&zN8wj;

Tracxn has released its UAE Tech 9M 2025 Funding Report, highlighting key trends in the country’s technology investment landscape. The UAE’s tech ecosystem demonstrated steady funding growth, driven by strong early and late-stage rounds and the emergence of new unicorns. The report captures significant funding momentum across core sectors such as Enterprise Applications, Real Estate and Construction Tech, and FinTech, alongside a rise in large-ticket investments and IPO activity.

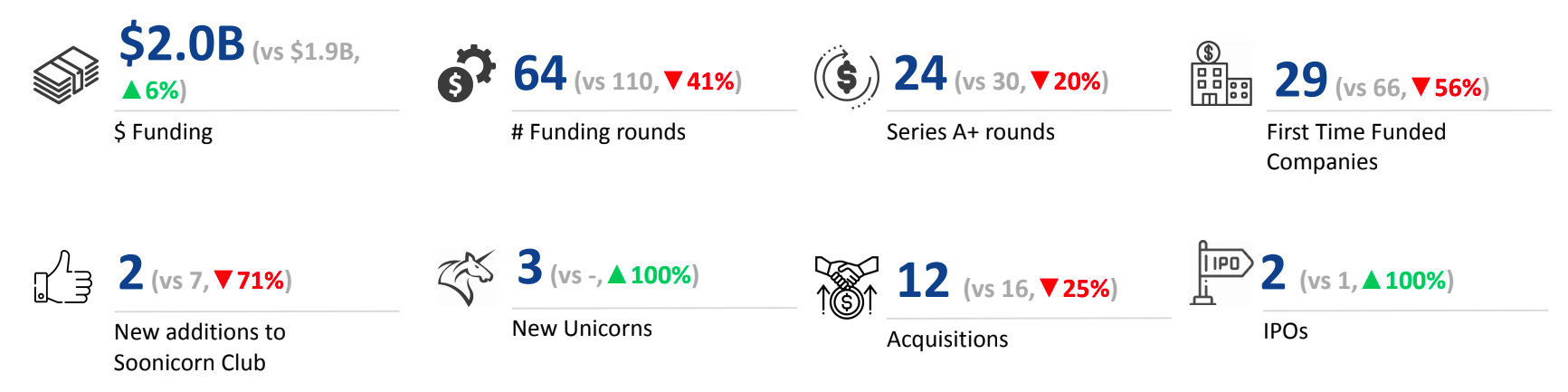

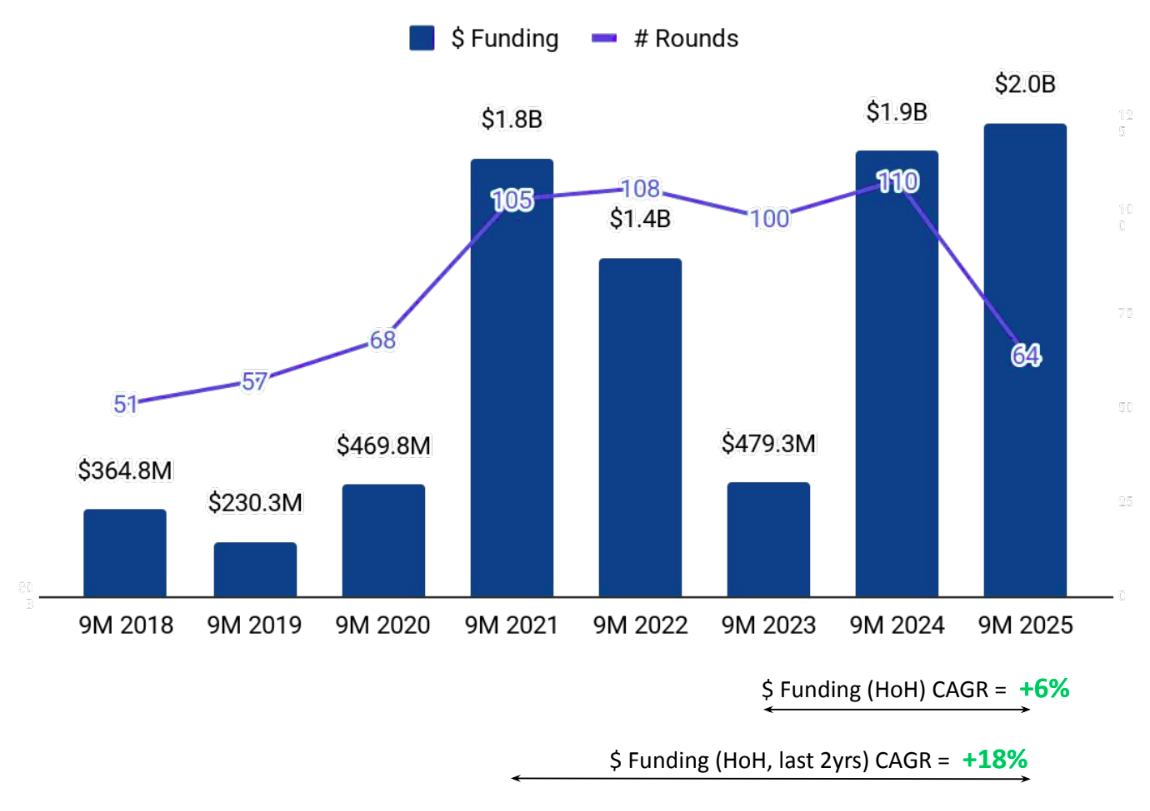

UAE’s tech sector raised a total of $2.0B in 9M 2025, up 6% from $1.9B in 9M 2024 and 316% higher than $479M in 9M 2023. The funding growth was primarily driven by strong early and late-stage activity, supported by sustained investor participation across Enterprise Applications, Real Estate and Construction Tech, and FinTech sectors.

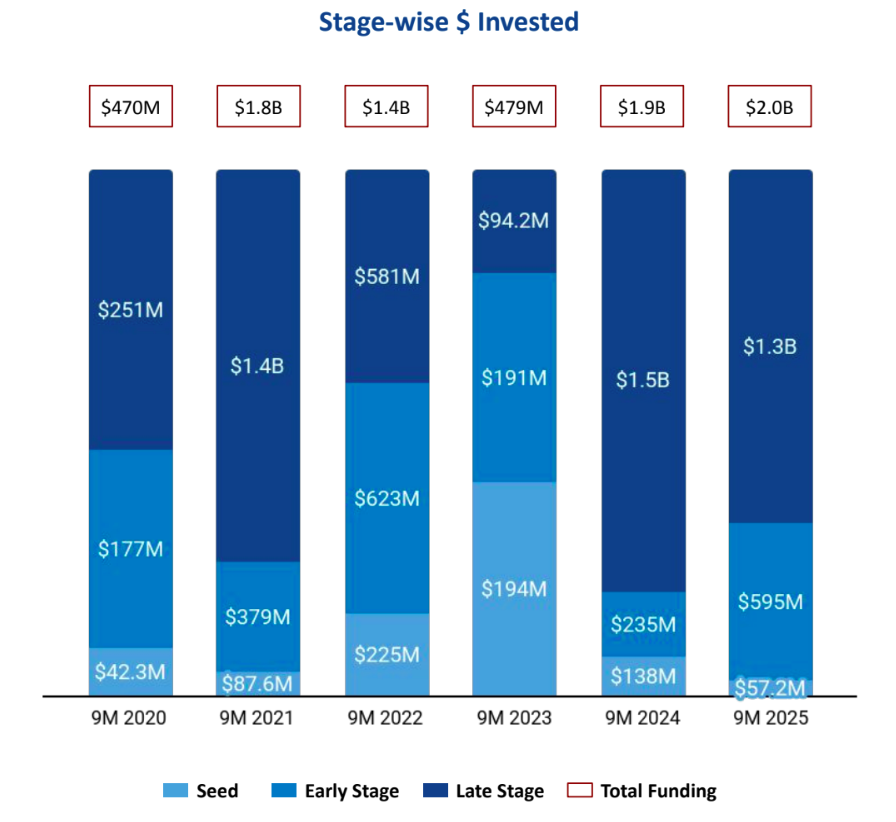

Funding activity across stages in the UAE showed mixed trends in 9M 2025. Seed-stage funding stood at $57.2M, recording a 58% decline from $138M in 9M 2024 and a 71% drop compared to $194M in 9M 2023. In contrast, early-stage funding surged to $595M, marking a 153% rise from $235M in 9M 2024 and a 212% increase from $191M in 9M 2023. Late-stage funding reached $1.3B, down 11% from $1.5B in 9M 2024, but still significantly higher than the $94.2M in 9M 2023, reflecting strong investor participation in mature companies backed by several $100M+ rounds.

The top-performing sectors in the UAE during 9M 2025 were Enterprise Applications, Real Estate and Construction Tech, and FinTech. Enterprise Applications led the funding landscape with $1.3B raised, reflecting a 22% decline from $1.7B in 9M 2024. Real Estate and Construction Tech followed with $610M, marking a sharp increase from $49M in 9M 2024, while FinTech attracted $421M, representing a 191% rise compared to $144M in 9M 2024.

The UAE recorded four $100M+ funding rounds in 9M 2025, compared to one such round in 9M 2024 and none in 9M 2023. Notable large rounds included Vista Global ($600M, PE round), Property Finder ($525M, PE round), and XPANCEO ($250M, Series A round). Tabby also secured funding above $100M during the period. A major portion of these large rounds originated from the Enterprise Applications, Real Estate and Construction Tech, and Retail sectors.

On the public markets front, UAE Tech recorded two IPOs in 9M 2025, representing a 100% rise from one IPO in 9M 2024, and matching the count in 9M 2023. The companies C1 and Micropolis went public during this period. Additionally, three unicorns were created in 9M 2025, marking a notable increase from zero in both 9M 2024 and 9M 2023.

The UAE’s M&A landscape saw 12 acquisitions in 9M 2025, marking a 25% decline from 16 acquisitions in 9M 2024 and a 20% drop compared to 15 in 9M 2023. Despite the slowdown in deal activity, several notable transactions underscored continued strategic consolidation in the market. Prominent deals included Xeneta’s acquisition of eeSea, IHC’s acquisition of Funder.ai, and Nawy’s acquisition of Smart Crowd, reflecting sustained interest in scaling capabilities and expanding market presence.

Dubai-based tech firms accounted for 98% of all funding raised by UAE tech companies in 9M 2025, cementing its position as the country’s leading innovation hub. Abu Dhabi followed at a distant second, contributing 1% of total funding during the same period.

Investor participation in the UAE’s tech ecosystem remained strong and well-distributed across stages in 9M 2025. Plus VC, Endeavor, and Oraseya Capital were the most active investors at the seed stage, supporting early innovation and startup growth. At the early stage, Peak XV Partners, e&, and MoreThan Capital Advisors played a key role in driving scale-up investments and fueling expansion across high-growth sectors.

The UAE tech ecosystem showed sustained momentum in 9M 2025, marked by a modest rise in overall funding, a surge in early-stage activity, and the creation of three new unicorns. Despite a slowdown in seed and acquisition activity, the presence of multiple $100M+ rounds and continued IPO activity underscore the maturity of the ecosystem. With Enterprise Applications, Real Estate and Construction Tech, and FinTech leading funding inflows, and Dubai dominating the funding landscape, UAE continues to reinforce its position as a regional technology hub.