Southeast Asia (SEA) faced a challenging year in 2024, marked by a significant contraction in funding, amid a weak global economy. According to Tracxn's latest report, crafted by expert analysts, the region's tech ecosystem experienced a steep decline in financial inflows and major shifts in the market landscape while continuing to innovate and adapt to the challenges.

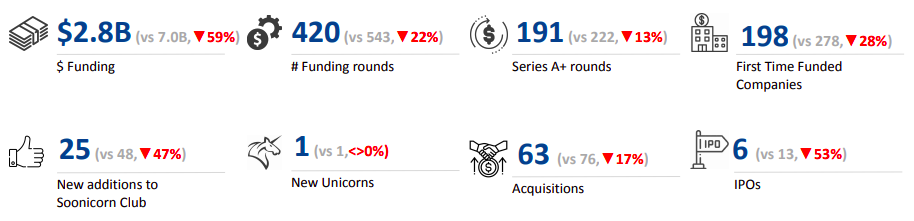

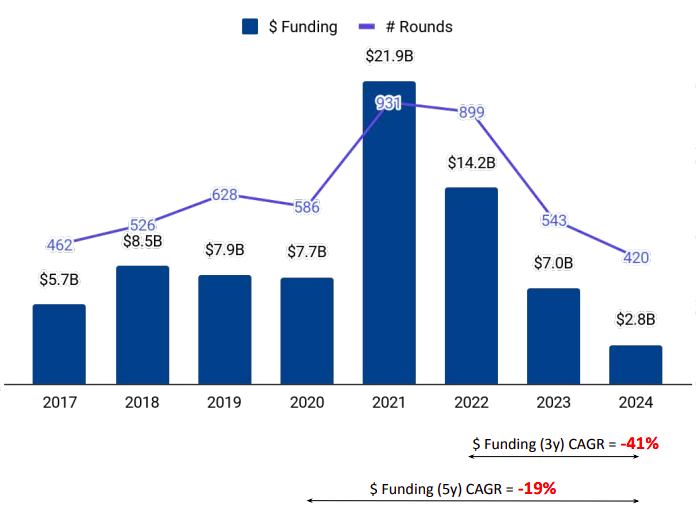

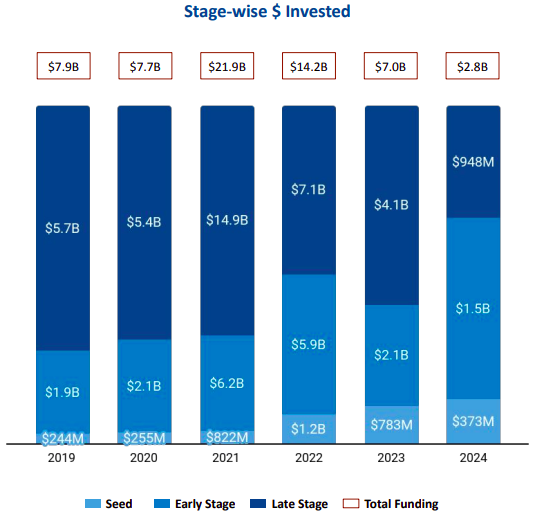

SEA Tech startups raised $2.84 billion across 420 rounds in 2024 (YTD), a striking 59% decline from $7 billion in 2023 and an 80% fall compared with $14.2 billion in 2022. Late-stage investments were most impacted this year, plunging 76.9% to $948 million in 2024 from $4.1 billion in 2023. Seed funding reached $373 million in 2024, reflecting a 52.4% decline compared to $783 million in 2023. Early-stage funding amounted to $1.5 billion, registering a 28.6% decrease from the previous year.

Uwin

Among SEA cities, Singapore led funding activity, accounting for nearly 67% of the region's total funding, followed by Jakarta and Bangkok. Tech startups based in Singapore raised $1.9 billion in 2024, while those headquartered in Jakarta and Bangkok raised $276 million and $261 million respectively.

Commenting on the reports’ insights, Neha Singh, Co-Founder of Tracxn, said “While 2024 has undeniably been a challenging year for Southeast Asia's tech funding landscape, it has also highlighted the region's resilience and unwavering commitment to innovation. Despite a sharp decline in investments, key sectors such as FinTech, CleanTech, and Blockchain such as FinTech, CleanTech, and Blockchain remain at the forefront, fueled by market evolution and robust government initiatives. This year serves as a reminder that setbacks often pave the way for strategic adaptation, and we are confident that Southeast Asia’s tech ecosystem will emerge stronger, fostering growth and breakthrough technologies in the years to come.”

Despite the overall funding decline, certain sectors in Southeast Asia's tech ecosystem demonstrated resilience and continued to attract investor interest. FinTech led the funding charts with $1.4 billion raised in 2024, followed by High Tech at $966 million and Enterprise Applications at $764 million. Additionally, emerging industries such as CleanTech and Blockchain showed significant promise, fueled by robust regulatory support and sustained interest from investors, signalling the potential for growth in the coming years.

While overall acquisitions slowed to 63 deals, down from 76 in 2023 (17% drop), notable transactions like PropertyGuru’s $1.1 billion acquisition by EQT and GHL’s $154 million acquisition by NTT reflected targeted consolidation efforts. Only one unicorn, Polyhedra Network, emerged in 2024 similar to one in 2023. The number of IPOs, too, declined by over 50%, falling to 6 in 2024 from 13 in 2023.

“While 2024 witnessed a notable contraction in tech funding across Southeast Asia, the seeds of long-term growth are being sown. The demand for innovation in sustainability, digital transformation and strategic government initiatives along with investor confidence in high-potential sectors reaffirm that challenging times often serve as a catalyst for transformative progress, positioning the region for a dynamic 2025," added Abhishek Goyal, Co-founder of Tracxn.

SEA remained a hub for innovation in 2024, with Indonesia and Vietnam ranking among the top five globally in crypto adoption. Singapore also reported a significant increase in AI-related patents, which have grown by 50% over the past five years, demonstrating the region’s commitment to cutting-edge technology.

Strategic policies introduced by governments across the region aimed to mitigate economic challenges and support startup growth:

Despite challenges, the SEA tech ecosystem demonstrated adaptability through continued investment, innovation, and government support. The focus for 2025 will centre on high-growth sectors like FinTech, CleanTech, and Blockchain, alongside leveraging policy frameworks and investor enthusiasm to navigate economic complexities.

(Data for 2024 has been taken from Jan 1, 2024 - Dec 9, 2024)