Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Maharashtra Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the Maharashtra Tech space.

The Maharashtra Tech startup ecosystem is the second-highest funded startup ecosystem in the country, after Karnataka, with an overall funding of more than $32 billion to date. Maharashtra is home to more than 24k startups, which includes 28% of active unicorn companies in India.

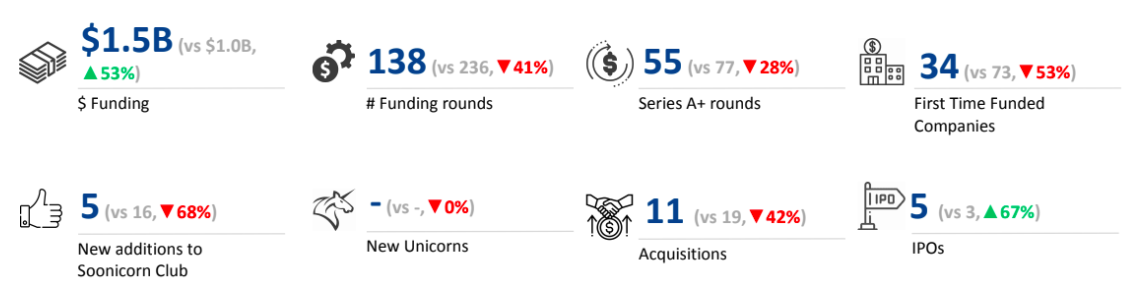

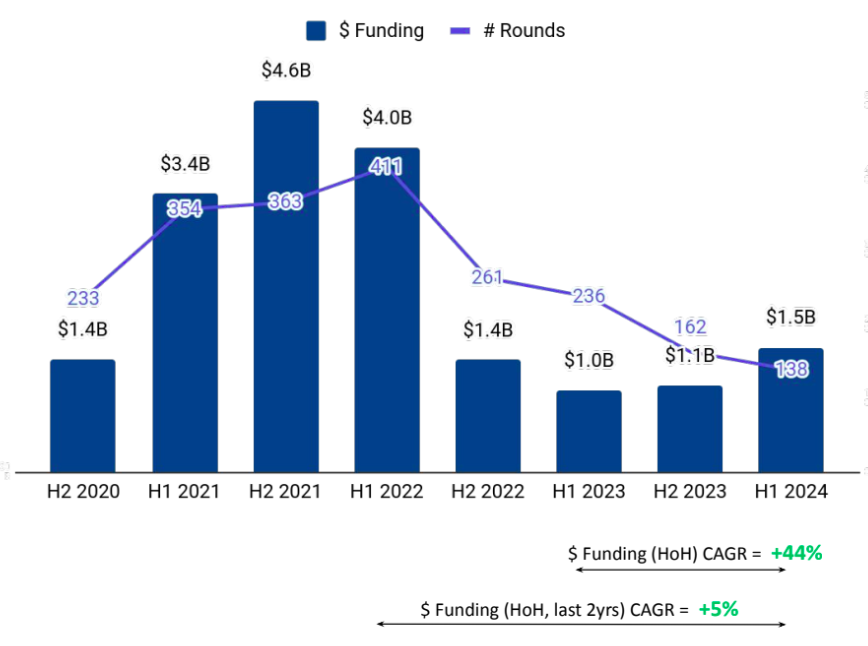

Funding into the Maharashtra Tech startup ecosystem surged 50% to $1.5 billion in H1 2024 from $1 billion in H1 2023. This is also an increase of 36% compared with the $1.1 billion raised in H2 2023.

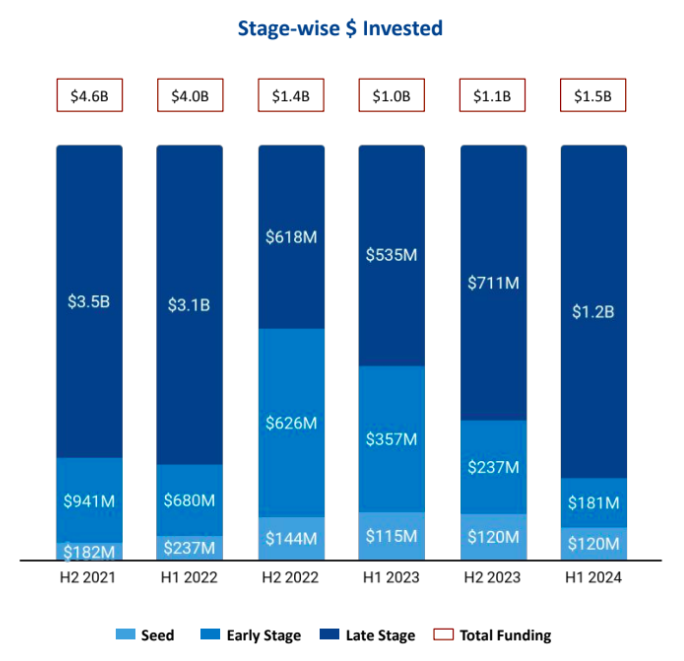

The growth in investments was largely due to late-stage rounds. The tech startup landscape in the state secured late-stage funding of $1.2 billion in H1 2024, a 124% spike compared with the $535 million raised in the first half of 2023.

Early-stage funding in the first six months of 2024 fell 49% to $181 million from $357 million in H1 2023. Seed-stage funding stood at $120 million in H1 2024, a 4% uptick from the $115 million raised in H1 2023.

Zepto, API Holdings, and Avanse reported $100M+ rounds in the first half of 2024. Zepto raised $655 million in Series F funding, making it the largest funding round in this space in H1 2024. API Holdings raised $216 million in a Series F funding round, while Avanse raised $120 million in a Series C funding round. Further, the ecosystem did not witness any new Unicorns in the first half of 2024, similar to H1 2023.

Food & Agriculture Tech, Enterprise Applications, Retail and FinTech were the top-performing sectors in H1 2024 in the Maharashtra Tech startup ecosystem. The Food & Agriculture sector attracted investments worth $735 million in H1 2024, a massive increase of 1519% from $45.4 million raised in H1 2023. Funding in the Enterprise Applications sector rose 91% to $340 million in H1 2024 from $178 million in the first six months of 2023. The Retail space raised $322 million in H1 2024, a decline of 14% compared with $375 million raised in H1 2023. FinTech companies secured total funding of $289 million, 8% lower than the $313 million raised in H1 2023.

The number of acquisitions dropped to 11 in H1 2024, as against 19 in H1 2023 and 18 in H2 2023. Aerpace Industries acquired Aerpace at an acquisition price of $961K. However, there was a minor uptick in the number of IPOs, to five in H1 2024 from three in H1 2023.

Mumbai took the lead in terms of city-wise funding in the first half of this year, accounting for 83% of the total funding raised by the state. Tech startups based in the state’s capital raised $1.3 billion, followed by those headquartered in Pune ($180 million) and Thane ($50.4 million).

Blume Ventures, Venture Catalysts and LetsVenture are the all-time top investors observed in the Maharashtra Tech startup ecosystem to date. Venture Catalysts, Capital A and Z Nation Lab were the top seed-stage investors in H1 2024, while Orbimed, Vertex Ventures and Lightbox took the lead in terms of early-stage investments. Glade Brook Capital, Epiq Capital Advisors and UC-RNT Fund were the top late-stage investors.