Tracxn, a leading global SaaS-based market intelligence platform, has released its Annual Report: Singapore Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Singapore Tech space.

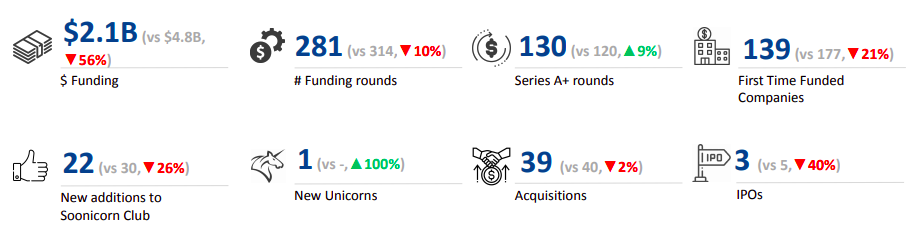

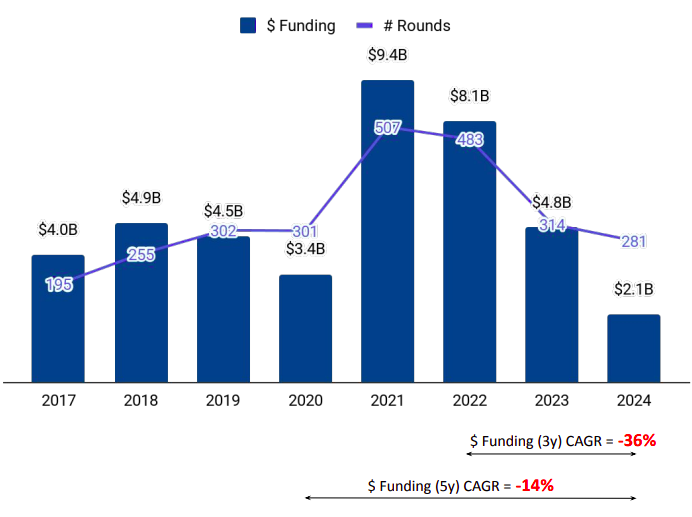

In 2024, Singapore tech startups raised $2.1 billion in funding, representing a 56% increase from the $4.8 billion secured in 2023 and a 74% drop compared to the $8.1 billion raised in 2022.

N8

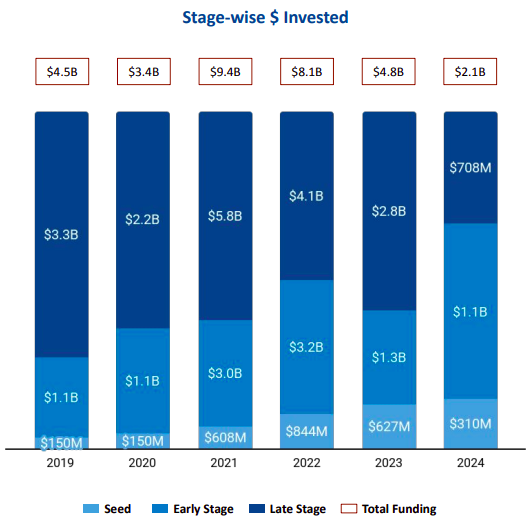

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage investments dropped by 74.71%, falling to $708 million in 2024 from $2.8 billion in 2023.

● Seed-Stage Funding: Seed-stage investments dropped by 50.6%, falling to $310 million in 2024 from $627 million in 2023.

● Early-Stage Funding: Early-stage investments dropped by 15.38%, falling to $1.1 billion in 2024 from $1.3 billion in 2023.

Sectoral Performance

Top-performing sectors in 2024 included FinTech, High Tech, and Enterprise Applications:

● FinTech: Funding decreased by 15% in 2024 compared to 2023 and 71% drop compared to 2022.

● High Tech: Funding increased by 4% in 2024 compared to 2023 and 67% drop compared to 2022.

● Enterprise Applications: Funding decreased by 29% in 2024 compared to 2023 and 77% drop compared to 2022.

Top cities leading the landscape

● Singapore-based tech firms accounted for all funding raised by Singapore tech companies.

Leading Investors

Wavemaker Partners, Peak XV Partners and SEEDS Capital emerged as the top investors in the Singapore tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions

The Singapore tech ecosystem recorded 39 acquisitions in 2024, down from 40 in 2023. Notable deals include:

● PropertyGuru acquisition by EQT for $1.1B, the highest-valued deal of the year.

● Skuad’s acquisition by Payoneer for $61M.

This data underscores the evolving dynamics of the Singapore tech ecosystem, reflecting both growth opportunities and challenges across different funding stages, sectors, and regions.