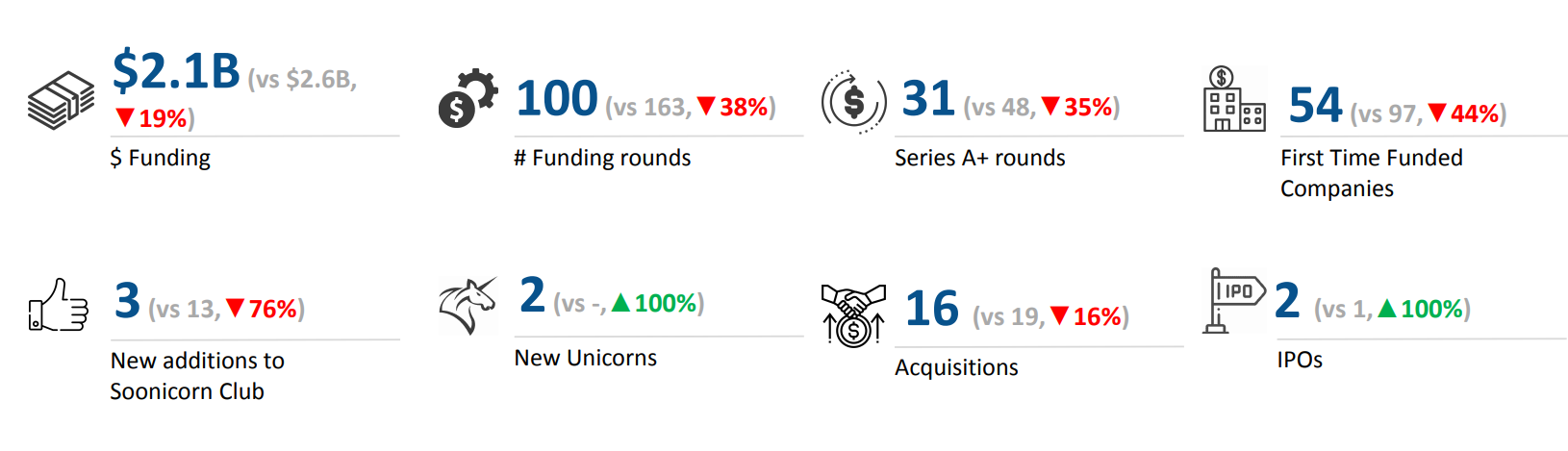

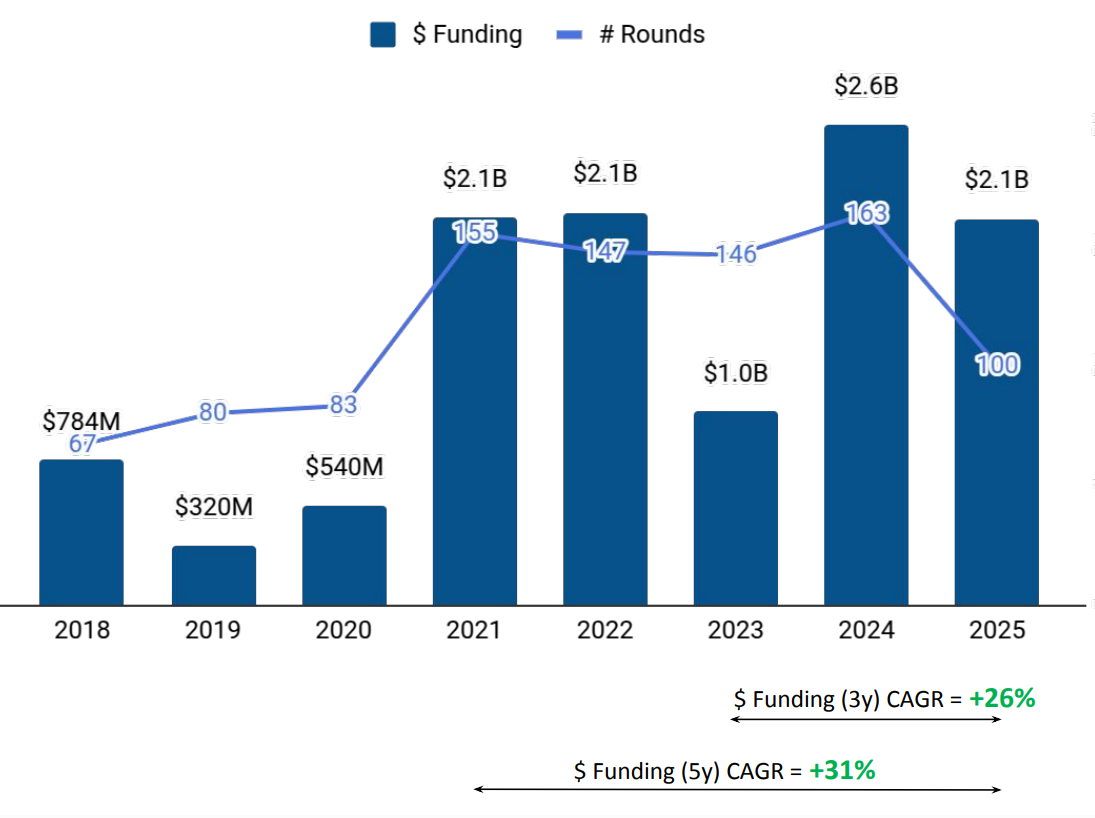

Tracxn has released its insights on the UAE tech ecosystem for 2025, outlining funding activity, sector performance, deal trends, and investor participation across the year. The data reflects shifts in total capital deployment, variations across funding stages, and continued concentration of funding within specific sectors and cities. The report captures investment levels, large funding rounds, IPO activity, acquisitions, and unicorn creation across the UAE tech landscape during the 2025 period.

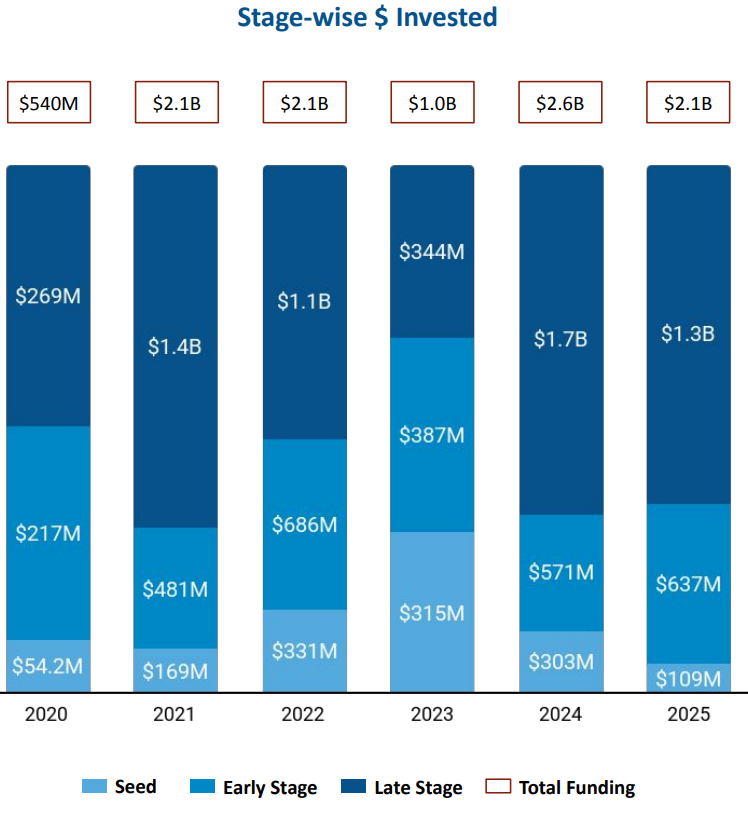

A total of $2.1B was raised by UAE tech companies in 2025. This represents a drop of 19% compared to the $2.6B raised in 2024, while also marking a rise of 110% compared to the $1B raised in 2023. The overall funding activity reflects changes across stages, with variations in capital allocation between early-stage, late-stage, and seed investments over the three-year period.

Seed stage funding in 2025 totaled $109M, representing a drop of 64% compared to the $303M raised in 2024 and a drop of 65% compared to the $315M raised in 2023. Early-stage funding reached $637M in 2025, marking a rise of 12% compared to $571M in 2024 and a rise of 67% compared to $387M in 2023. Late-stage funding amounted to $1.3B in 2025, reflecting a drop of 24% compared to the $1.7B raised in 2024, while also showing a rise of 278% compared to the $344M raised in 2023.

Enterprise Applications, Real Estate and Construction Tech, and Retail were the top-performing sectors in the UAE tech ecosystem in 2025. The Enterprise Applications sector recorded total funding of $1.4B in 2025, which is a decrease of 30% compared to the $1.9B raised in 2024 and an increase of 632% compared to the $187M raised in 2023. The Real Estate and Construction Tech sector attracted $612M in funding in 2025, representing a strong rise from $59M in 2024 and a dramatic increase from just $6.5M in 2023. The Retail sector saw total funding of $196M in 2025, which is an increase of 3% compared to the $190M raised in 2024 and a decrease of 47% compared to the $369M raised in 2023.

In 2025, the UAE tech ecosystem witnessed 4 $100M+ funding rounds, the same number as in 2024, compared to 1 such round in 2023. Companies such as Vista Global, Property Finder, and XPANCEO raised funding above $100M during this period. Vista Global raised a total of $600M through a PE round, Property Finder raised a total of $525M through a PE round, and XPANCEO raised a total of $250M through a Series A round. A major part of these $100M+ funding rounds came from the Enterprise Applications, Real Estate and Construction Tech, and Retail sectors.

UAE tech also recorded 2 IPOs in 2025, a rise of 100% from 1 IPO in 2024 and a drop of 33% from the 3 IPOs recorded in 2023. Optasia and Micropolis were the companies that went public in 2025. Additionally, there were 2 unicorns created in 2025, compared with none in 2024 and the same number as in 2023.

Tech companies in the UAE recorded 16 acquisitions in 2025. This represents a drop of 16% compared to the 19 acquisitions recorded in 2024 and a drop of 11% compared to the 18 acquisitions recorded in 2023. Notable acquisitions during the year included Peko being acquired by IHC and TimeMoto being acquired by Workwell Technologies.

Dubai-based tech firms accounted for 98% of all funding raised by tech companies across the UAE in 2025. Abu Dhabi followed as the next largest contributor, accounting for nearly 2% of the total funding raised during the year.

Plus VC, Orbit Ventures, and Endeavor emerged as the top seed-stage investors in the UAE tech ecosystem in 2025. At the early stage, e&, Peak XV Partners, and MoreThan Capital Advisors were the most active investors supporting UAE-based tech companies during the year.

The UAE tech ecosystem recorded $2.1B in funding during 2025, marking a decline compared to 2024 while remaining significantly higher than 2023 levels. Funding activity showed divergent trends across stages, with seed and late-stage funding declining alongside growth in early-stage investments. Enterprise Applications, Real Estate and Construction Tech, and Retail led sector-wise funding, supported by multiple $100M+ funding rounds and the creation of two new unicorns. Funding activity remained heavily concentrated in Dubai, reinforcing its role as the primary hub for tech investment in the UAE.