Tracxn has released its South Korea Tech H1 2025 Funding Report, capturing the state of investment in the country’s tech ecosystem for the first half of 2025. The report highlights a sharp decline in overall funding compared to previous periods, with significant drops across all funding stages. Despite the downturn, several sectors including Enterprise Applications and Food and Agriculture Tech continued to attract investor interest, and M&A activity showed signs of growth.

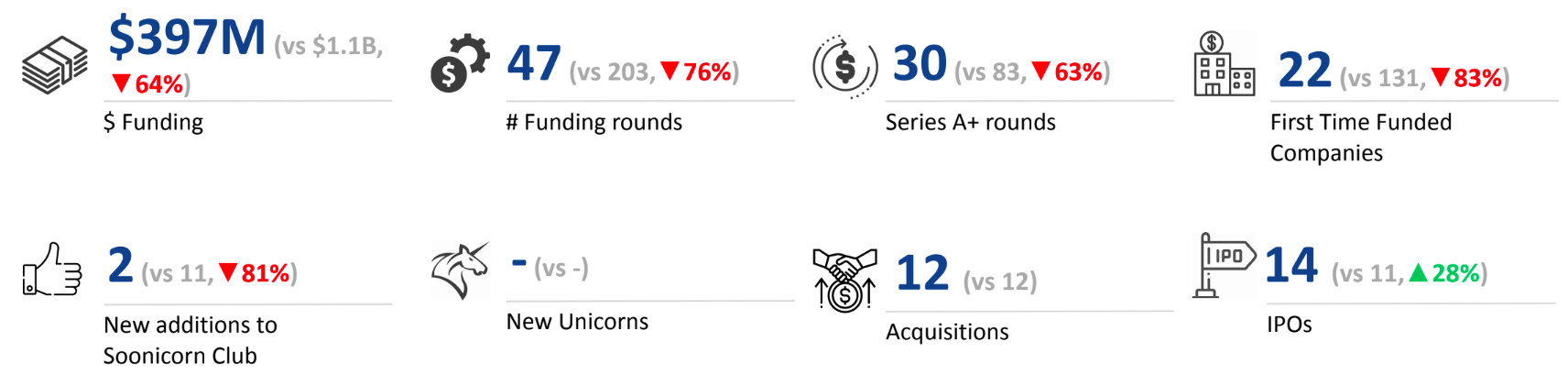

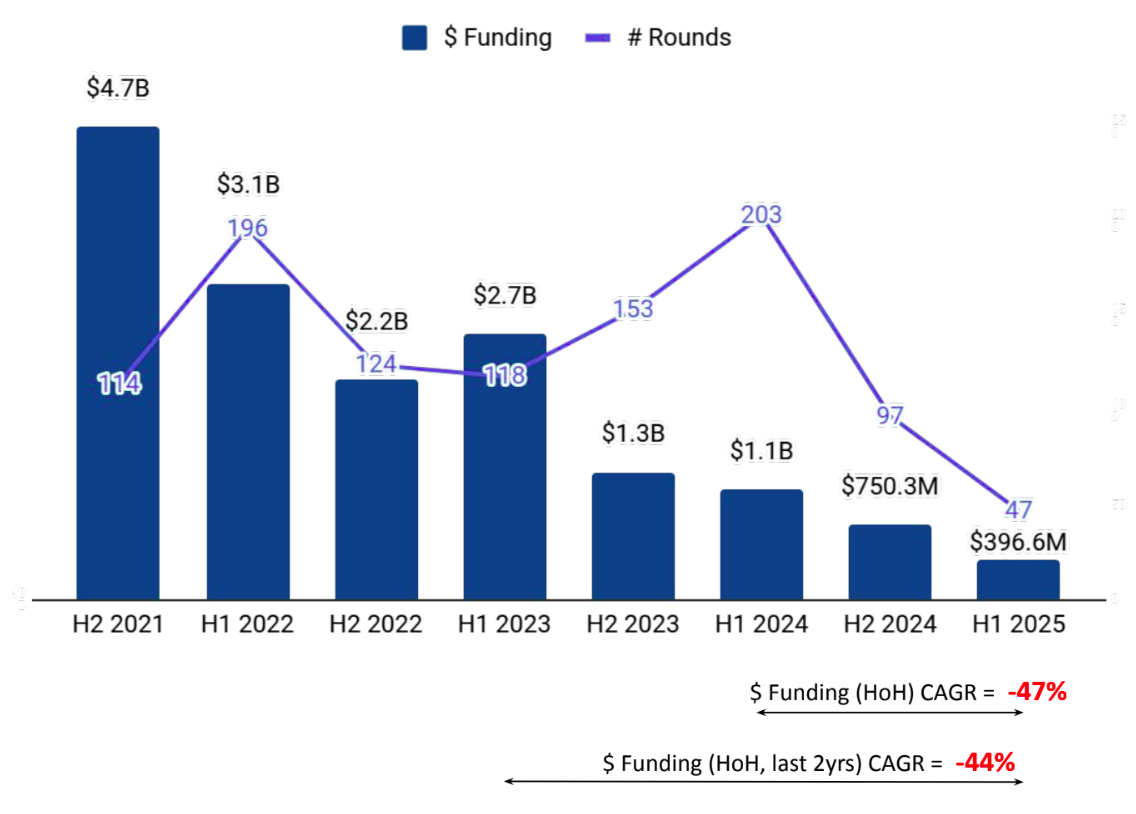

A total of $397M was raised in South Korea’s tech ecosystem in H1 2025, marking a 47% drop compared to the $750M raised in H2 2024, and a 64% decline from the $1.1B raised in H1 2024. The reduction in capital inflow is reflected across all funding stages and sectors, underscoring a broad contraction in the investment landscape over the past year.

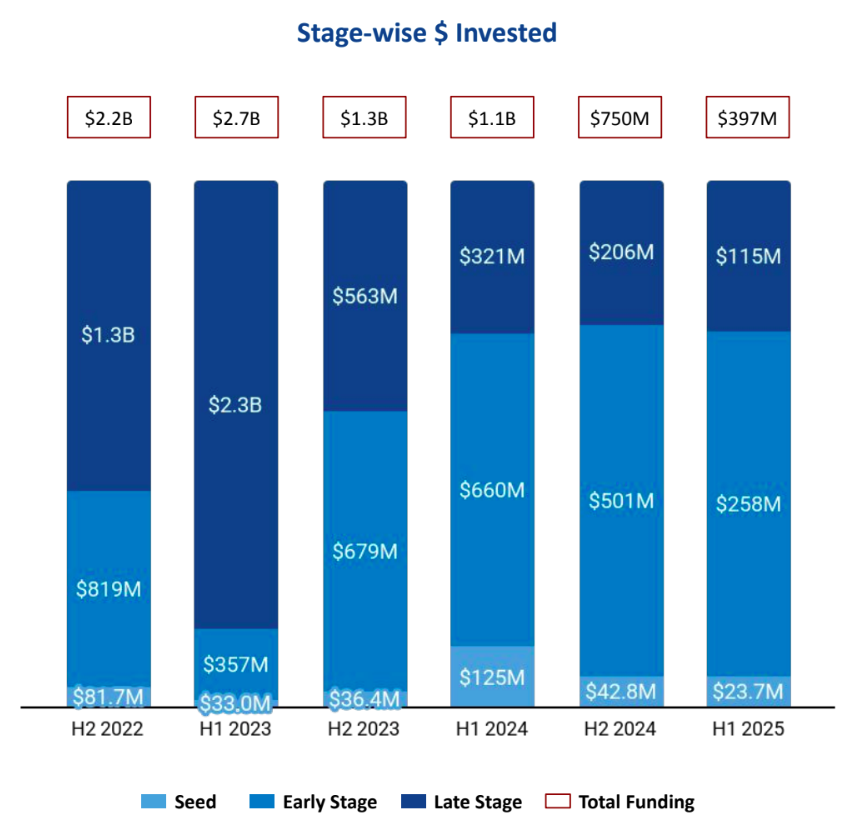

Seed Stage funding amounted to $23.7M in H1 2025, reflecting a 45% decrease from the $42.8M raised in H2 2024 and an 81% drop compared to $125M in H1 2024. Early Stage funding totaled $258M, down 48% from $501M in H2 2024 and 61% lower than the $660M raised in H1 2024. Late Stage funding reached $115M in H1 2025, marking a 44% decline from $206M in H2 2024 and a 64% decrease compared to the $321M raised in H1 2024.

Enterprise Applications, Food and Agriculture Tech, and HealthTech emerged as the top-performing sectors in H1 2025. The Enterprise Applications sector saw a total funding of $194M, a drop of 4% compared to $203M in H2 2024 and 58% compared to $463M in H1 2024. Food and Agriculture Tech received $71.4M in funding, representing a 49% increase from $47.9M in H1 2024, with no funding recorded in H2 2024. HealthTech recorded a total of $49.8M in funding, a drop of 36% compared to $77.5M in H2 2024 and 63% compared to $134M in H1 2024.

There were no $100M+ funding rounds in H1 2025. Additionally, no unicorns were created in H1 2025 or H1 2024, while one unicorn was created in H2 2024. On the public markets front, GC Genome, IntoCell, ImmuneOncia, and ROKIT Healthcare were some of the companies that went public in H1 2025.

A total of 12 tech companies were acquired in South Korea in H1 2025, the same as in H1 2024 and up 33% from 9 in H2 2024. REGEN Biotech was acquired by IMEIK at a price of $190M, becoming the highest-valued acquisition in H1 2025. This was followed by the acquisition of Manyo by KL & Partners at a price of $129M.

Seoul-based tech firms accounted for 79% of all funding seen by tech companies across South Korea. This was followed by Daejeon at a distant second, highlighting the dominant position of the capital city in the country’s tech funding landscape.

SparkLabs, KB Investment, and Kakao Ventures were the overall top investors in the South Korea tech ecosystem. Crit Ventures, NAVER D2 Startup Factory, and Coolidge Corner Investment were the top seed stage investors for H1 2025. Altos Ventures Management, BSK Investment, and IMM Investment emerged as the top early stage investors. Aju IB Investment, Korea Investment Holdings and GNTech Venture Capital were the top late stage investors in the ecosystem.

The South Korea tech ecosystem experienced a significant funding decline in H1 2025, with steep drops across all stages and most sectors. Despite this, Enterprise Applications, Food and Agriculture Tech, and HealthTech remained key focus areas for investors. Acquisition activity picked up pace, and Seoul continued to dominate the funding landscape. While no unicorns emerged, the ecosystem saw several companies going public and major acquisitions led by IMEIK and KL & Partners.