Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: UK FinTech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the United Kingdom (UK) FinTech space.

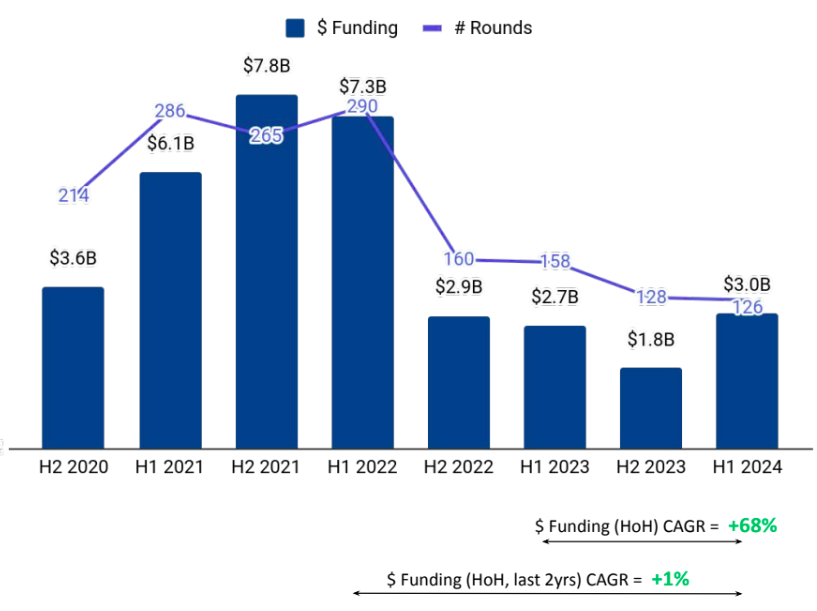

The UK FinTech ecosystem was the second highest globally in terms of funding, after the US. Though the top regions including the US and India have witnessed a funding decline in the FinTech space, the UK has shown positive growth. The uptick in investments can be attributed to the country’s economic recovery in recent months.

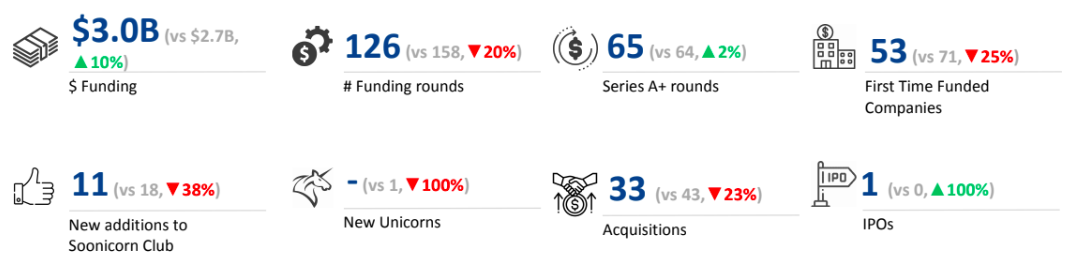

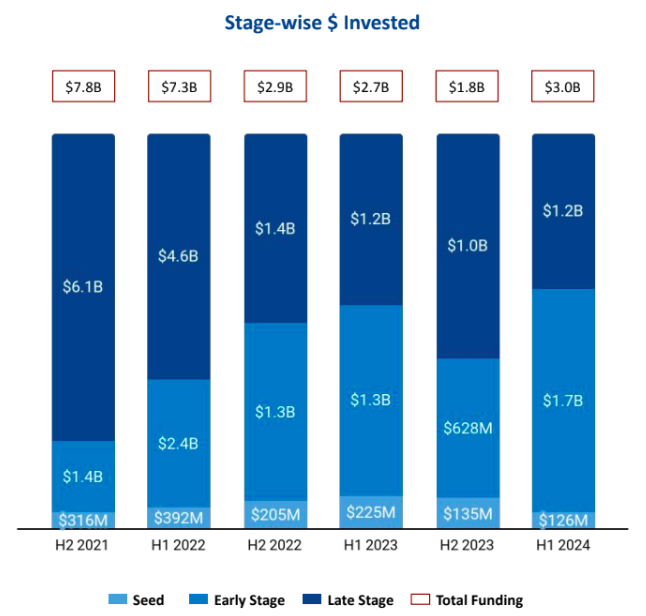

FinTech companies in the UK secured a total funding of $3 billion in the first six months of this year, a growth of 67% from $1.8 billion raised in H2 2023, and 11% higher than the $2.7 billion raised in H1 2023. This spike was largely due to a 171% surge in early-stage funding, which rose to $1.7 billion in H1 2024 from $628 million in the latter half of 2023. The ecosystem attracted late-stage funding worth $1.2 billion in H1 2024, 20% higher than the $1 billion raised in H2 2023. Seed-stage investments stood at $126 million in H1 2024, a minor drop of 6% compared with $135 million raised in H2 2023.

H1 2024 has witnessed five $100M+ funding rounds, similar to the second half of 2023. Abound raised $862 million in Series B funding in Q2 2024. Monzo raised $620 million through through multiple Series I funding rounds in Q1 and Q2 of 2024. Flagstone raised $139 million in Series B funding in the first quarter of 2024.

Alternate Lending, Banking Tech, and Payments were the top-performing segments in the first half of 2024. Companies in the Alternate Lending segment witnessed $1.28 billion in funding, a spike of 1167% compared with $101 million raised in H2 2023. The Banking Tech segment witnessed $1 billion in funding in H1 2024, an increase of 143% compared with the $412 million raised in H2 2023. Investments in the Payments sector fell 43% to $262 million in H1 2024 from $463 million in H1 2023.

On the IPO front, there has been very little activity in both 2023 and 2024, Marex was the only FinTech startup in the UK to go public in H1 2024, similar to H2 2023. Further, number of acquisitions fell to 33 in H1 2024 from 43 in H1 2023 and 34 in H2 2023.

London dominated the funding landscape, accounting for 97% of the total investments. FinTech companies based in the country’s capital raising $2.9 billion in the first six months of 2024.

Seedcamp, Techstars and Anthemis Group are the all-time top investors in this space. Techstars, Fuel Ventures, and SFC Capital were the most active seed investors in this space in H1 2024, while Mundi Ventures, Octopus Ventures, and Northzone were the top early-stage investors. CapitalG, Sprints, and Hedosophia were the most active late-stage investors during the same period.

The UK FinTech startup ecosystem is showing some signs of stability. The growth in funding indicates a recovery in investors' confidence in the landscape, despite the global economic challenges.