Tracxn has released its insights on the United Kingdom FinTech ecosystem for 2025, outlining funding activity, deal dynamics, IPOs, acquisitions, and investor participation across stages. The data reflects the funding landscape for UK FinTech companies during the calendar year 2025, highlighting shifts in capital allocation across stages, continued large-ticket deal activity, steady public market exits, and sustained acquisition momentum.

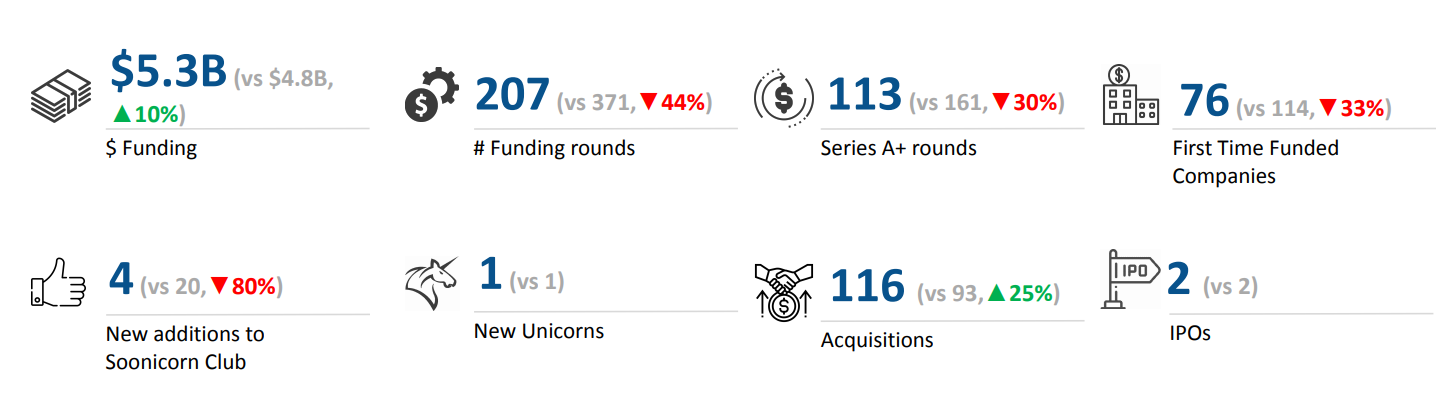

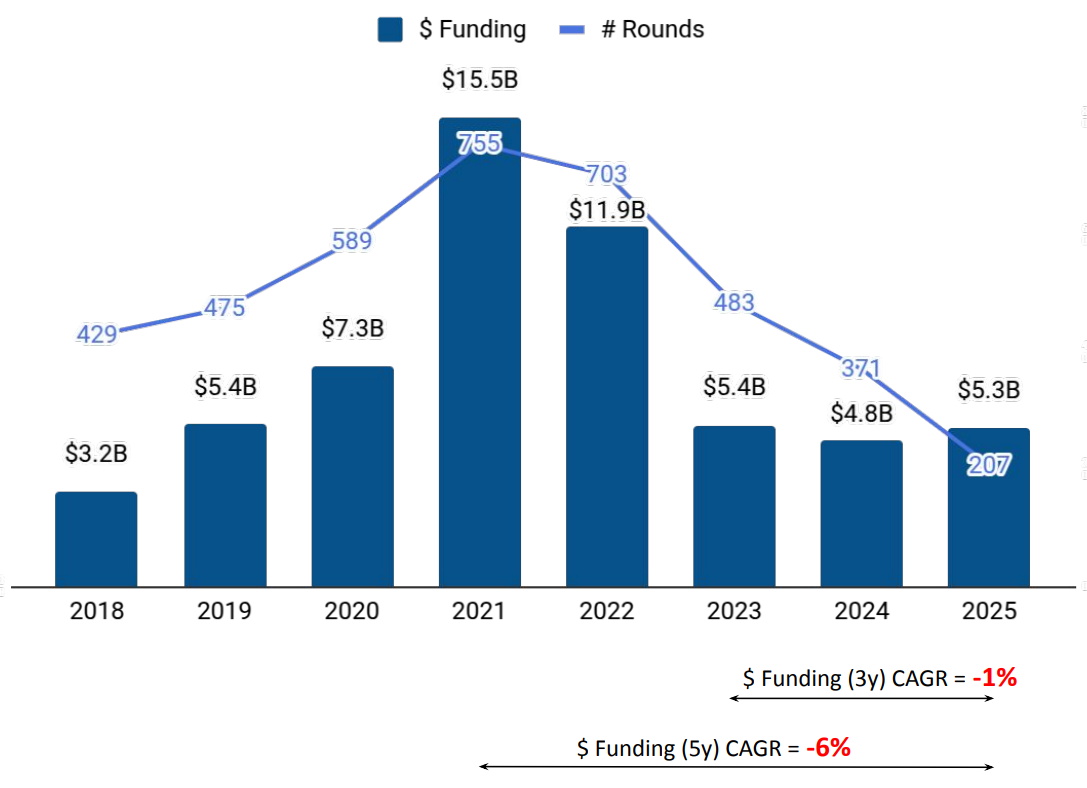

A total of $5.3B was raised by UK FinTech companies in 2025, representing a 10% increase compared to the $4.8B raised in 2024, while recording a 2% decline compared to the $5.4B raised in 2023. The year saw continued participation in large funding rounds, with 11 $100M+ funding rounds recorded, compared to 10 such rounds in 2024 and 12 such rounds in 2023.

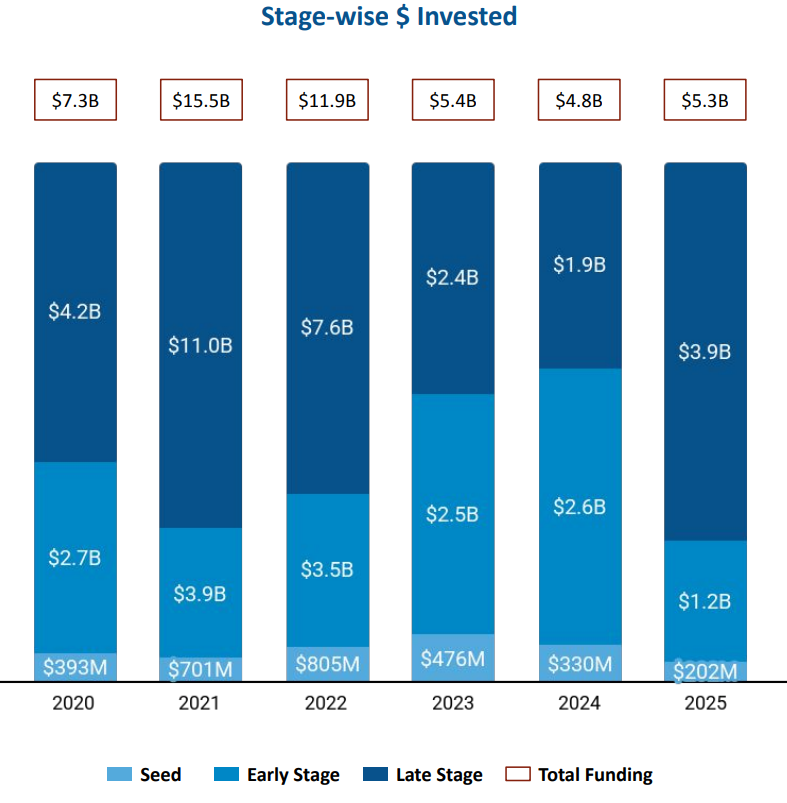

Seed-stage funding in the UK FinTech ecosystem totaled $202M in 2025, reflecting a 39% drop compared to $330M raised in 2024 and a 58% decline compared to $476M raised in 2023. Early-stage funding stood at $1.2B in 2025, marking a 54% decrease from $2.6B in 2024 and a 52% decline compared to $2.5B raised in 2023. Late-stage funding witnessed a significant rise, with $3.9B raised in 2025, representing a 101% increase compared to $1.9B raised in 2024 and a 61% rise compared to $2.4B raised in 2023.

The UK FinTech ecosystem recorded 11 funding rounds exceeding $100M in 2025. Companies such as FNZ, DRML Miner, and Rapyd raised funding rounds above the $100M threshold during the year. FNZ raised a total of $1.2B through Unattributed and PE rounds, DRML Miner raised $1B in a Series D round, and Rapyd raised $250M in a Series F round.

In terms of public market exits, UK FinTech recorded two IPOs in 2025, consistent with 2024 and 2023 each, with RedCloud and Diginex going public during the year. The year also saw the creation of one unicorn in 2025, the same as in 2024, representing a 50% decline compared to the two unicorns created in 2023.

FinTech companies in the United Kingdom recorded 116 acquisitions in 2025, reflecting a 25% rise compared to 93 acquisitions in 2024 and a 55% increase compared to 75 acquisitions in 2023. The largest acquisition of the year was Worldpay’s acquisition by Global Payments for $24.3B, making it the highest-valued acquisition in 2025. This was followed by KKR’s acquisition of OSTTRA for $3.1B.

London-based FinTech companies accounted for 75% of all funding raised across the United Kingdom in 2025. Derby emerged as the second-highest funded city, capturing 19% of the total funding raised by UK FinTech companies during the year.

Investor participation remained active across stages in 2025. Y Combinator, Haatch, and Project A emerged as the top seed-stage investors in the UK FinTech ecosystem. At the early stage, Sequoia Capital, DN Capital, and AlbionVC were the most active investors. Late-stage investments were led by Hedosophia, Latitude Venture Partners, and Georgian, marking their prominence in larger funding rounds during the year.

The UK FinTech ecosystem recorded $5.3B in funding in 2025, supported by a sharp increase in late-stage investments and continued activity in $100M+ funding rounds. While seed and early-stage funding declined compared to previous years, late-stage capital inflows, steady IPO activity, and a rise in acquisitions played a central role in shaping overall ecosystem activity. London continued to dominate funding distribution, and investor participation remained strong across all stages of growth.