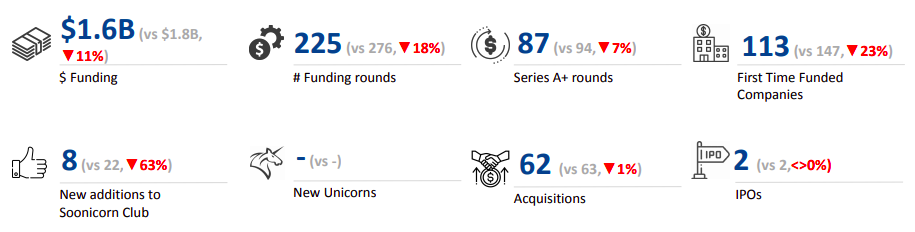

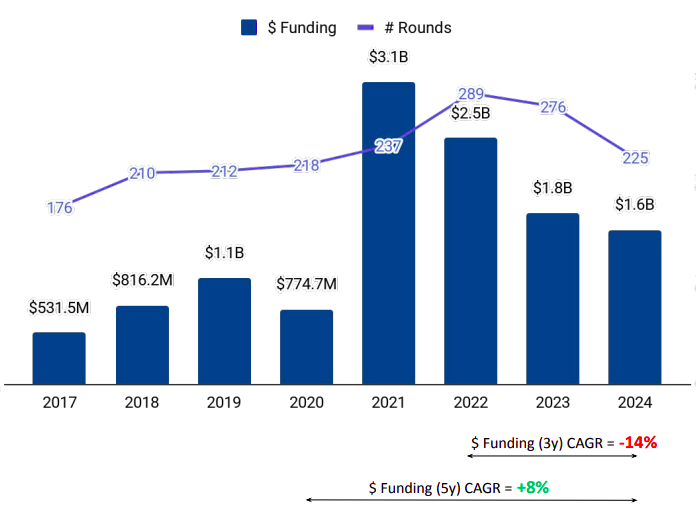

Funding Trends:

A total of $1.6 billion was raised, with $713 million contributed in Q4-2024 alone. During the second half of 2024, funding reached $933 million, highlighting sustained investor interest. Barcelona led Spain’s funding landscape, accounting for 60.92% of all investments, underscoring its dominance as the country’s tech capital.

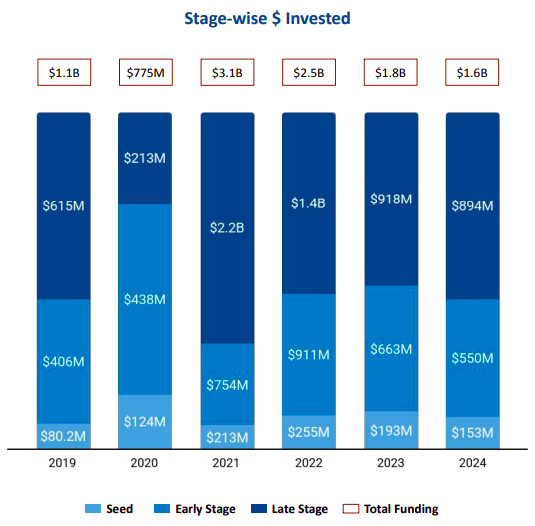

Stage-Wise Analysis:

Seed-stage investments saw a total of $153 million, marking a decline of 20.73% compared to 2023 and 40% lower than 2022. Early-stage funding amounted to $550 million, reflecting a 17.04% year-over-year drop and a 39.63% decrease compared to 2022. Late Stage witnessed a total funding of $894M in 2024, a drop of 2.61% compared to $918M raised in 2023, and a drop of 36.14% compared to $1.4B raised in 2022.

Sector Performance:

The retail, enterprise applications, and high-tech sectors led the charge in 2024, collectively attracting the bulk of investments. The retail sector stood out, securing $522 million in funding, a 140.55% increase compared to 2023 and slightly surpassing 2022. Enterprise applications raised $399 million, reflecting a modest 5.28% increase from 2023 but a significant decline of 69.31% from 2022. High-tech funding totaled $370.6 million, a 4% decrease year-over-year and a 55% drop compared to 2022.

Deals and IPOs:

Only two $100M+ funding rounds were recorded in 2024. SeQura raised $435.63 million in a Series D round led by Citi, while TravelPerk secured $105 million in a Series D round led by SoftBank Vision Fund, valuing the company at $1.4 billion.

Spain did not see any new unicorns during the year, continuing the trend from 2023. IPO activity was similarly limited, with only two companies - Cox and ORYZON - going public in 2024.

Acquisition Trends:

Acquisition activity saw a slight decline, with 62 deals completed in 2024 compared to 63 in 2023 and 90 in 2022. Idealist was acquired by Cinven at a price of $3.1B. This becomes the highest valued acquisition in 2024. Additionally, Livespins was acquired by Evolution Robotics for $5.4 million.

City-Wise Trends:

Barcelona dominated with 60.92% of total funding, followed by Madrid and Valencia. These three cities collectively shaped Spain’s tech funding narrative.

Investor Activity:

Inveready, Caixa Capital Risc and Kibo Ventures were the overall top investors in Spain Tech ecosystem.

At the seed stage, Demium, Ship2B, and Wayra were prominent investors, while Sabadell Venture Capital, Axon Partners Group, and Adara Ventures were notable at the early stage. SoftBank Vision Fund, Vitruvian Partners and Unbound were the top late-stage investors in Spain Tech ecosystem for 2024.