Tracxn has released its Spain Tech H1 2025 Report, providing insights into the country's startup ecosystem and investment activity from January to June 2025. The report highlights a strong rebound in funding, led by a surge in early-stage investments and a rise in the number of $100M+ deals. Enterprise Applications, Travel and Hospitality Tech, and Life Sciences emerged as the top-performing sectors. Despite the funding momentum, no new unicorns were created during the period.

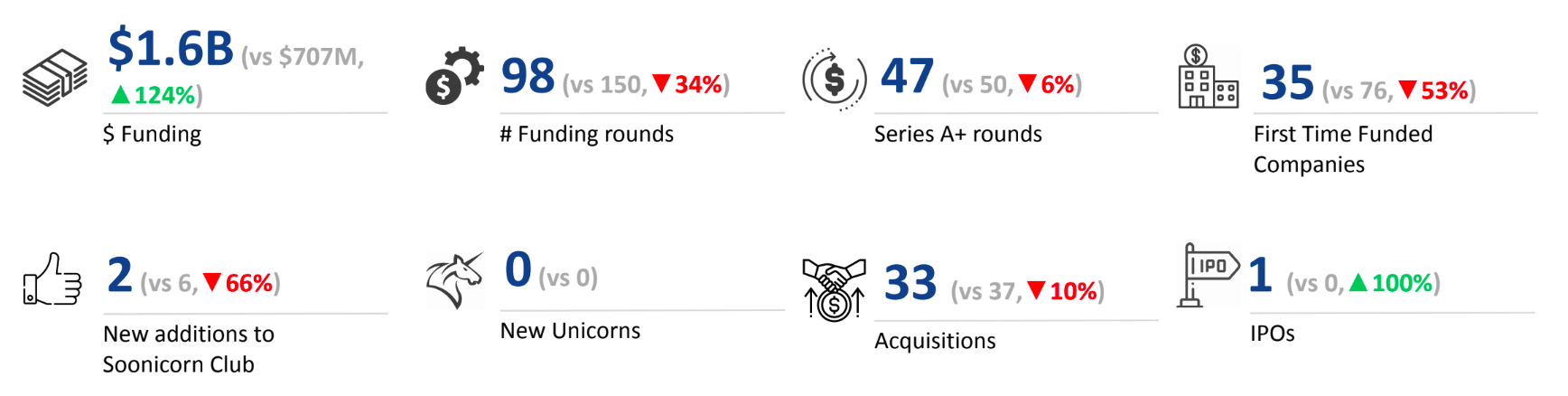

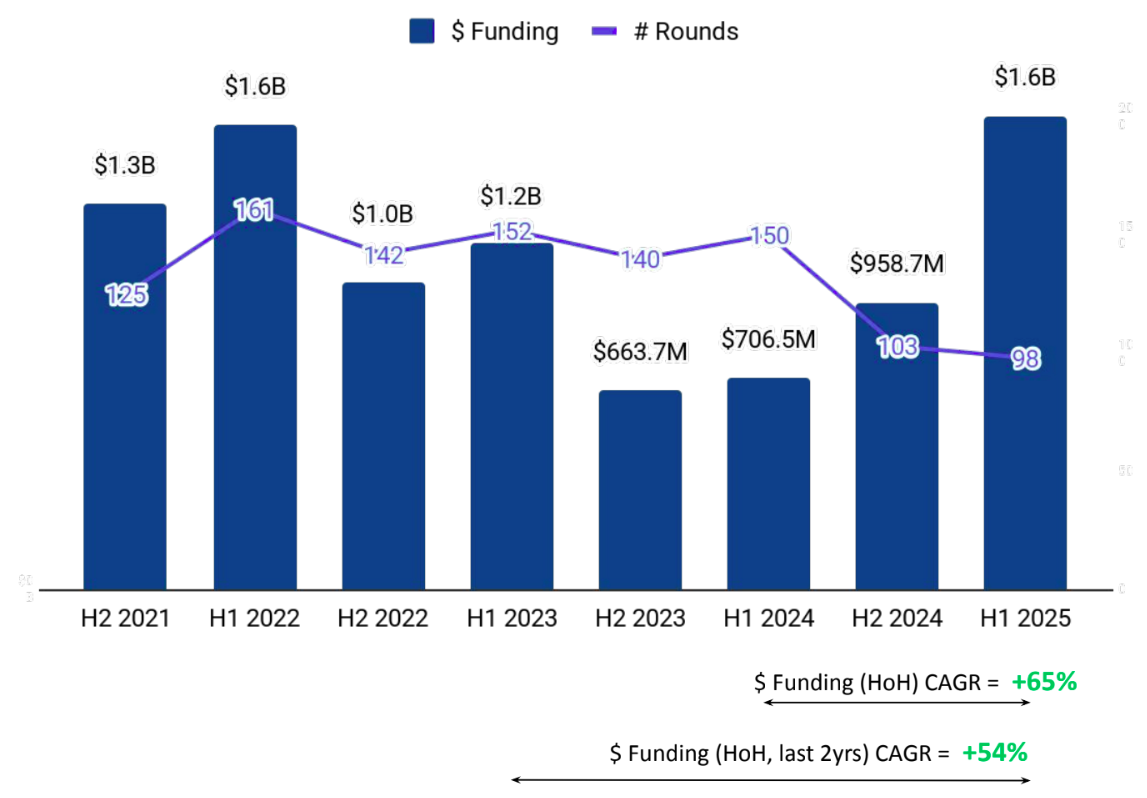

A total of $1.6B was raised in H1 2025, marking an increase of 65% compared to $958.7M raised in H2 2024, and a 124% rise compared to $706.5M raised in H1 2024. This upward trend reflects renewed investor activity in Spain’s tech ecosystem after subdued funding in the previous periods.

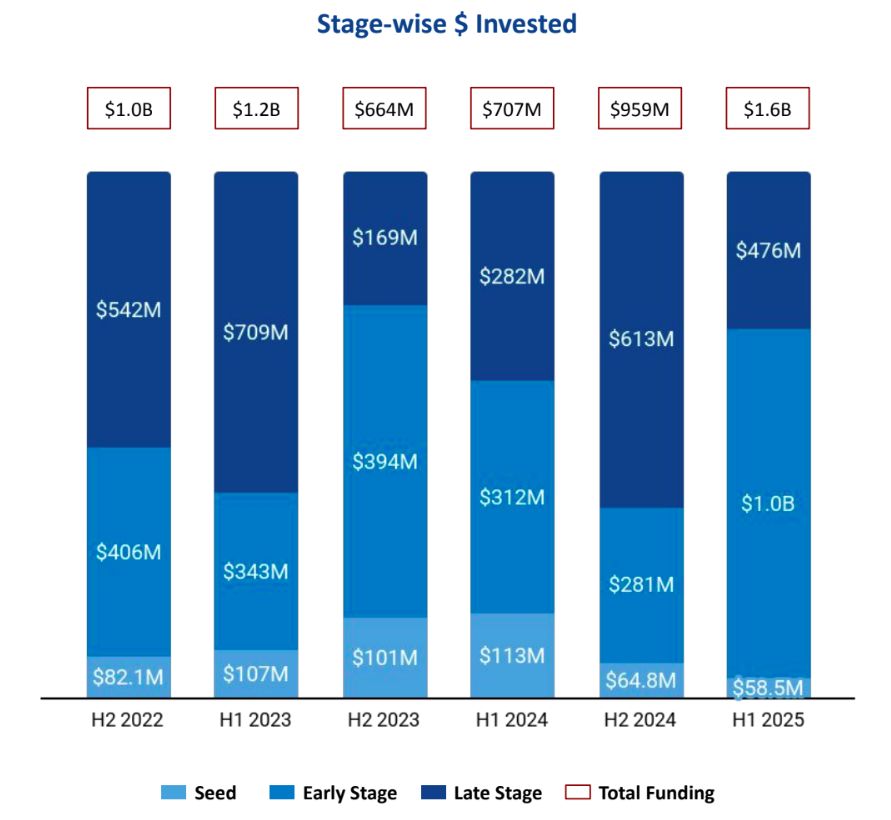

Seed Stage funding stood at $58.5M in H1 2025, representing a 10% decline compared to $64.8M in H2 2024, and a 48% drop compared to $113M in H1 2024. Early Stage investments saw a significant boost, with a total of $1.0B raised in H1 2025, an increase of 273% over $281M in H2 2024, and 236% compared to $312M in H1 2024. Late Stage funding amounted to $476M in H1 2025, reflecting a 22% decrease from $613M in H2 2024, but a 69% increase compared to $282M in H1 2024.

Enterprise Applications, Travel and Hospitality Tech, and Life Sciences were the top-performing sectors in H1 2025. The Enterprise Applications sector saw a total funding of $825M, which is an increase of 675% compared to $107M in H2 2024, and an increase of 132% compared to $356M in H1 2024.The Travel and Hospitality Tech sector raised $410M, reflecting a 366% increase over $88M in H2 2024, and a 163% rise from $156M in H1 2024. Life Sciences funding totaled $333M, which is a 201% increase compared to $110M in H2 2024, and a 1565% jump over $20M in H1 2024.

Spain saw 5 funding rounds above $100M in H1 2025, up from 1 such round each in H2 2024 and H1 2024. Companies that raised over $100M this period include Multiverse Computing, TravelPerk, Auro, Splice Bio, and Jobandtalent. Multiverse Computing raised $215M in a Series B round.TravelPerk raised $200M in a Series E round. Auro secured $185M in a Series B round. A major part of these $100M+ funding rounds came from Enterprise Applications, Travel and Hospitality Tech, and Auto Tech sectors. HBX Group was the only company to go public in H1 2025. No unicorns were created in H1 2025, H2 2024 and H1 2024.

Tech companies in Spain recorded 33 acquisitions in H1 2025, a 3% increase compared to 32 acquisitions in H2 2024, and a 10% decrease from 37 acquisitions in H1 202Uwin4. vlex was acquired by Clio for $1.0B, making it the highest valued acquisition in H1 2025, followed by Touchland, acquired by Church & Dwight. for $880M.

Barcelona-based tech firms accounted for 32% of all funding raised in Spain in H1 2025, followed by Madrid at 27%, making them the top two cities in terms of capital inflow during the period.

Inveready, Caixa Capital Risc, and Ship2B were the overall top investors in the Spain tech ecosystem for H1 2025. Itnig, Easo Ventures, and BeAble Capital led seed-stage investments. Bonsai Partners, Seaya, and Acurio Ventures were dominant in early-stage investments. Atomico, FJ Labs, and Columbus Venture Partners emerged as the leading late-stage investors. Among VCs, Spain-based K Fund led the most number of investments in H1 2025 with 3 rounds, while another Spain-based firm, Bonsai Partners, added 3 new companies to its portfolio. In late-stage VC investments, United Kingdom based SoftBank Vision Fund and United States-based DST Global Partners added 5 and 1 company, respectively, to their portfolios.

The Spain tech ecosystem saw a notable resurgence in H1 2025, with funding activity rising sharply across early-stage investments and top-performing sectors like Enterprise Applications, Travel and Hospitality Tech, and Life Sciences. While seed-stage funding continued to decline and no new unicorns emerged, the increase in $100M+ deals, acquisitions, and active investor participation signals growing confidence in the market.