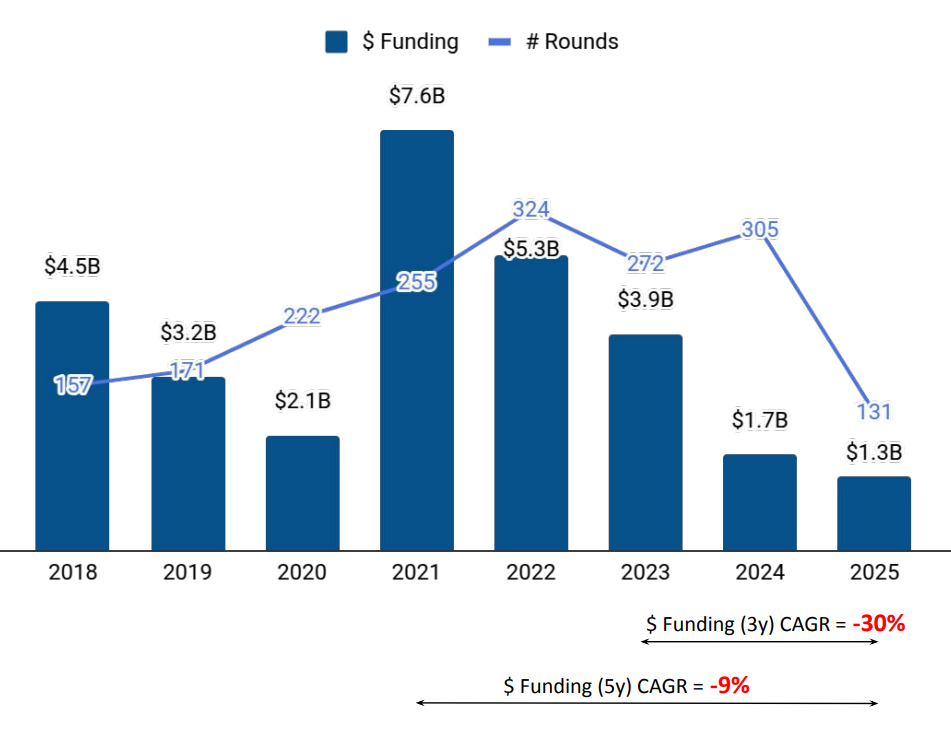

Tracxn has released its analysis of the South Korea Tech ecosystem for the year 2025, outlining key developments across funding, sector performance, deals, IPOs, acquisitions, and investor activity. The report highlights shifts in capital deployment across stages, changes in sector-wise funding distribution, and evolving deal activity within the South Korean tech landscape during the 2025 period.

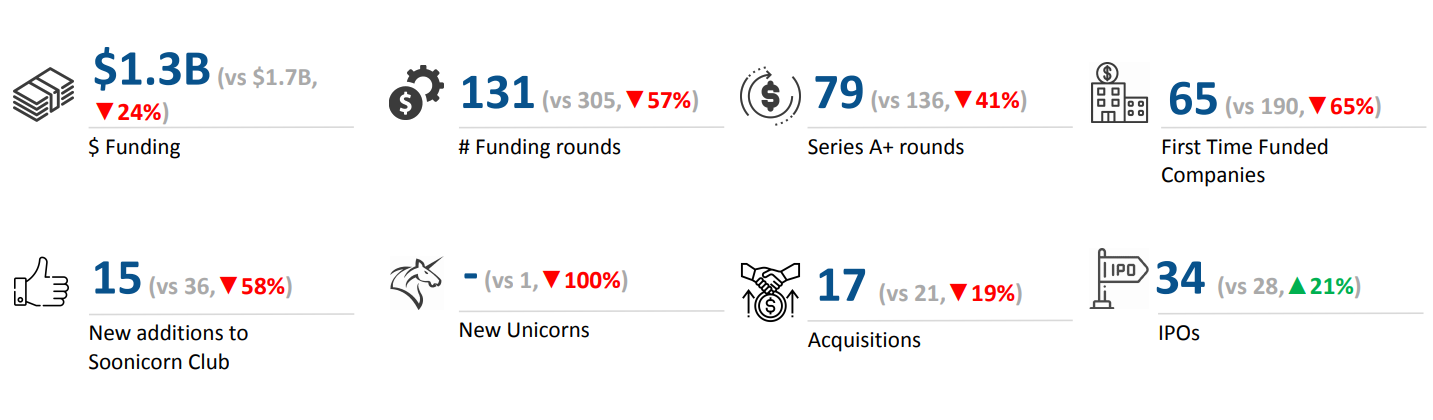

A total of $1.3B was raised by tech companies in South Korea in 2025. This represents a drop of 24% compared to the $1.7B raised in 2024 and a significant decline of 66% when compared to the $3.9B raised in 2023. The overall funding activity reflects varied movements across stages, with declines at the seed and early stages and an increase in late-stage funding compared to the previous year.

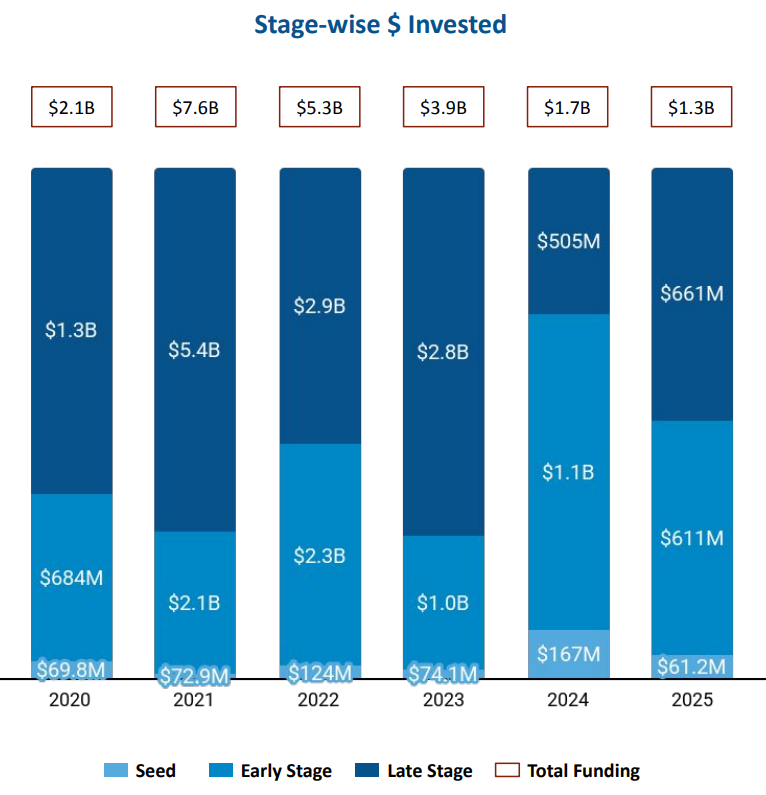

N8Seed-stage funding in South Korea Tech stood at $61.2M in 2025, reflecting a drop of 63% compared to the $167M raised in 2024 and a decline of 17% compared to the $74.1M raised in 2023. Early-stage funding totaled $611M in 2025, marking a 43% decrease from the $1.1B raised in 2024 and a 40% drop compared to the $1.0B raised in 2023. Late-stage funding reached $661M in 2025, representing a rise of 31% compared to the $505M raised in 2024, while registering a drop of 77% from the $2.8B raised in 2023.

Enterprise Applications, Semiconductors, and Industrial Goods and Manufacturing were the top-performing sectors in South Korea Tech during 2025. The Enterprise Applications sector saw total funding of $521M in 2025, which is a decrease of 9% compared to $575M raised in 2024 and a decrease of 15% compared to $616M raised in 2023. The Semiconductors sector recorded total funding of $280M in 2025, reflecting a decrease of 17% from $336M raised in 2024 and an increase of 384% compared to $57.9M raised in 2023. The Industrial Goods and Manufacturing sector attracted $165M in funding in 2025, representing an increase of 301% compared to $41.2M raised in 2024 and an increase of 627% compared to $22.8M raised in 2023.

The South Korea Tech ecosystem witnessed 3 $100M+ funding rounds in 2025, compared to 1 such round in 2024 and 9 in 2023. Companies such as Rebellions, HD Hyundai Robotics, and Furiosa raised funding above $100M during the year. Rebellions raised a total of $250M through a Series C round, HD Hyundai Robotics raised $125M through a Series D round, and Furiosa raised $125M through a Series C round. A major part of the $100M+ funding rounds in 2025 came from the Semiconductors, & Industrial Goods and Manufacturing sectors.

There were no new unicorns created in 2025, compared to 1 new unicorn in 2024 and 2 in 2023. South Korea Tech recorded 34 IPOs in 2025, up 21% from 28 IPOs in 2024 and up 143% from 14 IPOs in 2023. SemiFive, Rznomics, and NaraSpace were among the companies that went public during the year.

Tech companies in South Korea recorded 17 acquisitions in 2025, representing a drop of 19% compared to 21 acquisitions in 2024 and a decline of 35% compared to 26 acquisitions in 2023. The largest acquisition of the year was Dunamu being acquired by Naver at a price of $10.3B, making it the highest-valued acquisition in 2025. This was followed by the acquisition of Remember by EQT at a price of $400M.

Seoul-based tech firms accounted for 79% of all funding raised by tech companies across South Korea in 2025. Daegu emerged as the next most funded city, accounting for 10% of the total funding raised during the year.

FuturePlay, Kakao Ventures, and STH emerged as the top seed-stage investors in the South Korea Tech ecosystem in 2025. At the early stage, KB Investment, IMM Investment, and Shinhan Venture Investment were the most active investors. Yuanta Investment led late-stage investments in the South Korea Tech ecosystem during 2025.

The South Korea Tech ecosystem in 2025 recorded $1.3B in total funding, with declines across seed and early-stage investments and a year-over-year increase in late-stage funding. Enterprise Applications, Semiconductors, and Industrial Goods and Manufacturing led sector-wise funding during the year, while the ecosystem saw 3 $100M+ funding rounds and no new unicorn creations. IPO activity increased to 34 listings, and acquisition activity totaled 17 deals, led by the $10.3B acquisition of Dunamu by Naver.