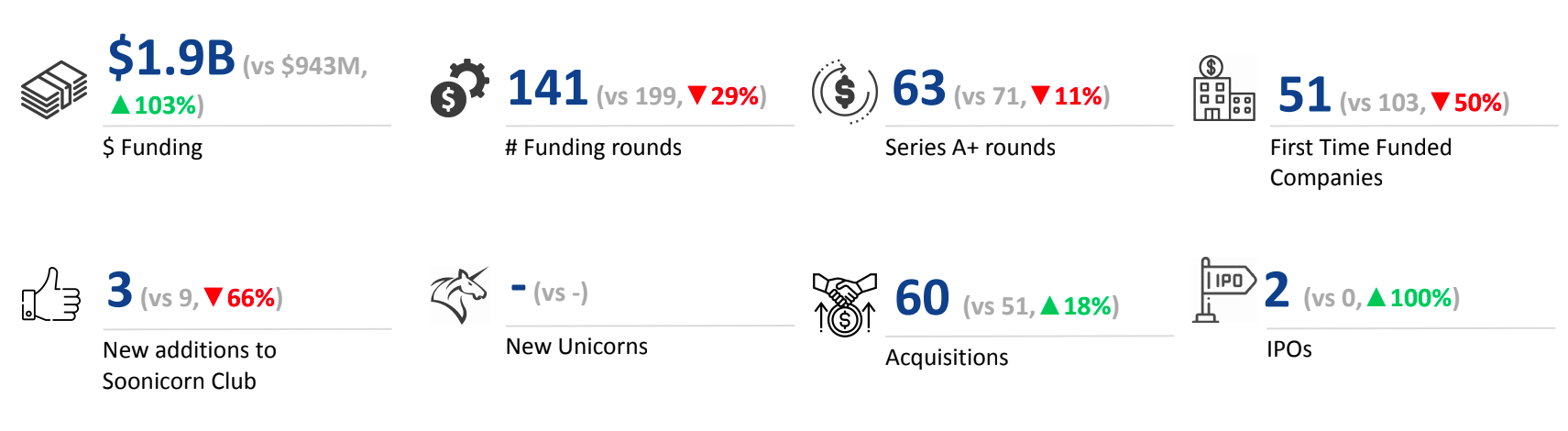

Tracxn has released its Spain Tech 9M 2025 Funding Report, highlighting key trends shaping the country’s startup investment landscape. The Spanish tech ecosystem saw robust growth in funding activity, with total investments more than doubling compared to the same period last year. The surge was primarily driven by strong early-stage funding rounds and major $100M+ deals across key sectors such as Enterprise Applications, Travel and Hospitality Tech, and Life Sciences.

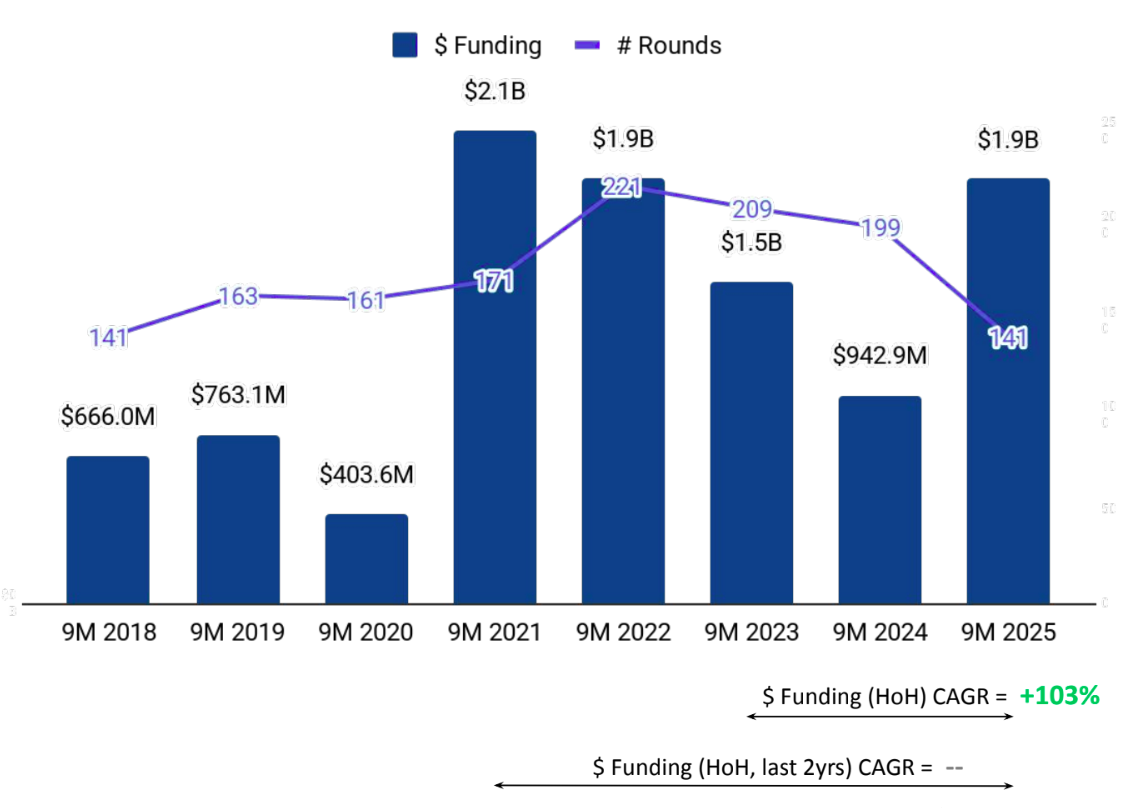

Spain’s tech sector raised a total of $1.9B in 9M 2025, marking a 103% increase compared to $943M in 9M 2024 and a 32% rise from $1.5B in 9M 2023. The sharp recovery was largely driven by strong early-stage funding activity and multiple $100M+ rounds across key sectors.

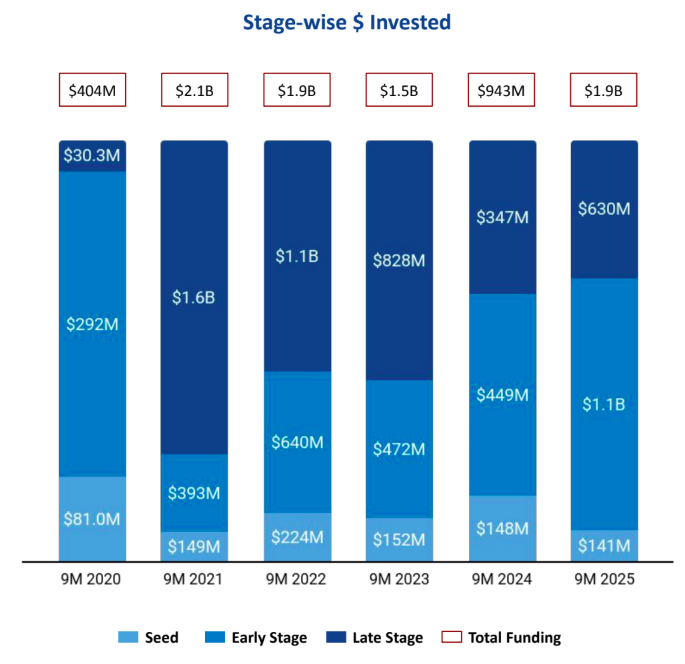

Funding activity across stages in Spain reflected mixed trends in 9M 2025. Seed-stage funding stood at $141M, marking a 4% decline from $148M in 9M 2024 and a 7% drop from $152M in 9M 2023. Early-stage funding showed strong momentum, reaching $1.1B, a 156% surge compared to $449M in 9M 2024 and a 143% rise from $472M in 9M 2023. In contrast, late-stage funding totaled $630M, reflecting an 82% increase from $347M in 9M 2024 but a 24% decline compared to $828M in 9M 2023, indicating a moderate slowdown in mature-stage investments.

Enterprise Applications, Travel and Hospitality Tech, and Life Sciences emerged as the top-performing sectors in Spain during 9M 2025. The Enterprise Applications sector recorded total funding of $1.0B, marking a 129% rise compared to $444M in 9M 2024 and a 338% increase from $233M in 9M 2023. The Travel and Hospitality Tech sector saw total funding of $419M, reflecting an 84% increase from $228M in 9M 2024 but a 23% decline from $542M in 9M 2023. The Life Sciences sector attracted $399M, registering a 554% surge compared to $61M in 9M 2024 and a 225% rise from $123M in 9M 2023.

Six $100M+ funding rounds were recorded in Spain in 9M 2025, compared to one in 9M 2024 and two in 9M 2023. Multiverse Computing raised $215M in a Series B round, TravelPerk secured $200M in a Series E round, and Auro raised $187M in a Series B round, while Splice Bio also joined the list of companies surpassing the $100M mark. The $100M+ deals were primarily driven by the Enterprise Applications, Travel and Hospitality Tech, and Auto Tech sectors.

Spain’s IPO environment showed renewed activity, with two public listings recorded in 9M 2025, up from none in 9M 2024 and a 100% increase compared to one in 9M 2023. The companies that went public during this period were HBX Group and Student Property Income SOCIMI. No new unicorns emerged in 9M 2025, maintaining the same zero count as in both 9M 2024 and 9M 2023.

Spain’s M&A landscape remained active in 9M 2025, with 60 acquisitions recorded during the period. This reflected an 18% increase compared to 51 acquisitions in 9M 2024 and a 30% rise from 46 acquisitions in 9M 2023. The market also saw several high-value transactions, led by Clio’s $1.0B acquisition of vlex, the largest deal of the period, followed by Church & Dwight’s $880M acquisition of Touchland.

Funding activity in Spain was concentrated around major cities. Madrid-based tech firms accounted for 33% of total funding raised across the country, while Barcelona-based companies contributed 31% of the total investments during 9M 2025.

Investor participation in Spain’s tech ecosystem remained diverse across stages in 9M 2025. Itnig, Easo Ventures, and Demium emerged as the most active investors at the seed stage, supporting the growth of early-stage startups. At the early stage, Bonsai Partners, Seaya, and Acurio Ventures played a leading role in driving scale-up investments and fueling the country’s expanding innovation landscape.

The Spain tech ecosystem showed strong recovery in 9M 2025, with overall funding more than doubling year-on-year and a surge in early-stage investments driving growth. The dominance of Enterprise Applications, Travel and Hospitality Tech, and Life Sciences sectors underscored investor confidence in innovation-driven industries. Despite the absence of new unicorns, increased IPO activity, multiple $100M+ rounds, and a rise in acquisitions highlight Spain’s growing maturity as a technology investment hub.