Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: SEA Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the SEA Tech space.

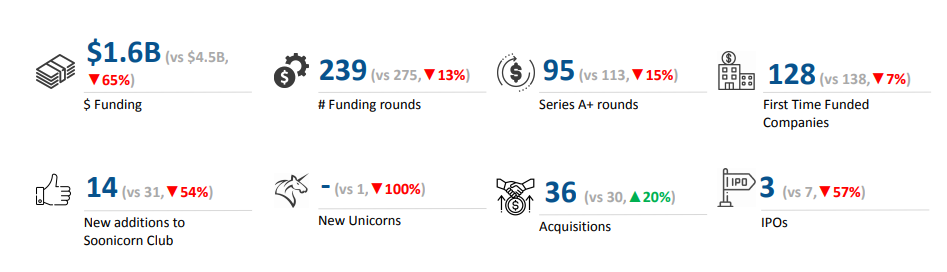

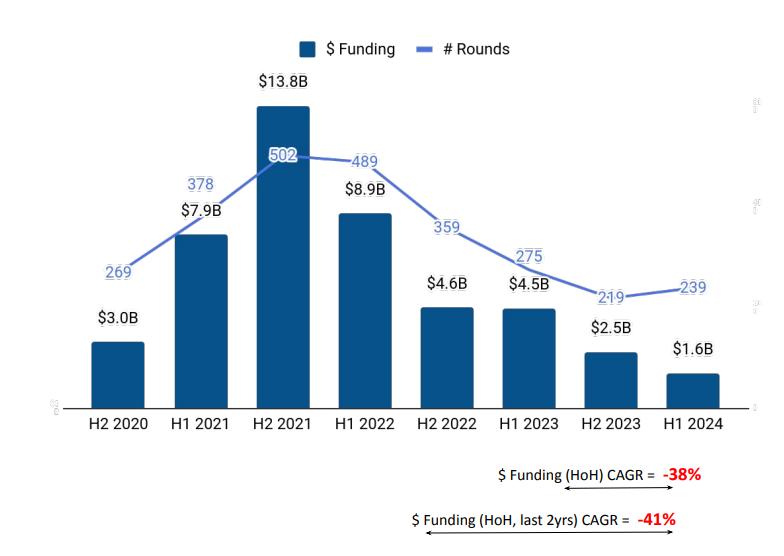

Companies in the SEA Tech space raised $1.6 billion in H1 2024, a substantial 65% drop compared to the $4.5 billion raised in the first half of 2023, and 37% lower than $2.5 billion raised in H2 2023. The SEA region ranks ninth globally in terms of tech startup funding in H1 2024.

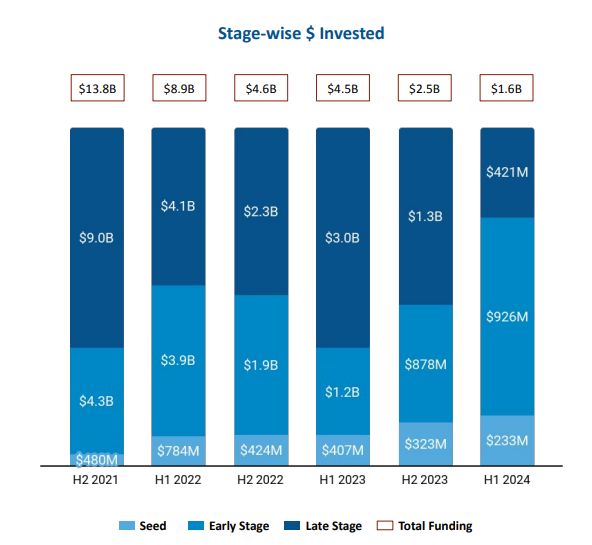

The funding landscape across different stages indicated varied trends. Late-stage funding was the most impacted, falling 69% to $421 million in H1 2024 from $1.3 billion in H2 2023, and an 86% plunge from $3 billion in the first six months of 2023. Early-stage investments stood at $946 million in H1 2024, a decline of 19% from $1.2 billion raised in H1 2023. However, this is an 8% uptick from the $878 million raised in H2 2023. This space attracted seed-stage funding worth $234 million in H1 2024, a decrease of 27% from $323 million in the latter half of 2023 and a drop of 42% from the $407 million raised in H1 2023.

SEA tech startups raised $477 million in Q2 2024, an 85% decrease from $3.16 billion in Q2 2023 and 57% lower than $1.12 billion raised in Q1 2024.

Notably, this period witnessed two major funding rounds exceeding $100 million. ANEXT Bank raised $148 million in a Series D round led by Ant Group, while GuildFi secured $140 million in a Series A round. No new unicorns were created in H1 2024, as against one unicorn in H1 2023.

However, acquisition activity increased, with 36 companies, compared with 30 in H1 2023 and 42 in H2 2023. The most significant acquisition was Singlife by Sumitomo Life Insurance Company for $1.2 billion, followed by the acquisition of GHL by NTT DATA for $154 million.

MaNaDr, RYDE, and Topindoku were the only three companies to go public in H1 2024. Only three IPOs took place, a decline from seven in H1 2023 and four in H2 2023.

The leading sectors in terms of performance in H1 2024 were FinTech, HighTech, and Enterprise Applications. Companies in the FinTech space attracted funding worth $851 million in H1 2023, 20% lower than $1.07 billion in H1 2023. Funding in the HighTech segment stood at $476 million, a 47% jump from $323 million in H1 2023. The Enterprise Applications sector witnessed a 49% decrease in funding, from $775 million in the first half of 2023 to $393 million in H1 2024.

Singapore led the region in terms of total funds raised in the first half of this year, followed by Jakarta and Bangkok. Tech startups based in Singapore raised $1.1 billion in H1 2024, while those based in Jakarta and Bangkok raised $185 million and $150 million respectively.

Investment activity remained robust, with East Ventures, 500 Global, and Wavemaker Partners emerging as the overall top investors in the SEA Tech ecosystem in H1 2024.

SEEDS Capital, Temasek, and Seventure Partners were the leading investors in early-stage funding, while MUFG Innovation Partners, NewView Capital, and Avataar Ventures topped the late-stage investment charts. Antler, 500 Global Ventures and East Ventures are the top investors in the seed stage for the SEA Tech ecosystem in H1 2024.

These developments highlight the evolving dynamics of the SEA Tech startup ecosystem as it navigates through varying stages of growth and investment trends.