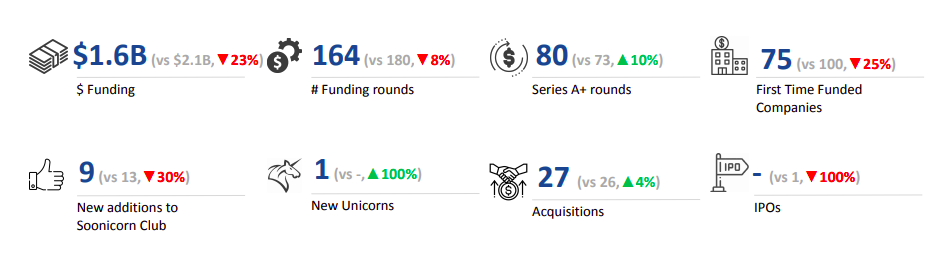

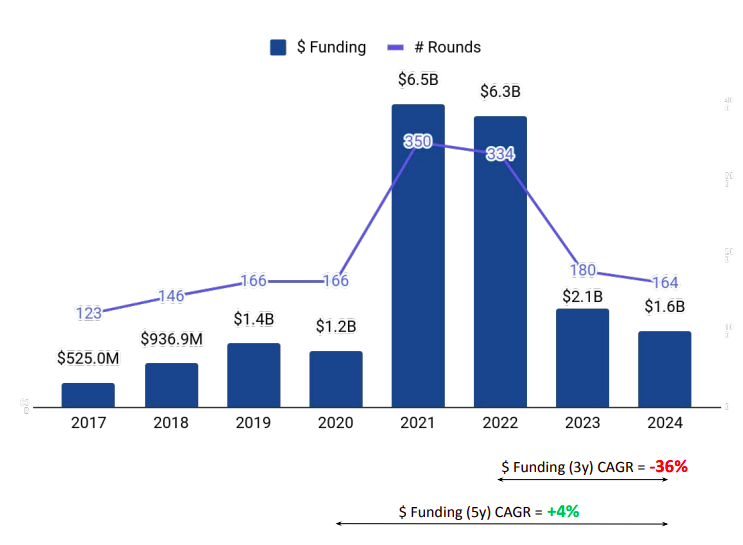

Southeast Asia’s (SEA) Fintech ecosystem witnessed total funding of $1.6 billion, a 23% drop from $2.1 billion in 2023 and a significant 75% decrease from $6.3 billion in 2022.

Funding in 2024 returned to pre-pandemic levels, reflecting challenges posed by macroeconomic conditions, rising interest rates, and geopolitical tensions. However, the sector showed resilience and became one of the top-performing areas in the overall tech startup landscape in Southeast Asia in 2024. The industry has experienced a significant digital shift, accelerated by the pandemic's push for contactless payments and eCommerce.

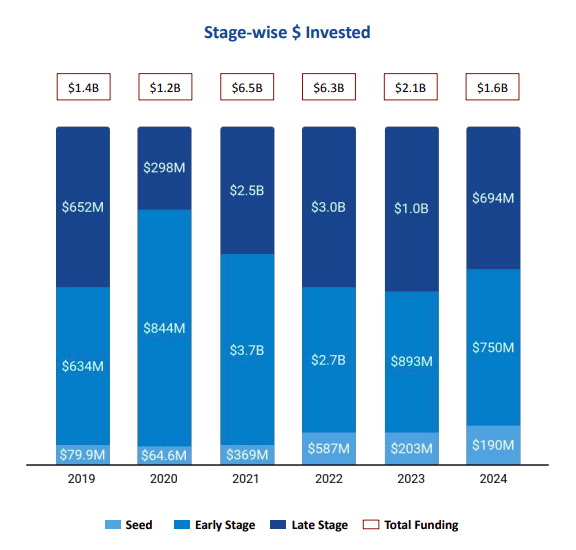

Investments declined across all stages, with late-stage rounds facing the maximum impact. FinTech companies in the region secured seed-stage funding worth $190 million, 6.4% lower than the $203 million in 2023. Early-stage funding fell 16% to $750 million in 2024 from $893 million in 2023. Late-stage investments declined 31% to $694 million in 2024 from $1 billion in 2023.

Despite the overall decline, some bright spots emerged. The Payments segment raised $366 million in 2024, marking a 53% growth from 2023. Similarly, the Cryptocurrencies space attracted $325 million, marking a 20% uptick from 2023. Banking Tech companies secured funding worth $265 million, a 63% surge from the previous year.

“Southeast Asia's FinTech ecosystem demonstrated remarkable resilience in 2024, despite funding dropping to $1.6 billion from $2.1 billion in 2023. Despite challenges such as rising interest rates, the sector's innovative spirit continued to shine, with segments like Payments and Cryptocurrencies achieving significant growth. This is a pivotal moment for startups to refine their strategies and unlock the region's immense potential,” says Neha Singh, Co-Founder and CEO of Tracxn.

Ascend Money’s $195 million Series D round was the biggest deal of the year in Southeast Asia’s FinTech landscape. Other notable $100M+ deals in 2024 include ANEXT Bank’s $148 million Series D round, and Bolttech’s $100 million Series C round.

Polyhedra Network became the only new Unicorn in 2024, after raising $20 million in a Series B funding round with a valuation of $1 billion.

The ecosystem also saw 27 acquisitions, a minor increase from 26 in 2023. The largest acquisition was NTT Data’s acquisition of GHL for $154 million. However, no FinTech company in the region went public in 2024, compared to one IPO in 2023.

Singapore led the funding activity this year, followed by Jakarta and Bangkok. FinTech companies based in Singapore raised $955 million in 2024, while those headquartered in Jakarta and Bangkok raised $242 million and $198 million, respectively.

“The Southeast Asia FinTech ecosystem is at an inflection point. While macroeconomic challenges have tempered funding activity, the region’s dynamic entrepreneurial spirit, its young, tech-savvy population and supportive government initiatives promise a bright future,” added Abhishek Goyal, Co-Founder of Tracxn.

N8Most active investors in the ecosystem include East Ventures, Y Combinator, and 500 Global. Antler, Mirana, and Alliance DAO were the most active seed-stage investors, while UOB, Argor Capital Management, and Peak XV Partners took the lead in early-stage funding. NewView Capital and The Rise Fund were the most active late-stage investors.

The SEA Fintech ecosystem faces challenges such as declining demand, valuation concerns, and rising geopolitical risks, but long-term growth prospects remain optimistic. The region’s young, tech-savvy population, large consumer base, reliance on informal financial systems, and supportive government initiatives aimed at enhancing financial inclusion provide a strong foundation for future growth.