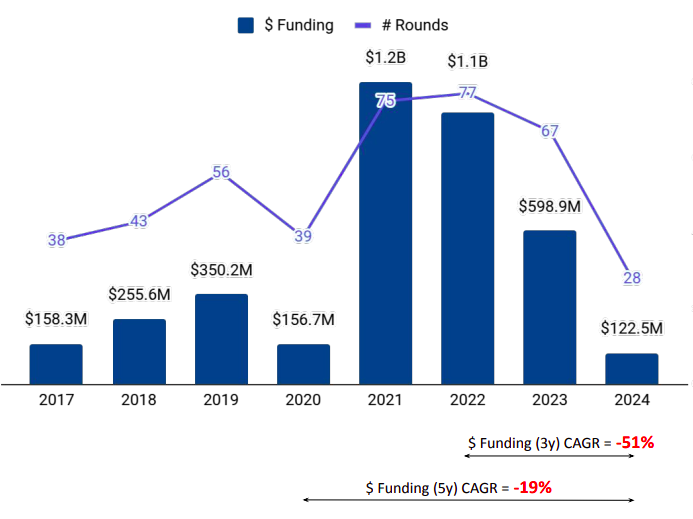

The Southeast Asia (SEA) HealthTech and Life Sciences startup ecosystem currently consists of over 3,600 companies, yet only 322 have received funding to date. The sector experienced its peak funding activity in 2021 but has since witnessed a steady decline, making 2024 the least-funded year in the past seven years.

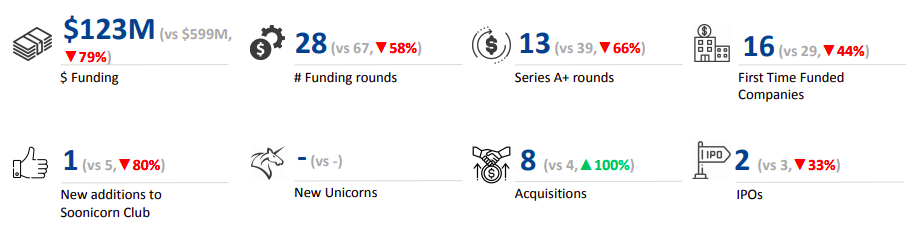

Total funding for SEA HealthTech and Life Sciences startups in 2024 amounted to $123 million, marking a significant 79% drop from $599 million in the previous year (2023) and a 90% decline from $1.1 billion in 2022. Singapore accounted for 75% of the funds raised by the sector, with investments worth $92 million in 2024.

The overall funding contraction aligns with broader trends in Asia, which saw an 11% drop compared to the previous year. Several factors contributed to this downturn, including macroeconomic uncertainties and geopolitical tensions that have led to a more cautious investment climate.

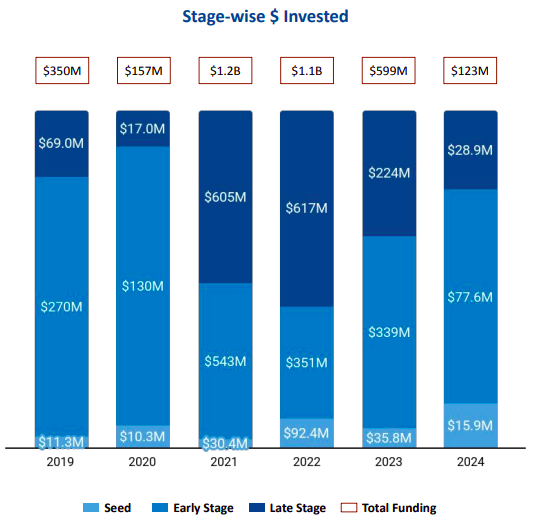

Late-stage funding in 2024 amounted to $28.9 million, reflecting an 87% drop from the $224 million raised in 2023. Early-stage funding saw a steep decline as well, reaching $77.6 million, a 77% decrease compared to the $339 million secured in 2023. Seed-stage funding was also affected, with total funding in 2024 standing at $15.9 million, down 56% from the $35.8 million raised in the previous year.

The second quarter of 2024 emerged as the highest-funded quarter of the year, raising $41.2 million, though this still marked a 63% decline compared to the $109.8 million secured in the second quarter of 2023. The first half of 2024 accounted for 57% of the total funding in the sector.

HealthifyMe, a fitness and wellness platform, secured $20 million in a Series C round, making it the highest-funded company in the sector. Biobot Surgical, a developer of surgical automation devices, raised $17.9 million in a Series B round. Unlike previous years, 2024 did not witness any $100 million-plus funding rounds, in contrast to one such round in 2023 and two in 2022.

Among the top-funded segments, the Employee Health IT sector received $26.5 million in funding, which represented a 44% decline from the $47.5 million raised in 2023. The Neurology sector saw total funding of $22.7 million in 2024, which was a significant development given that it had not recorded any funding in 2023, though it still represented an 82% drop from the $126 million raised in 2022. The Fitness & Wellness Tech segment secured $20 million in 2024, experiencing a 20% drop from the $25.1 million raised in 2023, but a remarkable increase of 293% compared to the $5.1 million raised in 2022.

The SEA HealthTech and Life Sciences market saw a decline in IPO activity, with only two IPOs recorded in 2024, a 33% decrease from the three IPOs in 2023. Medeze Group went public in October 2024, while MaNaDr went public in April 2024.

Acquisition activity in the space saw an upward move, with eight acquisitions recorded in 2024, double the number observed in 2023. The acquisition of VinBrain, an AI-based disease diagnosis tool provider, by NVIDIA, was one of the notable deals in 2024.

SEEDS Capital, EDBI and East Ventures are the overall all-time top investors in the SEA HealthTech and Life Science Startup space. Antler, East Ventures and Y Combinator were the lead seed-stage investors in 2024, while Polaris Partners, SeventurePartners and Mitsubishi UFJ Capital took the lead in early-stage investments.

Despite the funding downturn, the SEA HealthTech and Life Sciences sector is positioned for future growth, driven by ongoing digitalization efforts aimed at improving access to healthcare and enhancing the quality of care. The demand for remote healthcare services and mental health solutions is rising, reflecting evolving consumer needs. Initiatives like the MedTech Innovator Asia Pacific Accelerator Program continue to support startups by providing mentorship and non-dilutive funding, which can stimulate innovation and attract further investment.

Although 2024 has been a challenging year for funding, the sector’s focus on technological advancements and healthcare transformation suggests promising long-term prospects for the ecosystem.