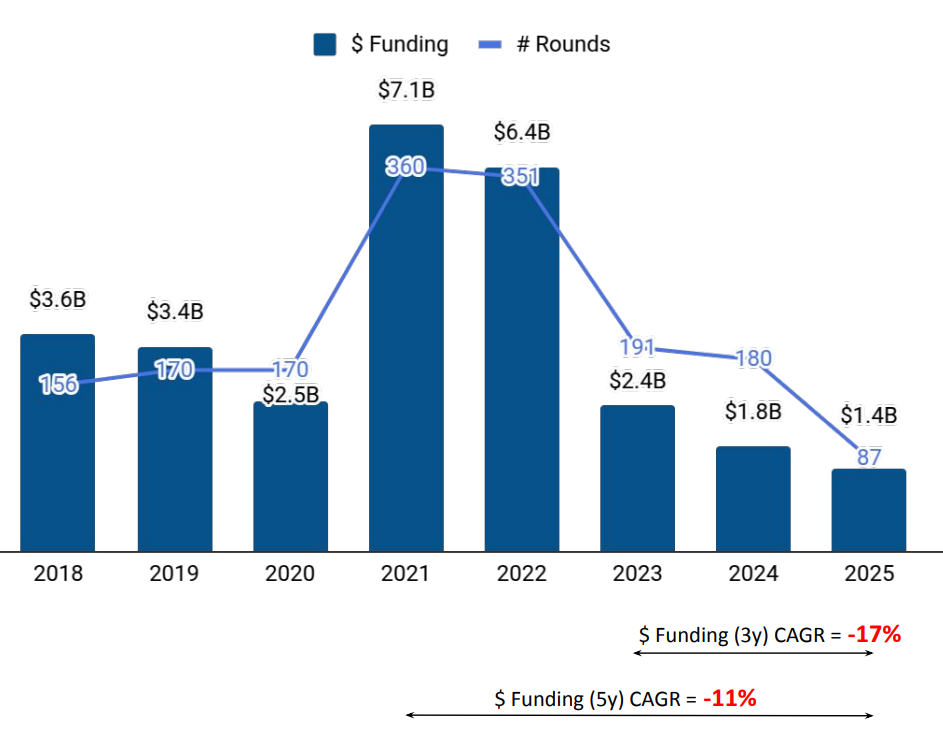

Tracxn has released its insights covering the Southeast Asia (SEA) FinTech ecosystem for the year 2025. The report highlights the funding, investment, exit, and acquisition activity across the region during the period. In 2025, SEA FinTech funding activity reflected a mixed trend, with overall capital deployment declining compared to previous years, while late-stage investments showed relative strength. The data also captures developments in IPOs, unicorn creation, acquisitions, city-wise funding concentration, and investor participation across funding stages.

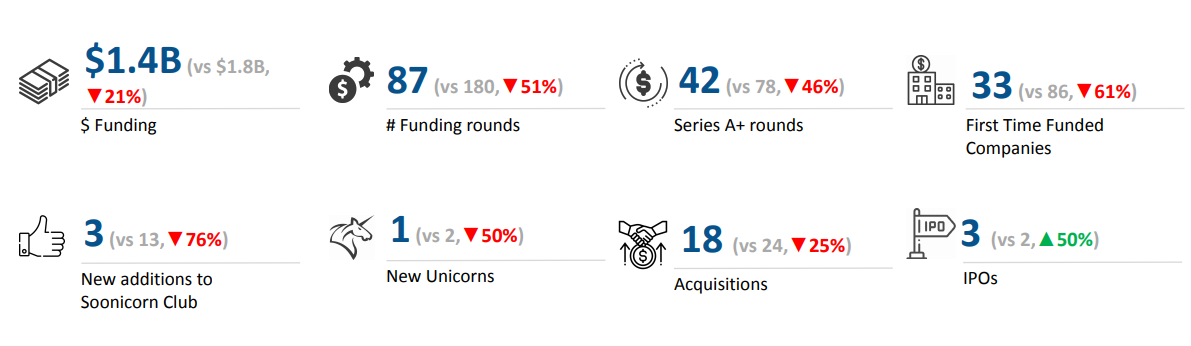

A total of $1.4B was raised by SEA FinTech companies in 2025. This represents a 21% decline compared to the $1.8B raised in 2024 and a sharper 43% drop from the $2.4B raised in 2023. While overall funding volumes fell, the distribution of capital across stages varied significantly, indicating a continued focus on mature companies despite reduced overall investment levels.

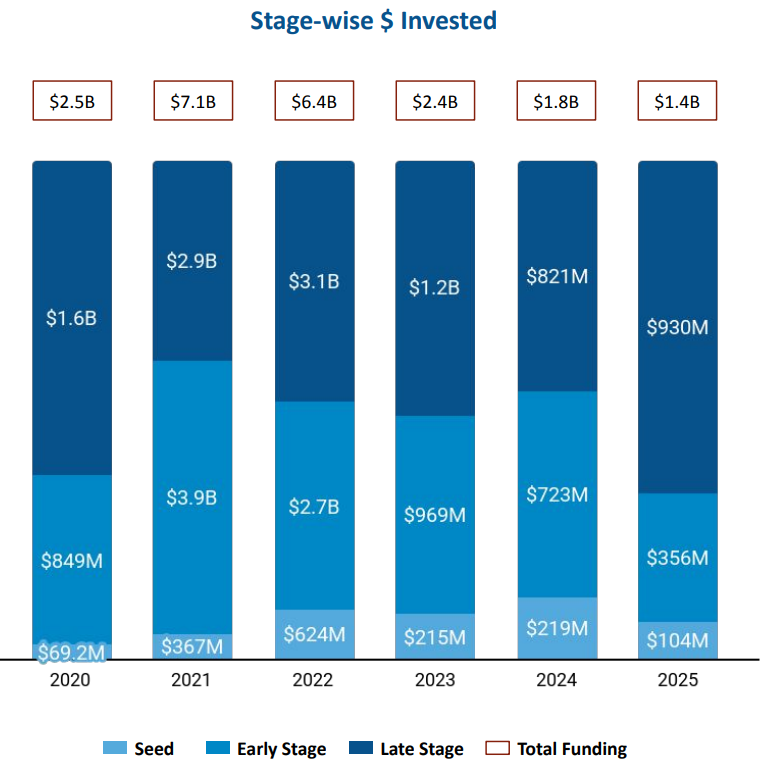

Seed-stage funding in SEA FinTech stood at $104M in 2025, marking a 53% decline from $219M in 2024 and a 52% drop compared to $215M in 2023. Early-stage funding also contracted, with companies raising $356M in 2025, down 51% from $723M in 2024 and 63% from $969M in 2023. In contrast, late-stage funding reached $930M in 2025, representing a 13% increase over the $821M raised in 2024, although it remained 25% lower than the $1.2B raised in 2023.

SEA FinTech recorded 3 $100M+ funding rounds in 2025, the same number as in 2024, but significantly fewer than the 7 such rounds recorded in 2023. During this period, companies such as Airwallex and Thunes raised funding rounds exceeding $100M. Airwallex raised a total of $480M through Series G and Series F rounds, while Thunes raised $150M in a Series D round.

In terms of public market activity, SEA FinTech recorded 3 IPOs in 2025, up 50% from 2 IPOs in 2024 and 2023 each. The companies that went public during the year were Superbank, TCBS, and Antalpha. Only one unicorn was created in 2025, representing a 50% decline from the two unicorns created in 2024, while no new unicorns emerged in 2023.

FinTech companies in Southeast Asia recorded 18 acquisitions in 2025, reflecting a 25% decline compared to 24 acquisitions in 2024 and a 31% drop from 26 acquisitions in 2023. The largest acquisition of the year was ASCENT, which was acquired by KFin Technologies for $34.7M, making it the highest-valued acquisition in 2025. This was followed by the acquisition of Coinseeker by Titanlab at a value of $30M.

Funding activity in 2025 remained highly concentrated geographically. Singapore-based tech firms accounted for 85% of all funding raised by FinTech companies across Southeast Asia. Bangkok emerged as the next most funded city, accounting for 4% of the total funding raised during the year.

Investor participation varied across funding stages in the SEA FinTech ecosystem in 2025. Iterative, 500 Global, and Selini Capital were the top seed-stage investors during the year. At the early stage, Peak XV Partners, Singtel Innov8, and Prosus emerged as the most active investors. In late-stage funding, DST Global, Unbound, and Asia Partners led investment activity across the region.

The Southeast Asia FinTech ecosystem in 2025 reflected a period of moderation in funding activity, with capital deployment increasingly skewed toward more mature companies. While early-stage investments faced pressure, late-stage funding demonstrated relative resilience, indicating sustained investor interest in established businesses. Exit activity remained present through multiple public listings, supporting continued liquidity pathways across the region. Unicorn creation was limited during the year, pointing to a more selective growth environment. Acquisition activity declined compared to previous periods, though strategic deals continued to shape the competitive landscape. Funding remained highly concentrated geographically, with Singapore maintaining its position as the primary hub for FinTech investment in Southeast Asia. Investor participation spanned all stages, led by a mix of global and regional venture firms. Overall, the ecosystem showed a cautious yet structured investment environment marked by selective capital allocation and concentrated activity.