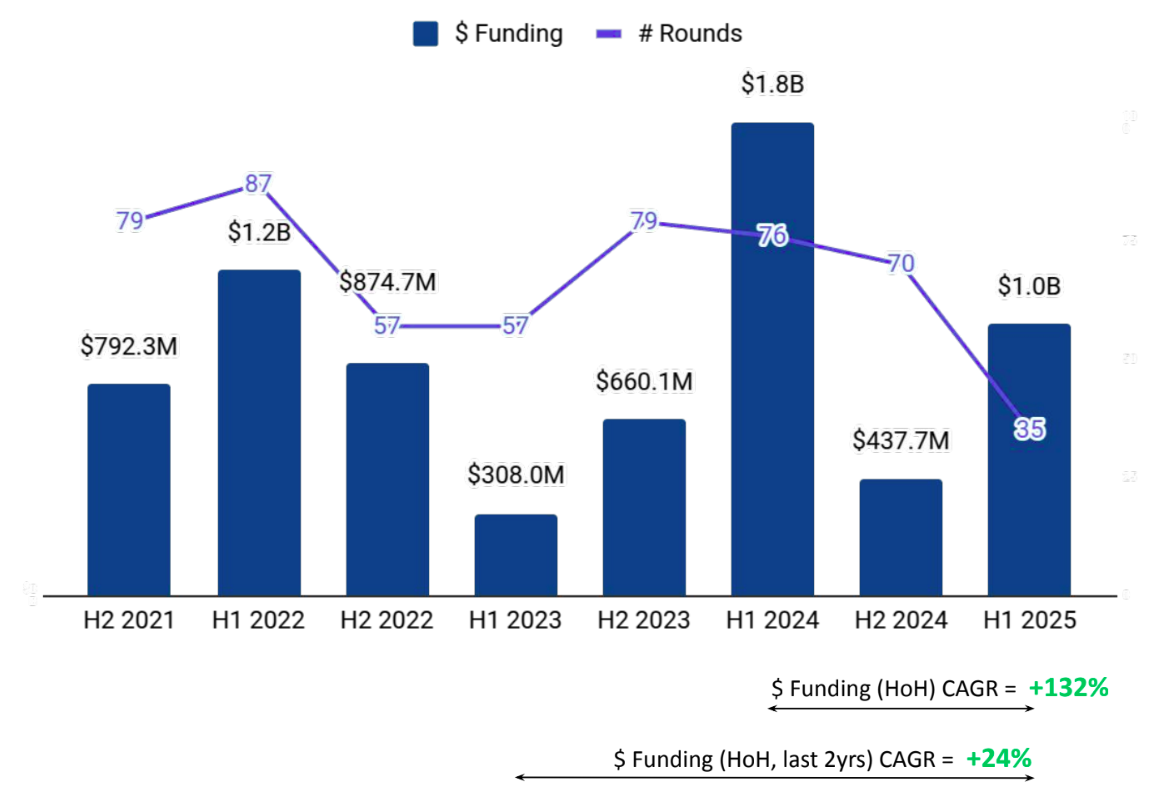

Tracxn has released its United Arab Emirates Tech H1 2025 Report, offering a comprehensive view of the country's tech funding landscape during the first half of the year. The report highlights a significant increase in funding activity compared to the previous half-year, although total funding remains below H1 2024 levels. The funding landscape continues to be driven by late-stage investments and strong performances across sectors such as Enterprise Applications, FinTech, and Retail.

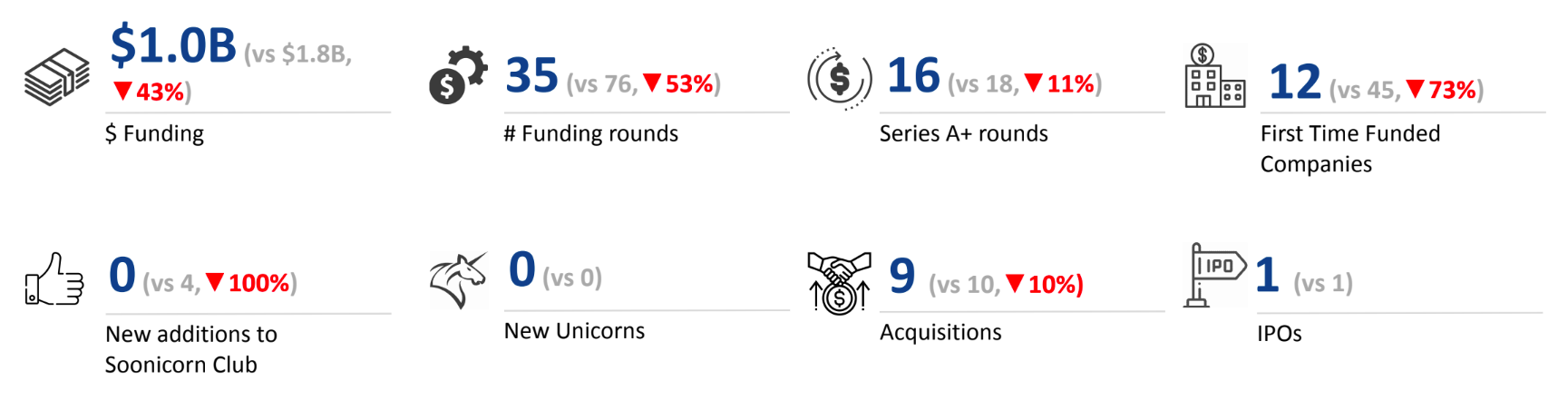

A total of $1.0B was raised in H1 2025, marking an increase of 133% compared to $438M raised in H2 2024. However, this also reflects a drop of 43% compared to $1.8B raised in H1 2024. The significant half-yearly recovery places the UAE among the most active tech ecosystems in the MENA region during H1 2025.

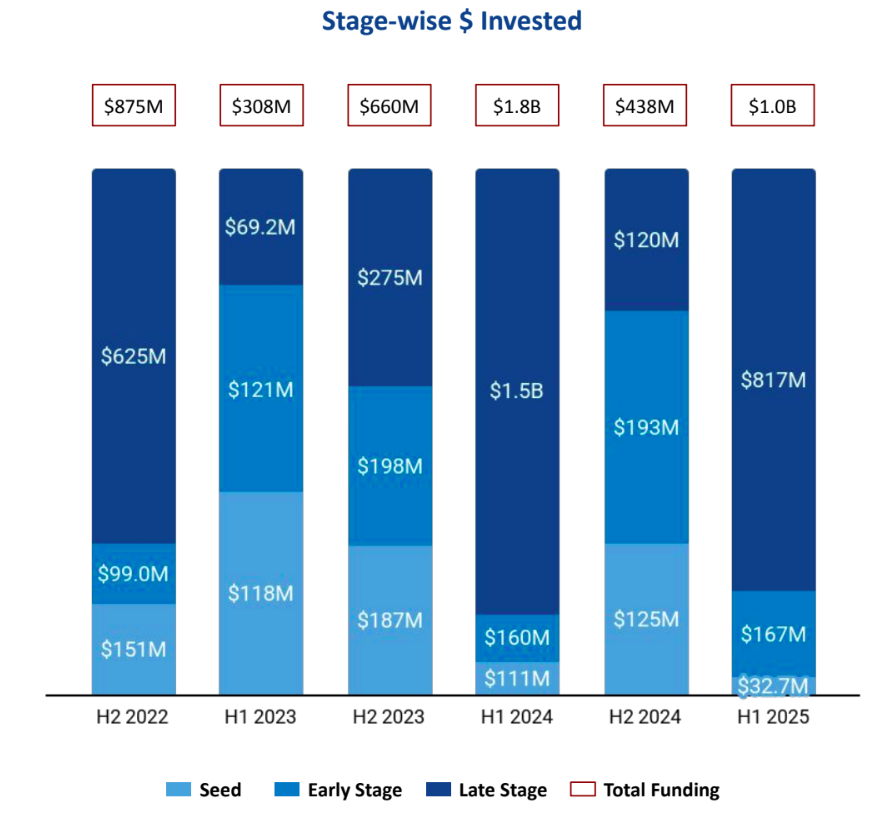

Seed stage saw a total funding of $32.7M in H1 2025, representing a drop of 74% compared to $125M raised in H2 2024, and a drop of 71% compared to $111M raised in H1 2024. Early stage funding amounted to $167M in H1 2025, reflecting a drop of 13% compared to $193M raised in H2 2024, and an increase of 4% compared to $160M raised in H1 2024. Late stage witnessed a total funding of $817M in H1 2025, which is an increase of 583% compared to $120M raised in H2 2024, and a drop of 46% compared to $1.5B raised in H1 2024.

Enterprise Applications, FinTech, and Retail were the top-performing sectors in H1 2025. The Enterprise Applications sector saw a total funding of $728M in H1 2025, which is an increase of 543% when compared to $113M raised in H2 2024 and a drop of 56% when compared to $1.7B raised in H1 2024. The FinTech sector recorded a total funding of $286M in H1 2025, reflecting an increase of 47% compared to $195M raised in H2 2024 and an increase of 276% compared to $76.2M raised in H1 2024. The Retail sector saw a total funding of $172M in H1 2025, representing an increase of 20% compared to $144M raised in H2 2024 and a rise of 275% compared to $46M raised in H1 2024.

H1 2025 witnessed 2 $100M+ funding rounds, compared to 1 such round in both H2 2024 and H1 2024. Companies like Vista Global and Tabby managed to raise funds above $100M in this period. Vista Global raised a total of $600M in a PE round, while Tabby secured $160M in a Series E round. A major part of these $100M+ funding rounds came from Enterprise Applications, Retail, and FinTech. Micropolis was the only company that went public in H1 2025. No unicorns were created in H1 2025, H2 2024, and H1 2024.

Tech companies in the United Arab Emirates saw 9 acquisitions in H1 2025, which is a 10% decrease as compared to 10 acquisitions in both H2 2024 and H1 2024. Among the notable acquisitions in H1 2025, Everdome was acquired by Hokoworld, Gulf Craft was acquired by Saronic, and Property Monitor was acquired by Dubizzle Group.

Dubai-based tech firms accounted for 93% of all funding seen by tech companies across the United Arab Emirates. This was followed by Abu Dhabi at a distant second in terms of funding concentration.

500 Global, Wamda Capital, and Middle East Venture Partners were the overall top investors in the United Arab Emirates tech ecosystem. Oraseya Capital, Plus VC, and Endeavor were the top seed stage investors in the United Arab Emirates tech ecosystem for H1 2025. e&, Flourish, and MoreThan Capital Advisors were the top early stage investors in the United Arab Emirates tech ecosystem for H1 2025. STV emerged as the top late stage investor in the United Arab Emirates tech ecosystem for H1 2025. Late stage VC investments saw Saudi Arabia-based STV add one company to their portfolio.

The United Arab Emirates tech ecosystem witnessed a significant recovery in H1 2025, driven by a surge in late-stage funding and strong performances across Enterprise Applications, FinTech, and Retail sectors. While seed-stage investments contracted sharply, the presence of multiple $100M+ deals helped maintain momentum. With Dubai continuing to dominate funding activity and a steady flow of acquisitions, the region remains a key player in the global tech investment landscape.