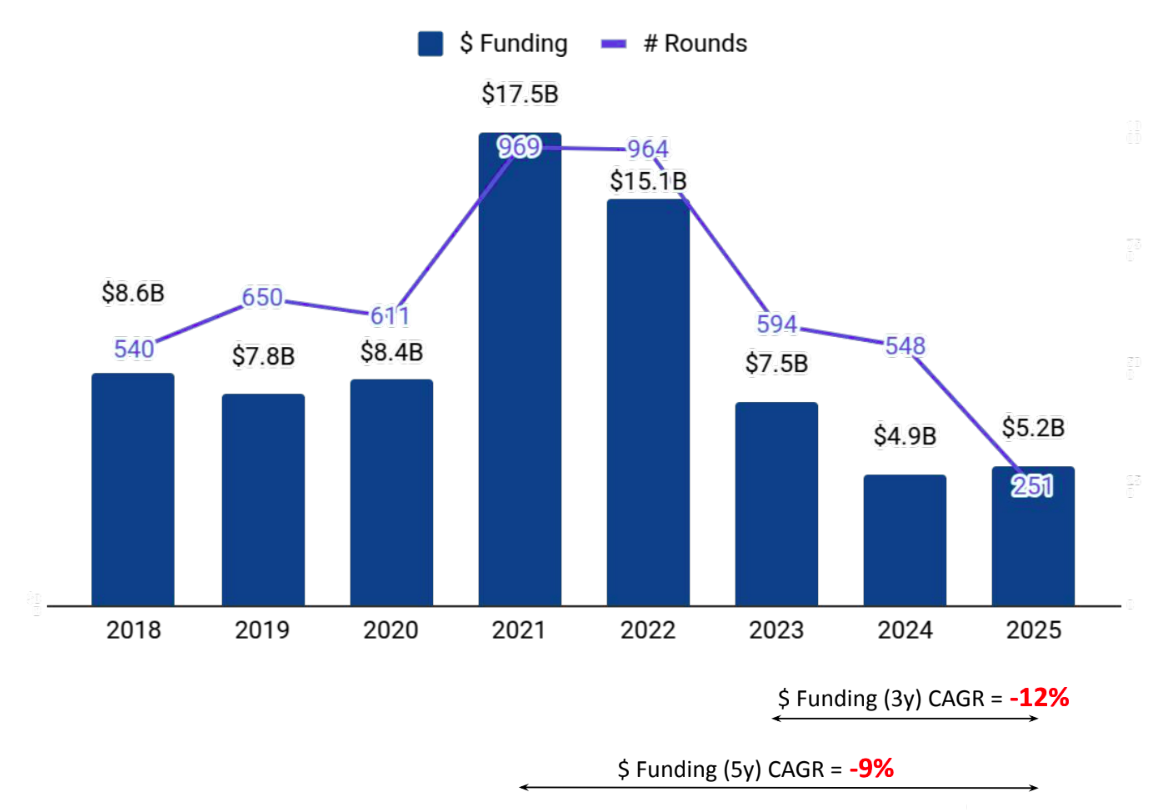

Tracxn has released its insights on the SEA Tech ecosystem for 2025, highlighting funding activity, sector performance, deal flow, and investor participation across the region. The data reflects how total funding, stage-wise investments, sector allocations, exits, and acquisitions evolved during the year, offering a detailed view of capital deployment across Southeast Asia’s technology landscape.

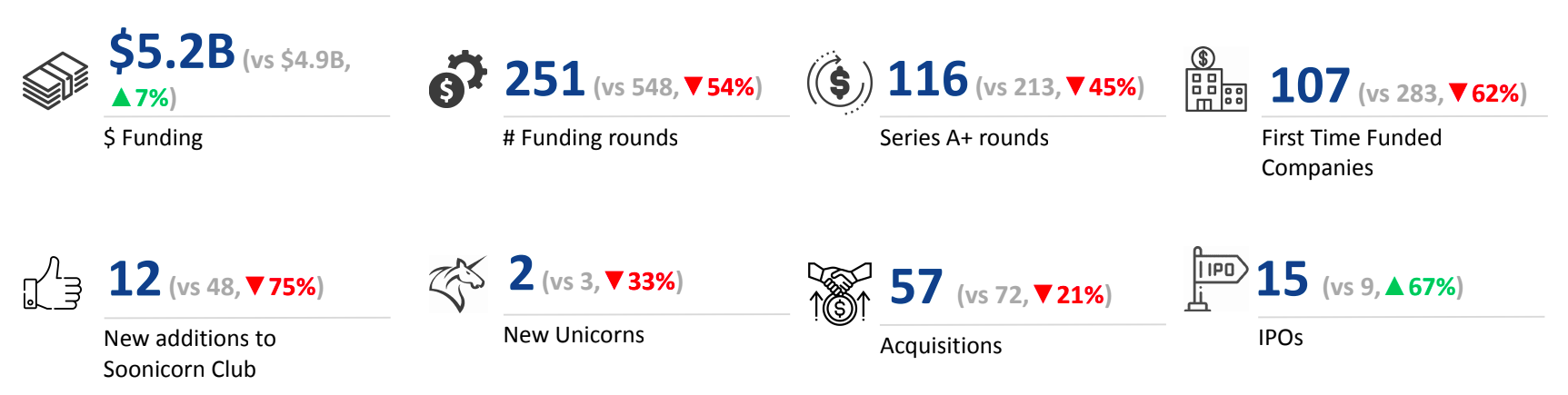

A total of $5.2B was raised by SEA tech companies in 2025. This represents a rise of 7% compared to the $4.9B raised in 2024, while also reflecting a drop of 31% compared to the $7.5B raised in 2023. Overall funding levels in 2025 were supported largely by large late-stage rounds, even as earlier-stage funding showed notable declines compared to previous years.

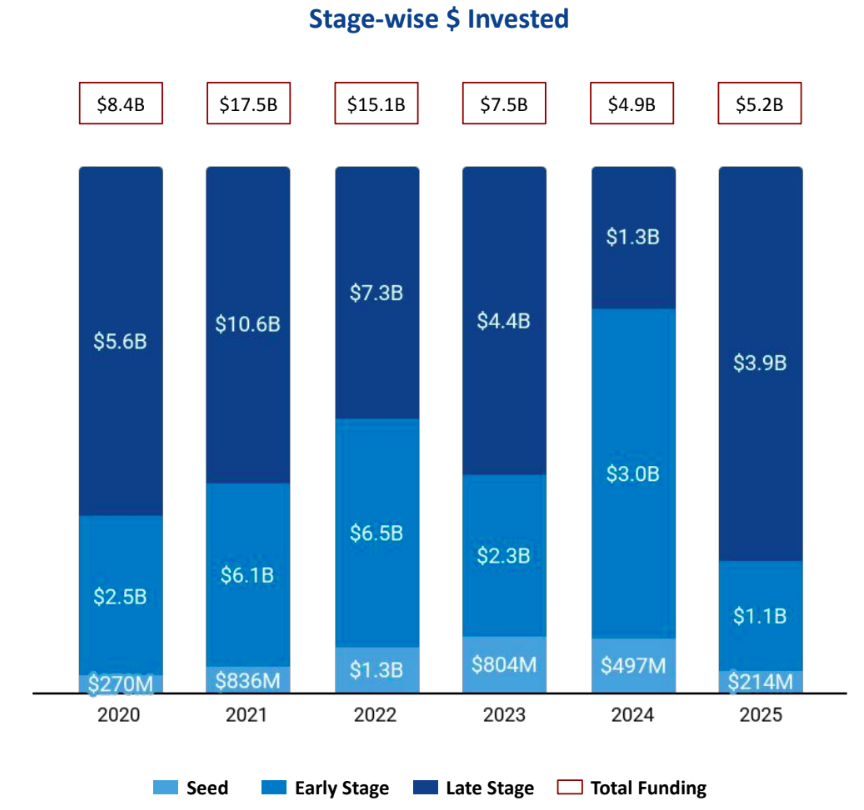

Seed-stage funding in SEA Tech stood at $214M in 2025, marking a drop of 57% compared to $497M raised in 2024 and a drop of 73% compared to $804M raised in 2023. Early-stage funding totaled $1.1B in 2025, reflecting a decline of 64% from $3.0B in 2024 and a drop of 53% from $2.3B in 2023. In contrast, late-stage funding reached $3.9B in 2025, registering a rise of 194% compared to $1.3B raised in 2024, while showing a drop of 13% compared to $4.4B raised in 2023.

Enterprise Infrastructure, FinTech, and Enterprise Applications were the top-performing sectors in SEA Tech during 2025. The Enterprise Infrastructure sector recorded total funding of $2.3B in 2025, marking a 70% increase over the $1.3B raised in 2024 and over a 12x rise compared to the $182M raised in 2023. The FinTech sector raised $1.5B in 2025, which is a decrease of 21% compared to $1.9B raised in 2024 and a decrease of 42% compared to $2.6B raised in 2023. Enterprise Applications attracted $1.42B in funding in 2025, reflecting a decrease of 38% compared to $2.3B raised in 2024 and an increase of 4% compared to $1.36B raised in 2023.

The SEA Tech ecosystem witnessed 9 funding rounds of $100M or more in 2025, compared to 7 such rounds in 2024 and 16 in 2023. Companies such as Princeton Digital Group, Digital Edge, and Airwallex raised funding above $100M during the year. Princeton Digital Group raised a total of $1.3B in a Series C round, Digital Edge raised $640M in a Series D round, and Airwallex raised $330M in a Series G round. A major part of the $100M+ funding rounds in 2025 originated from Enterprise Infrastructure, Enterprise Applications, and FinTech.

In terms of public market activity, SEA Tech recorded 15 IPOs in 2025, up 67% from 9 IPOs in 2024 and up 7% from 14 IPOs in 2023. Superbank, TCBS, and Agroz Group were among the companies that went public in 2025. The year also saw the creation of 2 unicorns, representing a drop of 33% compared to 3 unicorns in 2024 and a rise of 100% compared to 1 unicorn in 2023.

Tech companies in SEA recorded 57 acquisitions in 2025, reflecting a drop of 21% compared to 72 acquisitions in 2024 and a drop of 30% compared to 81 acquisitions in 2023. Dropsuite was acquired by NinjaOne for $270M, making it the highest-valued acquisition in 2025. This was followed by the acquisition of ASCENT by KFin Technologies at a price of $34.7M.

Singapore-based tech firms accounted for 91% of all funding raised by tech companies across SEA in 2025. Jakarta emerged as the next most funded city, contributing 4% of the total funding during the year.

Investor participation varied across stages in the SEA Tech ecosystem in 2025. Iterative, 500 Global, and East Ventures emerged as the top seed-stage investors. At the early stage, SEEDS Capital, Integra Partners, and Peak XV Partners were the most active investors. In late-stage funding, DST Global, Unbound, and Asia Partners led investment activity across the region.

The SEA Tech ecosystem raised $5.2B in 2025, with funding activity largely propelled by a sharp increase in late-stage investments, even as capital deployment at the seed and early stages declined. Enterprise Infrastructure, FinTech, and Enterprise Applications stood out as the most heavily funded sectors, underpinned by several $100M+ funding rounds during the year. Singapore maintained its dominance as the primary hub for tech funding in the region, while IPO activity picked up and acquisition volumes moderated compared to previous years.