Tracxn, a leading market intelligence platform, has released its first India Military Tech Report 2025. The report provides a comprehensive overview of the Military Tech startup ecosystem in India, covering funding trends, investor activity, active players, and the macro factors shaping the country’s military and defence landscape.

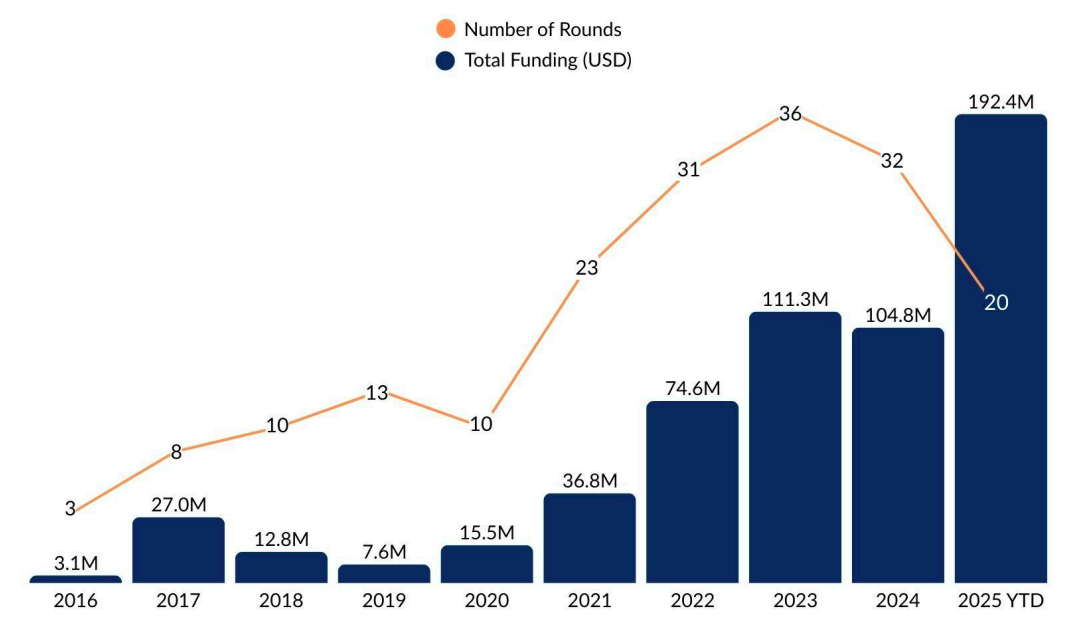

According to the report, India’s Military Tech sector has witnessed exponential growth over the last decade. Annual funding surged from $3.1M in 2016 to $192.4M in 2025 YTD, a 61-fold increase. This makes 2025 YTD the most funded year to date, driven by Raphe mPhibr’s landmark $100M Series-B round. To date, the sector has raised $611M across 211 equity funding rounds. The number of funding rounds has mirrored this growth, rising from only three in 2016 to a peak of 36 in 2023, with 20 already recorded in 2025.

India’s Military Tech ecosystem comprises over 150 active startups, with Bengaluru (37), Delhi NCR (36), and Hyderabad (21) emerging as the leading hubs. As of 2025 YTD, 76 startups have secured equity funding. Of these, 58 have raised capital at the seed stage or later, while 18 have advanced to Series A and beyond.

Funding trends across stages in 2025 YTD reflect an evolving landscape. Early-stage companies led the sector, with the top-funded round by Raphe mPhibr, which raised $100M in their Series B round, followed by Newspace Research and Technologies with $33M in Series B and Sagar Defence Engineering with $25.4M in Series A. Notably, early-stage rounds accounted for 8 of the 10 largest all-time funding deals, underscoring strong investor focus at this stage. Seed-stage startups raised smaller but critical rounds, including DroneAcharya which raised $4.6M, Gamma Rotors, which raised $3.1M, and Constelli raised $3.0M. Late-stage funding witnessed notable rounds such as Big Bang Boom Solutions’ $29.9M with their Series C round and Tonbo Imaging’s $20.4M Series D round. .

Commenting on the findings, Neha Singh, Co-Founder, Tracxn, said, “India’s Military Tech sector is entering a defining phase, shaped by innovation, policy support, and growing investor participation. Deep tech solutions such as drones, AI, robotics, and cybersecurity are moving from experimental to mission-critical, with dual-use applications strengthening both defence and civilian domains. Government initiatives like Atmanirbhar Bharat, iDEX and the Defence Industrial Corridors are accelerating this shift, while a widening pool of investors, from established domestic players to new global entrants, signals strong confidence in the sector’s future. Together, these factors are laying the foundation for India to emerge as a global hub for next-generation defence technologies.”

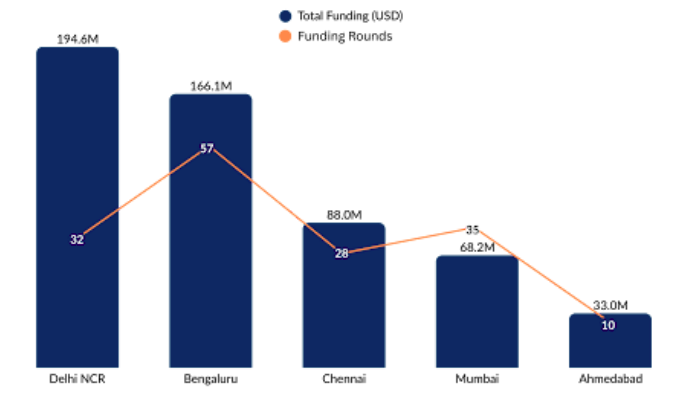

Geographically, Delhi NCR led the funding landscape in 2025, securing $194.6M in funding to date, driven primarily by Raphe mPhibr and Anadrone. Bengaluru followed as the second-largest hub, attracting $166.1M, led by Newspace Research and Technologies, Tonbo Imaging, and Sanlayan.

The sector has recorded 4 acquisitions to date, reflecting growing consolidation in the ecosystem. Notable deals include Reliance Industries’ acquisition of Asteria Aerospace in 2019, Adani Defence Systems and Technologies’ acquisitions of Flaire Unmanned Systems in 2019 and Alpha Design Technologies in 2018 and Trentar’s acquisition of Trishula in 2021.

4 companies went IPO, marking an important milestone for India’s defence technology ecosystem. ideaForge went public in 2023 and DroneAcharya in 2022, while earlier listings include Zen Technologies in 2015 and Astra Microwave Products in 2004. These IPOs demonstrate the sector’s growing maturity, with startups scaling to public markets and attracting wider investor participation.

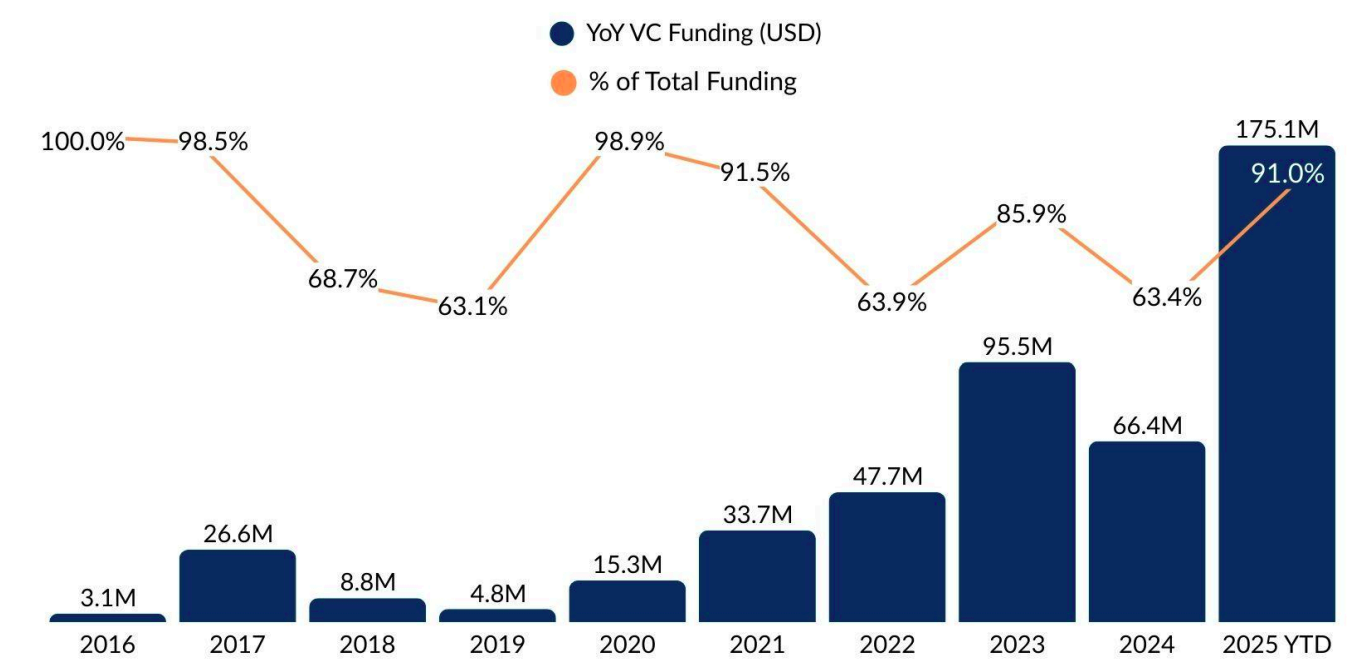

On the investor front, around 110 VCs have invested in India’s Military Tech sector till 2025 YTD. Among the most active are IDBI Capital Markets & Securities Ltd, Hda Tech Growth and Venture Catalysts. IDBI Capital led with 6 rounds across 4 portfolio companies, while Hda Tech Growth and Venture Catalysts participated in 5 rounds each. Other notable investors include Celesta Capital, Accel and Gujarat Venture Finance, backing companies such as ideaForge, Axio Biosolutions and Optimized Electrotech.

During 2016–2025 YTD, the number of first-time VCs outnumbered repeat investors in five out of ten years, reflecting an expanding investor base and the gradual mainstreaming of defence innovation. In 2025, new entrants included General Catalyst (Raphe mPhibr), Dexter Ventures and AC Ventures (Armory) and Navam Capital (Vayudh).