Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: UAE Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the UAE Tech space.

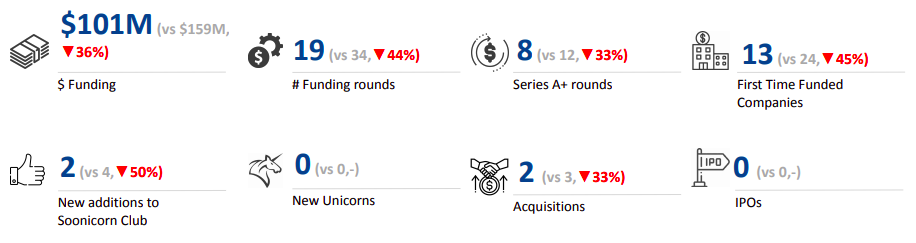

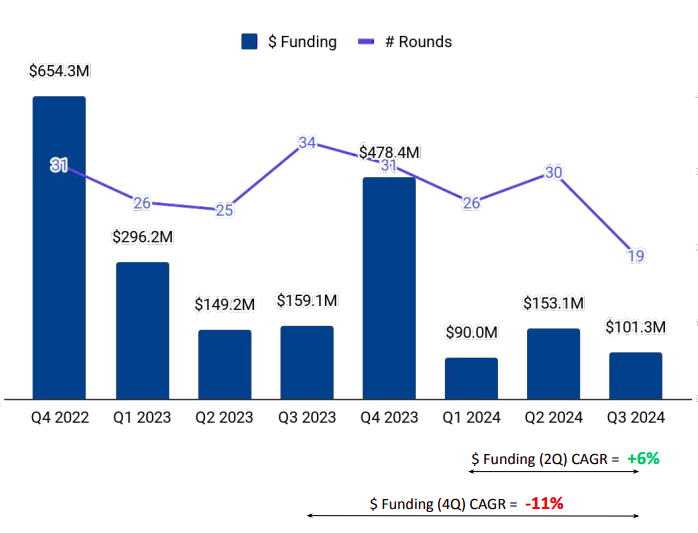

Total funding secured by UAE tech startups in Q3 2024 was $101 million, a 33.8% drop from $153M raised in the previous quarter (Q2 2024), and a 36.29% drop compared with the $159 million raised in the corresponding quarter last year (Q3 2023).

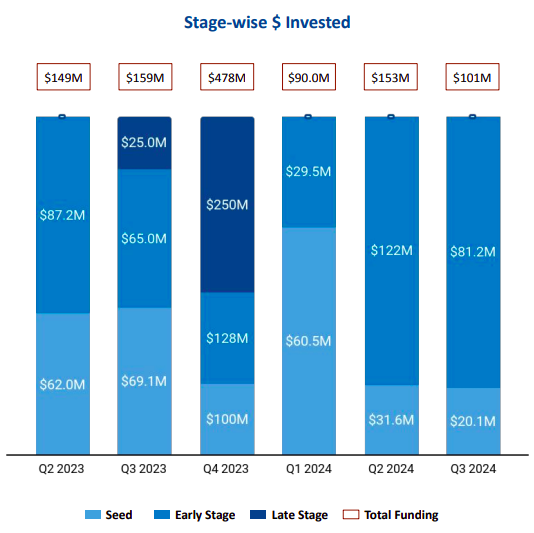

Seed-stage funding plunged 70.83% to $20.1 million in Q3 2024, from $69.1 million in Q3 2023. Early-stage investments stood at $81.2 million in the third quarter of this year, a 24.92% surge from the $65 million raised in Q3 2023. UAE’s startup landscape has not witnessed any late-stage rounds this year.

Only two acquisitions took place in the third quarter of this year. AXE Securities acquired Forex Funder, and CoinDCX bought BitOasis. Further none of the UAE-based tech startups took the IPO route in Q3 2024.

The top-performing sectors in Q3 2024 were FinTech, Enterprise Applications and Retail. FinTech startups saw a funding decline of 29% in Q3 2024, compared with the corresponding quarter last year. Funding in the Enterprise Applications segment declined 67% in Q3 2024, when compared with the corresponding quarter last year. The Retail sector witnessed a 98% rise in funding in Q3 2024, compared with Q3 2023.

No new unicorns emerged in Q3 2024, similar to the scenario in the corresponding quarter last year. Further, there was hardly any activity with only two acquisitions and an absence of IPOs.

Dubai remains the startup hub in the UAE, with companies based in the city raising $93.2 million in the third quarter of 2024. This is followed by startups based in Abu Dhabi, which raised only $8.2 million during the period.

Wamda Capital, 500 Global and Middle East Venture Partners are the all-time top investors in the UAE Tech ecosystem. Y Combinator, Middle East Venture Partners and 500 Global were the top seed-stage investors in the UAE Tech ecosystem for Q3 2024, while Atinum Investment, Altos Ventures Management and Gobi Partners were the top early-stage investors.

As the UAE’s tech ecosystem navigates through a challenging period, industry stakeholders will watch closely to see how market dynamics evolve in the coming quarters. The resilience of early-stage investments offers a glimmer of hope, even as broader challenges persist.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 16, 2024)