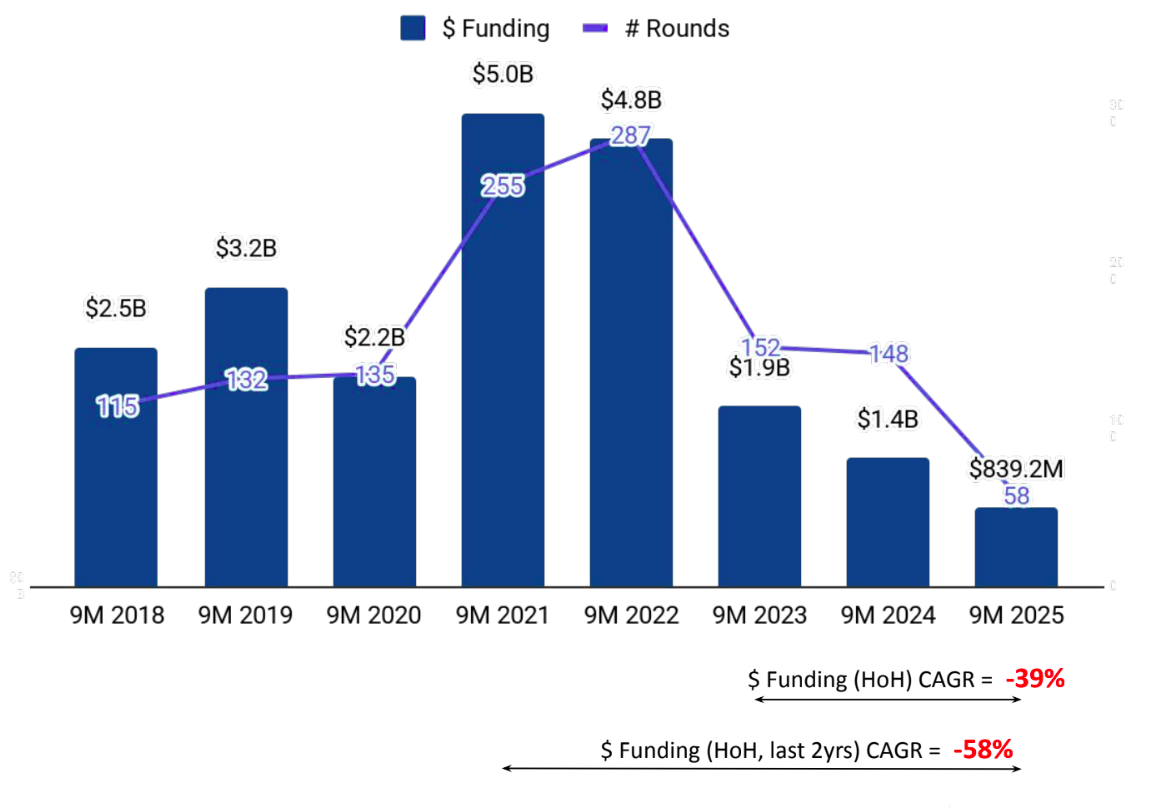

Tracxn has released its Southeast Asia FinTech Report - 9M 2025, outlining funding and investment trends across the region’s FinTech ecosystem. The report reveals that Southeast Asia’s FinTech startups collectively raised $839 million during the first nine months of 2025, reflecting a continued slowdown compared to previous years. Despite the overall decline, the period saw steady late-stage funding, notable $100M+ rounds, and a consistent number of IPOs and unicorn creations.

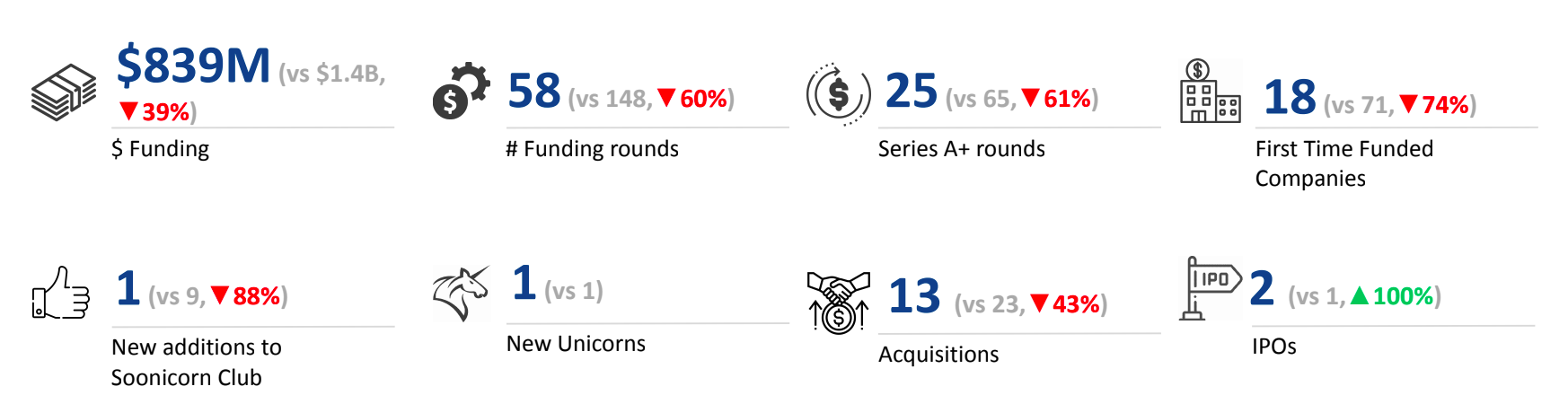

Southeast Asia’s FinTech sector raised a total of $839 million in 9M 2025, marking a 39% decline compared to $1.4 billion in 9M 2024 and a 56% drop compared to $1.9 billion in 9M 2023. The figures highlight a cooling trend in regional investment after two consecutive years of higher capital inflows.

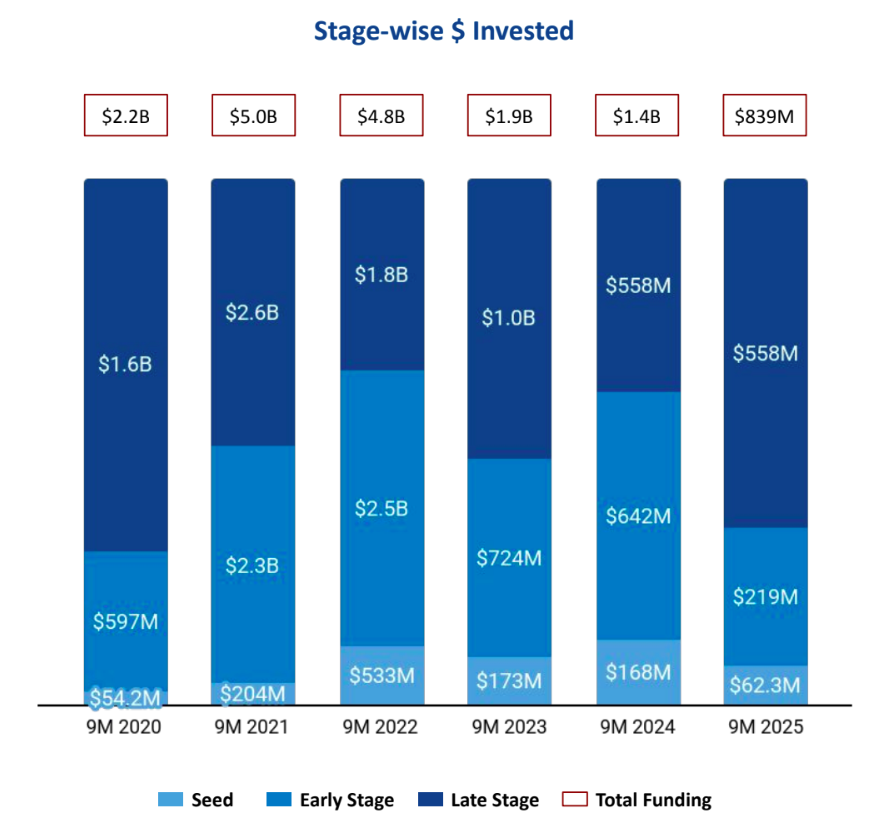

Seed-stage activity remained muted, with startups raising $62.3 million in 9M 2025, down 63% from $168 million in 9M 2024 and 64% lower than $173 million in 9M 2023. Early-stage investments followed a similar trend, totaling $219 million in 9M 2025, marking a sharp decline of 66% from $642 million in 9M 2024 and 70% compared to $724 million in 9M 2023. Late-stage funding held steady at $558 million, matching 9M 2024 levels, though still 45% below the $1.0 billion recorded in 9M 2023.

Southeast Asia recorded three $100M+ funding rounds in 9M 2025, up from two in 9M 2024 but down from six in 9M 2023. Notable mega-rounds during the period included Thunes ($150M, Series D), Airwallex ($150M, Series F), and Bolttech ($147M, Series C), underscoring strong investor backing for select growth-stage FinTech players in the region.

The region also saw two IPOs in 9M 2025, an increase of 100% compared to one IPO in 9M 2024, and the same number as two IPOs in 9M 2023. The companies that went public were Antalpha and TCBS. Additionally, there was one new unicorn in 9M 2025, the same number as in 9M 2024, while no unicorns were created in 9M 2023.

FinTech companies in Southeast Asia recorded 13 acquisitions in 9M 2025, representing a 43% drop compared to 23 acquisitions in 9M 2024, and a 35% decline from 20 acquisitions in 9M 2023. Among the key deals, ASCENT was acquired by KFin Technologies for $34.7 million, making it the highest-valued acquisition of the period. This was followed by Coinseeker’s acquisition by Titanlab for $30.0 million.

Singapore emerged as the dominant FinTech hub in Southeast Asia, accounting for 84% of total funding in 9M 2025. It was followed by Jakarta, which contributed 4% of the region’s funding. This reinforces Singapore’s position as the central hub for FinTech investments in Southeast Asia.

Investor participation in Southeast Asia’s FinTech ecosystem remained active across all stages in 9M 2025. Iterative, 500 Global, and 1337 Ventures were the most prominent investors at the seed stage, backing early innovation and startup formation in the region. At the early stage, Peak XV Partners, OSK Ventures International Berhad, and Citi Ventures played a leading role in fueling growth-focused investments. Meanwhile, DST Global Partners and Unbound stood out as the top late-stage investors, supporting mature FinTech companies with significant expansion potential.

The Southeast Asia FinTech ecosystem saw a contraction in overall funding activity in 9M 2025, primarily driven by steep declines in seed and early-stage investments. However, late-stage funding remained stable, supported by three $100M+ deals. Singapore continued to dominate regional FinTech investments, while IPO and unicorn activity remained consistent with previous periods. Despite reduced acquisition momentum, major M&A transactions such as KFin Technologies’ acquisition of ASCENT underscored continued investor interest in strategic consolidation within the sector.