&zN8wj;

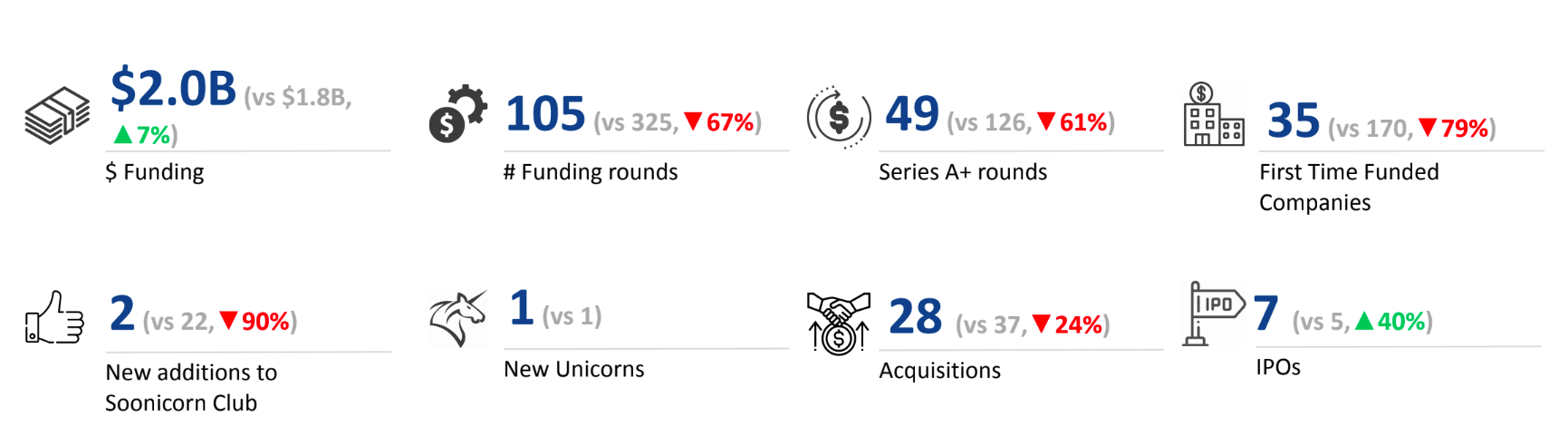

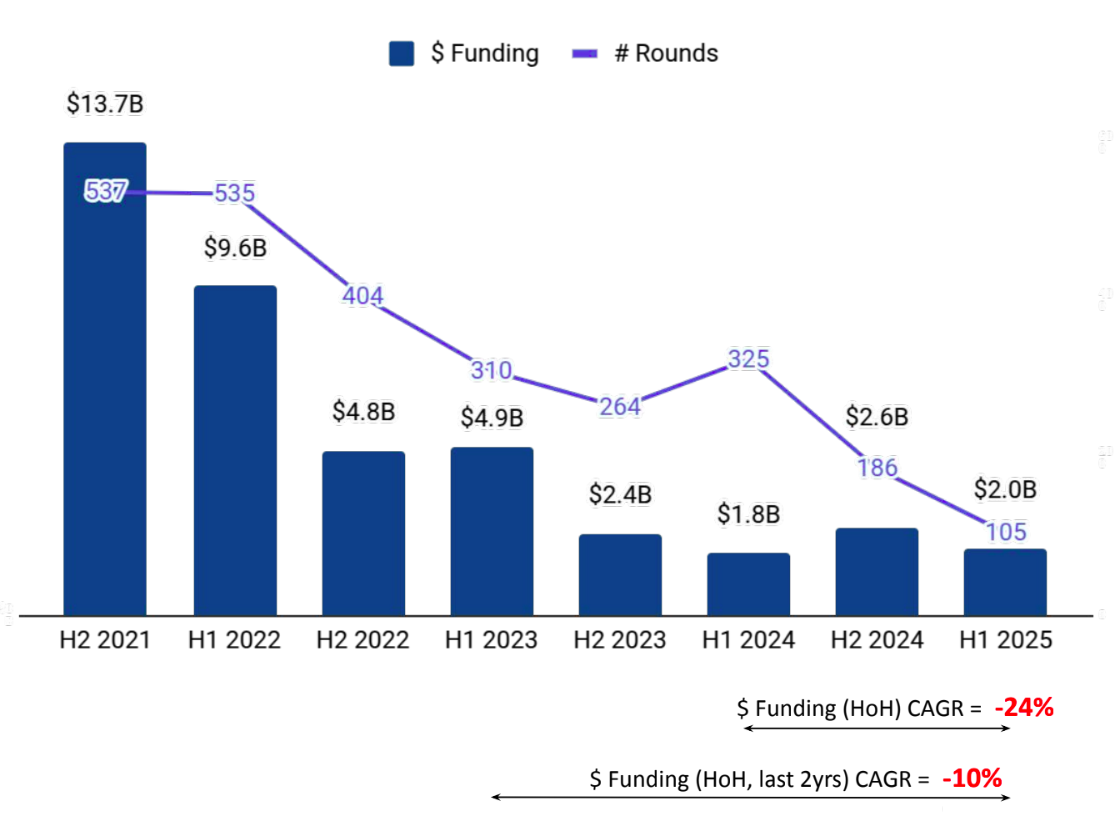

Tracxn has released its H1 2025 SEA Tech Funding Report, providing a comprehensive view of the region’s technology investment activity. The first half of 2025 witnessed significant shifts across funding stages and sectors, highlighting both resilience and evolving trends. Against a backdrop of global market fluctuations, SEA tech firms raised a total of $2.0B in the first half of 2025, underscoring their critical role in shaping the region’s digital ecosystem.

In H1 2025, total funding for the SEA tech ecosystem amounted to $2.0B, a drop of 24% compared to the $2.6B raised in H2 2024, and an increase of 7% compared to the $1.8B raised in H1 2024. These figures reflect both a short-term slowdown and a longer-term recovery trend in the regional market.

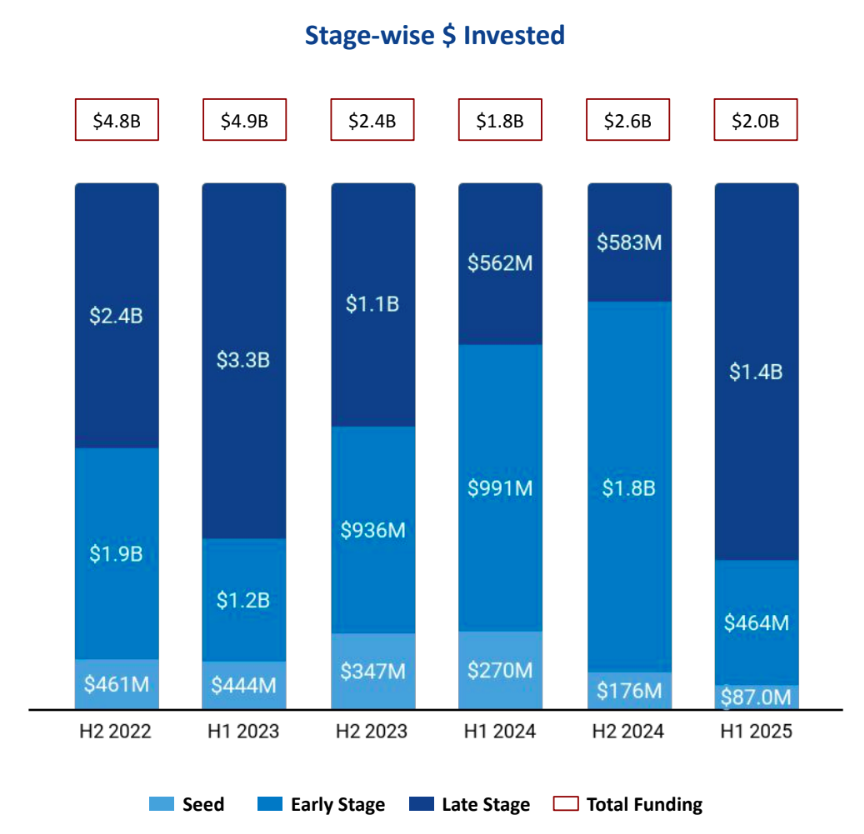

Seed-stage investments totalled $87M in H1 2025, marking a drop of 51% compared to the $176M raised in H2 2024, and a drop of 68% compared to the $270M raised in H1 2024. Early-stage funding came in at $464M in H1 2025, a decline of 74% compared to the $1.8B raised in H2 2024, and a decrease of 53% compared to the $991M raised in H1 2024. Late-stage funding witnessed a sharp rise, reaching $1.4B in H1 2025, an increase of 140% compared to the $583M raised in H2 2024, and an increase of 149% compared to the $562M raised in H1 2024.

In H1 2025, Enterprise Infrastructure emerged as a top-performing sector, attracting $859M in funding. This represented a decrease of 35% compared to the $1.3B raised in H2 2024, and an increase of 3,787% compared to the $22.1M raised in H1 2024. FinTech followed with $775M, an increase of 31% compared to the $593M raised in H2 2024, and a drop of 26% compared to the $1.0B raised in H1 2024. The Enterprise Applications sector recorded $545M in H1 2025, down 66% from the $1.6B raised in H2 2024, and up 33% from the $409M raised in H1 2024.

H1 2025 witnessed five $100M+ funding rounds compared to three such rounds in H2 2024 and two in H1 2024. Notable rounds included Digital Edge raising $640M in a Series D round, Supabase raising $200M in a Series D round, and Thunes raising $150M in a Series D round. The period also featured notable IPOs from Oasis Home, Mirxes, Antalpha, and Concorde Security. Sygnum, a banking solutions provider for digital assets, was the only unicorn created in H1 2025, the same number as in H1 2024 and no unicorn emerged in H2 2024.

The SEA tech sector witnessed 28 acquisitions in H1 2025, a drop of 26% compared to the 38 acquisitions in H2 2024, and a drop of 24% compared to the 37 acquisitions in H1 2024. The largest transaction was Dropsuite’s acquisition by NinjaOne for $270M, followed by the acquisition of ASCENT by KFin Technologies for $34.7M.

Singapore based tech firms accounted for 92% of all funding seen across the SEA region in H1 2025, making it the dominant geography. Taguig trailed far behind in a distant second place.

East Ventures, 500 Global, and Wavemaker Partners emerged as the overall top investors in the SEA Tech ecosystem. Iterative, 500 Global, and Antler were the top investors in seed-stage funding. In early-stage investments, SEEDS Capital, Altos Ventures Management, and Openspace Ventures were the top investors. In the late stage, DST Global Partners, Unbound, and Vitruvian Partners were the top investors.

The SEA tech ecosystem demonstrated a strong momentum in H1 2025, with late-stage funding surge and a rise in mega-round activity despite a general slowdown in early and seed-stage investments. The dominance of Enterprise Infrastructure, FinTech, and Enterprise Applications highlights growing investor focus on scalable and impact-driven sectors. Meanwhile, the significant role of Singapore as a funding hub, combined with strong activity across acquisitions and IPOs, underscores the region’s resilience and evolving role in the global technology landscape.