Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Singapore Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the Singapore Tech space.

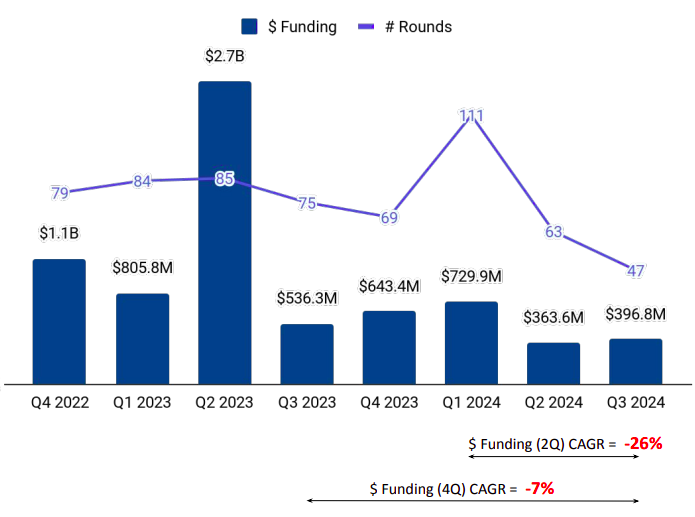

In Asia, Singapore’s tech startup ecosystem ranks fourth after China, India and Israel based on all-time funding to date. Singapore witnessed its peak startup funding in Q3 2021 ($4.1 billion), after which a downward trend was observed. The decline can be attributed to a notable shift in investor interest due to global economic challenges, including macroeconomic conditions and geo-political issues.

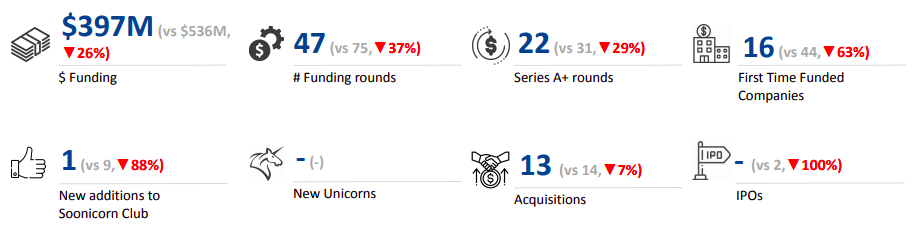

Singapore Tech startup ecosystem secured total funding of $397 million in Q3 2024 which is a 26% decline from $536 million raised in the corresponding quarter last year (Q3 2023) and a 9% uptick from $363.6 million raised in the previous quarter (Q2 2024).

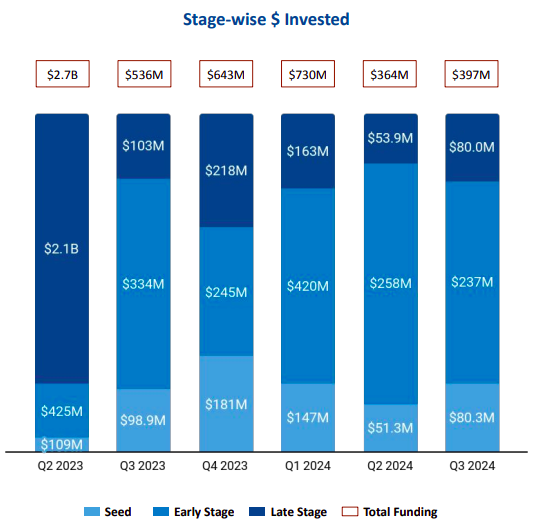

Late-stage funding rose 48% to $80 million in Q3 2024, from $53.9 million raised in Q2 2024. Early-stage investments worth $237 million were recorded in Q3 2024, an 8% drop compared with $258 million raised in Q2 2024. Seed-stage funding, too, grew 56.5% to $80.3 million in Q3 2024 from $51.3 million raised in Q2 2024.

Funding was driven by small-ticket rounds, due to the lack of $100M+ rounds in Q3 2024. Further, no new unicorns emerged during the period, similar to the scenario in Q3 2023.

FinTech, Enterprise Applications, and Retail were the top-performing sectors in Q3 2024. FinTech companies raised a total of $208 million in funding in Q3 2024, a 10% drop from $231 million raised in Q3 2023. Funding garnered by the Enterprise Applications segment rose 55% to $157 million in Q3 2024 from $101 million in Q3 2023. The Retail sector raised a total of $97 million in Q3 2024, a massive 229% increase from $29.5 million in the corresponding quarter last year.

The number of acquisitions was mostly unchanged, with a minor drop to 13 in the third quarter of 2024 from 14 in the corresponding quarter in 2023. However, this is an upward move from six acquisitions in Q2 2024. PropertyGuru was acquired by EQT for $1.1 billion, in the third quarter of 2024.

Only two Singapore tech startups have gone public this year so far, one each in Q1 and Q2 2024. The third quarter of the year did not witness any IPOs from Singapore’s startup landscape.

Wavemaker Partners, Antler and Entrepreneur First were the all-time top investors observed in Q3 2024, while Antler, Orbit Startups, and East Ventures took the lead in seed-stage investments, while Peak XV Partners, SEEDS Capital, and Temasek were the top early-stage investors.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 30, 2024)