Tracxn, a global leader in SaaS-based market intelligence, today released its latest Geo Quarterly Report: SEA FinTech Q3 2024, offering comprehensive insights into the FinTech ecosystem across Southeast Asia (SEA). According to the report, the region witnessed a significant decline in funding, primarily affecting late-stage investments.

SEA remains a prominent hub for FinTech investments, accounting for 14.5% of the total sector funding across Asia. Notably, Singapore ranked third in the region in terms of FinTech investment, further establishing itself as a major player in this space.

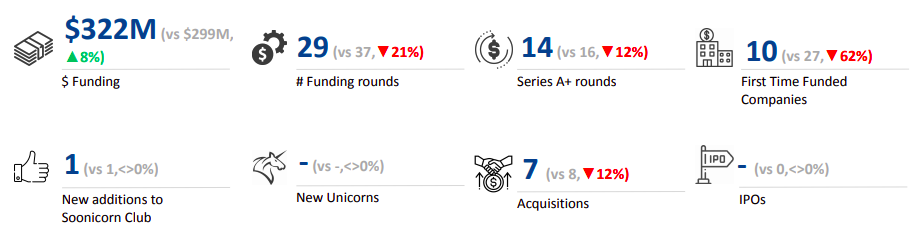

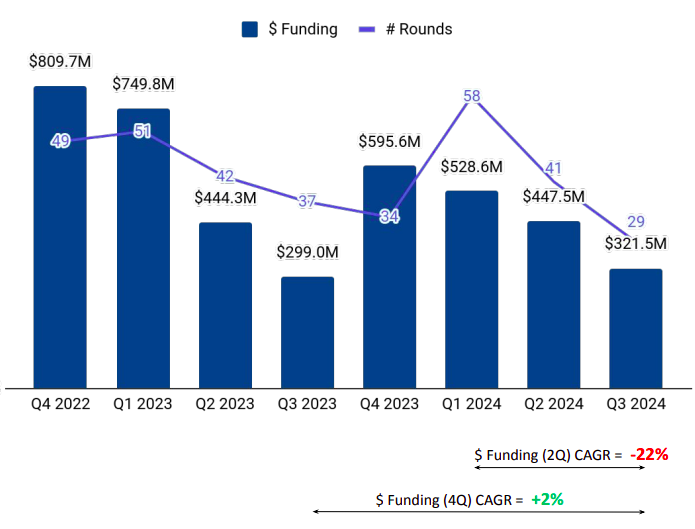

While the SEA FinTech ecosystem experienced its peak funding in Q3 2021, a steady decline has persisted since, despite a brief recovery in Q4 2023. Q3 2024 saw a funding drop to $322 million, a 28% decrease compared to the $447.5 million raised in the previous quarter. However, when compared year-on-year, this marks an 8% rise from $299 million in Q3 2023.

Neha Singh, CEO and Co-founder of Tracxn, commented on the report: “The FinTech landscape in Southeast Asia continues to be dynamic despite ongoing macroeconomic challenges. Although late-stage funding has taken a hit, it's encouraging to see early-stage investments showing resilience. The region's large consumer base and rapidly growing digital economy provide strong growth opportunities in the long term."

Uwin

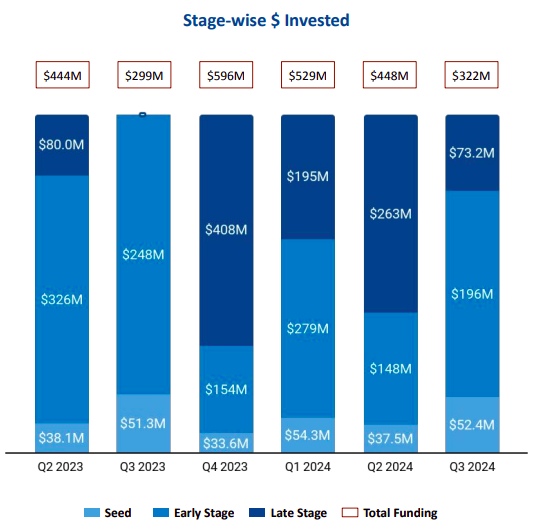

Early-stage and seed funding remained bright spots in Q3 2024. Early-stage funding increased by 32% to $196 million from the previous quarter’s $148 million, while seed-stage funding rose by 40%, reaching $52 million from $37.5 million in Q2 2024.

Late-stage funding, however, witnessed a steep 72% decline, dropping to $73 million in Q3 2024, down from $263 million in Q2 2024. None of the FinTech startups managed to secure funding rounds exceeding $100 million in the third quarter, signalling challenges for more mature companies seeking large capital injections. Notable funding rounds in Q3 2024 included Superbank’s $73.2 million Series C and Partior’s $60 million Series B.

Despite the overall decline, Payments, Banking Tech, and Forex Tech remained the top-performing segments in the FinTech space. The Payments segment raised $123 million in Q3 2024, although this was 44% lower than the $223 million raised in Q2 2024. Banking Tech saw a significant surge, raising $80 million compared to just $6 million in the previous quarter, while Forex Tech garnered $60 million, marking a substantial improvement.

The third quarter saw no new unicorns or IPOs in the SEA FinTech space. There have been no IPOs in this sector in 2024. However, the number of acquisitions rose to seven in Q3 2024, up from five in Q2 2024, reflecting ongoing consolidation in the region.

Among cities, Singapore led with $157.7 million in funding raised during Q3 2024, followed by Jakarta with $103.2 million, and Taguig with $8.6 million.

Top investors in the space included 500 Global, East Ventures and Y Combinator. Specifically, 500 Global, K300 Ventures and Antler dominated seed-stage investments, while Peak XV Partners, Temasek, and Valor Capital Group led early-stage funding rounds.

Neha Singh further added, "While the immediate outlook remains cautious, the overall optimism in Southeast Asia’s FinTech sector continues to be bolstered by favourable long-term factors. Government initiatives, wide internet penetration, and a thriving digital economy will be crucial drivers of future growth."

Despite the current funding downturn, Tracxn remains optimistic about the region's potential for long-term growth. SEA’s large consumer base, fast-growing digital economy, and favourable government policies make it a region to watch closely in the coming years.

(Data for Q3 2024 covers the period from July 1, 2024, to September 30, 2024)