Tracxn has released its Maharashtra Tech H1 2025 Funding Report, covering the funding landscape for tech companies in the state during the first half of 2025. The report highlights an uptick in overall funding, driven by robust early-stage activity and a steady presence of mega-deals. While unicorn creation remained limited, sectors like Transportation and Logistics Tech and Retail experienced sharp growth in investor interest. The report also notes shifts in city-wise funding dynamics and identifies the most active investors across stages.

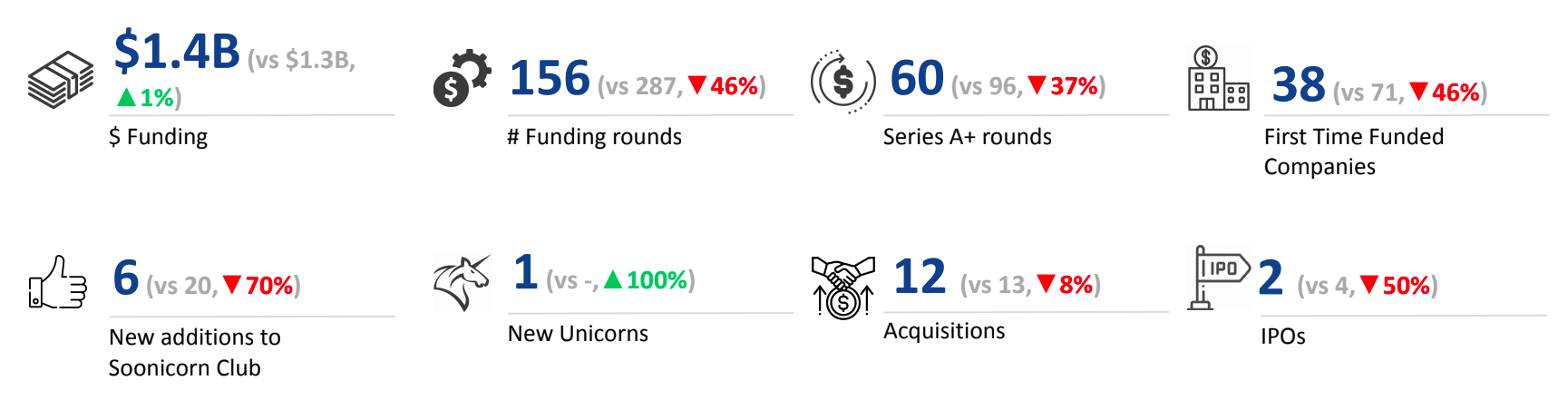

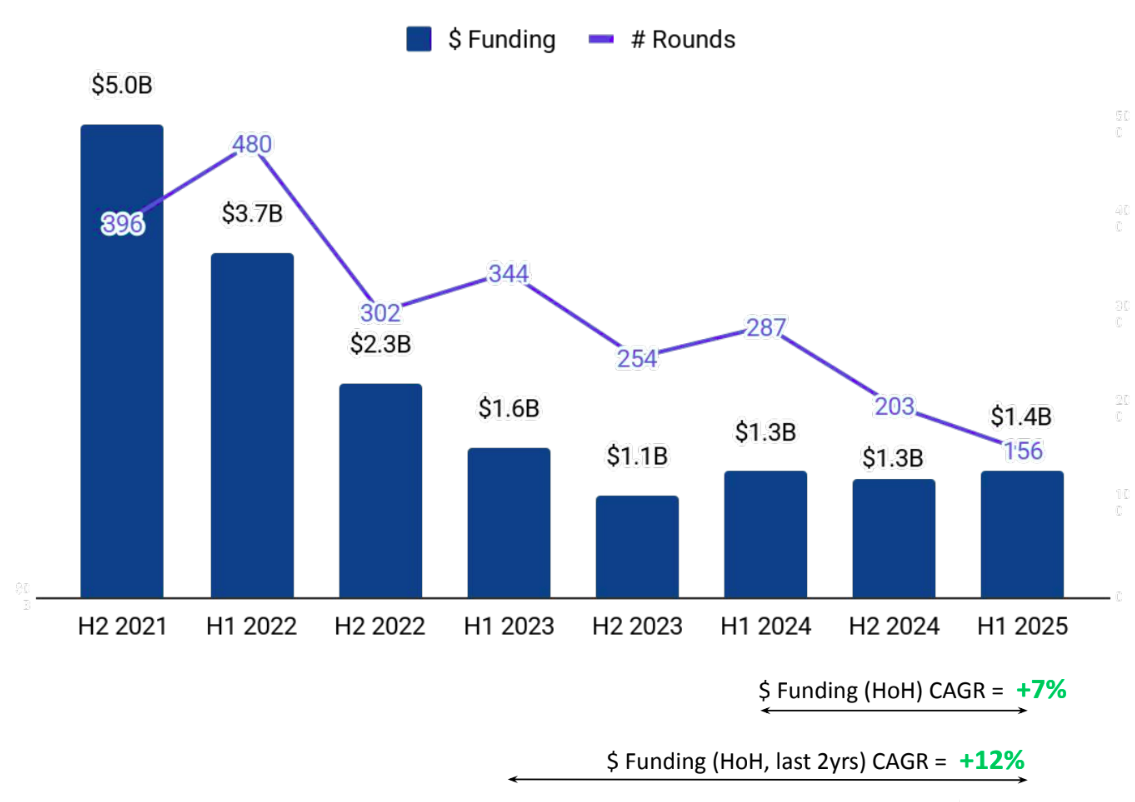

A total of $1.4B was raised by tech companies in Maharashtra in H1 2025, marking an increase of 8% compared to $1.26B raised in H2 2024 and a 1% increase from $1.34B in H1 2024. The funding trend indicates a relatively stable and slightly improving investment climate for the region across consecutive periods.

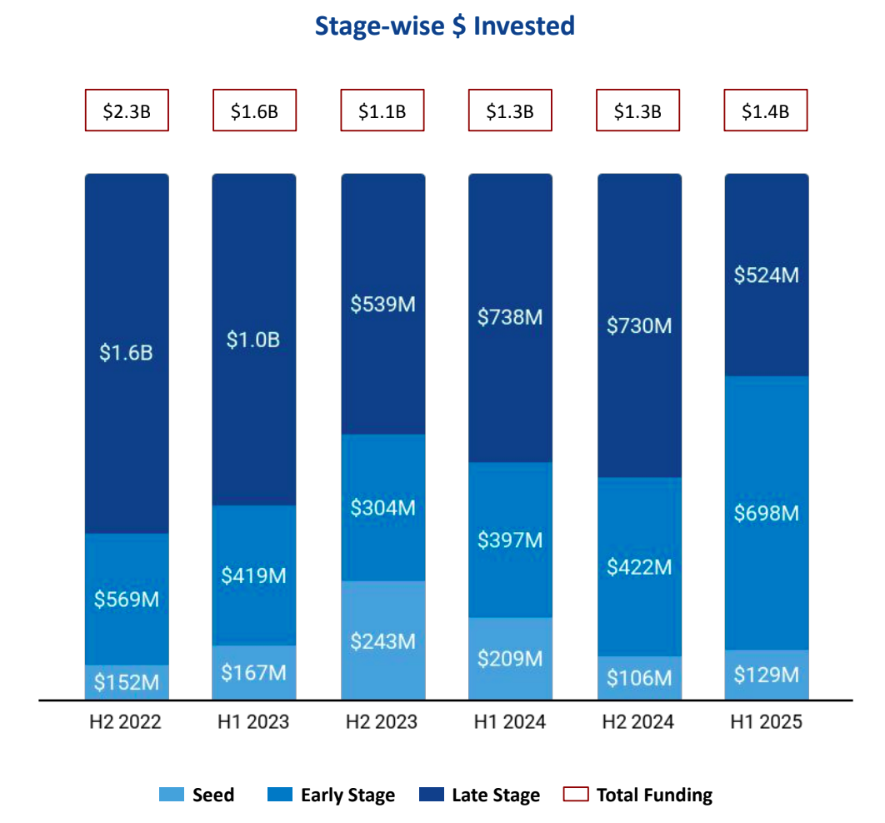

Seed Stage saw a total funding of $129M in H1 2025, an increase of 22% compared to $106M raised in H2 2024, and a drop of 38% compared to $209M raised in H1 2024. Early Stage saw a total funding of $698M in H1 2025, an increase of 65% compared to $422M raised in H2 2024, and an increase of 76% compared to $397M raised in H1 2024. Late Stage witnessed a total funding of $524M in H1 2025, a drop of 28% compared to $730M raised in H2 2024, and a drop of 29% compared to $738M raised in H1 2024.

Retail, Transportation and Logistics Tech & Enterprise Applications were the top-performing sectors in H1 2025 in this space. The Retail sector saw a total funding of $463M in H1 2025 which is an increase of 109% when compared to $222M raised in H2 2024 and a rise of 29% when compared to $360M raised in H1 2024. The Transportation and Logistics Tech sector saw a total funding of $378M in H1 2025 which is an increase of 280% when compared to $99.6M raised in H2 2024 and an increase of 199% when compared to $127M raised in H1 2024. The Enterprise Applications sector saw a total funding of $321M in H1 2025 which is a decrease of 6% when compared to $340M raised in H2 2024 and a drop of 18% when compared to $390M raised in H1 2024.

H1 2025 saw 2 $100M+ funding rounds, same as H2 2024 and 3 in H1 2024. Companies like GreenLine and Infra.Market have managed to raise funds above $100M in this period. GreenLine has raised a total of $275M in a Series A round. Infra.Market has raised a total of $222M in a Series F round. A major part of these $100M+ funding rounds are from Transportation and Logistics Tech & Real Estate and Construction Tech. Only one unicorn was created in H1 2025, while there were none in H2 2024 and H1 2024. ArisInfra and ATC Group were the only two companies to go public in H1 2025.

Tech companies in Maharashtra saw 12 acquisitions in H1 2025, a drop of 40% and 8% compared to 20 in H2 2024 and 13 in H1 2024, respectively. Magma General Insurance was acquired by DS Group, Patanjali Ayurved at a price of $516M. This became the highest valued acquisition in H1 2025 followed by the acquisition of Dice by Zaggle at a price of $14.3M.

Mumbai based tech firms accounted for 64% of all funding seen by tech companies across Maharashtra. This was followed by Thane at a distant second.

Blume Ventures, LetsVenture and Venture Catalysts were the overall top investors in Maharashtra Tech ecosystem. Venture Catalysts, Z47 and Rainmatter were the top seed stage investors in Maharashtra Tech ecosystem for H1 2025. Bessemer Venture Partners, Lightspeed Venture Partners and Evolvence India were the top early stage investors in Maharashtra Tech ecosystem for H1 2025. Accel, Tiger Global Management and Iron Pillar were the top late stage investors in Maharashtra Tech ecosystem for H1 2025. Among VCs, India based Z47 led the most number of investments in H1 2025 with 3 rounds, while another India based fund Venture Catalysts added 3 new companies to its portfolio. Late stage VC investments saw Belgium based Sofina and Singapore based Mars Growth Capital add 2 and 1 company each to their portfolios.

The Maharashtra tech ecosystem showed steady momentum in H1 2025, with a rise in total funding supported by strong early-stage activity and the presence of large-ticket deals. While late-stage funding and seed-stage volumes declined on a YoY basis, the sharp increase in sectoral funding particularly in Retail and Transportation and Logistics Tech highlighted evolving investor priorities. Mumbai retained its leadership as the top funding hub, with a notable share of 64%, while the ecosystem also witnessed two IPOs and the creation of one unicorn during the period.