Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: UAE Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the UAE Tech space.

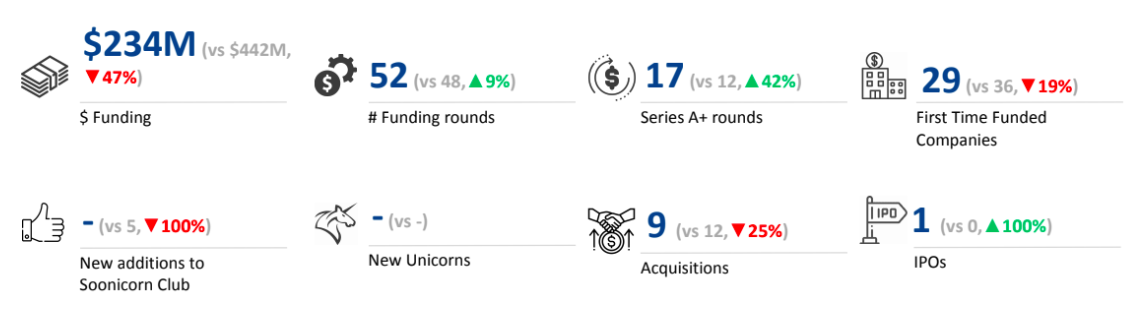

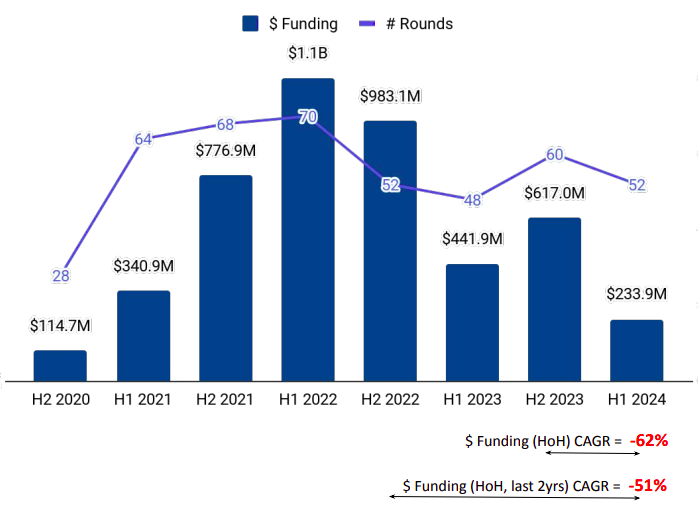

The UAE Tech startup ecosystem ranks 26th globally in terms of funding in the first half of 2024. UAE tech startups secured funding worth $234 million in H1 2024, a 47% decline from $442 million raised in H1 2023. This is also a 62% decline from the $617 million raised in H2 2023.

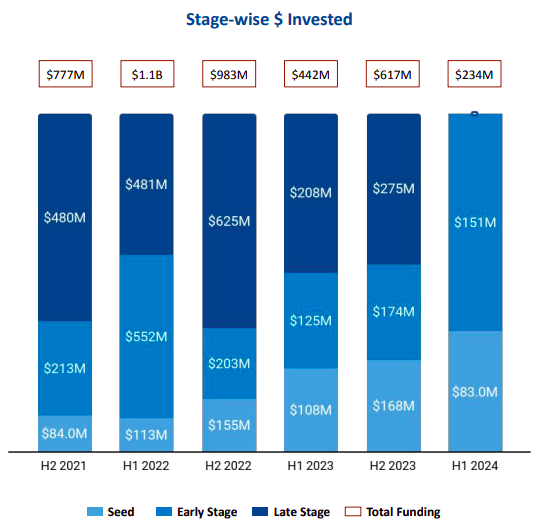

Seed-stage funding stood at $83 million in H1 2024, a 23.5% decrease from the $108 million raised in H1 2023. Early-stage funding rose 20.6% to $151 million in the first half of 2024 from $125 million in H1 2023. The UAE startup landscape did not witness any late-stage funding in H1 2024, a contrast from 2023. Late-stage funding of $275 million and $208 million was observed in H2 2023 and H1 2023 respectively.

Enterprise Applications, FinTech and Real Estate & Construction Tech were the top-performing sectors in H1 2024 in this space. Funding in the Enterprise Applications space surged 1119% to $156 million in H1 2024 from $12.8 million in H1 2023. FinTech companies saw a 39% fall in funding, from $98.8 million in H1 2023 to $59.8 million in H1 2024.

The quarter-wise trend shows some resilience. Funding rose 60% to $145 million in Q2 2024 from $90 million in Q1 2024. This is also a drop of only 3% from the $149 million raised in Q2 2023

N8

Alef Education was the only company to go public from this space in the first half of 2024. Only one IPO took place in H2 2023, while H1 2023 did not witness any new IPOs. Further, the number of acquisitions fell from 12 in H1 2023 to nine in H1 2024. Drive Arabia, AIQ and Callmi are some of the companies that got acquired in H1 2024.

Most of the funding went into tech startups based in Dubai, which accounted for 91% of the overall investments in H1 2024. Companies based in Dubai raised $213 million in H1 2024, while those based in Abu Dhabi raised $13.9 million. The Real Estate & Construction segments saw a sharp spike in funding, from $20K in H1 2023 to $48 million in H1 2024.

Wamda Capital, 500 Global and Middle East Venture Partners are the all-time overall top investors in the UAE Tech ecosystem. Oryx Fund, Middle East Venture Partners and Oraseya Capital were the overall top investors in the UAE Tech ecosystem in H1 2024. Elevation Capital, Balderton Capital and Jump Capital were the top early-stage investors in the UAE Tech ecosystem during the same period.

Despite the decline in investments, the UAE startup landscape has established itself as a dynamic and diverse environment, with tremendous potential for further growth.

The UAE government recently announced a partnership with Emirates Development Bank (EDB) to provide a $100 million (Dh370 million) financing solution for the new AI innovation program. The nation also aims to attract top-tier talent through the introduction of a 10-year Golden Visa program. This initiative is accessible to entrepreneurs, data scientists, and coders, underscoring the country's commitment to fostering a dynamic and innovative ecosystem. Such initiatives will provide crucial support to startups by giving a boost to innovation.