Tracxn has released its Q1 2025 UAE Tech Funding Report, highlighting a remarkable surge in investment activity across the country’s tech ecosystem. The United Arab Emirates witnessed a significant rebound in venture funding during the quarter, marked by an influx of late-stage capital and an uptick in $100M+ mega deals. With key sectors such as Enterprise Applications, FinTech, and Retail driving investment momentum, the ecosystem appears to be entering a phase of renewed investor confidence.

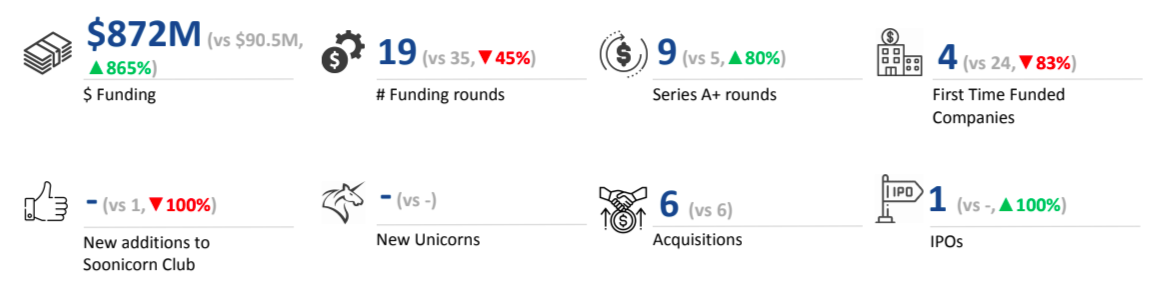

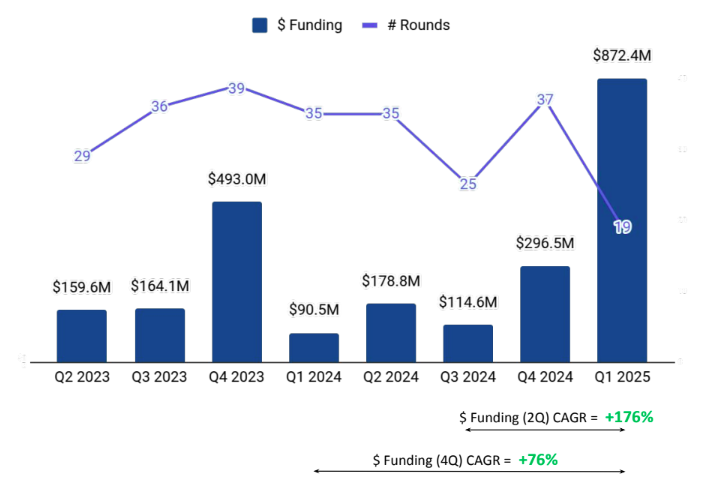

A total of $872M was raised in Q1 2025, reflecting a substantial increase of 194% compared to the $297M raised in Q4 2024, and a dramatic 865% rise from the $90.5M raised in Q1 2024. This sharp climb in funding signals a notable shift in capital deployment patterns within the UAE's tech sector.

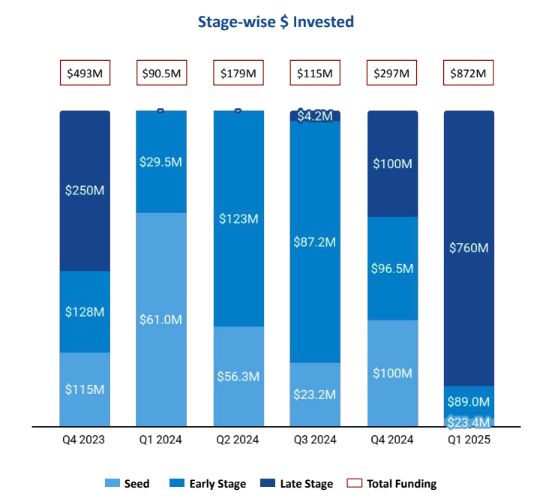

Seed-stage funding in Q1 2025 totaled $23.4M, marking a significant decline of 77% compared to $100M in Q4 2024 and a 62% drop from $61M in Q1 2024. Early-stage investments amounted to $89M in Q1 2025, a modest decline of 8% from the $96.5M raised in Q4 2024 but a substantial increase of 202% over the $29.5M raised in Q1 2024. Late-stage funding drove the overall funding surge, with $760M raised in Q1 2025 an impressive 660% increase over the $100M raised in Q4 2024.

Enterprise Applications emerged as the leading sector in Q1 2025, securing a total of $688.1M in funding. This represents a 664% increase compared to the $90.1M raised in Q4 2024 and a 1111% surge over the $56.8M raised in Q1 2024. The FinTech sector followed with $215.6M in funding, a 73% increase from $124.6M in Q4 2024 and a 574% jump from $32M in Q1 2024. The Retail sector saw $171.5M in funding in Q1 2025, reflecting a 134% rise from $127.6M in Q4 2024 and a staggering 13092% increase compared to $1.3M in Q1 2024.

In Q1 2025, the United Arab Emirates saw two $100M+ funding rounds, compared to one such round in Q4 2024 and none in Q1 2024. Vista Global and Tabby were among the companies that raised over $100M this quarter. Tabby raised a total of $160M in a Series E round led by Blue Pool Capital, valuing the company at over $3300M. Vista Global secured $600M in a late-stage round led by RRJ Capital. A major part of these $100M+ funding rounds came from Enterprise Applications, FinTech, and Retail sectors. Micropolis was the only company to go public in Q1 2025. There were no unicorns created in Q1 2025, Q4 2024, or Q1 2024.

Tech companies in the United Arab Emirates recorded six acquisitions in Q1 2025, maintaining the same level as Q1 2024. Cartlow was acquired by Basatne in what became the highest valued acquisition of Q1 2025, followed by the acquisition of HotCold Studio by Grandstores.

Dubai-based tech firms accounted for 96% of all funding seen by tech companies across the United Arab Emirates in Q1 2025, establishing the city as the undisputed leader in attracting venture capital. Abu Dhabi followed at a distant second.

500 Global, Wamda Capital, and Middle East Venture Partners were the overall top investors in the United Arab Emirates tech ecosystem. Oraseya Capital, Plus VC, and Endeavor were the top seed-stage investors in Q1 2025. QED Investors and Tech Invest Com led early-stage investments in the country during the same period.

The UAE tech ecosystem experienced a sharp surge in funding in Q1 2025, primarily driven by significant late-stage investments and multiple $100M+ deals in Enterprise Applications, FinTech, and Retail. While seed-stage investments declined, the dominance of Dubai in attracting capital, along with a strong uptick in acquisitions, highlights the growing maturity of the region’s tech sector.