Tracxn has released its Southeast Asia Tech Funding Report for 9M 2025, capturing the investment activity across the region. The report highlights a sharp contraction in overall funding levels compared to previous years, coupled with selective resilience in late-stage funding. While certain sectors such as Enterprise Applications, Enterprise Infrastructure, and FinTech led the investment landscape, the period also witnessed fewer unicorns, subdued acquisitions, and a dominant contribution from Singapore-based startups.

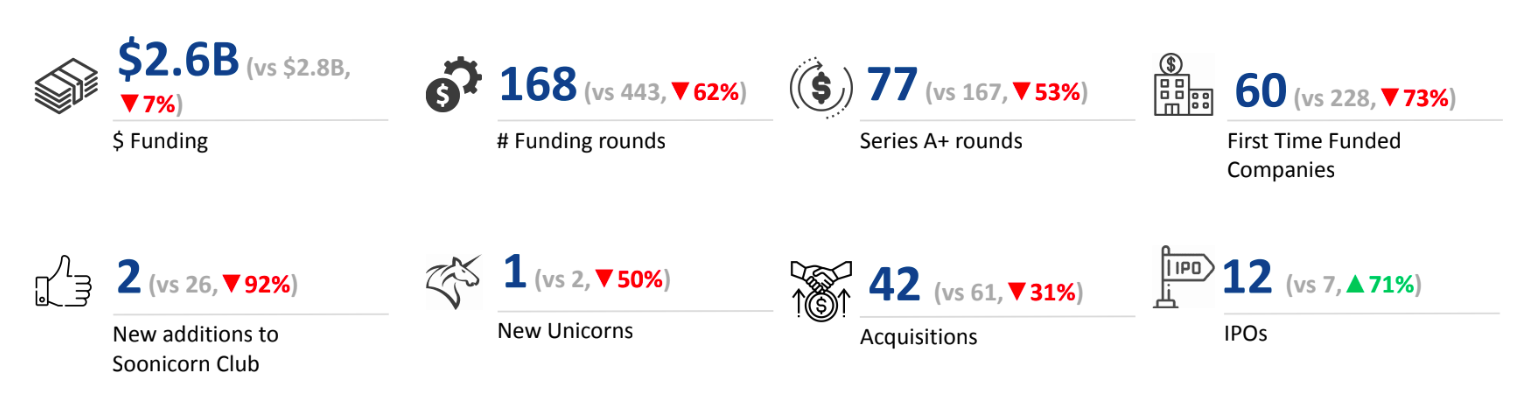

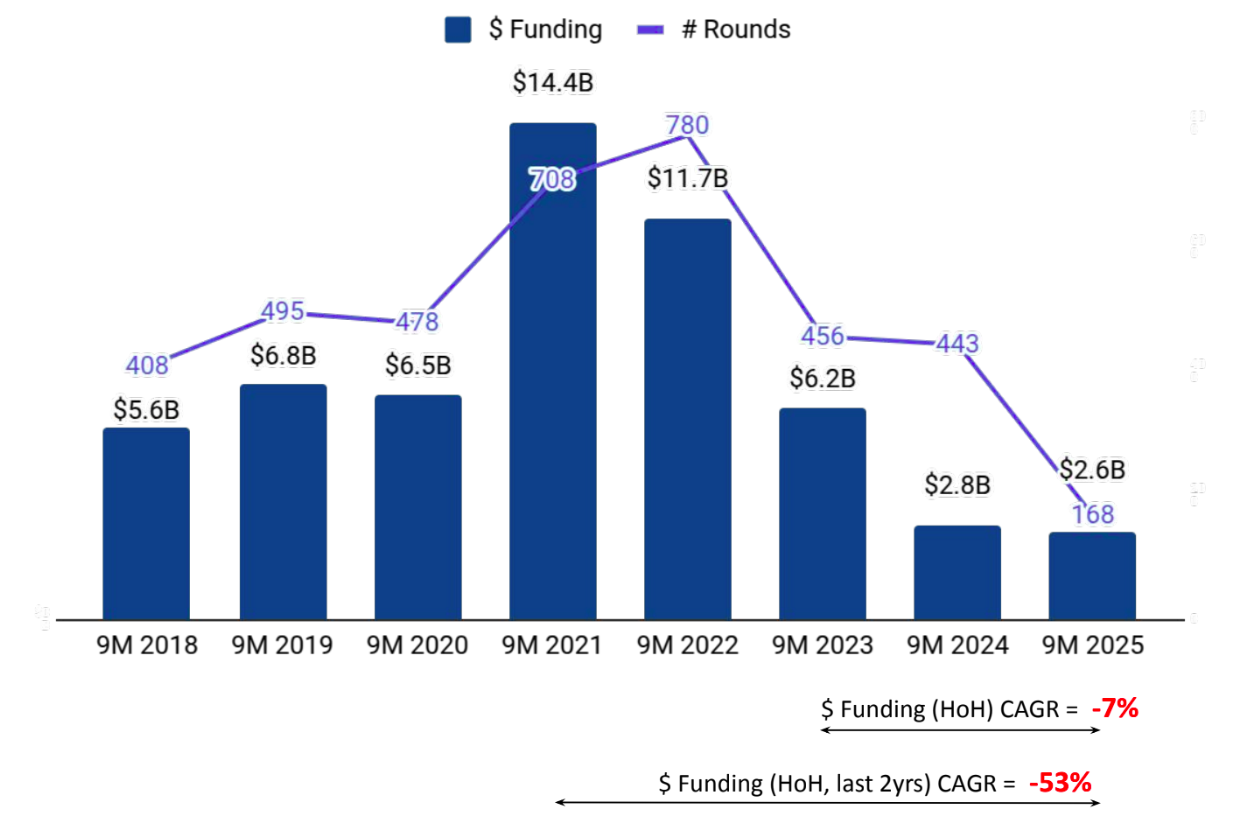

A total of $2.6B was raised in 9M 2025, a drop of 7% compared to $2.8B raised in 9M 2024, and a drop of 58% compared to $6.2B raised in 9M 2023.The sharp contraction highlights a continued cooling of the funding environment across the region. Despite the slowdown, select late-stage deals provided resilience, offering crucial support to the overall investment landscape.

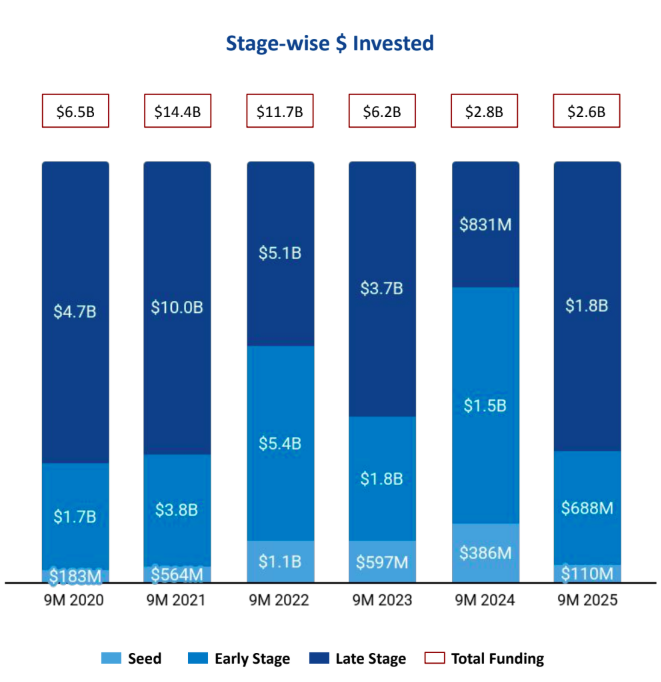

Seed Stage saw a total funding of $110M in 9M 2025, a drop of 72% compared to $386M raised in 9M 2024, and a drop of 82% compared to $597M raised in 9M 2023. Early Stage saw a total funding of $688M in 9M 2025, a drop of 55% compared to $1.5B raised in 9M 2024, and a drop of 62% compared to $1.8B raised in 9M 2023. Late Stage witnessed a total funding of $1.8B in 9M 2025, a rise of 112% compared to $831M raised in 9M 2024, and a drop of 53% compared to $3.7B raised in 9M 2023.

Enterprise Applications, Enterprise Infrastructure, and FinTech were the top-performing sectors in 9M 2025. The Enterprise Applications sector saw a total funding of $951M in 9M 2025, an increase of 32% compared to $719M raised in 9M 2024, and a decrease of 8% compared to $1.0B raised in 9M 2023. The Enterprise Infrastructure sector saw a total funding of $857M in 9M 2025, an increase of 621% compared to $121M raised in 9M 2024, and a rise of 407% compared to $173M raised in 9M 2023. The FinTech sector saw a total funding of $839M in 9M 2025, a decrease of 39% compared to $1.4B raised in 9M 2024, and a drop of 56% compared to $1.9B raised in 9M 2023.

9M 2025 has witnessed 6 $100M+ funding rounds when compared to 3 such rounds in 9M 2024 and 12 in 9M 2023. Companies like Digital Edge, MiniMax, Supabase, Thunes, and Airwallex managed to raise funds above $100M in this period. Digital Edge raised a total of $640M in a Series D round. MiniMax raised a total of $300M in a Series D round. Supabase raised a total of $202M in a Series D round. A major part of these $100M+ funding rounds came from Enterprise Infrastructure, Enterprise Applications, and FinTech.

There was only 1 unicorn created in 9M 2025, a drop of 50% compared to 2 in 9M 2024, and equivalent to 9M 2023. SEA Tech recorded 12 IPOs in 9M 2025, up 71% from 7 in 9M 2024, and the same as 9M 2023. Companies such as The GrowHub, Nusatrip, A K Koh, and Info Tech went public during the period.

Tech companies in Southeast Asia saw 42 acquisitions in 9M 2025, which is a 31% drop compared to 61 acquisitions in both 9M 2024 and 9M 2023. Dropsuite was acquired by NinjaOne at a price of $270M, becoming the highest valued acquisition in 9M 2025, followed by ASCENT’s acquisition by KFin Technologies at a price of $34.7M.

Singapore-based tech firms accounted for 88% of all funding seen by tech companies across the Southeast Asia region in 9M 2025. This was followed by Jakarta at a distant second.

East Ventures, 500 Global, and Wavemaker Partners were the overall top all-time investors in the Southeast Asia tech ecosystem in 9M 2025. Iterative, 500 Global, and AppWorks were the top seed stage investors. SEEDS Capital, Integra Partners, and Tin Men were the top early stage investors. Vitruvian Partners, DST Global Partners, and Unbound were the top late stage investors in the region during the same period.

The Southeast Asia tech ecosystem saw a steep decline in overall funding in 9M 2025, with total inflows down 58% from 9M 2023. Seed and early-stage investments weakened sharply, though late-stage activity more than doubled compared to 9M 2024. Enterprise Applications, Enterprise Infrastructure, and FinTech led sector funding, while six large deals above $100M shaped the landscape. IPO activity gained momentum with 12 listings, but unicorn creation slowed, and acquisitions declined. Singapore maintained its position as the dominant hub, attracting 88% of funding in the region, supported by leading investors across all stages.