Tracxn has released its insights covering the Telangana Tech ecosystem for the year 2025, outlining funding, sectoral performance, exits, acquisitions, and investor activity. The data highlights the overall capital raised by tech companies in Telangana, the distribution of funding across stages and sectors, and the trends shaping investment, IPOs, and M&A activity during the year.

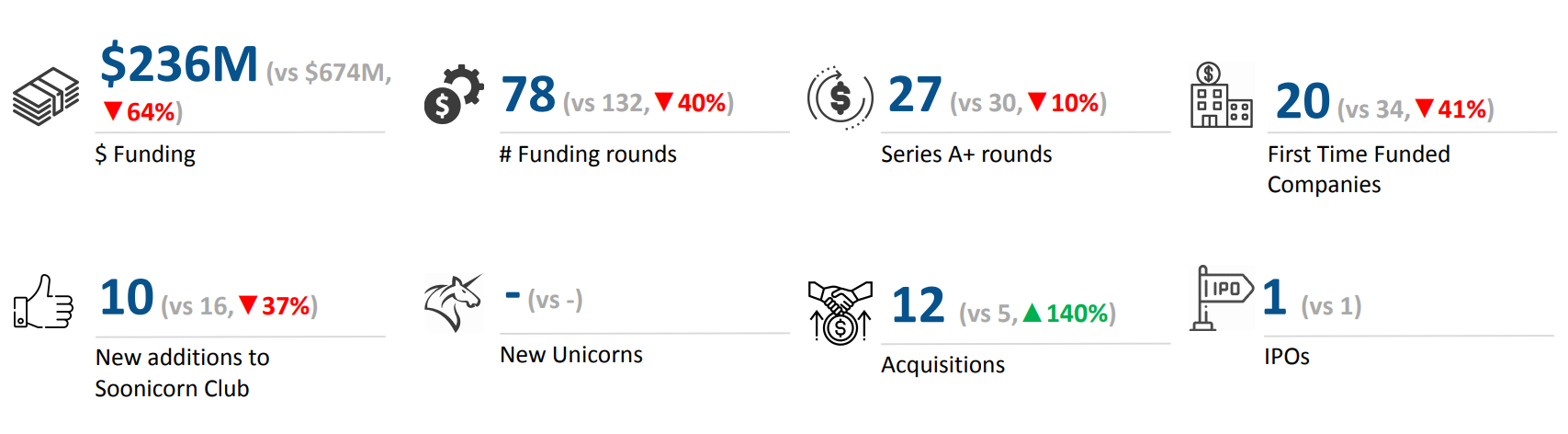

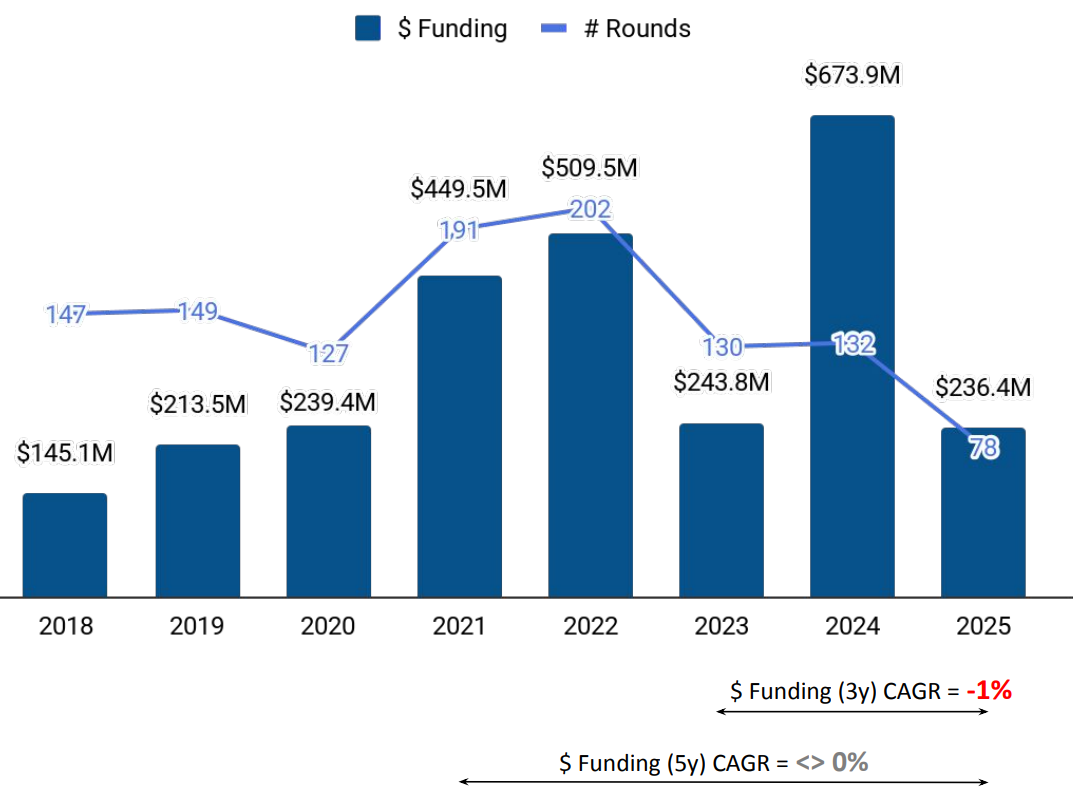

A total of $236M was raised in 2025, marking a drop of 64% compared to the $674M raised in 2024, and a drop of 3% compared to the $244 raised in 2023. This places 2025 well below the previous year’s funding levels, while remaining slightly lower than 2023, reflecting a broader pullback in investment activity within the region for the reporting period.

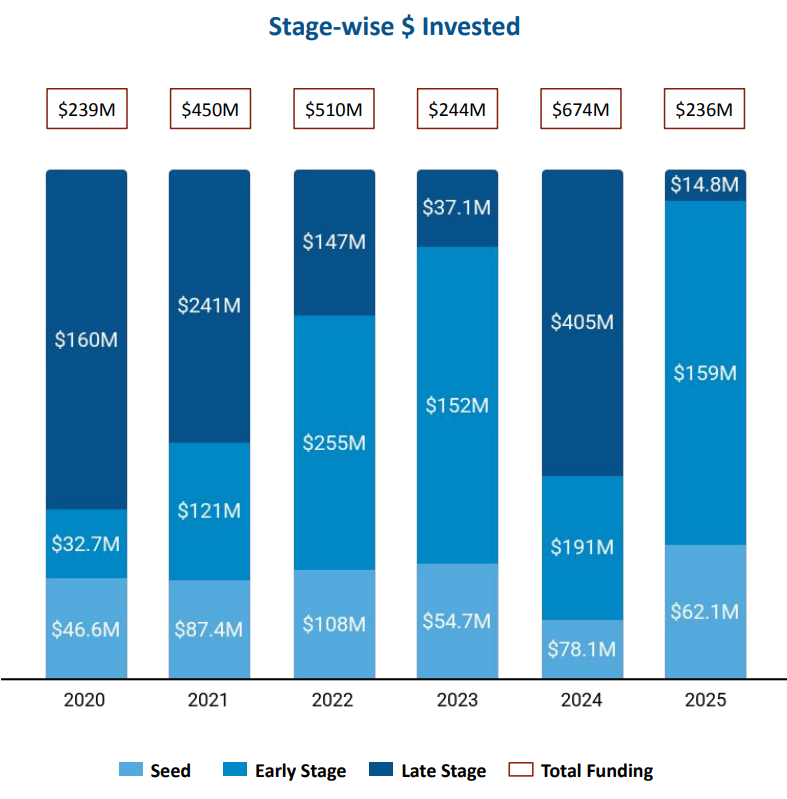

Seed Stage funding in Telangana Tech stood at $62.1M in 2025, reflecting a drop of 21% compared to $78.1M raised in 2024 and an increase of 14% compared to $54.7M raised in 2023. Early Stage funding totaled $159M in 2025, a decline of 17% compared to $191M raised in 2024 and a rise of 5% compared to $152M raised in 2023. In contrast, Late Stage funding reached $14.8M in 2025, marking a drop of 96% compared to $405M raised in 2024 and a drop of 60% compared to $37.1M raised in 2023.

Enterprise Applications, FinTech, and Environment Tech were the top-performing sectors in the Telangana Tech ecosystem in 2025. The Enterprise Applications sector saw total funding of $115M in 2025, a decrease of 42% compared to $197M raised in 2024 and an increase of 116% compared to $53.4M raised in 2023. The FinTech sector recorded $65.2M in total funding in 2025, representing an increase of 11% compared to $58.8M raised in 2024 and a decrease of 17% compared to $78.1M raised in 2023. The Environment Tech sector attracted $59.7M in funding in 2025, registering a rise of 66% compared to $36M raised in 2024 and a rise of 80% compared to $33.2M raised in 2023.

The year 2025 witnessed no funding rounds of $100M or more, compared to 1 such round in 2024 and none in 2023.

No unicorns were created in 2025, similar to 2024 and 2023. Telangana Tech recorded 1 IPO in 2025, the same as in 2024 and 2023, with EPW India being the only company that went public during the year.

Tech companies in Telangana completed 12 acquisitions in 2025, marking a rise of 140% compared to 5 acquisitions in 2024 and a rise of 100% compared to 6 acquisitions in 2023. The largest acquisition of the year was Reginald Men, which was acquired by Honasa Consumer for $21.7M. This was followed by the acquisition of Nautilus Mobile by Krafton at a price of $14M.

Hyderabad-based tech firms accounted for 100% of all funding raised by tech companies across Telangana in 2025.

pi Ventures, IvyCap Ventures Advisors, and India Accelerator emerged as the top seed-stage investors in the Telangana Tech ecosystem in 2025. Sorin, JAFCO Asia, and Athera were the most active early-stage investors during the year.

The Telangana Tech ecosystem raised $236M in 2025, with funding declining sharply compared to 2024 and remaining slightly below 2023 levels. Enterprise Applications, FinTech, and Environment Tech led sector-wise funding, while seed and early-stage investments accounted for the majority of deployed capital amid a significant contraction in late-stage funding. The year saw no $100M+ rounds and no new unicorns, alongside consistent IPO activity and a notable rise in acquisition volumes, with Hyderabad accounting for all funding activity across the state.