Tracxn's research desk publishes quarterly analysis of the broad funding trends in startups and tech companies across the globe. The following are the key findings from the UK FinTech report for July-August-September 2024.

In the global FinTech space, The UK ranks third in terms of overall funding after the US and China. The country accounts for 9% of the number of FinTech companies across the globe, being home to more than 10K active companies in the sector.

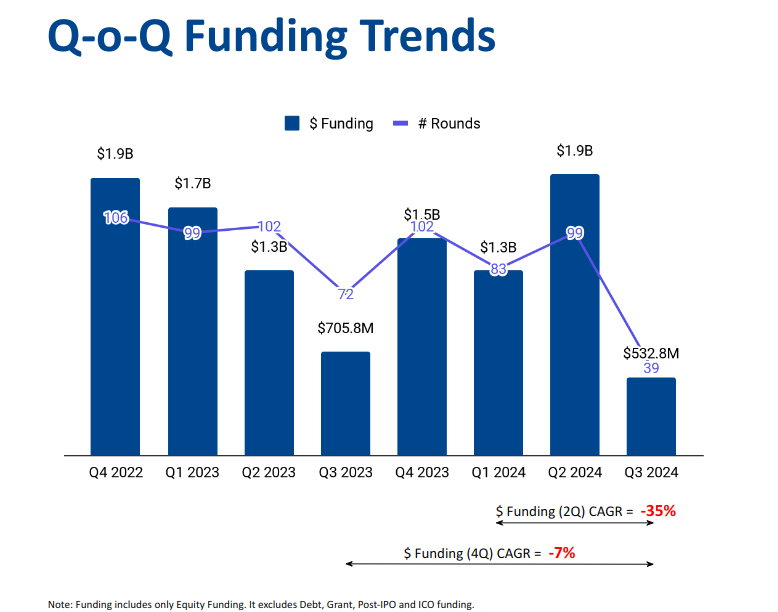

However, the FinTech ecosystem has seen ups and downs in quarterly funding in the past two years. The UK FinTech ecosystem secured total funding of $533 million in Q3 2024, a 72% plunge from $1.9 billion raised in the previous quarter (Q2 2024). This is also 24% lower than the $706 million raised in the corresponding quarter (Q3 2023).

CloudPay was the only UK-based FinTech company to raise more than $100 million in the third quarter of this year, garnering funding worth $120 million. As a result of this round, Payroll Management Solutions was the top-funded business model in Q3 2024, securing funding worth $134.6 million through three rounds.

The ecosystem saw 19 acquisitions in Q3 2024, a strong upward move from 13 in Q2 2024. Infinite Reality acquired LandVault for $450 million, making it the largest deal in the overall UK tech startup ecosystem in Q3 2024.

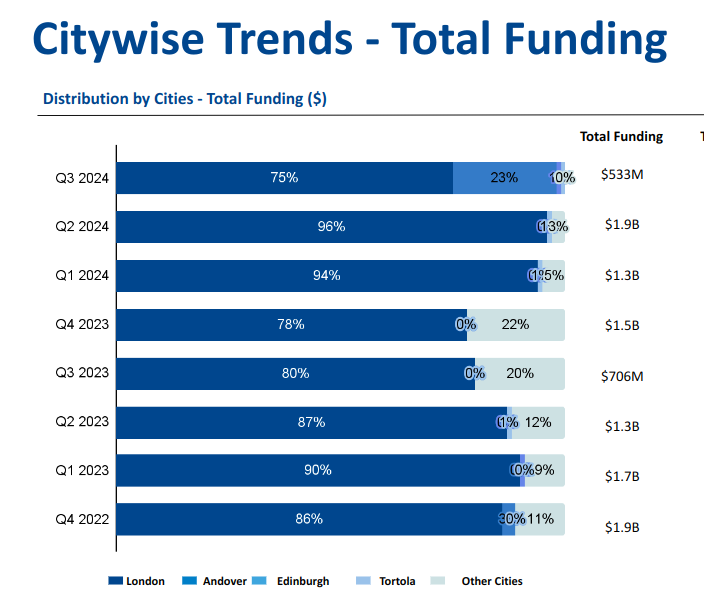

London has consistently dominated the sector, securing at least 75% of the total funding raised by FinTech startups in each of the quarters in 2024. FinTech startups headquartered in the British Capital raised $400.6 million in Q3 2024, accounting for 75% of investments garnered by FinTech companies in the country.

VCs typically participated in only one funding round each in Q3 2024 in the UK FinTech ecosystem. Among VCs, China-based Fenbushi Capital and Germany-based Target Global were some of the prominent seed-stage investors, adding one company each from this sector to their portfolio. US-based Bessemer Venture Partners and UK-based Index Ventures were some of the notable early-stage investors during the same period, participating in one round each.

Conclusion

The UK’s FinTech landscape continues to face challenges in terms of funding. However, multiple factors are helping the landscape evolve, such as a quality talent pool, a higher fintech adoption rate, a higher concentration of financial and professional services firms and forward-thinking regulations.

Notes:

Data for Q3 2024 has been taken from July 1, 2024 - Sep 30, 2024.