Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo YTD Report: SEA Tech 9M 2024. The report, based on Tracxn’s extensive database, provides insights into the SEA Tech space.

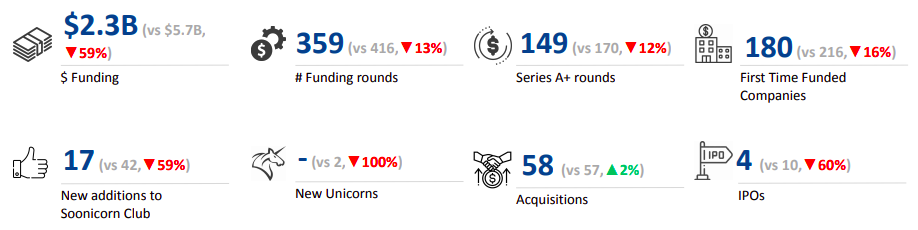

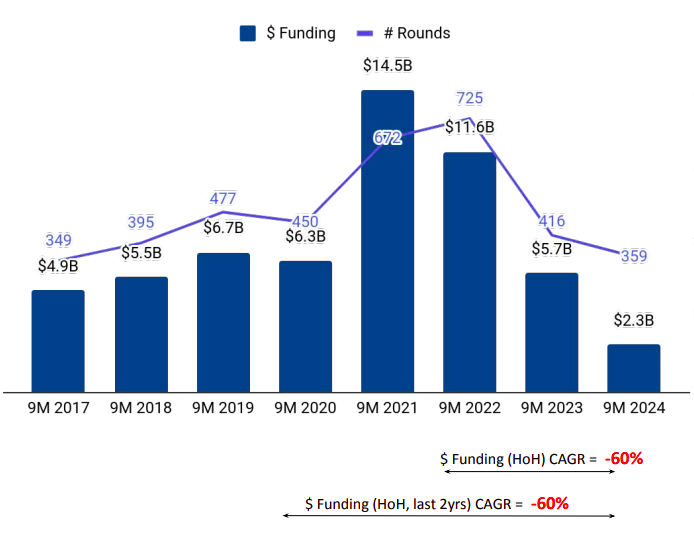

2024 has been a difficult year for SEA tech startups, with the ongoing funding winter, geopolitical headwinds, and global economic challenges. The SEA Tech space secured $2.3 billion in funding in the first nine months of 2024, less than half (a 59% drop) of the $5.7 billion raised in the same period in 2023. This is also an 80% plummet from the $11.6 billion raised by SEA-based tech startups in 9M 2022.

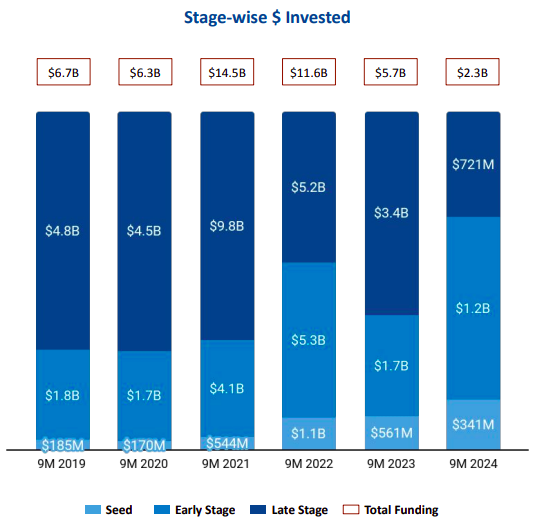

SEA’s tech startup ecosystem witnessed early-stage investments worth $1.2 billion in 9M 2024, a 30% decline from $1.7 billion raised in 9M 2023. Late-stage funding in the first three quarters of this year dropped 79% to $721 million, from $3.4 billion in the same period in 2023. Seed-stage funding stood at $341 million in 9M 2024, a 39% fall from $561 million raised in the first nine months of 2023.

Only two $100M+ rounds were observed in 9M 2024, lower than nine in the same period in 2023. Ascend Money raised $195 million in a Series D round from Krungsri Finnovate, while ANEXT Bank raised $148 million in a Series D round from Ant Group.

FinTech, Enterprise Applications and Retail were the top-performing sectors in 2024 so far. The FinTech sector secured total funding of $1.34 billion in 9M 2024 YTD, a drop of 11% compared with $1.51 billion raised in the same period in 2023. Companies in the Enterprise Applications segment raised a total of $606 million in funding in 9M 2024, a decline of 30% from the $869 million garnered during the same period in 2023. Retail companies received a total funding of $247 million in 2024 YTD, a 91% decline from $2.82 billion raised in 9M 2023.

The number of acquisitions observed in the entire ecosystem was 58 in 9M 2024, similar to 57 recorded in 9M 2023, but far lower than 79 in 9M 2022. Singlife was acquired by Sumitomo Life Insurance Company for $1.2 billion, while PropertyGuru was acquired by EQT for an acquisition price of $1.1 billion.

The SEA tech startup landscape has witnessed four IPOs in 2024 so far, as against 10 and two in the first nine months of 2023 and 2022, respectively. GoHub, MaNaDr, RYDE, and Topindoku are the four companies from this space that have gone public in 2024 so far.

Singapore retained its top position in terms of city-wise funding in the region, with the city’s tech startups attracting investments worth $1.4 billion in 9M 2024. Tech startups based in Jakarta and Bangkok raised $313 million and $265 million, respectively.

East Ventures, 500 Global and Wavemaker Partners are the all-time top investors in the SEA Tech space to date. Antler, 500 Global and East Ventures were the lead investors in seed-stage rounds in 9M 2024, while SEEDS Capital, Peak XV Partners and Gobi Partners were the most active early-stage investors.

MUFG Innovation Partners and NewView Capital were the leading investors in terms of late-stage investments in the first nine months of this year.

N8

(Data for 9M 2024 has been taken from Jan 1, 2024 - Sep 27, 2024)