Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: SEA FinTech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the Southeast Asia (SEA) FinTech space.

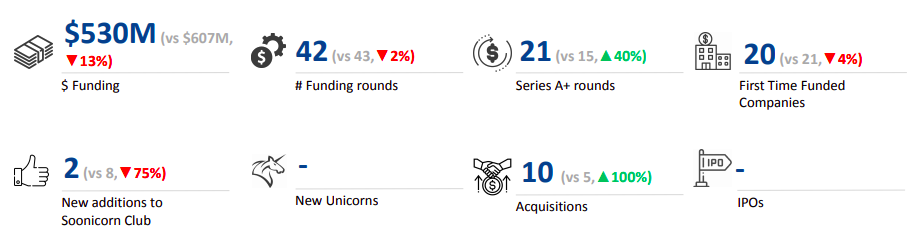

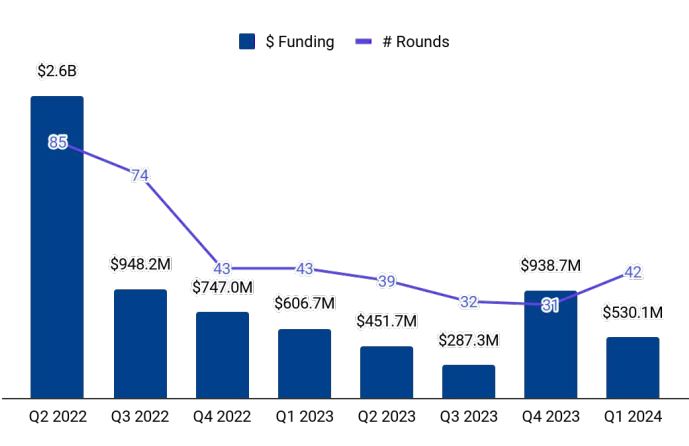

The SEA FinTech sector secured funding worth $530 million in Q1 2024, a 44% fall compared with the $939 million raised in the previous quarter (Q4 2023). This is also 13% lower than the $607 million raised in the corresponding quarter last year (Q1 2023).

N8

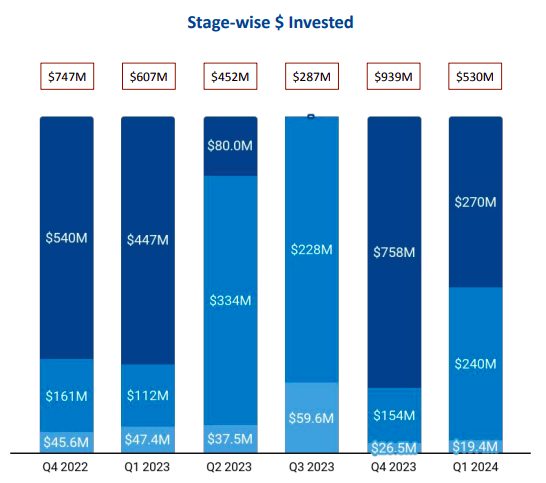

This drop in funding is largely due to the decline in late-stage funding, which declined 64% from $758 million in Q4 2023 to $270 million in Q1 2024. This is also a 40% drop when compared with the $447 million raised in Q1 2023.

Seed-stage investments in Q1 2024 stood at $19.4 million, a 27% decrease from $26.5 million raised in the previous quarter. This is also a 59% plunge from the $47.4 million raised in Q1 2023.

However, a surge was observed in early-stage investments, which rose 114% to $240 million in Q1 2024 from $112 million raised in Q1 2023. This is also a 56% increase from the $154 million raised through early-stage rounds in Q4 2023.

Q1 2024 witnessed only one $100M+ funding round, as against four and two such rounds in Q4 2023 and Q1 2023 respectively. Singapore-based ANEXT Bank raised $148 million from Ant Group. Further, no new unicorns emerged during the first three months of 2024.

The SEA FinTech startup ecosystem did not witness any IPOs in the first three months of 2024, similar to both Q1 2023 and Q4 2023. However, the number of acquisitions rose to 10 in Q1 2024, from six in Q4 2023 and five in Q1 2023.

Banking Tech, Alternative Lending, and Cryptocurrency were the top funded segments in this space in Q1 2024. Companies in the Banking Tech space witnessed $180 million in funding in Q1 2024, compared with $108 million raised in the previous quarter and just $5.5 million raised in Q1 2023.

Funding into the Alternative Lending segment stood at $126 million in Q1 2024, a 76% plunge compared with the $531 million funding raised in Q4 2023 and a 58% drop from the $302 million raised in the corresponding quarter last year.

The Cryptocurrency sector attracted investments worth $91.9 million in Q1 2024, a spike of 138% and 246% compared with $38.2 million and $26.3 million raised in Q1 2023 and Q4 2023 respectively.

FinTech companies based in Singapore accounted for 70% of the total funding in the region, raising $372 million. This is followed by companies based in Jakarta and Taguig, which raised $103 million and $32.1 million respectively.

East Ventures, Y Combinator, and 500 Global are the all-time most active investors in the SEA FinTech space.

Mirana, Bixin Ventures, and Draper Dragon were the most active seed-stage investors in Q1 2024, while MassMutual Ventures, Nyca Partners and Illuminate Financial were the most active early-stage investors. MUFG Innovation Partners was the lead investor in terms of late-stage funding in Q1 2024.

The SEA FinTech startup ecosystem witnessed funding of more than $1 billion in each quarter, starting from Q2 2021 to Q2 2022. However, investments began to decline after this period. Though funding grew in Q4 2023, a decrease was observed again in the first three months of 2024.

This downward trend can be attributed to multiple factors including the slowing economic activity across industries, reduced consumer spending, and a shift in investor interest toward more sustainable and profitable businesses.

Despite the downward trend, the SEA FinTech startup ecosystem can continue to attract investor interest in the coming months, driven by the digital readiness of this region.