Tracxn has released its South Korea Tech Q1 2025 Funding Report, highlighting the significant shifts in the country’s tech investment landscape during the first quarter of the year. The report captures a notable contraction in overall funding activity, with a marked decline in investments across stages and the absence of mega-deals or unicorn creation. Despite the pullback, certain sectors like Enterprise Applications and Gig Economy demonstrated relative resilience, and acquisition activity recorded an uptick compared to the previous quarter.

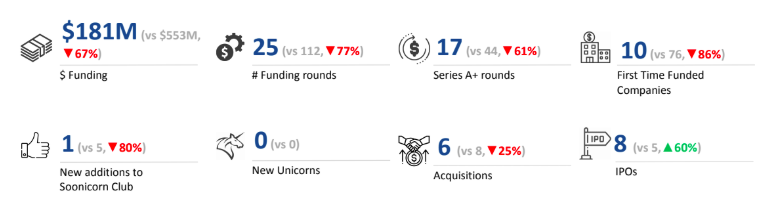

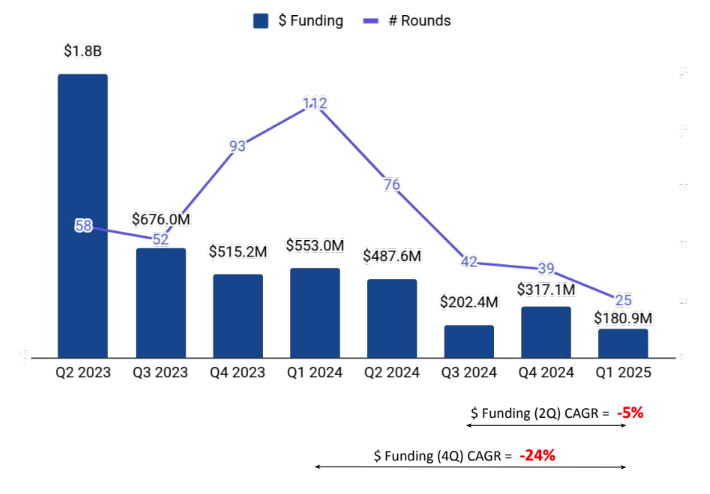

South Korea Tech startups raised a total of $181M in Q1 2025, reflecting a 43% drop compared to the $317M raised in Q4 2024 and a steep 67% decline from the $553M recorded in Q1 2024. This downturn indicates a broad-based deceleration in funding activity across the ecosystem during the quarter.

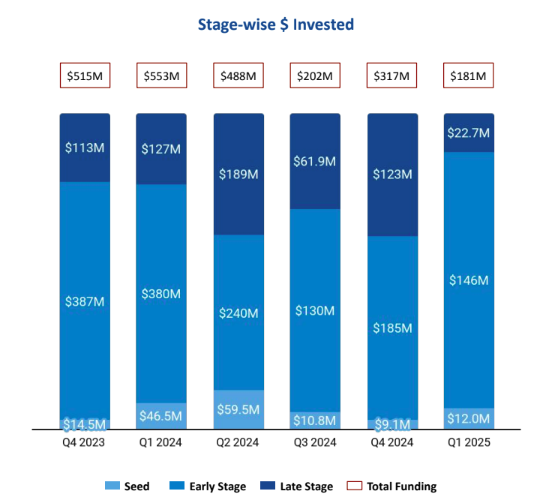

Seed Stage funding in South Korea reached $12M in Q1 2025, showing a 32% increase compared to the $9.1M raised in Q4 2024. However, it marked a significant 74% drop from the $46.5M recorded in Q1 2024. Early Stage funding totaled $146M, representing a 21% decrease from the $185M raised in Q4 2024 and a 62% fall from the $380M secured in Q1 2024. Late Stage funding stood at $22.7M in Q1 2025, witnessing a sharp 82% drop compared to $123M in Q4 2024 and $127M in Q1 2024.

Enterprise Applications, Food and Agriculture Tech, and Gig Economy emerged as the top-performing sectors in South Korea’s tech space in Q1 2025. The Enterprise Applications sector led the quarter with $103M in funding, reflecting a 48% increase from $69.9M in Q4 2024 but a 46% decline from $189.6M in Q1 2024. Food and Agriculture Tech raised $21.4M in Q1 2025, marking a 51% drop from the $43.8M raised in Q1 2024, after seeing no funding activity in Q4 2024. Gig Economy startups also recorded $21.4M in funding during the quarter, a revival in activity for the sector which had no funding in both Q1 and Q4 of 2024.

No companies in South Korea raised funds above $100M in Q1 2025. Additionally, no unicorns were created during the quarter, continuing the trend from Q1 2024, in contrast to one unicorn recorded in Q4 2024. Several tech firms went public in Q1 2025, including TXR Robotics, Orum Therapeutics, Dongbang Medical and iGinet.

The South Korea tech ecosystem saw a total of 6 acquisitions in Q1 2025, marking a 200% increase from the 2 acquisitions recorded in Q4 2024, though still down 25% compared to 8 acquisitions in Q1 2024. The most notable deal of the quarter was the acquisition of REGEN Biotech by IMEIK for $190M, making it the highest valued transaction during the period. This was followed by the acquisition of Manyo by KL Partners at a price of $129M.

Seoul-based tech companies dominated the funding landscape in Q1 2025, accounting for 82% of all investments made in South Korea during the quarter. Daejeon followed at a distant second, highlighting the concentration of capital in Seoul.

KB Investment, Korea Investment Holdings and Kakao Ventures were the overall top investors in South Korea Tech ecosystem. NAVER D2 Startup Factory, Hyosung Ventures and D.CAMP were the most active seed-stage investors for the quarter. In the early-stage segment, Altos Ventures Management, KB Investment and SBVA led the investment activity, maintaining strong participation across funding rounds.

The South Korea tech ecosystem faced a sharp pullback in Q1 2025, with overall funding dropping significantly across all stages and no presence of $100M+ rounds or new unicorns. Despite the downturn, Enterprise Applications, Food and Agriculture Tech and Gig Economy stood out as active sectors. Acquisition activity saw a notable rebound, led by the REGEN Biotech and Manyo deals. Seoul continued to dominate as the country’s tech funding hub, while early-stage investors remained active in driving startup momentum.