Tracxn has released its H1 2025 New York Tech Funding Report, providing an in-depth look at the funding landscape across the state’s tech ecosystem. The first half of 2025 marked a downturn in overall capital raised, but activity remained robust in enterprise-focused sectors. Despite declines in seed and early-stage investments, late-stage activity showed signs of resilience. The period also saw major acquisitions, public listings, and strong participation from leading global investors.

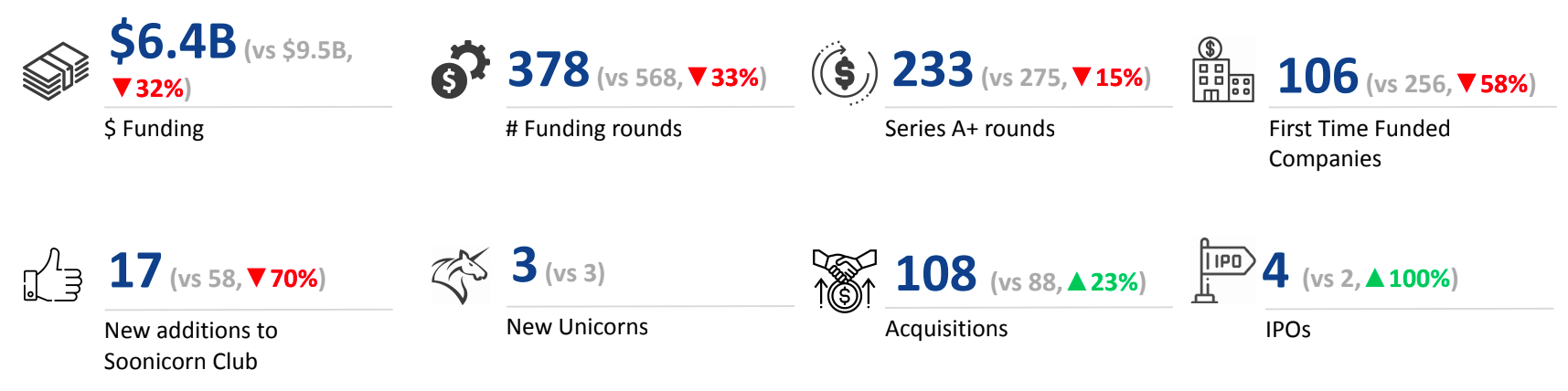

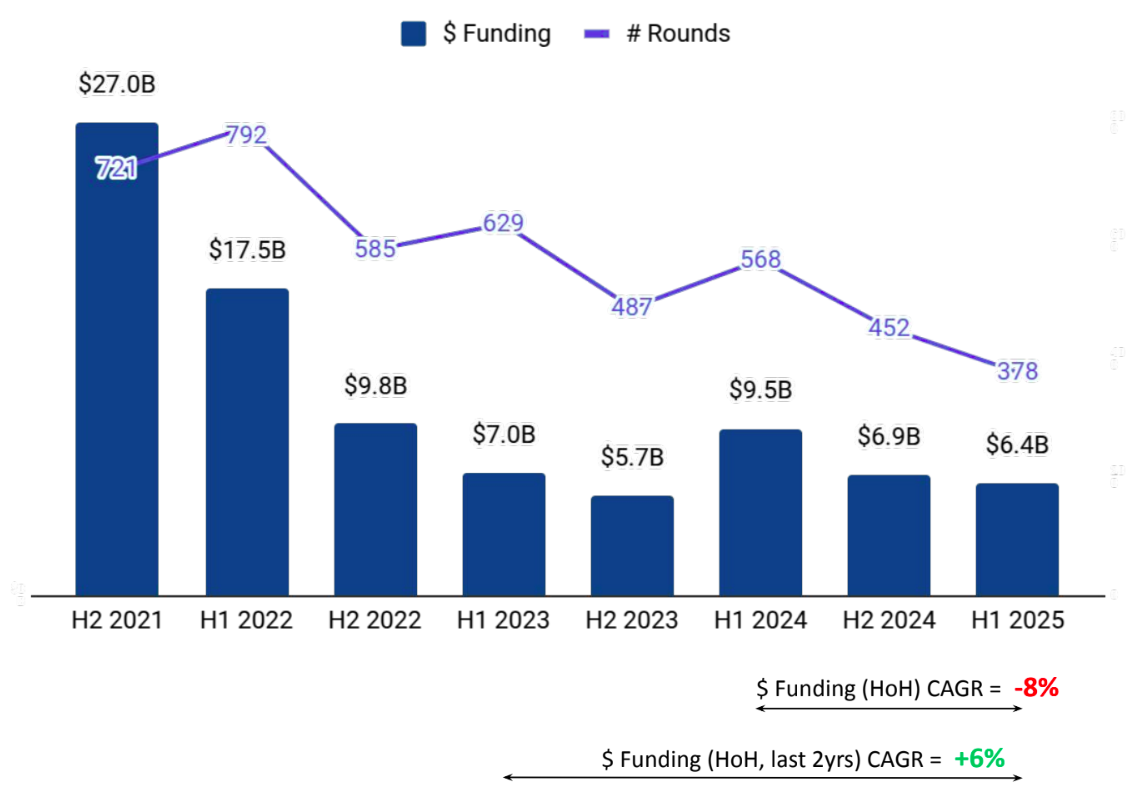

A total of $6.4B was raised in H1 2025, marking a drop of 8% compared to $6.9B in H2 2024 and a 32% decline from $9.5B in H1 2024. The decrease in funding was seen across most stages, pointing to a broader slowdown in tech investments over the past year.

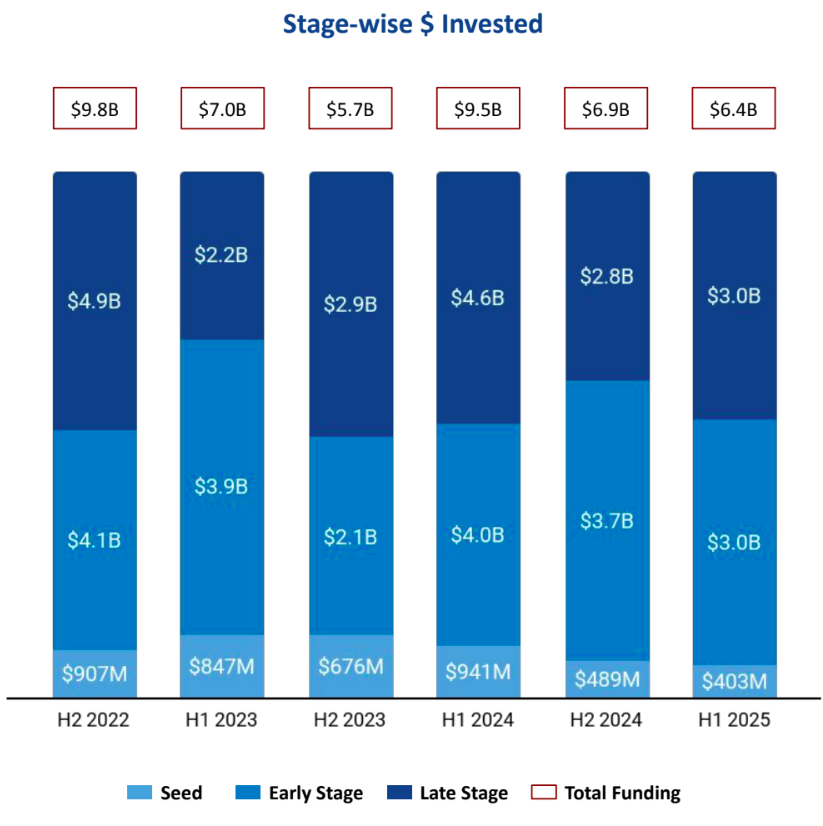

Seed Stage saw a total funding of $403M in H1 2025, a drop of 18% compared to $489M raised in H2 2024, and a drop of 57% compared to $941M raised in H1 2024. Early Stage saw a total funding of $3B in H1 2025, a drop of 19% compared to $3.7B raised in H2 2024, and a drop of 26% compared to $4B raised in H1 2024. Late Stage witnessed a total funding of $3.0B in H1 2025, an increase of 10% compared to $2.8B raised in H2 2024, and a drop of 34% compared to $4.6B raised in H1 2024.

Enterprise Applications saw a total funding of $4.1B in H1 2025, which is an increase of 10% compared to $3.7B raised in H2 2024, but a decline of 40% compared to $6.8B raised in H1 2024. FinTech sector saw a total funding of $1.7B in H1 2025, marking a drop of 11% from $1.9B in H2 2024 and a decline of 34% from $2.6B in H1 2024. Enterprise Infrastructure saw a total funding of $1.1B in H1 2025, representing a 47% increase from $755.1M in H2 2024, but a 48% drop from $2.1B raised in H1 2024. Enterprise Applications, Enterprise Infrastructure, and FinTech were the top-performing sectors in H1 2025 in this space.

H1 2025 has witnessed 11 $100M+ funding rounds, compared to 13 in H2 2024 and 19 rounds in H1 2024. Companies like Cyera, Runway, Ramp, Stash, and Kalshi were some of the companies that managed to raise funds above $100M in this period. Cyera has raised a total of $540M in a Series E round. Runway has raised a total of $308M in a Series D round. Ramp has raised a total of $200M in a Series E round. A major part of these $100M+ funding rounds are from Enterprise Applications, Enterprise Infrastructure, and FinTech.

There were 3 unicorns created in H1 2025 and H1 2024, marking a 25% decline from 4 in H2 2024. Digital Asset, Aether Holdings, Brag House, and Metsera went public in H1 2025.

Tech companies in New York saw 108 acquisitions in H1 2025, an increase of 21% compared to 89 in H2 2024, and a rise of 23% compared to 88 in H1 2024. Wiz was acquired by Google at a price of $32B. This became the highest valued acquisition in H1 2025, followed by the acquisition of Intra-Cellular Therapies by Johnson & Johnson at a price of $14.6B.

New York City based tech firms accounted for 92% of all funding seen by tech companies across New York. This was followed by Brooklyn at a distant second.

Y Combinator, Techstars, and Lerer Hippeau were the overall top investors in the New York Tech ecosystem. Y Combinator, General Catalyst, and AlleyCorp were the top seed stage investors in the New York Tech ecosystem for H1 2025. Sequoia Capital, Founders Fund, and Accel were the top early stage investors in the New York Tech ecosystem for H1 2025. Bond Capital, Sapphire Ventures, and 137 Ventures were the top late stage investors in the New York Tech ecosystem for H1 2025. Among VCs, United States based General Catalyst led the most number of investments in H1 2025 with 33 rounds, while another United States based fund Sequoia Capital added 22 new companies to its portfolio. Late stage VC investments saw United States based Bond Capital and United States based Sapphire Ventures add 2 and 2 companies each to their portfolios.

Despite a decline in overall funding, New York’s tech scene saw consistent backing from top investors in H1 2025, securing $6.4B across key sectors. Big-ticket rounds in Enterprise Applications, FinTech, and Infrastructure, along with standout acquisitions like Google’s $32B purchase of Wiz, highlighted ongoing confidence in the market.