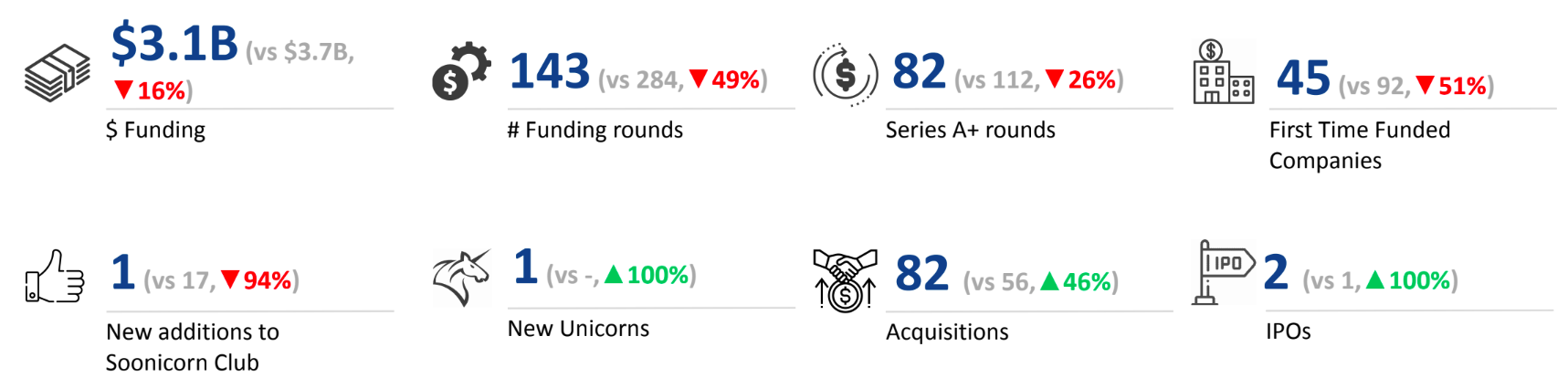

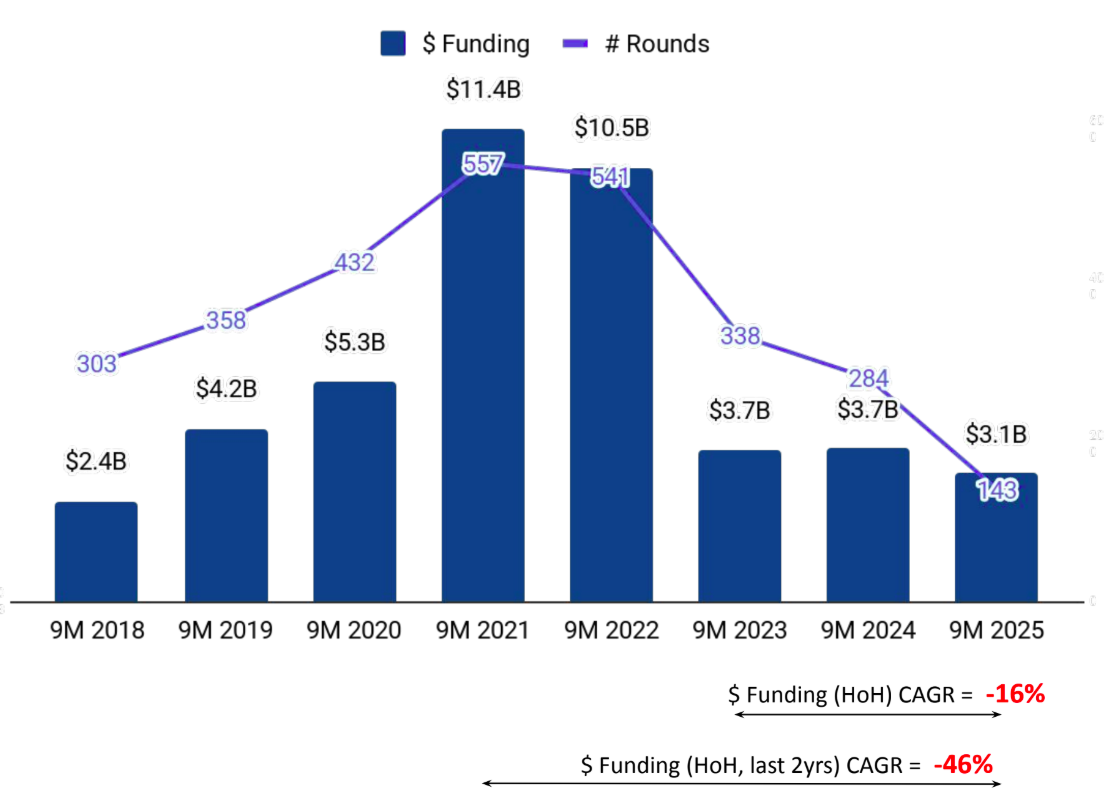

Tracxn has released its UK FinTech Report for 9M 2025, highlighting key investment and ecosystem trends across the country’s financial technology sector. The report captures funding, IPO, acquisition, and investor activity during the nine-month period ending September 2025. UK FinTech companies collectively raised $3.1B during the period, marking a 16% decline compared to $3.7B in both 9M 2024 and 9M 2023. Despite the overall drop, the ecosystem continued to show robust late-stage activity and a growing number of large funding rounds and acquisitions.

A total of $3.1B was raised in 9M 2025, a drop of 16% compared to $3.7B in 9M 2024 and in 9M 2023. This marks a contraction in overall funding volumes, reflecting lower investment activity across early stages, partially balanced by growth in later stages.

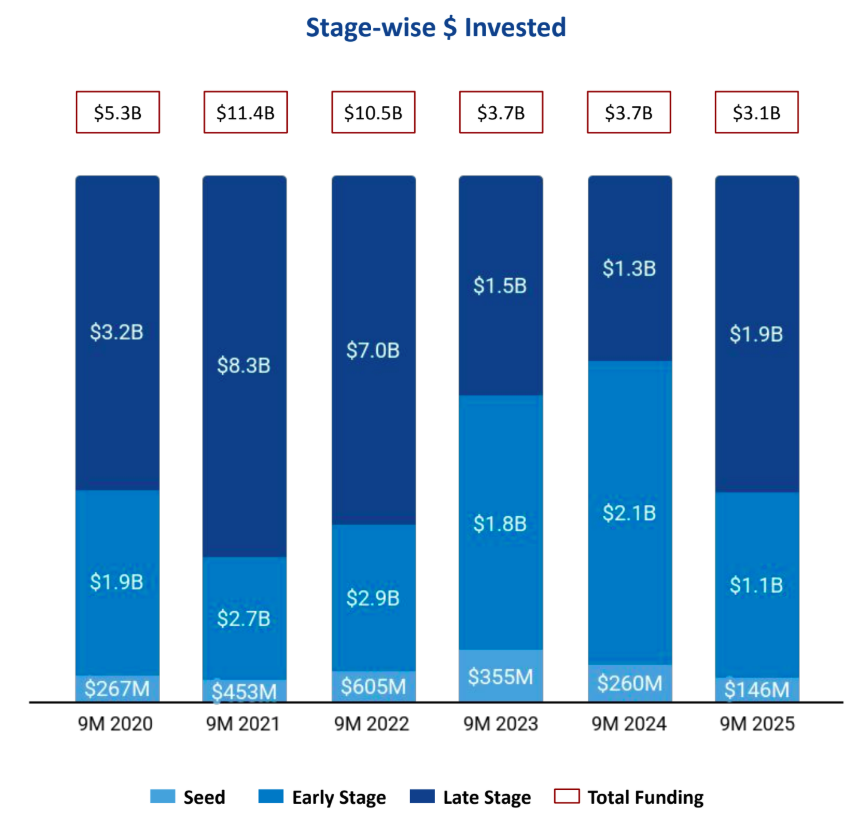

Seed-stage activity remained muted, with startups raising $146 million in 9M 2025, down 44% from $260 million in 9M 2024 and 59% below the $355 million recorded in 9M 2023. Early-stage funding also declined, totaling $1.1 billion in 9M 2025, a 49% drop from $2.1 billion in 9M 2024 and 31% lower than $1.8 billion in 9M 2023. In contrast, late-stage investments drove the period’s momentum, rising to $1.9 billion in 9M 2025, up 42% from $1.3 billion in 9M 2024 and 21% higher than $1.5 billion in 9M 2023.

9M 2025 has witnessed 8 $100M+ funding rounds when compared to 5 such rounds in 9M 2024 and 6 in 9M 2023. Companies like Rapyd, FNZ, Dojo, and Quantexa have managed to raise funds above $100M in this period. Rapyd has raised a total of $500M in a Series F round. FNZ has raised a total of $500M in an Unattributed round. Dojo has raised a total of $190M in a PE round.

The period also saw an uptick in public market activity, with 2 FinTech IPOs in 9M 2025, a 100% increase from 1 in 9M 2024 and the same number as in 9M 2023. RedCloud and Diginex were the companies that went public during this period. Additionally, 1 new unicorn was created in 9M 2025, marking a 100% rise compared to none in 9M 2024 and matching the count from 9M 2023.

The UK FinTech ecosystem witnessed 82 acquisitions in 9M 2025, marking a 46% rise compared to 56 acquisitions in 9M 2024 and a 49% increase from 55 acquisitions in 9M 2023. The most notable transaction was the $24.3B acquisition of Worldpay by Global Payments, standing as the highest-valued deal of the period. It was followed by KKR’s $3.1B acquisition of OSTTRA, underscoring a strong year of consolidation within the sector.

FinTech companies based in London received 90% of the total funding in the United Kingdom, while Swindon came next with 5%. London remained the undisputed hub for FinTech investments in the country.

Investor participation in the UK FinTech ecosystem remained active across stages in 9M 2025. At the Seed Stage, Y Combinator, Haatch, and Project A emerged as the top investors. In the Early Stage, Notion, AlbionVC, and DN Capital led investment activity. For Late Stage funding, Latitude Venture Partners and Durable Capital Partners were the most active investors, reflecting continued confidence in scaling FinTech ventures across the country.

The UK FinTech ecosystem in 9M 2025 reflected mixed investment trends. While overall funding fell by 16%, the rise in late-stage funding and the increase in large rounds above $100M underscored strong investor confidence in mature FinTech firms. The period also witnessed more IPOs and a sharp uptick in acquisitions, including landmark deals such as the $24.3B acquisition of Worldpay by Global Payments. London maintained its leadership with 90% of total funding, supported by active participation from both global and domestic investors.