Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: SEA FinTech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the Southeast Asia (SEA) FinTech space.

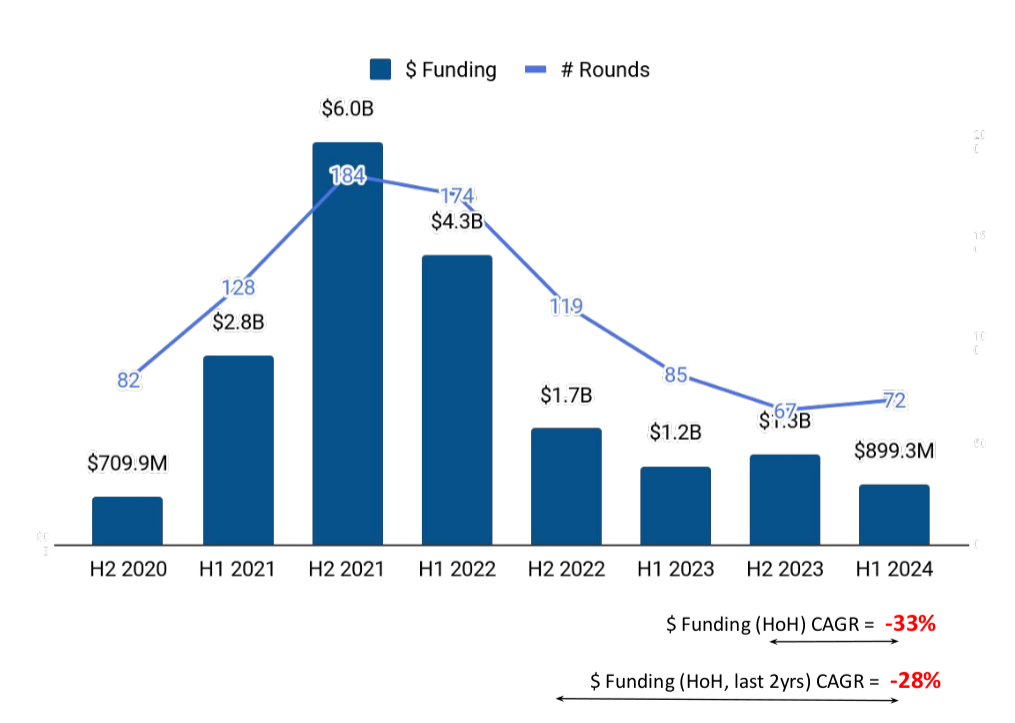

The SEA FinTech startup ecosystem experienced its highest half-yearly funding in H2 2021, after which the funding has significantly declined. The current macroeconomic conditions and geopolitical issues have further contributed to the downward trend, making H1 2024 the least funded half-year in the past three years.

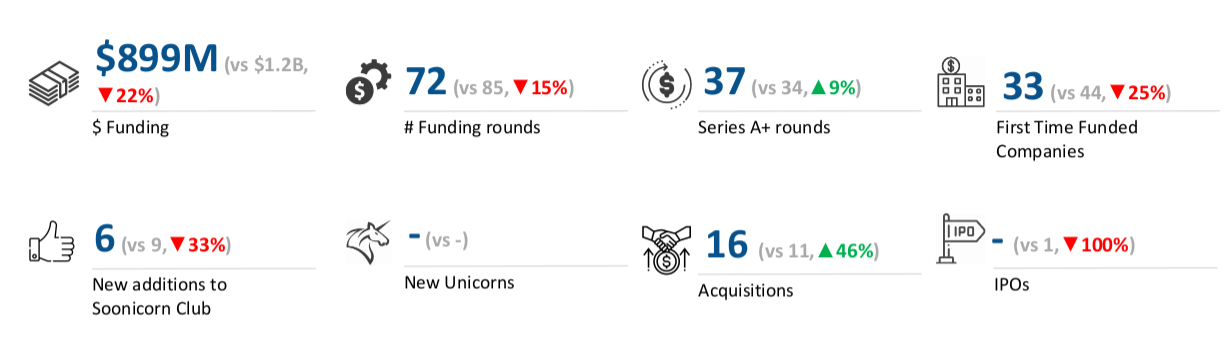

In the first six months of 2024, FinTech companies in SEA secured total funding of $899 million, 25% lower than the $1.2 billion raised in H1 2023, and a 31% decline from the $1.3 billion raised in the second half of 2023.

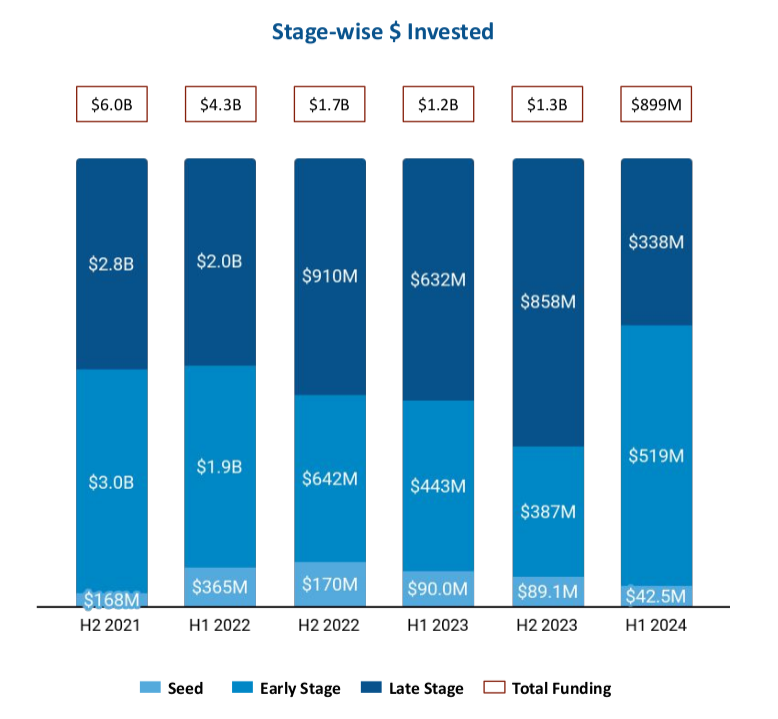

This downward move was driven by declines in seed and late-stage investments. Late-stage investments fell 47% to $338 million in H1 2024 from $632 million in H1 2023. Seed-stage investments stood at $42.5 million in the first half of 2024, a 53% decrease from $90 million in H1 2023. However, early-stage funding rose 17% to $519 million in H1 2024 from $443 million in the first half of 2023.

Only two $100 million+ rounds took place in H1 2024, as against four each in H1 2023 and H2 2023. ANEXT Bank raised $148 million in a Series D round, and GuildFi million secured $140 million in a Series A funding round.

Investment Tech, Alternative Lending, and Banking Tech are the top-performing segments based on funding in the H1 2024 SEA FinTech sector. A funding decline was observed across multiple segments. However, the Investment Tech segment secured total funding of $216 million in H1 2024, an increase of 666% compared with the $28.2 million in the first six months of 2023. The Alternative Lending segment raised $206 million in H1 2024, a drop of 59% compared with $502 million raised in H1 2023. Banking Tech companies raised $186 million in H1 2024, a growth of 59% from the $117 million raised in H1 2023.

None of the companies from this space went public in the first six months of 2024. However, there was an upward move in the number of acquisitions, to 16 in H1 2024 from 11 in H1 2023 and 13 in H2 2023.

Singapore took the lead in terms of funding in the sector, accounting for more than half of the total investments. FinTech companies based in Singapore raised $518 million in H1 2024, while those based in Bangkok and Jakarta raised $140 million and $128 million, respectively.

East Ventures, Y Combinator, and 500 Global are the all-time top investors in this space. Antler, Hashed, and AppWorks were the top investors in seed-stage rounds in H1 2024, while MassMutual Ventures, Illuminate Financial and Nyca Partners were the top early-stage investors. MUFG Innovation Partners and NewView Capital were the top investors in late-stage rounds during the period.

&zN8wj;

Despite certain challenges, significant optimism exists for this region's long-term growth. Factors such as the young population, large consumer base, reliance on informal financial and commercial systems, and government initiatives are expected to accelerate growth in this region.