The world is witnessing increasing climate anomalies, with each year seemingly setting new temperature records. On this World Environment Day, hosted by the Kingdom of Saudi Arabia on June 5th, the focus was on land restoration, desertification, and drought resilience. At Tracxn, we have analyzed startups and innovative tech companies addressing environmental challenges.

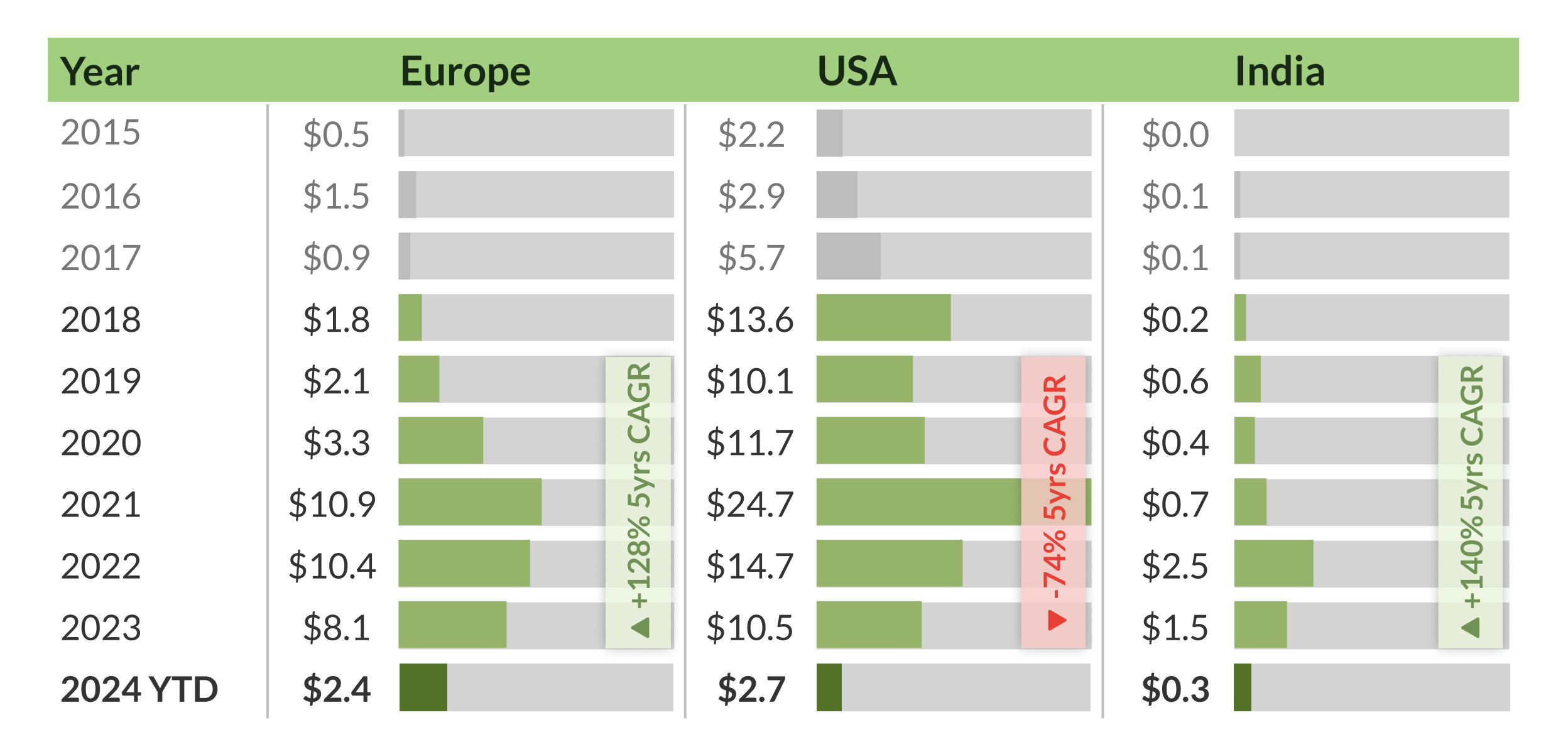

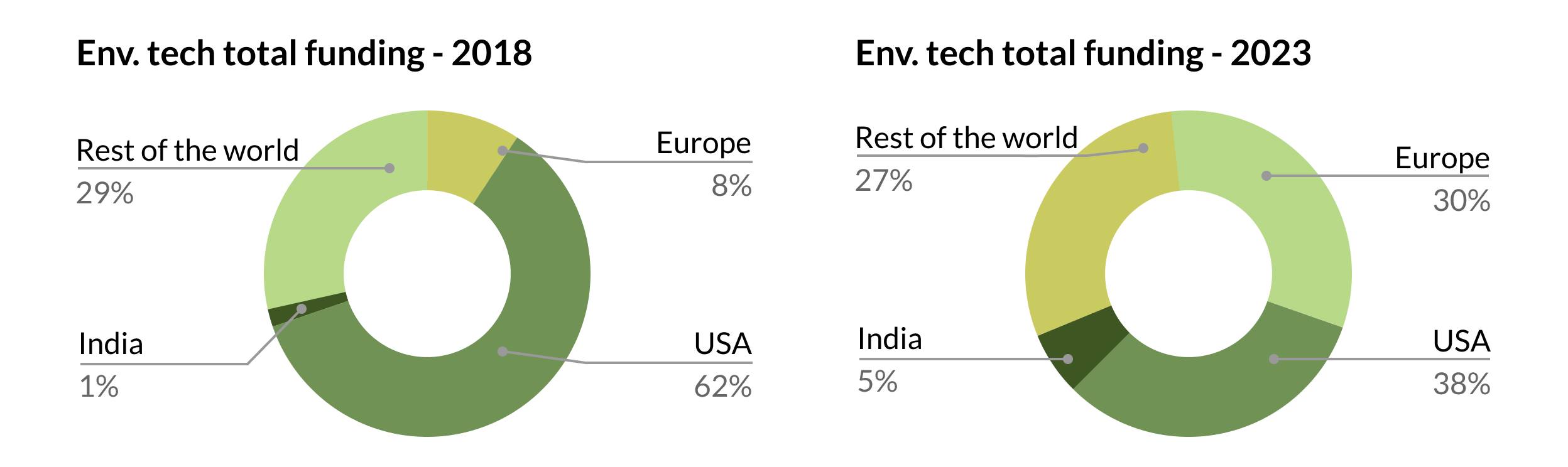

Equity funding, particularly from Venture Capital funds (VCs), is a key benchmark of innovation in the startup ecosystem. Recently, there has been a noticeable dip in the overall funding for Environment Tech companies, mirroring a trend observed across the global startup landscape. However, the proportion of funding directed towards Environment Tech has increased in recent years reflecting upon the broader global focus on climate related action. (see images below).

&zSportswj;

Despite a global slowdown in venture capital activity, VCs are actively investing in Environment Tech with close to 60% of all equity funding being done by VCs in this sector (see image below):

Recent notable rounds ($50M+) in the environment tech space see significant funding go into the space of Climate Insurance, Geographic Information Systems and Smart Grid Energy. Both VCs and sovereign wealth funds have participated in these. (see table 1):

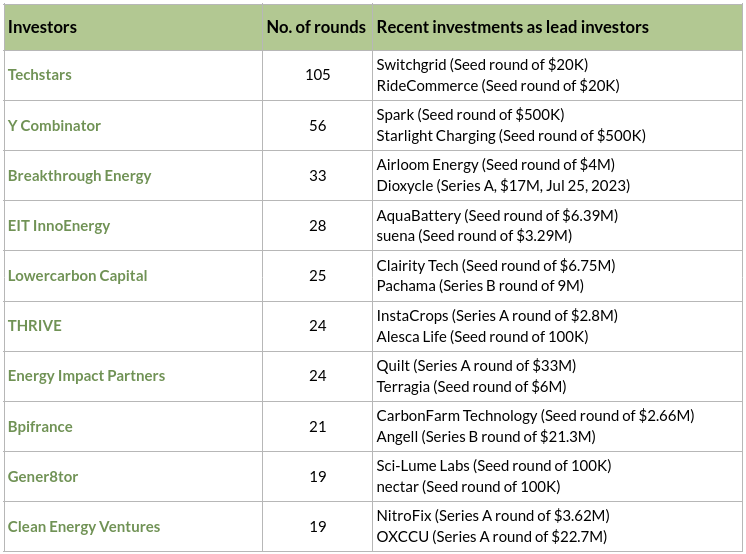

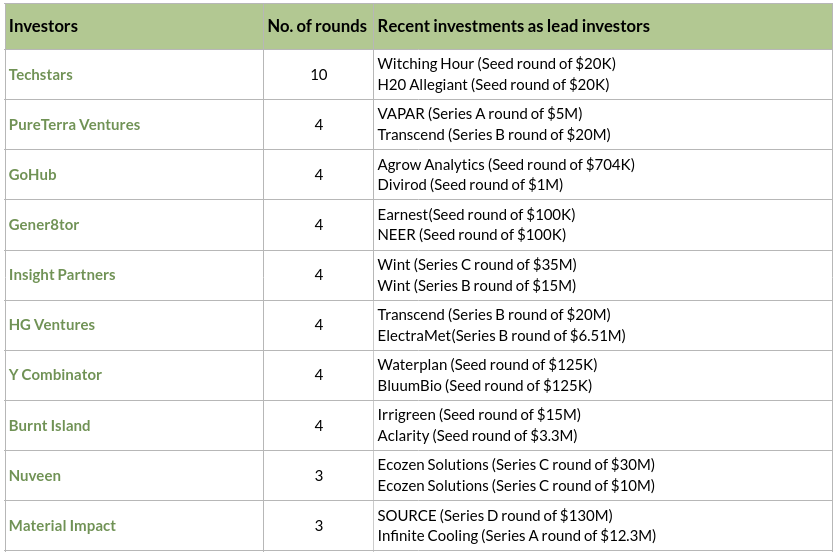

In the last 5 years, Techstars has been the most active investor with 100+ funding rounds in the sector. The top investors also include Green Funds such as Breakthrough Energy and Lowercarbon Capital (see table 2):

Europe and the United States are leading the world in environmental tech innovation. While the USA has historically dominated in terms of funding, there has been a notable shift towards Europe in 2024, with European startups raising as much funds as their American counterparts. Within Europe, the UK, Germany, and France are at the forefront of this trend.

Other regions, such as India, have also seen significant increases in funding. India’s funding jumped from $225 million in 2018 to $1.5 billion in 2023, marking a compounded annual growth rate of 140%.

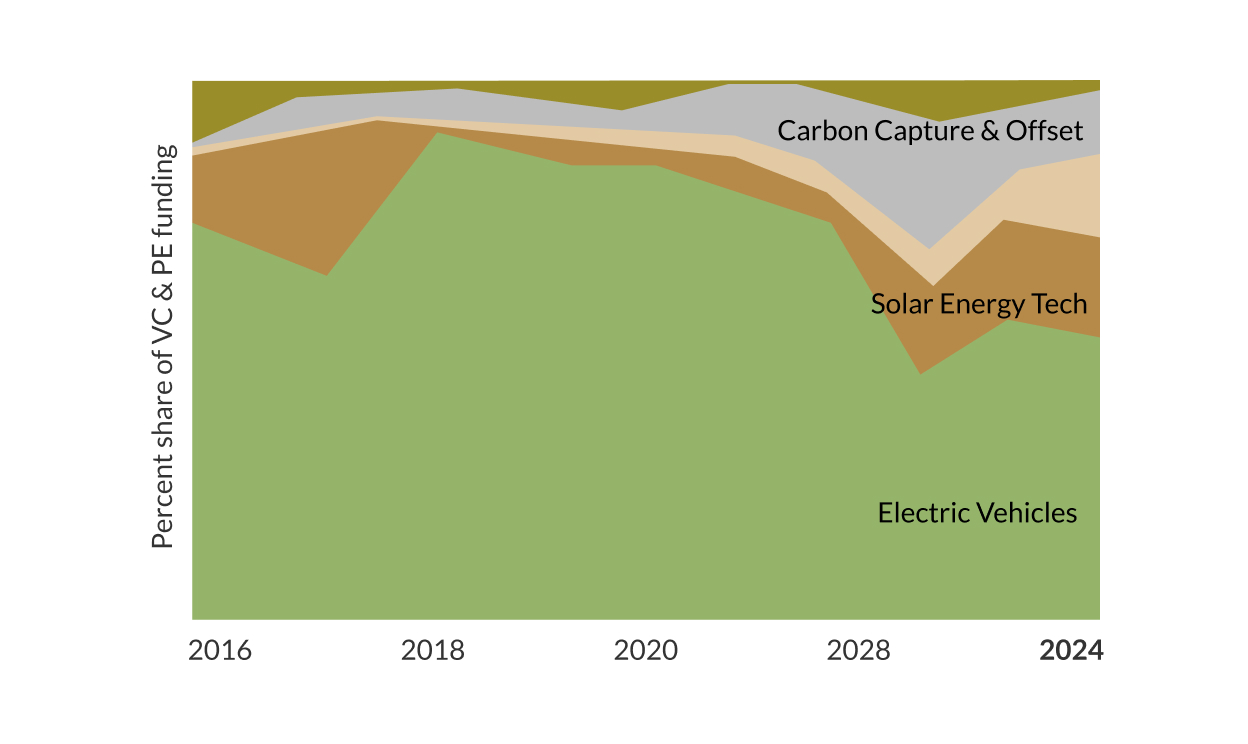

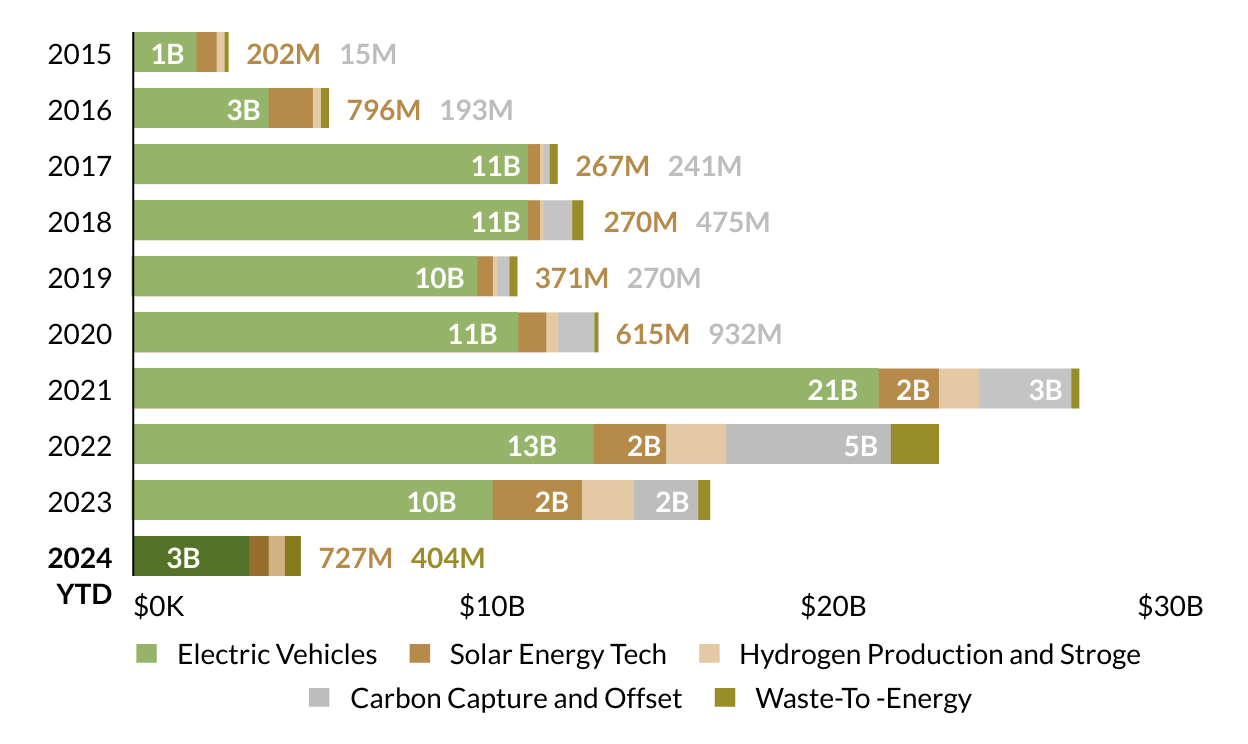

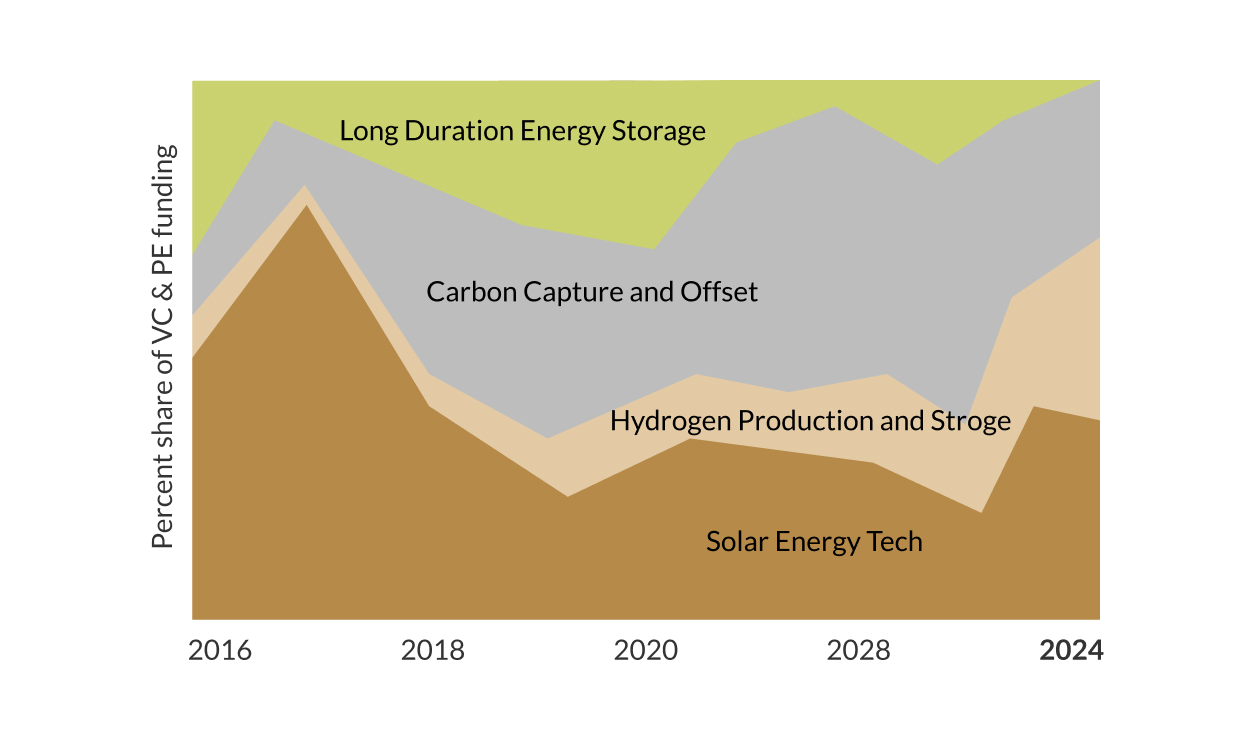

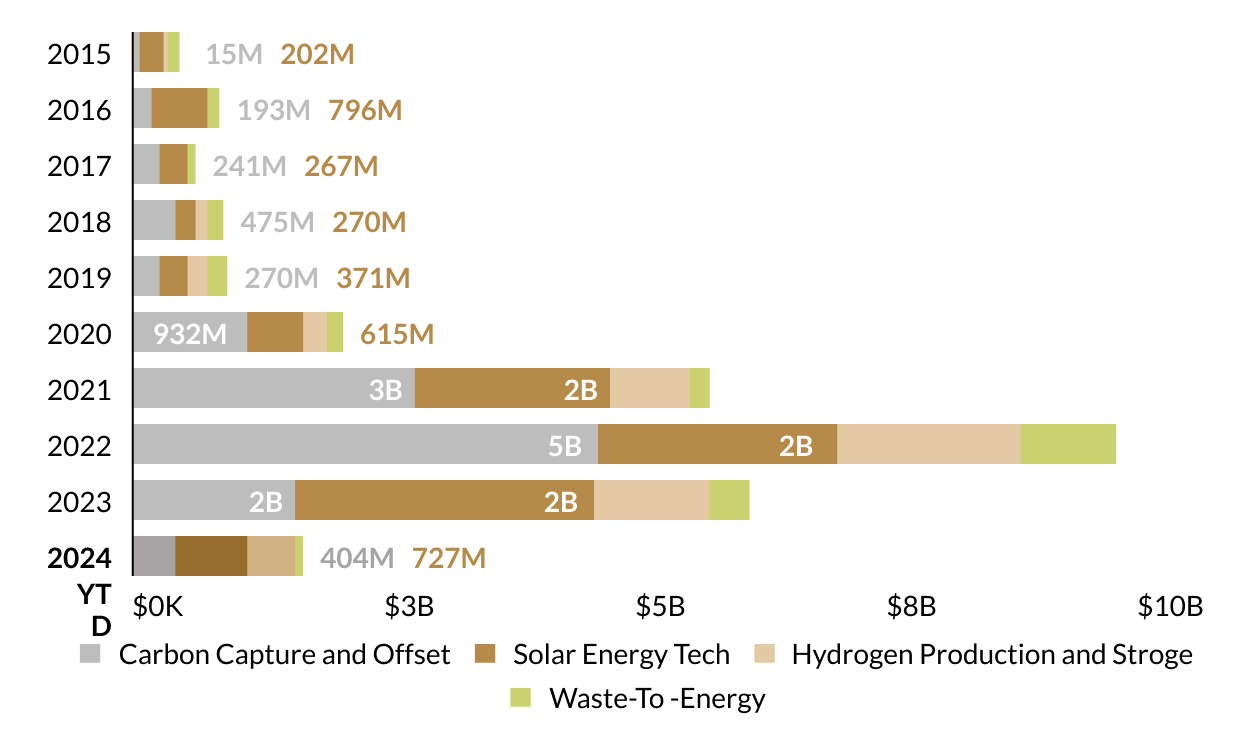

The majority of funding within Environment Tech is funneled into Electric Vehicles (EVs) and its auxiliary sectors such as Lithium-Ion Battery Recycling and Long Duration Energy Storage. In recent years, we have seen green offshoots in sectors such as Solar Energy Tech and Carbon Capture & Offset (see images below):

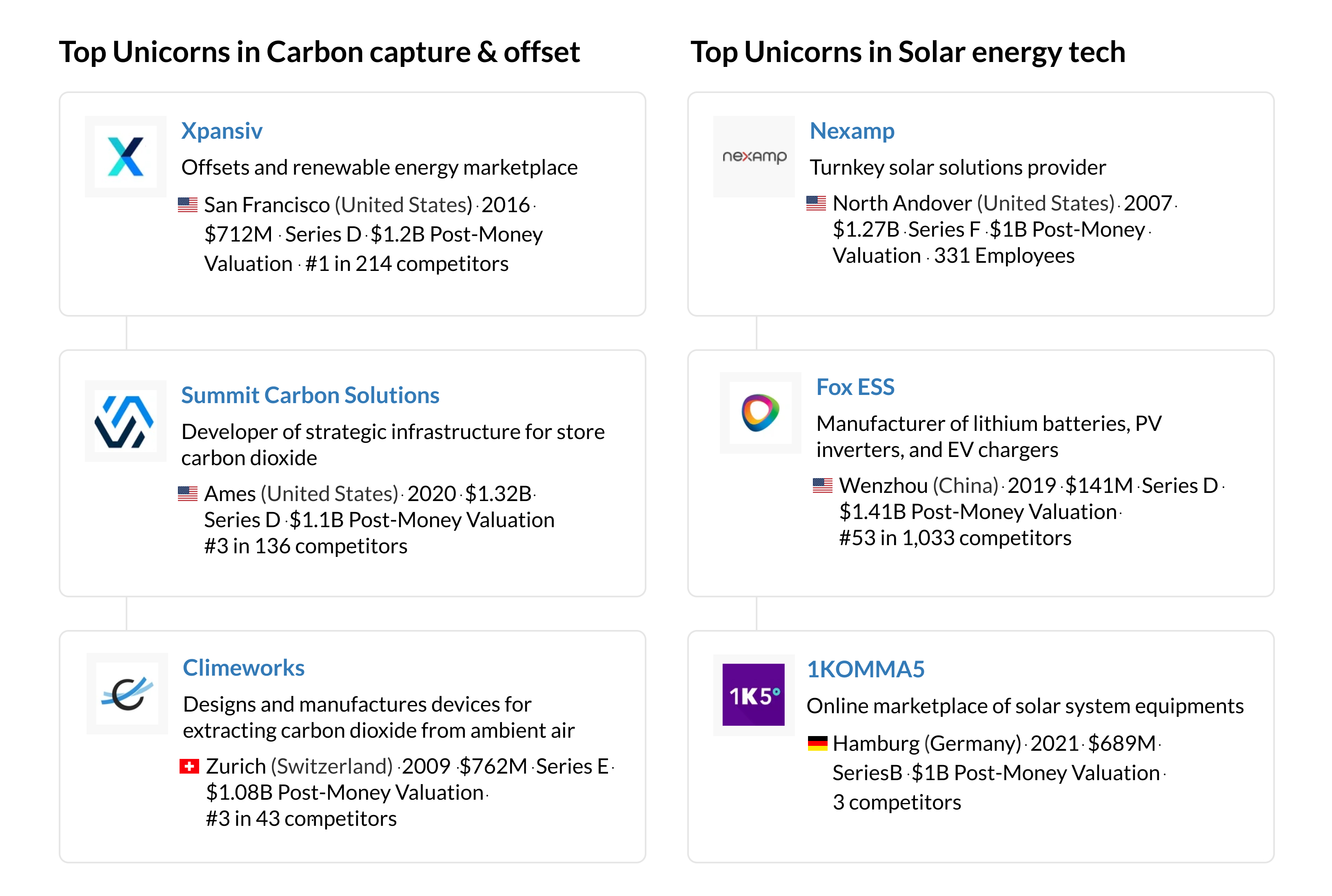

Electric vehicles and its auxiliary sectors have the most number of Unicorns with the latest ones being Verkor which develops lithium-ion batteries for EVs and One which is a provider of energy management systems for electric vehicles. However, unicorns are coming up in Solar Energy Tech and Carbon Capture & Offset sectors as well with both of them having 7 Unicorns each. (see image below):

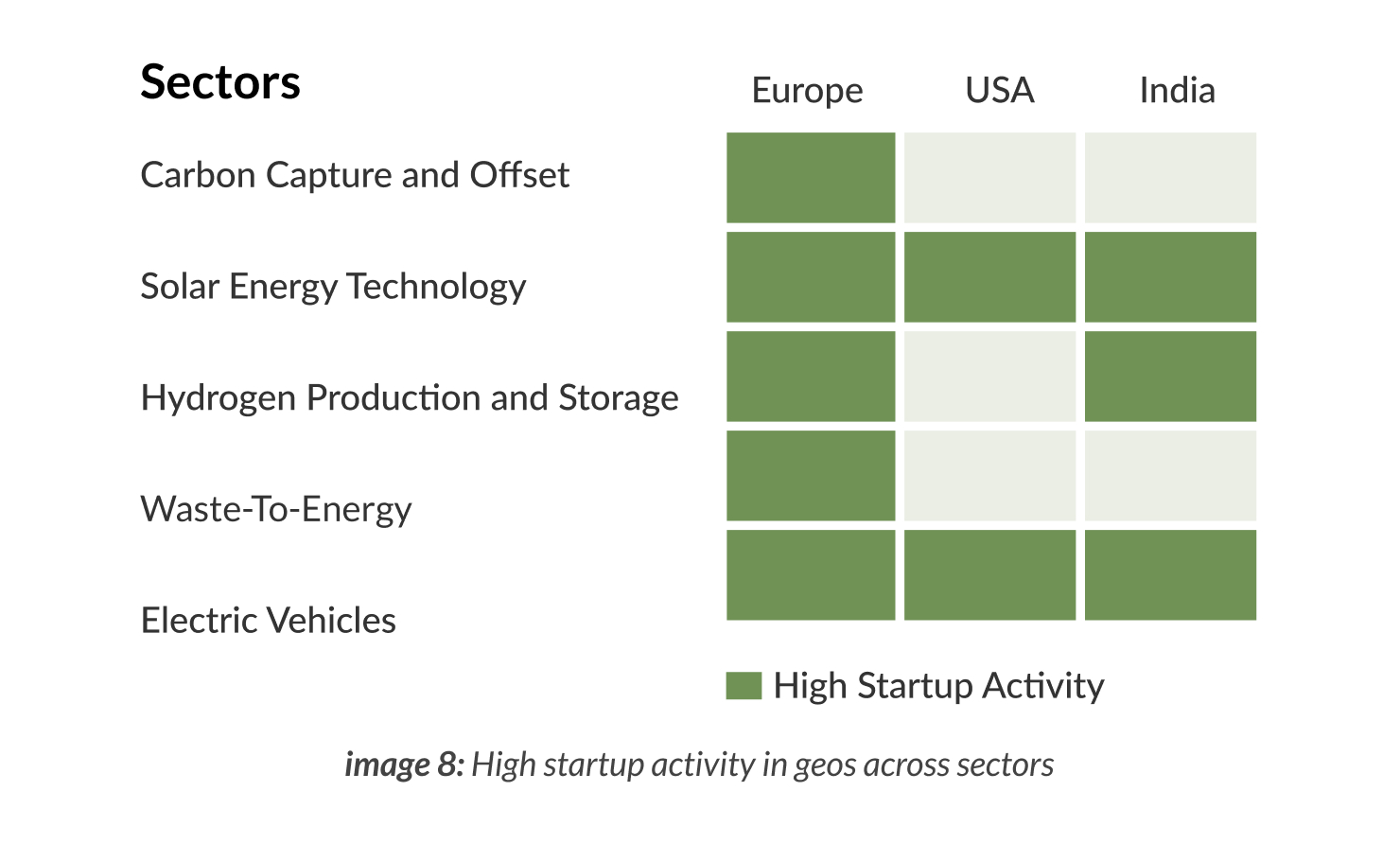

In Europe, there is a higher proportion of startups in Carbon Capture and Offset, Solar Energy Technology, and Hydrogen Production and Storage. However, funding has been more substantial in the Electric Vehicles ($17B+) and Waste-To-Energy ($60M+) sectors over the last 5 years.

In the United States, there is a noticeable surge in startups focusing on Solar Energy Technology and Electric Vehicles (EVs). Although the number of EV startups is increasing, the sector is experiencing a decline in equity funding.

In India, startups are emerging in Solar Energy Technology, Hydrogen Production and Storage, and EVs. Carbon Capture ($42M+) and Offset and Solar Energy Technology ($161M+) have attracted the most funding in the last 5 years.

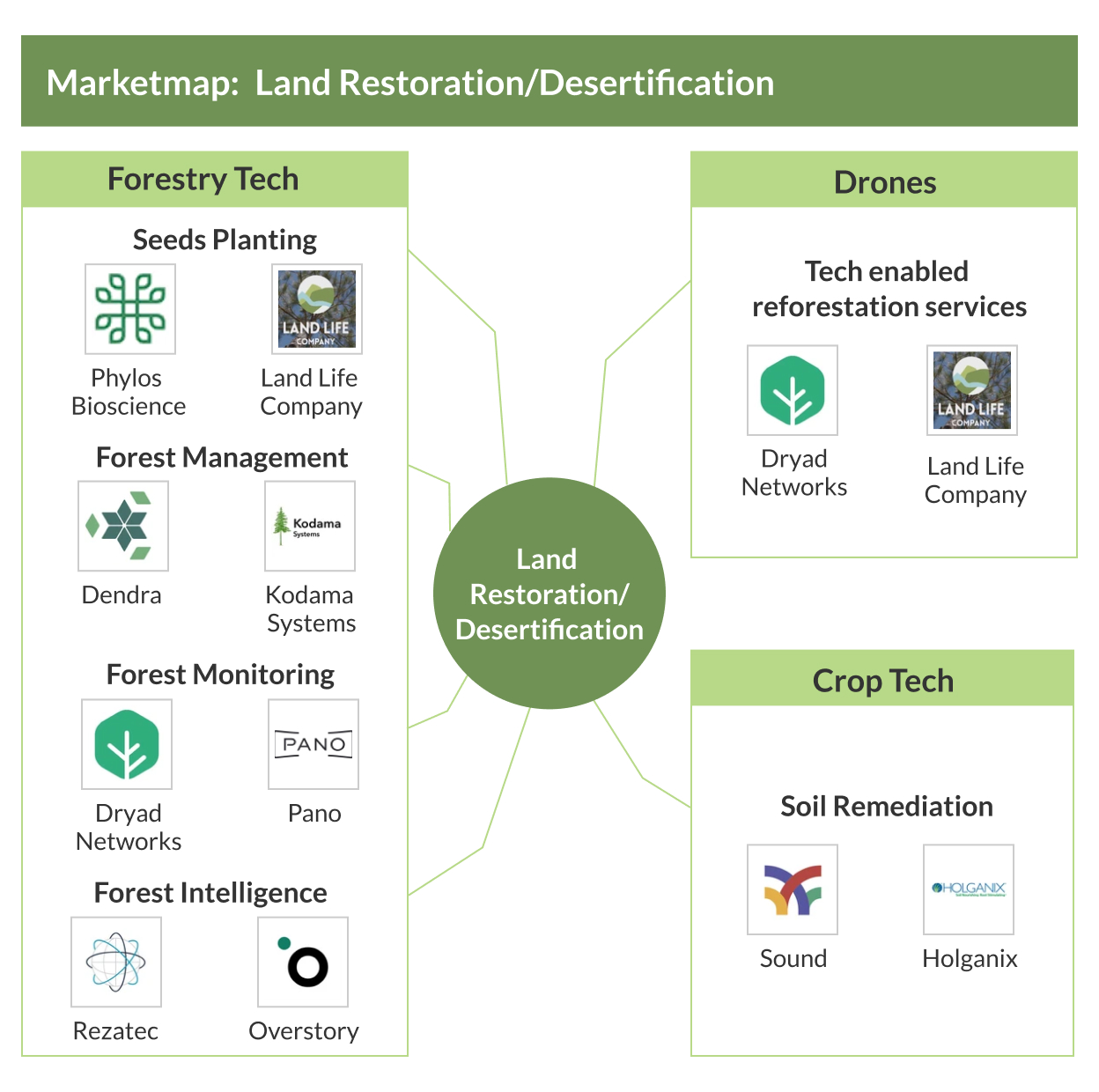

The theme for this year’s World Environment Day is land restoration, desertification, and drought resilience. With the global increase in flash floods and extended droughts, innovation in these areas is crucial. Our analysis shows that few new tech startups have emerged in these sectors globally such as Yolanda which is a platform offering AI-based forest management solutions and H20 Allegiant which provides water recycling solutions for industries.

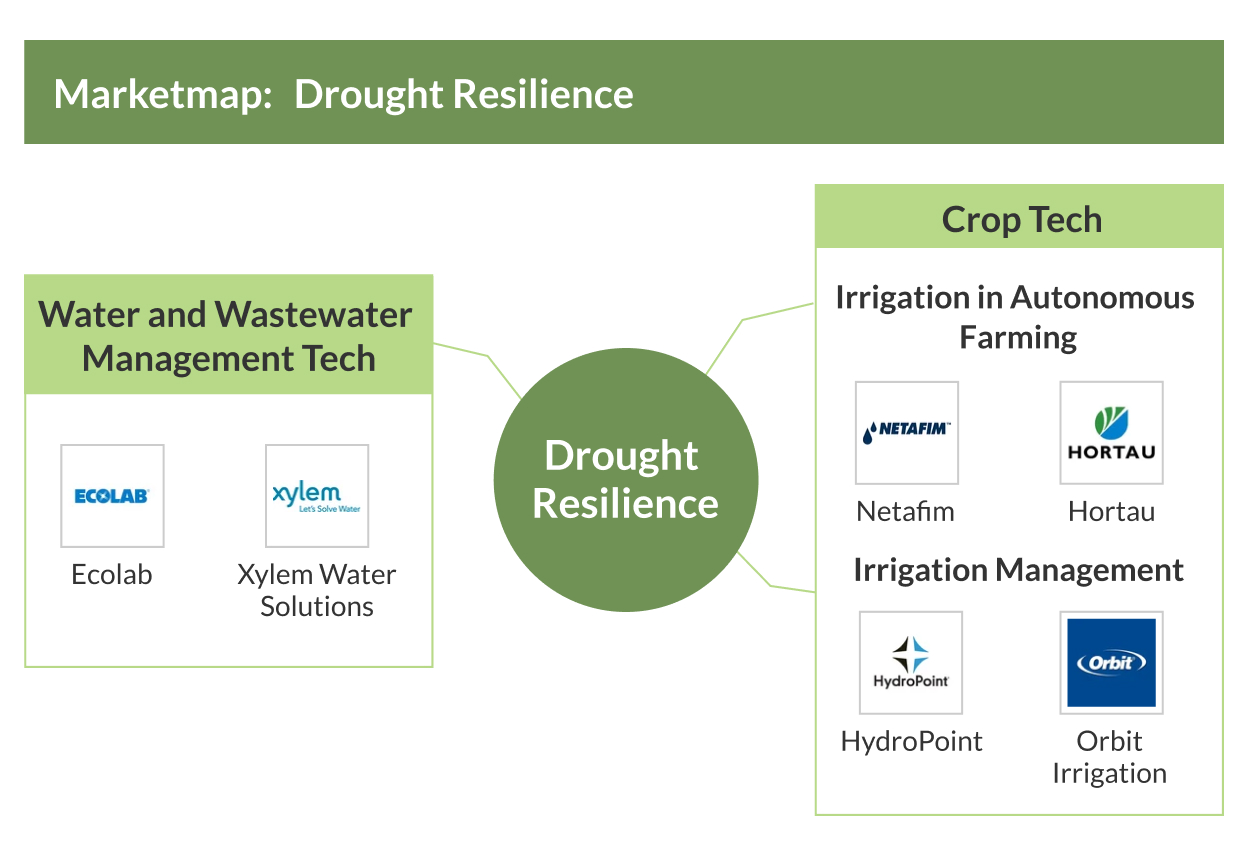

Here is a market map showing the all time top tech startups contributing towards this year’s theme and their business models (see images below):

Notably, there are two unicorns in the drought resilience sector.

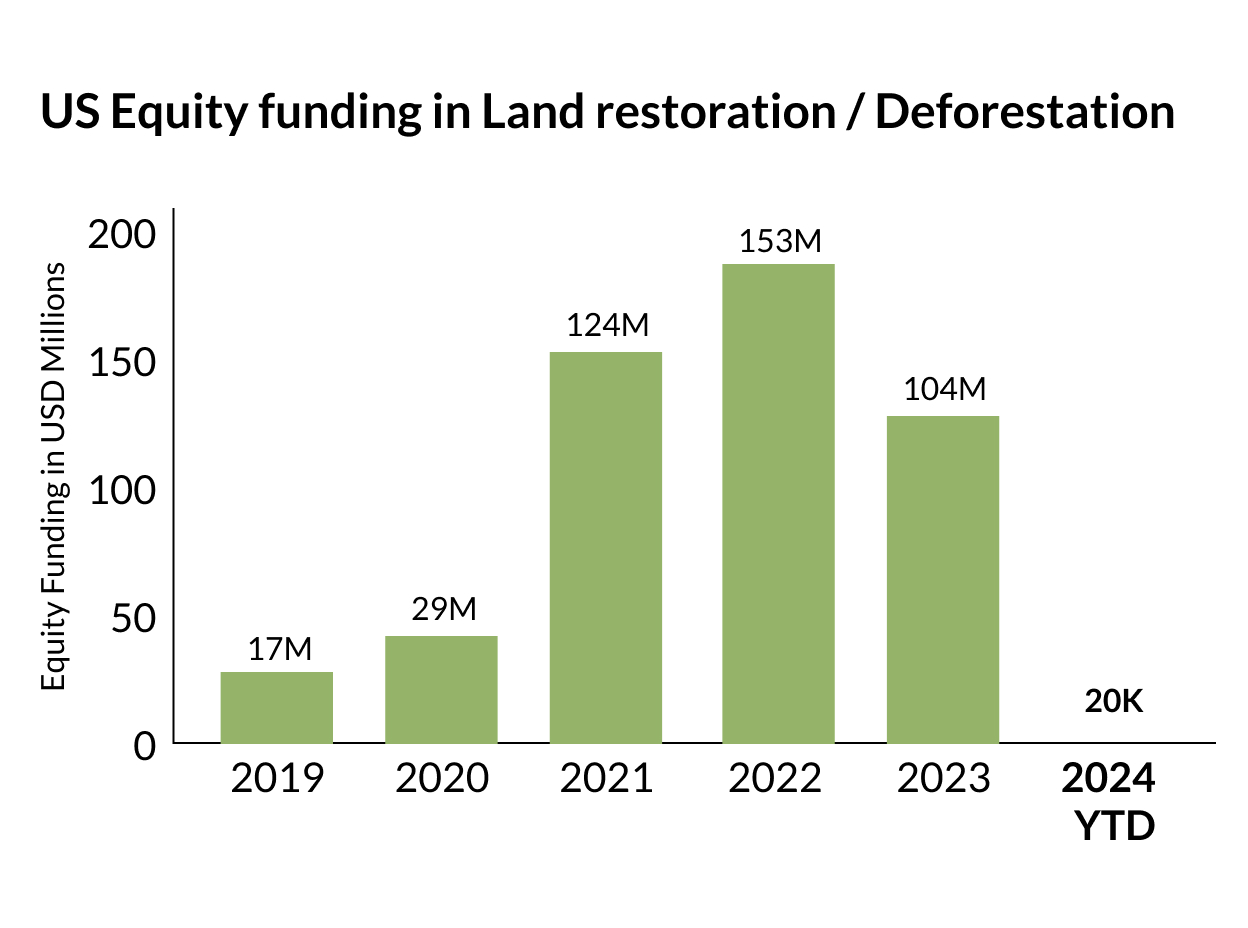

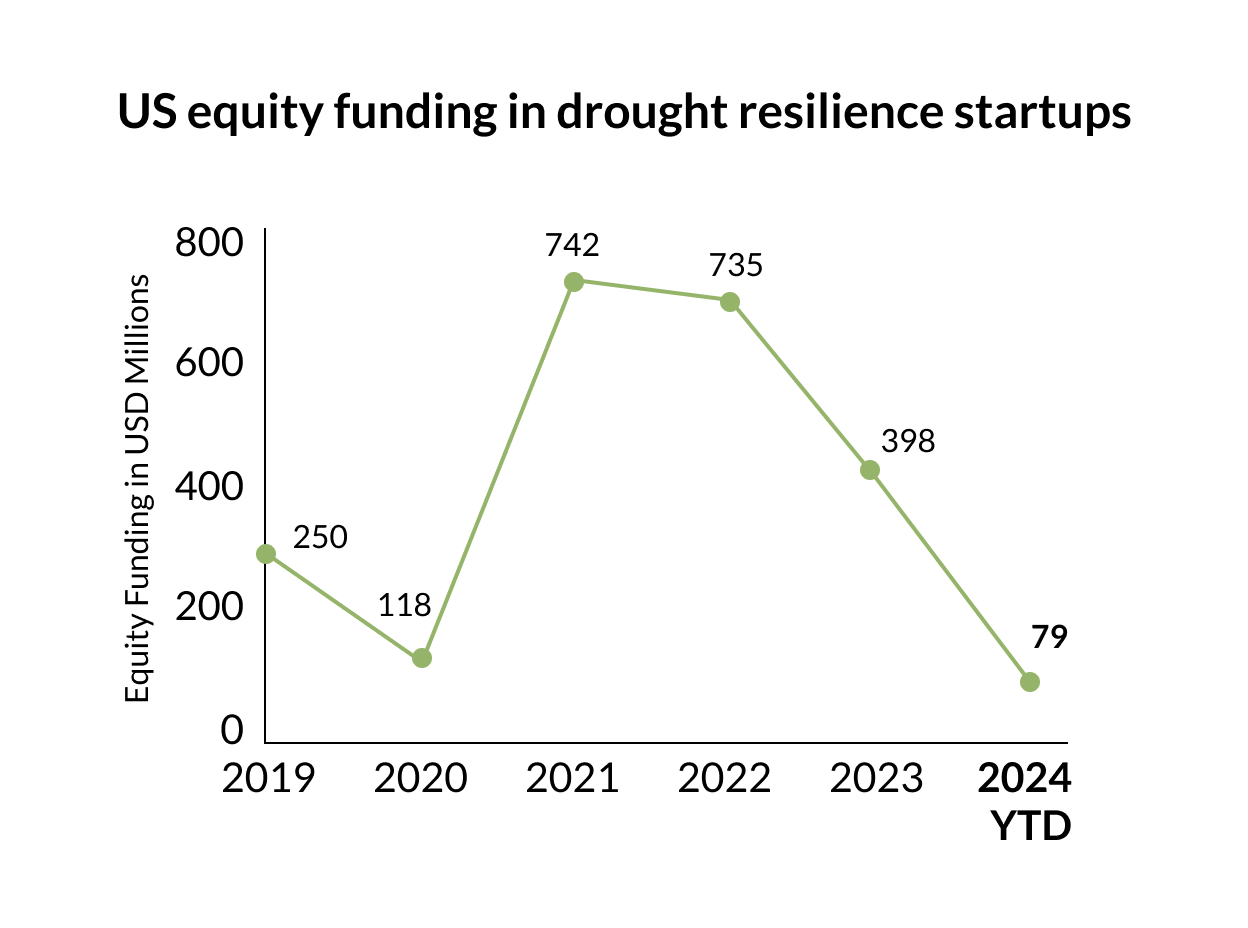

The USA is investing significantly more in startups related to land restoration/desertification, with close to a hundred million dollars invested annually over the past five years. However, its investment in drought resilience startups is declining (see image below):

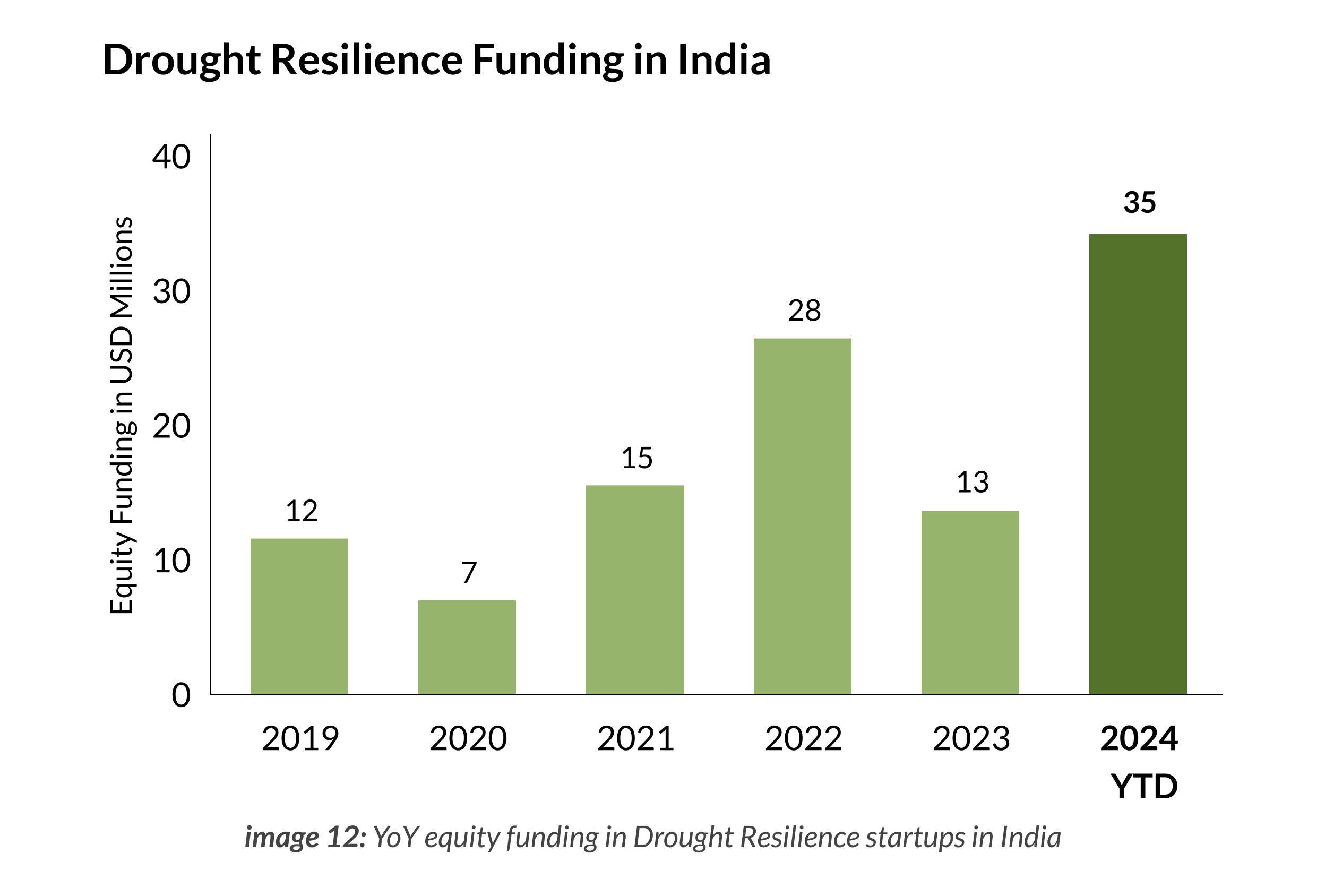

Interestingly, there has been a lot of funding in Indian startups tackling drought resilience through wastewater management, with over $35 million going in this year till date; which is significantly more than its annual investment each year over the past five years (see image below).

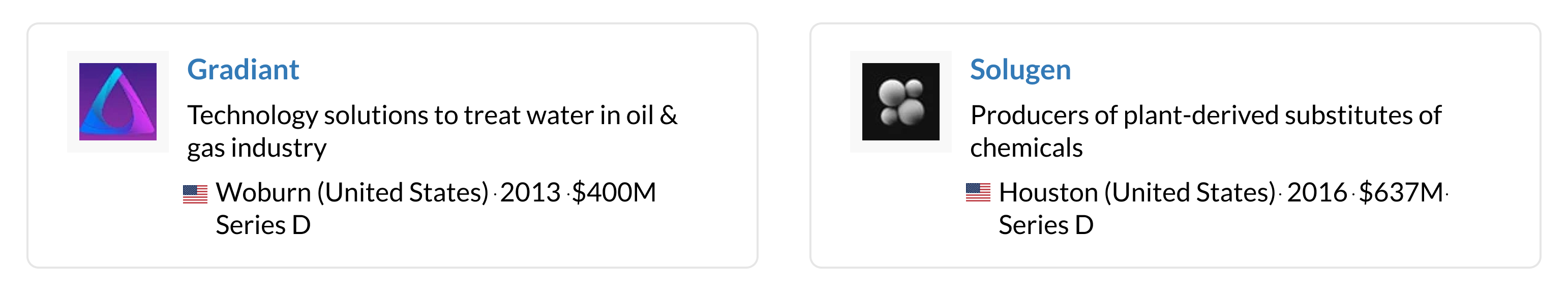

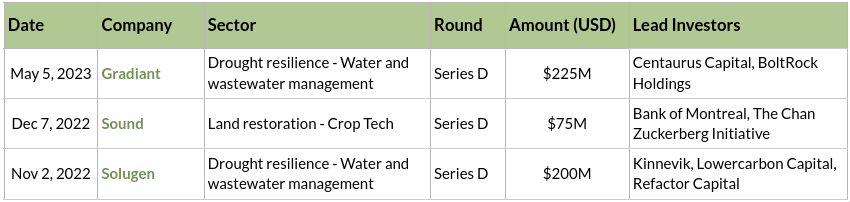

There are not too many notable rounds ($50M+) in startups catering to this year’s World Environment Day. The 3 most recent rounds saw more than $400M go into startups supporting water and wastewater management (see table 3):

Over the last 5 years, Techstars has led 10 funding rounds in startups catering to Land Restoration and Drought Resilience, which is more than twice of any other investor (see table 4).

The landscape of Environment Tech startups is evolving, with shifts in funding and innovation patterns across regions and sectors. As the world grapples with climate change, the role of startups in developing sustainable solutions is more critical than ever. Our analysis highlights key trends and emerging areas that are poised to make a significant impact in the fight against climate change.