Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: SEA Tech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the Southeast Asia (SEA) Tech space.

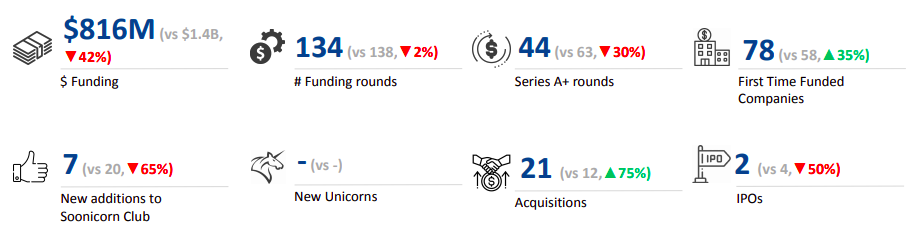

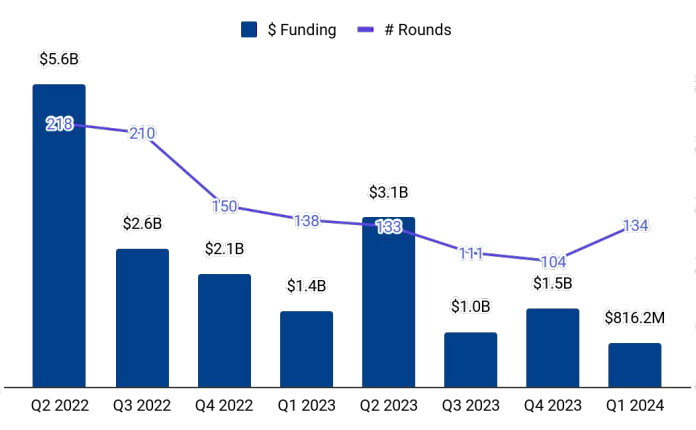

The SEA Tech startup ecosystem secured a total funding of $816 million in Q1 2024 to date (till March 15, 2024), a significant decline of 40% from the $1.36 billion raised in the same period in Q4 2023 and a drop of 13% from $935 million raised in the same period last year (till March 15, 2023). Q1 2024 is also the lowest-funded quarter in the past five quarters in the SEA Tech sector.

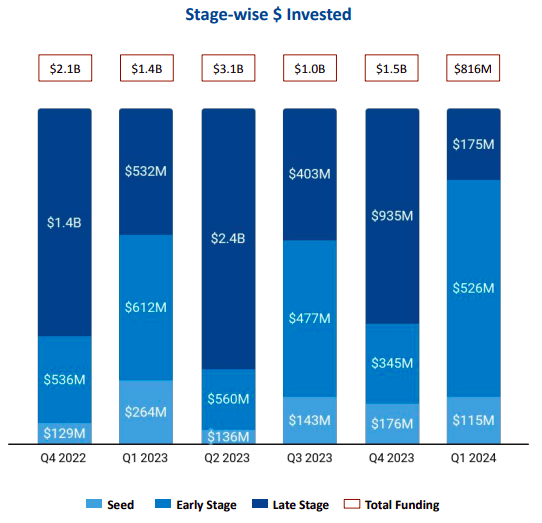

Funding in Q1 2024 to date was largely impacted by a decline in late-stage funding, which plummeted 80% to $175 million in Q1 2024 to date from $860 million raised in the same period in Q4 2023. Seed-stage funding stood at $115 million in Q1 2024 to date, a decrease of 36% from $173 million raised in the same period in Q4 2023 and 48% lower than the $220 million raised in the same period last year. However, early-stage investments surged 60.86% to $526 million in Q1 2024 to date, as against $327 million raised in Q4 2023 (till December 15, 2023).

There was an absence of large deals in the SEA Tech sector this quarter, with no $100M+ deals in Q1 2024 to date. Only three Singapore-based companies raised more than $50 million during the quarter. DCS Card Centre, Capillary, and Motorist raised $75 million, $95 million, and $60 million respectively in early-stage rounds.

FinTech, Enterprise Applications, and Retail are the top-performing sectors based on funding in Q1 2024 in this space. The FinTech sector has witnessed a total of $314 million in Q1 2024 to date, a plunge of 67% from $939 million raised in the same period in Q4 2023. However, this is a spike of 52% from the $206 million raised in the same period in Q1 2023.

The Enterprise Applications sector attracted investments worth $248 million in Q1 2024 to date, 14% higher than the $217 million raised in Q4 2023. However, this is also a drop of 17% compared with the $298 million raised in Q1 2023. Companies in the Retail segment secured funding worth $177 million in Q1 2024 to date, a growth of 160% and a drop of 46% from $68 million and $330 million raised in Q4 and Q1 2023 respectively.

An uptick was observed in the number of acquisitions, which rose to 21 in Q1 2024 to date, from 16 and 12 acquisitions in Q4 2023 and Q1 2023 respectively.

Singapore has yet again taken the lead among Southeast Asian cities in terms of startup funding. Tech startups based in Singapore raised $604 million in Q1 2024 to date, while those headquartered in Jakarta and Ho Chi Minh City raised $85.7 million and $33.2 million respectively.

East Ventures, 500 Global and Wavemaker Partners are the overall all-time most active investors in SEA to date.

Antler, HashKey Capital, and 500 Global were the top investors in seed-stage investors in Q1 2024, while UOB, Peak XV Partners, and Openspace Ventures were the most active investors in terms of early-stage investments. Avataar Ventures and Filter Capital were the top late-stage investors in Q1 2024.

The SEA Tech startup ecosystem received its highest quarterly funding in Q4 2021 after which there was a steady decline in funding in the region. The market for investments remains volatile globally and similar trends are visible in the SEA region as well. However, the region does show promise, as indicated by certain factors. The GDP growth rate of this region is higher when compared with many other countries. The region’s young population and the growing tech adoption can accelerate growth, if the startups can identify and fill the gaps in the market with sustainable and scalable solutions.