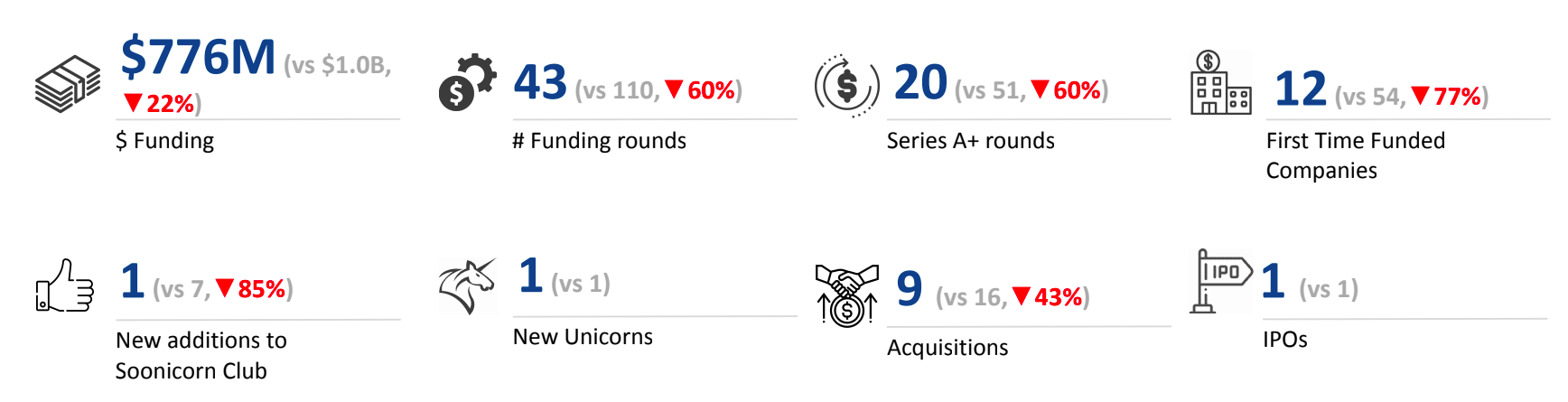

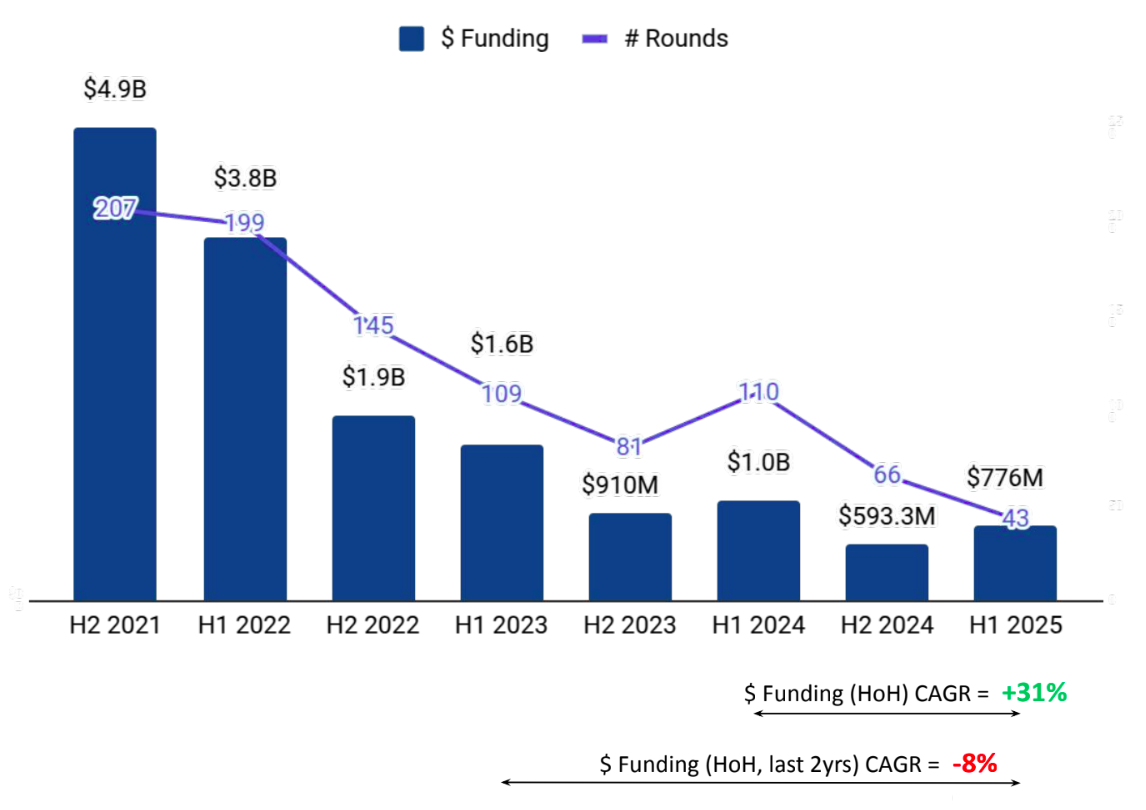

Tracxn has released its SEA FinTech Semi Annual Funding Report for H1 2025. The region’s FinTech ecosystem recorded notable shifts in investment dynamics, with a strong rebound in late-stage funding leading the overall growth. While early and seed-stage funding dipped significantly compared to both H2 2024 and H1 2024, large rounds and late-stage capital inflows helped offset the decline, bringing the total funding to $776M.

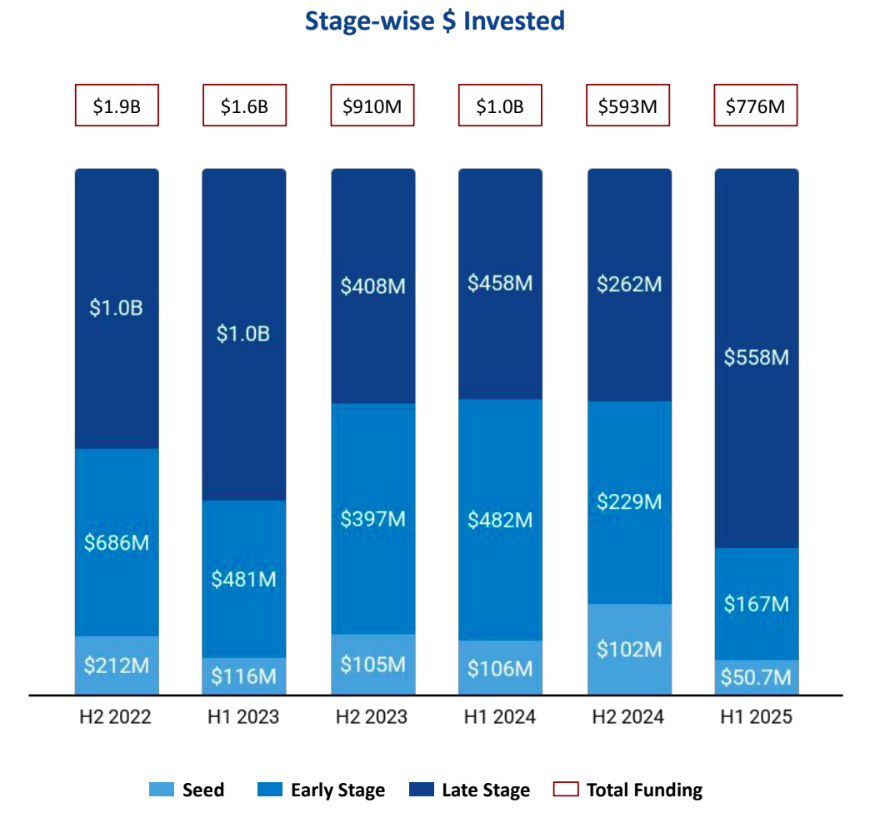

A total of $776M was raised in H1 2025, an increase of 31% compared to $593M raised in H2 2024, and a drop of 22% compared to $1.0B raised in H1 2024. The growth was primarily driven by larger deals and an uptick in late-stage activity.

Seed Stage saw a total funding of $50.7M in H1 2025, a drop of 50% compared to $102M raised in H2 2024, and a drop of 52% compared to $106M raised in H1 2024. Early Stage saw a total funding of $167M in H1 2025, a drop of 27% compared to $229M raised in H2 2024, and a drop of 65% compared to $482M raised in H1 2024. In contrast, Late Stage witnessed a total funding of $558M in H1 2025, an increase of 113% compared to $262M raised in H2 2024, and an increase of 22% compared to $458M raised in H1 2024.

FinTech continued to be a focus area across SEA, with funding activity primarily concentrated in this sector. Notably, this sector witnessed a mix of late-stage rounds and acquisitions, highlighting its maturity relative to other segments.

In H1 2025, SEA FinTech saw 3 $100M+ rounds, when compared to 1 such round in H2 2024 and 2 in H1 2024. Companies like Thunes, Airwallex and Bolttech have managed to raise funds above $100M in this quarter. Thunes has raised a total of $150M in a Series D round. Airwallex has raised a total of $150M in a Series F round. Bolttech has raised a total of $147M in a Series C round. Antalpha was the only company that went public in H1 2025. Only one unicorn was created in H1 2025, the same number as in H1 2024 and no unicorn emerged in H2 2024.

FinTech companies in SEA saw 9 acquisitions in H1 2025, which is a 18% decrease as compared to 11 acquisitions in H2 2024 and a decrease of 43% compared to 16 acquisitions in H1 2024. ASCENT was acquired by KFin Technologies at a price of $34.7M. This became the highest valued acquisition in H1 2025 followed by the acquisition of Coinseeker by Titanlab at a price of $30M.

Singapore based tech firms accounted for 88% of all funding seen by tech companies across the SEA. This was followed by Taguig at a distant second.

East Ventures, Y Combinator and 500 Global were the overall top investors in the SEA FinTech ecosystem. Iterative, Selini Capital and 500 Global were the top seed stage investors in SEA FinTech ecosystem for H1 2025. Back in Black Capital, Citi Ventures and HSG were the top early stage investors in the SEA FinTech ecosystem for H1 2025. DST Global Partners, Unbound and Vitruvian Partners were the top late stage investors in the SEA FinTech ecosystem for H1 2025. Late stage VC investments saw United States based DST Global Partners and United Kingdom based Unbound add 1 company each to their portfolios.

The SEA FinTech ecosystem witnessed a shift in funding dynamics in H1 2025, with a steep rise in late-stage capital offsetting the sharp declines in seed and early-stage investments. While unicorn creation remained stagnant and acquisition activity slowed, the presence of three $100M+ rounds and dominance of Singapore in overall funding signals sustained interest in mature FinTech players.