Tracxn has released its Q1 2025 Southeast Asia FinTech Report, capturing the latest trends and developments in the region’s startup ecosystem. The region witnessed its peak funding in Q3 2021, after which the funding started to decline steadily except for Q2 2022. Despite the decline in funding in this space, the region is witnessing a significant increase in digital adoption along with government support and the growing focus of FinTech companies in this region with region-specific solutions.

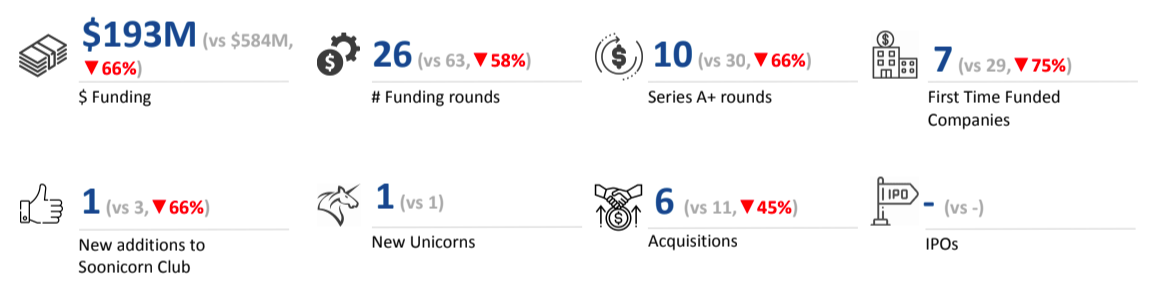

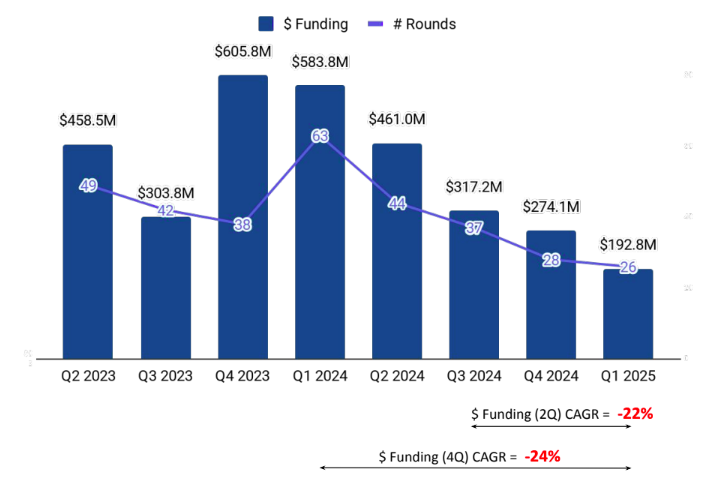

In Q1 2025, the Southeast Asia FinTech startup ecosystem witnessed a total of $193M in funding. This marks a 66% drop compared to the $584M raised in Q1 2024 and a 30% decline from the $274M raised in Q4 2024. January was the highest-funded month in Q1 2025 with $108M raised, accounting for 57% of the total funding this quarter.

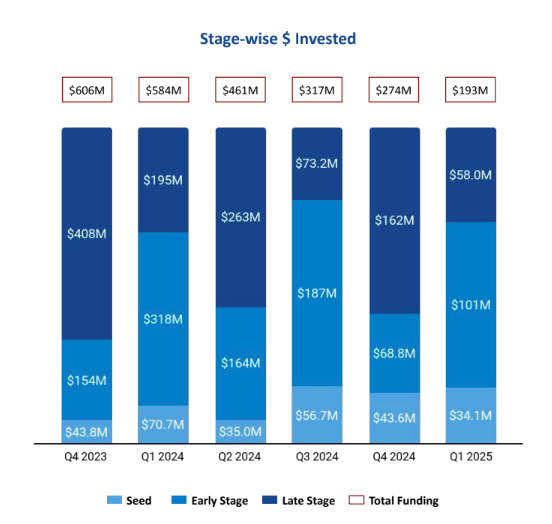

Seed-stage rounds in Q1 2025 attracted $34.1M in total funding, representing a 52% drop compared to the $70.7M raised in Q1 2024 and a 22% decline from the $43.6M raised in Q4 2024. Early-stage rounds secured $101M in funding in Q1 2025, a decrease of 68% from the $318M raised in Q1 2024, but showing an increase of 47% from the $68.8M raised in Q4 2024. Late-stage rounds witnessed a total funding of $58M in Q1 2025, experiencing a drop of 70% and 64% compared to the $195M and $162M raised in Q1 2024 and Q4 2024 respectively.

Cryptocurrencies, Alternative Lending, and Investment tech were the top-performing segments in the Southeast Asia FinTech ecosystem in Q1 2025. The Cryptocurrencies segment witnessed funding of $97.5M, a drop of 24% compared to $129M received in Q1 2024 and a 3% decline in comparison with $101M raised in Q4 2024. Sygnum, provider of banking solutions for digital assets, raised $58M in a Series C funding round. The Alternative Lending segment recorded $34.6M in funding in Q1 2025, a decline of 47% compared to $65.4M in Q1 2024 and a drop of 40% from $57.5M in Q4 2024. Techcoop, a FinTech platform providing lending solutions to the agriculture industry, raised $28M in a Series A funding round. The Investment tech segment saw total funding of $34.3M in Q1 2025, a drop of 45% and a growth of 37% compared to $62.7M and $25M raised in Q1 2024 and Q4 2024, respectively. Endowus, provider of a goal-based investment platform for individuals, raised $17.5M in a Series B funding round.

The Southeast Asia FinTech space did not witness any $100M+ funding rounds in Q1 2025. In contrast, there was one $100M+ funding round in Q1 2024 and Q4 2024 each. The region recorded one Unicorn in Q1 2025, while one Unicorn was also observed in Q1 2024. No Unicorns were seen in Q4 2024 in this space. Sygnum, provider of banking solutions for digital assets, earned the Unicorn status in January 2025, and it is the only FinTech company to become a Unicorn in 2025 on a global scale. The SEA FinTech space did not witness any IPOs in the last 5 quarters.

The Southeast Asia FinTech sector recorded six acquisitions in Q1 2025, reflecting a 45% decline from 11 acquisitions in Q1 2024 but a 20% increase compared to 5 in Q4 2024. Coinseeker, a blockchain intelligence platform, was acquired by Titanlab, a development arm of Tokenize Xchange, in a deal valued at $30M.

Singapore leads the funding in the Southeast Asia FinTech space as the highest-funded city, followed by Thu Duc and Petaling Jaya. A notable 74% of the funds raised in the SEA FinTech space originated from Singapore.

East Ventures, Y Combinator, and 500 Global are the overall top investors in the Southeast Asia FinTech startup space. Iterative, Selini Capital, and AppWorks were the lead investors in seed-stage funding in Q1 2025. Citi Ventures, HSG, and PayPal Ventures emerged as the top early-stage investors during the same period.

The Southeast Asia FinTech ecosystem saw a sharp funding decline in Q1 2025, impacted by global funding challenges, investor caution, and market saturation. Despite the overall downturn and absence of $100M+ funding rounds, the emergence of a new Unicorn and continued digital adoption underscore the region’s potential. Singapore's dominant share in regional funding, the performance of the Cryptocurrencies and Alternative Lending sectors, and rising investor specialization across stages reflect an evolving FinTech landscape driven by region-specific strategies.