Construction Tech, Transportation and Logistics Tech, and Retail sectors.

The period also saw positive public market activity, with 7 IPOs in 9M 2025, up 75% from 4 in 9M 2024, and 17% higher than 6 in 9M 2023. Companies that went public included Seshaasai, Anand Rathi, Jaro Education, and Electronics Bazaar. In addition, one new unicorn emerged in 9M 2025, compared to none in both 9M 2024 and 9M 2023.

Tech companies in Maharashtra recorded 24 acquisitions in 9M 2025, matching the total in 9M 2024, but down 33% from 36 acquisitions in 9M 2023. The state also witnessed significant M&A activity, with the acquisition of Magma General Insurance by DS Group and Patanjali Ayurved for $516M, marking the largest deal in 9M 2025. This was followed by the acquisition of Web Werks by Iron Mountain at a valuation of $164M.

N8Mumbai remained the leading hub for startup funding, accounting for 65% of all investments raised by tech companies in Maharashtra during 9M 2025. Pune followed as the second-strongest city, contributing 16% of total funding during the same period.

Investor participation in Maharashtra’s tech ecosystem remained active across stages in 9M 2025. Venture Catalysts, Antler, and Rainmatter emerged as the most active investors at the seed stage, backing early-stage startups across the state. At the early stage, Elevation Capital, Lightspeed Venture Partners, and Bessemer Venture Partners played key roles in driving scale-up investments. At the mature end of the market, Sofina led late-stage investment activity in the Maharashtra tech ecosystem during the period.

The Maharashtra tech ecosystem demonstrated strong activity in 9M 2025, with consistent funding inflows, multiple large-ticket deals, and sustained transaction volumes across IPO and M&A activity. Momentum was driven by strong performance in sectors such as Retail, Real Estate and Construction Tech, and FinTech. While seed and late-stage funding experienced declines, the sharp rise in early-stage investment and the continued dominance of Mumbai as a funding center reflect the resilience and growth trajectory of the state’s technology ecosystem.