Tracxn has released its UK FinTech H1 2025 Funding Report, offering a comprehensive view of the funding landscape between January and June 2025. The report captures notable developments in funding volumes, investor activity, major acquisitions, and IPOs. The United Kingdom FinTech ecosystem witnessed a recovery in capital inflow during H1 2025, driven by an upswing in late-stage funding and multiple $100M+ rounds.

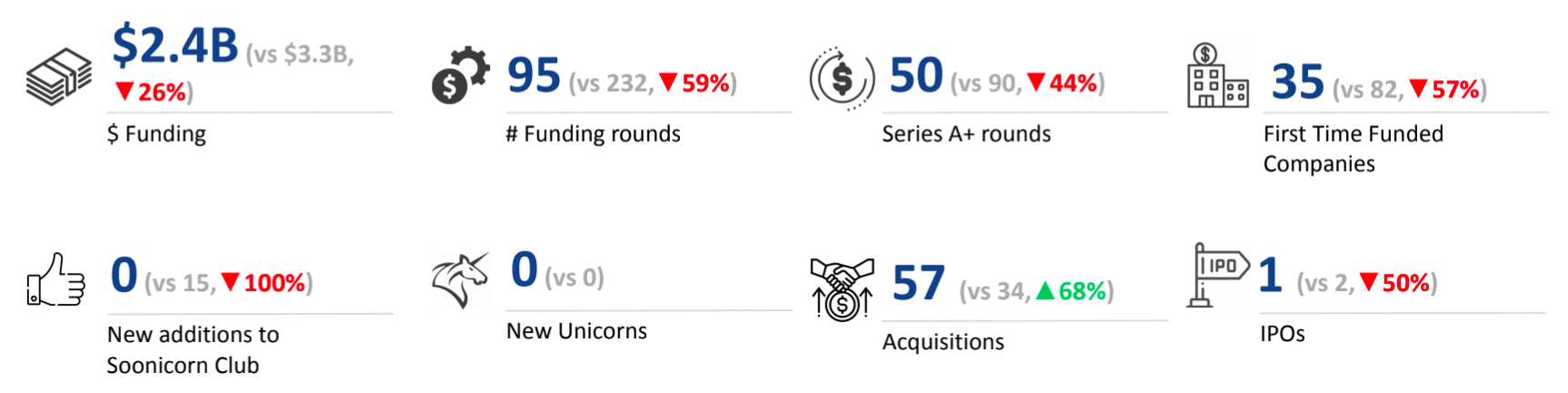

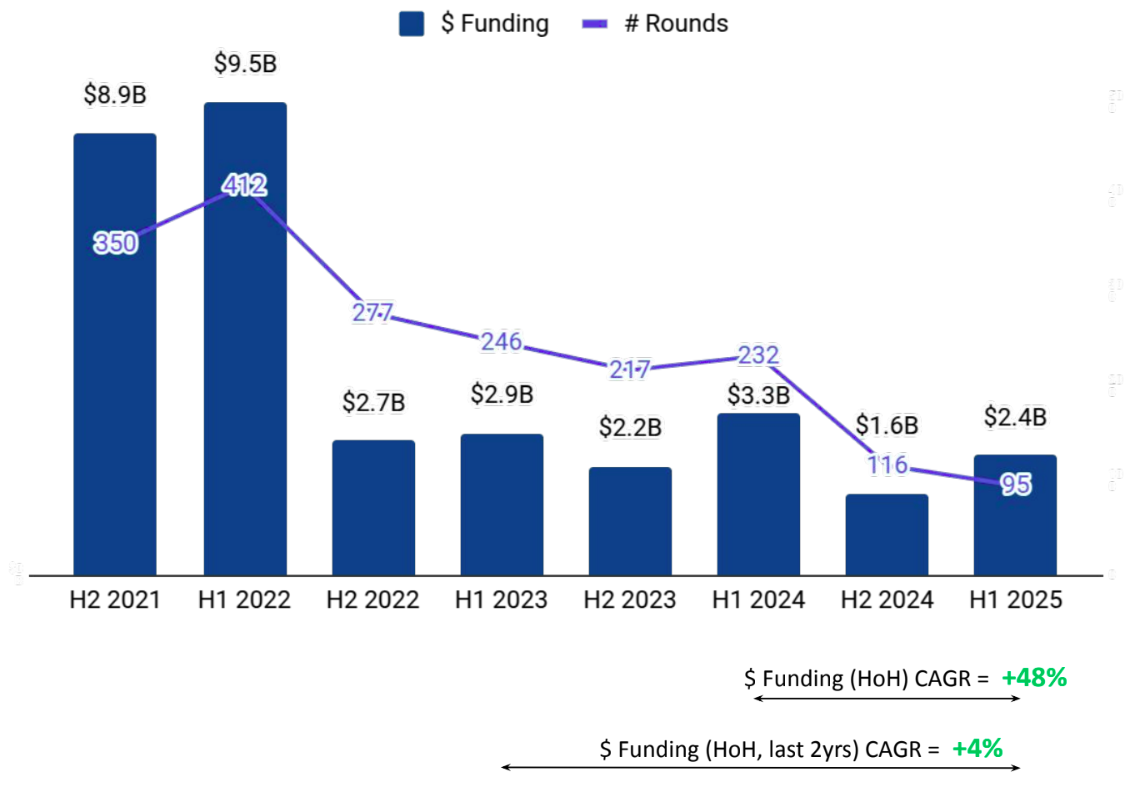

A total of $2.4B was raised in H1 2025 in the UK FinTech ecosystem. This marked a 48% increase compared to $1.6B raised in H2 2024 and a 26% decline from the $3.3B raised in H1 2024. The rebound in funding over the last six months highlights renewed investor activity, especially in the later stages.

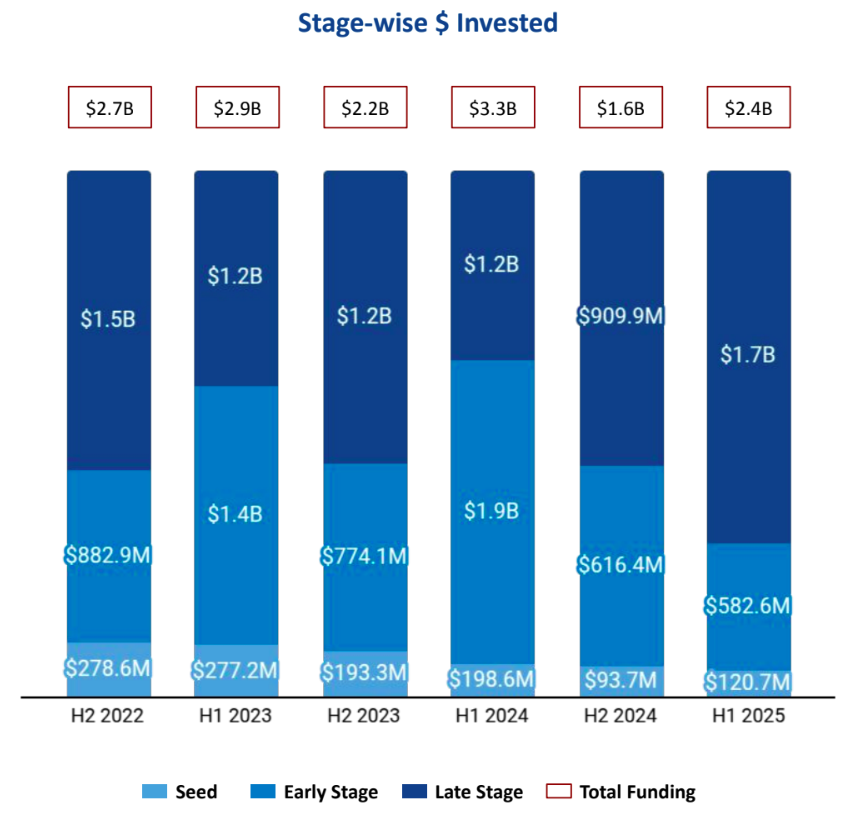

Seed-stage funding in H1 2025 stood at $120.7M, reflecting a 29% increase from $93.7M in H2 2024 but a 39% decline from $198.6M in H1 2024. Early-stage funding recorded a total of $582.6M in H1 2025, representing a 5% drop from $616M in H2 2024 and a 69% decline compared to $1.9B raised in H1 2024. Late-stage funding surged significantly, reaching $1.7B in H1 2025, an 87% increase from $909.9M in H2 2024 and a 45% increase from $1.2B in H1 2024.

The count of $100M+ funding rounds in H1 2025 stood at 6, compared to 3 in H2 2024 and 4 in H1 2024. Companies like Rapyd, FNZ, Dojo, Quantexa, The Openwork Partnership, and ZenMEV raised over $100M during this period. Rapyd raised a total of $500M in a Series F round, while FNZ raised $500M in an Unattributed round. Dojo secured $190M in a PE round. RedCloud was the only company to go public in H1 2025. No unicorns were created in H1 2025 and H1 2024, in contrast to one unicorn created in H2 2024.

FinTech companies in the United Kingdom saw 57 acquisitions in H1 2025, marking a 2% decrease compared to 58 in H2 2024 and a 68% increase from 34 in H1 2024. The most significant acquisition was Worldpay’s $24.3B buyout by Global Payments, making it the highest-valued deal of the period. This was followed by the acquisition of Esure by Ageas at a transaction value of $1.7B.

London accounted for 67% of the total funds raised in the UK FinTech ecosystem in H1 2025, maintaining its position as the dominant hub. Edinburgh followed at a distant second.

Seedcamp, Techstars and Anthemis Group emerged as the overall top investors in the UK FinTech ecosystem. Y Combinator, Fuel Ventures, and Haatch were the top seed-stage investors in the UK FinTech ecosystem for H1 2025. Notion, AlbionVC, and DN Capital led in early-stage investments, while ETFS Capital, British Patient Capital, and Portage were the most active in late-stage funding. Among VCs, United Kingdom-based Notion led the most number of investments in H1 2025 with 7 rounds. Another United Kingdom-based fund, Fuel Ventures, added 15 new companies to its portfolio.

The United Kingdom FinTech ecosystem experienced a recovery in H1 2025, driven primarily by strong late-stage funding and a notable rise in $100M+ deals. While early-stage activity remained subdued and no new unicorns emerged, robust investor participation and landmark acquisitions like that of Worldpay fueled overall market activity. London's dominance in attracting capital continues to solidify its status as the leading FinTech hub in the country.