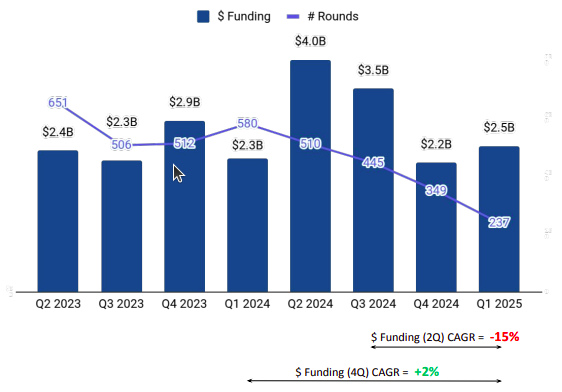

The Southeast Asian (SEA) Tech ecosystem is seeing some recovery in funding, but continues to face the impact of global macroeconomic headwinds.

In Q1 2025, SEA tech startups secured a total funding of $909 million in Q1 2025, reflecting a 30.79% increase from the $695 million raised in Q4 2024 (the previous quarter), but a 9.10% decline compared with $1 billion in Q1 2024 (the corresponding quarter last year).

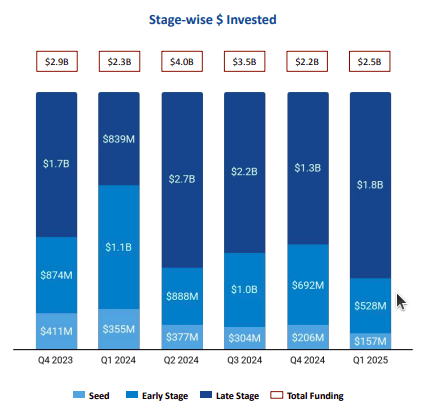

Late-stage funding saw a significant surge, reaching $700 million, marking a 110.21% increase from Q4 2024 ($333 million) and a 140.55% rise from Q1 2024 ($291 million). Seed Stage funding dropped to $44.8 million, a 43.07% decline from Q4 2024 ($78.7 million) and a 76.67% decline from Q1 2024 ($192 million). Early-stage funding stood at $164 million, down 42.05% from Q4 2024 ($283 million) and 70.82% lower than Q1 2024 ($562 million).

The first quarter of this year witnessed only one $100M+ funding round, compared to two in Q4 2024 and one in Q1 2024. Digital Edge led the funding charts, securing $640 million in a Series D round.

Enterprise Infrastructure, FinTech, and High Tech were the top-funded segments in the first quarter of this year. Enterprise Infrastructure saw the maximum growth, attracting $640 million in funding, a 3182.05% increase from Q4 2024 ($19.5M) and a 5665.77% increase from Q1 2024 ($11.1 million). FinTech companies raised $171.6 million, down 37.40% from Q4 2024 ($274.1 million) and 71.69% from Q1 2024 ($606.1 million). Funding into the High Tech space dropped to $111.1 million in Q1 2025, a 44.36% decrease from $199.6 million in the corresponding quarter last year, and a 77.53% drop from Q1 2024 ($494.2 million).

The first quarter of this year saw 13 acquisitions in SEA Tech, marking a slight 8.33% increase from 12 acquisitions in Q4 2024, but a 50% drop from 26 acquisitions in Q1 2024. Dropsuite was acquired by NinjaOne for $252M, making it the highest-valued acquisition of Q1 2025. None of the companies from the tech landscape went public in Q1 2025, as against one in Q4 2024 and two in Q1 2024. Only one unicorn was created in Q1 2025, the same as in Q1 2024.

Singapore-based tech firms dominated the funding landscape, accounting for 95% of total investments in SEA Tech. Singapore-based tech startups raised $865 million in Q1 2025, followed by Thu Duc ($28 million) and Jakarta ($6.2 million)

East Ventures, 500 Global, and Wavemaker Partners were the all-time overall top investors. In Q1 2025, AppWorks, Selini Capital, and Orbit Startups were the most active seed-stage Investors. JAFCO Asia, Prosus, and Citi Ventures were the top early-stage investors.

This momentum indicates the Southeast Asia tech ecosystem’s adaptability and long-term growth potential. As the landscape continues to evolve and drive innovation, the region remains well-positioned to attract sustained investor interest. With a rebound in late-stage funding and shifting sectoral dynamics, funding levels are expected to improve in the coming quarters, reinforcing Southeast Asia’s role as a thriving hub for technological advancement.